The portfolio changes of superstar investors like RARE Enterprises, Ashish Kacholia, Sunil Singhania, and Vijay Kedia offer valuable insights into the market, especially during periods of volatility. Their buys and sells help investors identify potentially profitable sectors and stocks. Let’s take a look at the sells made by these superstar investors in Q4FY25.

The chart below shows changes in superstar investors' current portfolio net worth (note that net worth reflects share price changes in current holdings and new buys and sells).

Most superstars see a fall in their net worth in Q4FY25

Previously, we focused on the key superstar buys in Q4FY25. Now, let's analyse their sells. The last quarter of FY25 turned volatile - most superstar investors remained cautious and increased stake sales, continuing the trend from the previous quarter. The chart below highlights their biggest sells during this period.

Biggest sells by superstars in Q4FY25

RARE Enterprises cuts a 2.1% stake in an edible oils maker

Rakesh Jhunjhunwala’s portfolio, currently managed by Rekha Jhunjhunwala and investment firm RARE Enterprises, reduced holdings in three companies during Q4. The portfolio’s net worth has risen by 24.4% to Rs 62,580 crore as of May 19, primarily due to the infusion from Inventurus Knowledge Solutions. It disclosed a 49.3% stake in the company when its IPO was listed on December 19.

RARE Enterprises trims stake in three firms

In the January-March quarter, the late big bull’s portfolio reduced its stake in Sundrop Brands by 2.1%. The portfolio held a 7% stake in the firm for two consecutive quarters. This edible oils maker has gained 13.3% in the past year, but underperformed its industry by 5.8% points.

During the latest quarter, RARE reduced its stake by 0.3% in the department stores chain Baazar Style Retail, taking its holding to 3.4%. The company has declined by 26.7% over the past year, underperforming its industry by 38.5%. It also has an expensive valuation, scoring only 20.8 as per Trendlyne’s Valuation score.

RARE Enterprises also cut its stake in Nazara Technologies by 0.2%, and now holds 7.1% in the internet software & services company. The portfolio has reduced its stake in the company for the past six quarters. Nazara has surged 102.9% in the past year. Trendlyne’s DVM score classifies it as an Expensive Rocket as it trades in the PE Sell Zone.

Ashish Kacholia adjusts holdings in key sectors

Ashish Kacholia’s net worth declined by 14.9% to Rs 2,670 crore as of May 19 as he dialled back on multiple stocks.

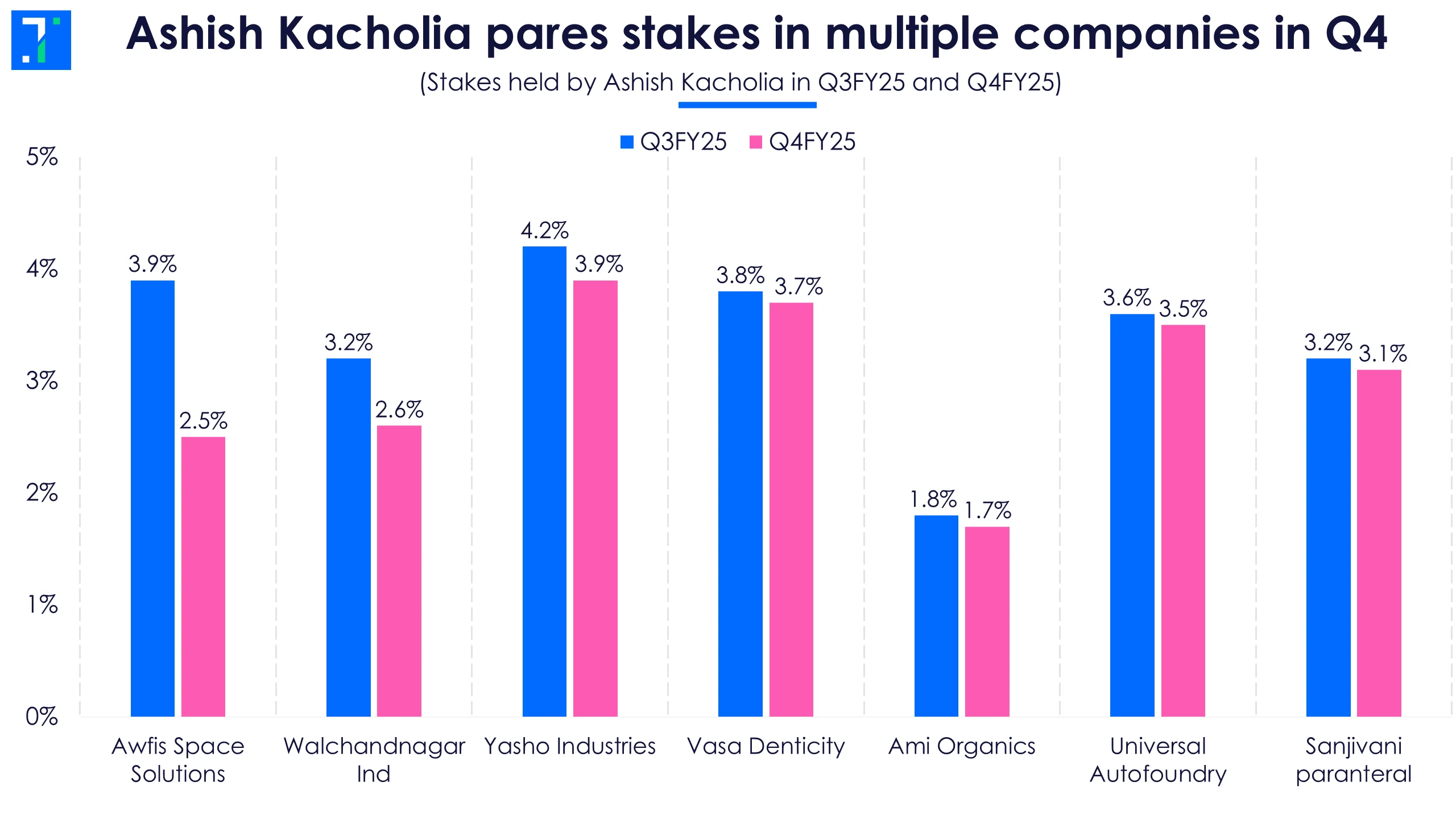

Ashish Kacholia pares stakes in multiple companies in Q4

During the latest quarter, Kacholia cut a 1.4% stake in Awfis Space Solutions, a special consumer services company. The company has weak financials and features in a screener of stocks with low Piotroski scores. The company is trading at an expensive valuation, suggested by Trendlyne’s valuation score of below 30, and is displaying a neutral momentum with Trendlyne’s momentum score of 39.

The marquee investor reduced his stake in industrial machinery maker Walchandnagar Industries by 0.6%, taking his holding to 2.6%. Trendlyne classifies the company as an Expensive Performer. The company posted a loss of Rs 41.8 crore in FY24 and Rs 29.8 crore during 9MFY25. It has been reporting losses since FY13, except in FY23.

High valuations, sustained FII selling, and weak market sentiment in mid- and small-cap stocks likely prompted Kacholia’s portfolio trimming in Q4.

Kacholia cut a 0.2% stake in specialty chemical firm Yasho Industries during the quarter, and now holds 3.9%. The company’s share price has declined by 8% over the past year, underperforming its industry by 20.9% points. It has a low Durability score of 35 and an expensive valuation, scoring 10.3.

During Q4, Kacholia offloaded 0.1% each in Vasa Denticity and Ami Organics. He held 3.8% and 1.8% stakes in the healthcare supplies and pharma companies in Q3FY25. Both companies feature in a screener of stocks with high PE (PE > 40).

The ace investor also sold 0.1% each in Universal Autofoundry and Sanjivani paranteral. The auto parts & equipment maker and pharma stock feature in a screener of bearish stocks. Universal Autofoundry has underperformed its industry by 59.6% points in the past year. Sanjivani is currently trading in the Strong Sell Zone, indicating it is trading above its historical PE.

Sunil Singhania’s Abakkus Fund cuts stakes in two firms to below 1%

Sunil Singhania’s Abakkus Fund saw its net worth fall by 14.9% to Rs 2,535.2 crore. The fund cut its holdings in two companies to below 1% and trimmed minor stakes in four others during Q4FY25.

Singhania reduces holdings in BirlaNu, Uniparts and others

Singhania’s fund reduced its holdings to below 1% each in cement & cement products maker BirlaNu and heavy electrical equipment firm Uniparts India. BirlaNu features in a screener of profit-to-loss companies (companies that moved from profit to loss QoQ). It has declined by 10.4% in the past year, underperforming its industry by 23.5% points. Uniparts ranks medium in Trendlyne’s checklist. It is currently trading in the Sell Zone.

During Q4, Abakkkus Fund lowered its stake in Sarda Energy & Minerals by 0.3% and now holds 1.5% in the steel products maker. The company is a Mid-range Performer and also features in a screener of stocks where mutual funds decreased their holdings last quarter.

Singhania’s fund cut 0.1% each in auto parts maker Shriram Pistons, specialty retail firm Ethos, industrial machinery company Anup Engineering, and IT consulting player Mastek in the March quarter. He now holds a 1% stake each in Shriram Pistons and Ethos, 3.6% in Anup Engineering and a 2.8% stake in Mastek. All four companies have declining net cash flows. Ethos and Anup Engineering have expensive valuation scores, while Shriram Pistons and Mastek have technically neutral momentum scores.

Vijay Kedia makes minor stake sales during Q4

Vijay Kedia’s net worth decreased by 24.1% to Rs 1,440.2 crore as of May 19. During the quarter, he reduced his stake in auto parts maker Precision Camshafts from 3.2% in Q3 to 2.1%. Over the past year, the company’s share price fell 10.8%, underperforming its industry by 15.8% points.

Kedia cuts his stake in Precision Camshafts, Tejas Networks and others

During the quarter, Kedia also cut a 0.3% stake in telecom equipment maker Tejas Networks. He held a 1.9% stake for five consecutive quarters before reducing it to 1.3% in Q3FY25. The company’s share price declined by 38.4% over the past year and is classified as a Slowing Down Stock by Trendlyne.

The ace investor further reduced his stakes in Global Vectra Helicorp and Sudarshan Chemical Industries by 0.3% and 0.2%, respectively, bringing his holdings to 4.9% and 1.3%. Global Vectra posted a loss of Rs 13.3 crore in 9MFY25 and a marginal profit of Rs 1.2 crore in FY24, while Sudarshan Chemicals is considered overvalued based on its current PE.

Kedia also sold a minor stake in Elecon Engineering, now holding 1.1% in the industrial machinery manufacturer.

Dolly Khanna cuts stakes in multiple companies

Dolly Khanna reduced her holdings in eight companies during Q4FY25, including four where her stake fell below 1%. Despite the reductions, her net worth rose by 22.5% to Rs 557 crore as of May 19, supported by new additions and stake increases. She added two new companies, Polyplex Corp and GHCL, and increased her stake in seven others during the quarter.

She lowered her stake in steel products maker Indian Metals & Ferro Alloys and oil exploration company Selan Exploration from 1.2% to below 1%. Over the past year, Indian Metals’ share price declined by 11.5%, while Selan Exploration dropped by 12.1%.

Dolly Khanna cuts stakes in four companies to below 1%

Khanna also reduced her stake in Nile and POCL Enterprises to below 1%. Both companies are currently in the PE Sell zone and appear in a screener of stocks with declining net cash flow.

During the quarter, she trimmed her stake in Zuari Industries by 1.3%, bringing it down to 1.6%. Trendlyne classifies this sugar company as a Mid-range Performer due to its medium financial strength, valuation, and a neutral Momentum score.

She also cut her stake in packaging firm Rajshree Polypack by 0.1%, now holding 1.1%. The company’s share price has fallen 27.5% over the past year, underperforming its industry by 74.5% points.

Khanna made a minor reduction in Rajshree Sugars & Chemicals as well during the quarter.

Porinju Veliyath reduces stake in an IT consulting firm to below 1%

Porinju V Veliyath’s net worth fell 33.7% to Rs 196.2 crore as of May 19. During the quarter, he reduced his stake in IT consulting firm RPSG Ventures to below 1%, down from 1.4% in Q3. The company’s share price has fallen 6.1% over the last six months but is up 32.2% over the past year.

Porinju pares stake in RPSG Ventures to below 1%; reduces holding in Kaya

He also cut his stake in Kaya, a skincare clinic chain, to 1.3% after consistently holding 2.9% for the past three quarters. Kaya holds a medium rank on the Trendlyne Checklist and has a neutral momentum score of 47.8. Its share price has underperformed its industry by 48% points over the past year.

Additionally, during the quarter, Veliyath marginally reduced his stake in Max India, a holding company.