By Melissa KoshyThe market snapped its three-day losing streak on Monday, with the Nifty 50 gaining 0.3%. This was driven by optimism over a potential end to the US government shutdown.

In addition, Goldman Sachs upgraded its rating on the Indian stock market to 'Overweight', citing stronger earnings momentum and supportive policy measures.

According to Vinod Nair, Head of Research at Geojit Investments, "The potential resolution of the US government shutdown, coupled with renewed FIIs buying driven by a favourable Q2 earnings season, support positive market sentiment.” He added, “The rise in the US 10-year Treasury yield shows improving confidence in stocks, linked to the federal government reopening. Domestically, stronger economic data should lead to higher earnings estimates for H2FY26, which will support current prices and attract new investment”.

The mood in the primary market remains strong this week, with seven new offerings opening for subscription. Meanwhile, five companies are set to make their stock market debut, following another five listings last week.

Five new companies listed last week, mainboard leads

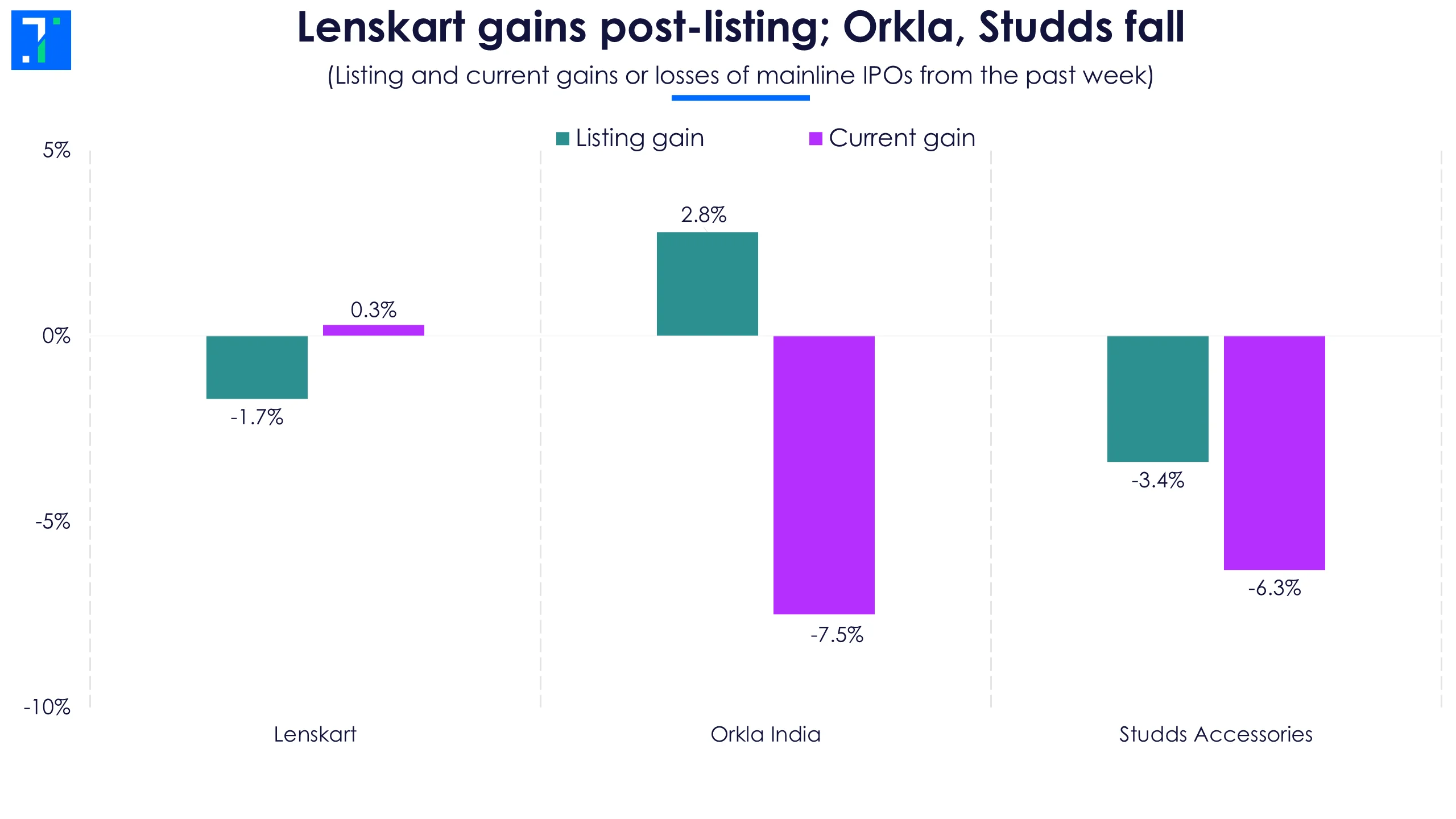

Last week saw three mainline listings: Lenskart, Orkla India and Studds Accessories.

The much-anticipated debut of Lenskart was muted, listing at a 1.7% discount to its Rs 402 issue price. The Rs 7,278 crore IPO was oversubscribed 28.3X, showing strong investor interest despite criticism that its high valuation wasn't justified by its profits. The company is currently trading 0.3% above its issue price. Lenskart is a tech-driven eyewear company that designs and sells glasses, sunglasses, and contact lenses.

Orkla India debuted on the stock market on November 6 at a 2.8% premium. Its Rs 1,667.5 crore IPO drew strong demand and was subscribed 48.7X, with QIBs bidding for 117.6X the shares offered. However, it soon lost its initial gains and currently trades 7.5% below its issue price. The company is home to iconic food brands like MTR Foods, Eastern Condiments, and Rasoi Magic.

Lenskart gains post listing; Orkla, Studds fall

Studds Accessories had a weak start, listing at a 3.4% discount. Its Rs 455.5 crore IPO was subscribed 73.3X, with very strong demand from QIBs, who bid for 160X the shares offered. The company produces helmets and a wide range of motorcycle accessories under the “Studds” and “SMK” brands.

Two SME firms also listed last week.

Game Changers Texfab listed on November 4 at a 2% premium to its Rs 102 issue price. Its IPO received a modest subscription of 1.2X. The company specialises in sourcing high-quality fabrics for the textile industry and is currently trading 7% above its issue price.

Safecure Services, a security and facility management company, debuted at a 20% discount after its IPO was subscribed 1.8X. It is currently trading 27.8% below its issue price.

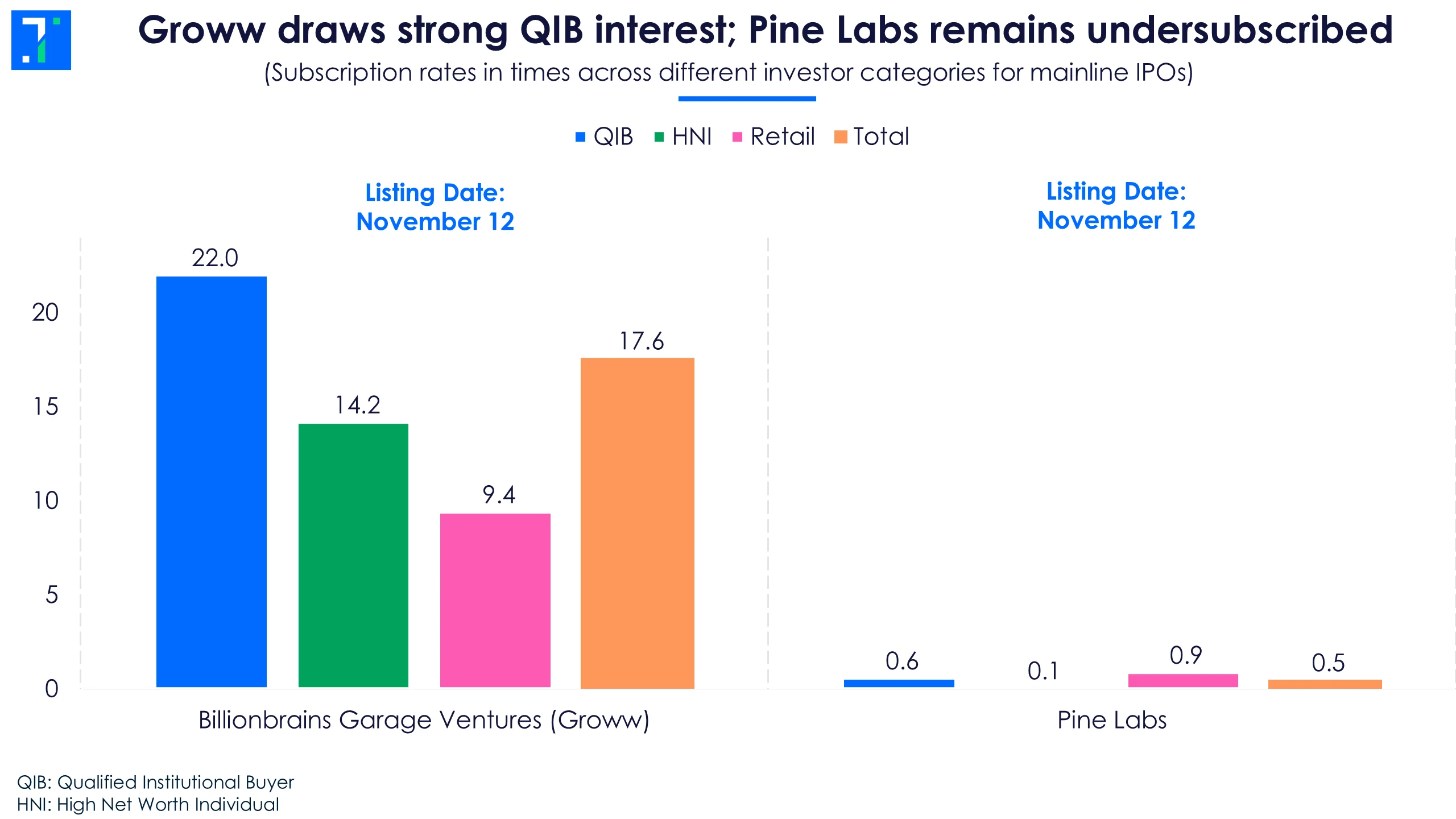

Groww, Pine Labs set to debut

Billionbrains Garage Ventures (Groww) offers a platform to invest in mutual funds, stocks, F&O, ETFs, IPOs, digital gold, and US stocks. The company is set to list on November 12, after its IPO saw strong demand, with bids for 17.6X the shares on offer.

Groww draws strong QIB interest; Pine Labs remains undersubscribed

Pine Labs is an Indian merchant commerce platform that provides point-of-sale (POS) solutions, payment processing, and merchant financing services. It offers digital payment and issuing solutions to merchants, brands, and financial institutions globally. The company is set to list on November 12. As on day 2, its IPO was subscribed 0.5X.

Three SME companies will also make their stock market debut this week.

Shreeji Global FMCG offers a variety of spices, grains, and other food products under its "SHETHJI" brand. The company is set to list on November 12. Its Rs 85 crore IPO was subscribed 3.1X.

Finbud Financial Services’ debut is scheduled for November 13, after its IPO saw modest demand, with bids for 1.2X the shares offered as on day 2. It offers a loan aggregation platform that assists individuals in obtaining personal, business, and home loans from banks and non-banking financial institutions.

Shining Toolsdesigns and manufactures solid carbide cutting tools like end mills, drills, reamers, and thread mills under the "Tixna" brand for various industries in India. The Rs 17.1 crore IPO was subscribed 0.5X as of day 1 and is set to list on November 14.

Seven IPOs are set to open for subscription

Physicswallah headlines a flurry of activity in the primary market this week.

Physicswallah is an edtech company that offers test preparation courses for various competitive examinations like JEE, NEET, and UPSC, and upskilling courses like data science and analytics, banking and finance, software development, among others.

The company plans to raise Rs 3,480 crore, with a price band of Rs 103-109. The IPO will be open for subscription from November 11 to November 13, with the listing scheduled for November 18. The IPO consists of a fresh issue worth Rs 3,100 crore and a Rs 380 crore offer for sale.

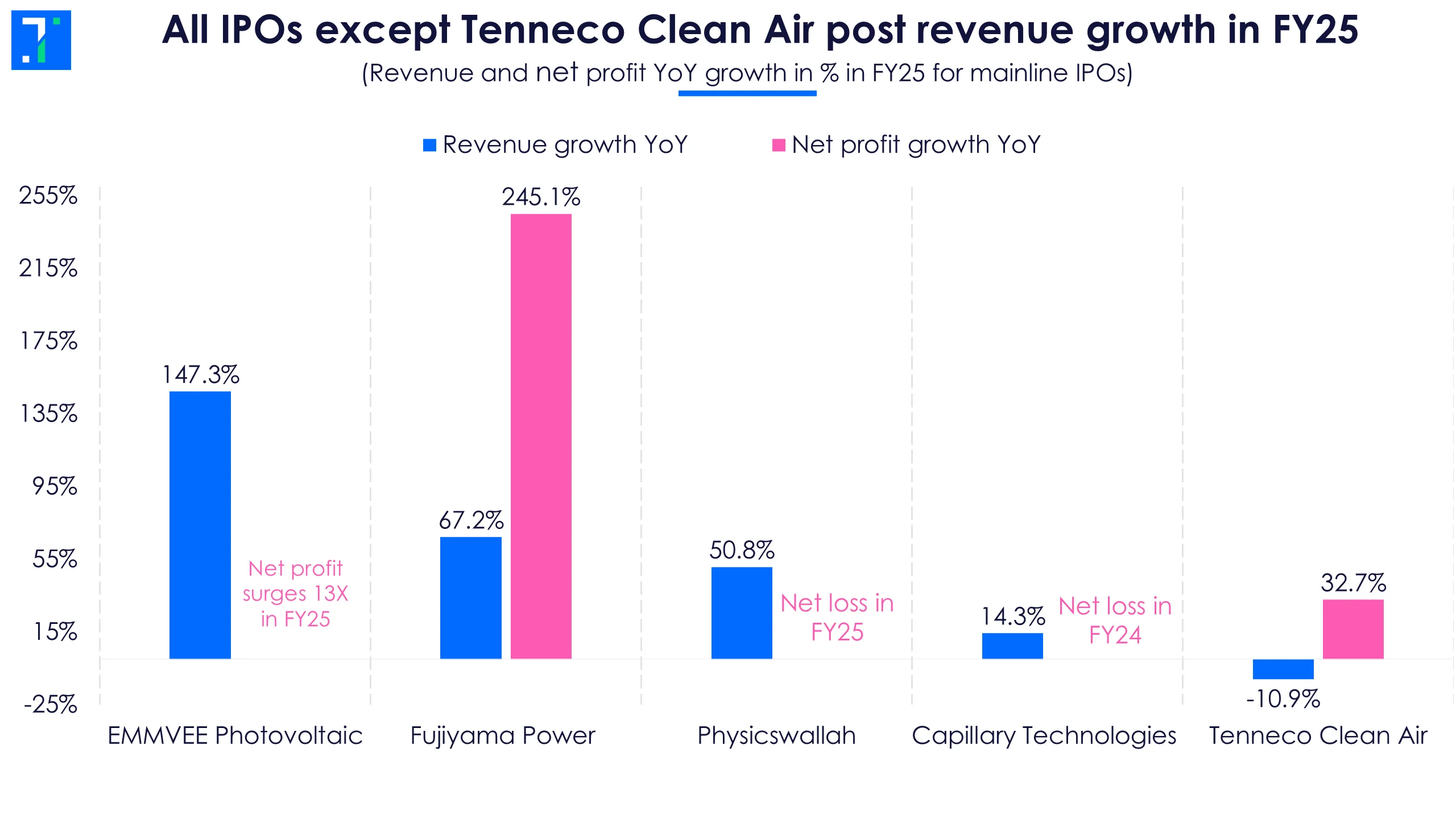

Physicswallah narrowed its losses in FY25 to Rs 243.3, mainly due to revenue growth and a Rs 17 crore deferred tax credit. Revenue was up ~51% during the year.

Tenneco Clean Air’s Rs 3,600 crore IPO will be open from November 12-14, and will list on November 19. The company provides advanced exhaust and after-treatment systems to help vehicle makers comply with stringent emission norms such as Bharat Stage VI. Its product portfolio includes catalytic converters, diesel particulate filters, mufflers, and exhaust pipes.

EMMVEE Photovoltaic Power is an integrated solar PV module and cell manufacturer. Its customers include independent power producers, commercial and industrial entities, and public and private engineering, procurement, and construction providers.

The company aims to raise Rs 2,900 crore, with a price band of Rs 206-217 per share. The IPO will be open between November 11-13, with the listing scheduled for November 18. The IPO comprises a fresh issue worth Rs 2,143.9 crore and an offer for sale of Rs 756.1 crore.

The company witnessed a 13X surge in net profit during FY25, mainly driven by revenue growth and inventory destocking.

All IPOs except Tenneco Clean Air post revenue growth in FY25

Fujiyama Power Systems’ Rs 828 crore IPO will open on November 13, close on November 17, and will list on November 20. The company supplies products and solutions for the rooftop solar industry, offering on-grid, off-grid, and hybrid solar systems. Its portfolio includes inverters, solar panels, batteries, and UPS (uninterruptible power supply) systems.

Capillary Technologies India is a software-as-a-service (SaaS) company specialising in customer loyalty and engagement solutions across industries such as retail, FMCG, and hospitality. The IPO comprises a fresh issue of Rs 345 crore and an offer for sale of 0.9 crore shares. Capillary will be open for subscription between November 14-18 and will list on November 21.

The company reversed its losses in FY25, and posted a net profit of Rs 14 crore, helped by improved operational efficiency, focus on international markets, and the integration of recent acquisitions.

Two SME IPOs will also open for subscription this week:

Mahamaya Lifesciences manufactures, registers, and exports crop protection products and bioproducts. It aims to raise Rs 70.4 crore with a price band of Rs 108-114 per share. The IPO will be open from November 11 to 13, with its listing set for November 18.

Workmates Core2Cloud Solution is a cloud and digital transformation firm specialising in helping enterprises modernise and secure their digital infrastructure. Its Rs 69.8 crore IPO is scheduled to open on November 11, close on November 13, and list on November 18.