There' was a lot of optimism around global growth at the beginning of 2023. China was reopening post Covid, inflation was slowing in the EU and US. India's rise was also being noticed by many analysts - "India is on the move", the writer Noah Smith declared.

But it's May now, and some of that early cheer has wilted in the heat. Germany, Europe's growth engine, is slowing down, China's reopening bump has faded, and Nomura in its recent report said that India is also affected. “India is on the cusp of a macro change," Nomura wrote, "moving from a 'high growth, high inflation' regime to a 'low growth, low inflation' one.”

India's retail inflation dropped to 4.7% in April (good), but industrial output stayed flat in March (not so good).

Financial organisations now forecast India’s GDP growth rate falling to 6% on average in FY24. They aren’t as optimistic as the RBI, which raised its growth forecasts slightly in April.

Signs of a slowdown are also visible in the Q4 results. According to India Inc’s Q4 results so far, net profit growth has fallen to single digits due to weaker sales growth, higher interest costs, and depreciation. On the positive side, industries like cement, paints and auto have seen margins improve as their input costs declined.

Even with growth decelerating, some companies have achieved industry-beating performance in Q4 and are confident of their prospects in the year ahead.

In this week’s Analyticks:

- Smallcap stars: Industry outperformers which are forecasting good growth in FY24

- Screener: Stocks which saw recent broker target price or recommendation upgrades

Let’s get into it.

When good things come in small packages: Seven smallcap stocks that are beating their industries

Size isn't everything. Tendulkar was the 'Little Master' of cricket for decades - his height was probably the only area where he underperformed compared to the other cricketers.

Some companies in the smallcap index are similar outperformers. We identify seven stocks from the BSE SmallCap that have beaten their respective industries in terms of both top-line and bottom-line growth in Q4. These companies also have a positive growth outlook for the future.

Syngene International to benefit from global supply chain shifts

Pharma player Syngene International beat consensus net profit estimates by 18% in Q4. Its growth was driven by its strong performance in both research services and contract manufacturing.

Commenting on the demand environment, Jonathan Hunt, CEO at Syngene, said, “We have seen a weaker funding environment for biotech startups in the US. So they are much more cost conscious and are looking to make sure that the funding they have can go a long way. That’s not a bad thing for Syngene as we are cost-competitive”.

The company’s management has guided for a 17%-19% growth in FY24 revenue (dollar terms). However, net profit growth may be lower due to a change in the tax rate. But analysts expect Syngene’s profits to rise by over 25% in rupee terms.

KPIT Technologies to gain from changing auto priorities in FY24

This tech player, which serves the auto space, outperformed the industry’s net profit growth by more than 30 percentage points in Q4. KPIT Tech’s strong performance in both top line and bottom line, with over 35% growth, was driven by the European markets.

Going forward, the company’s management is confident of clocking 27%-30% revenue growth (in dollar terms) in FY24. Its focus remains on getting more business from existing clients.

With auto OEMs working to reduce the number of electronic control units in vehicles, KPIT sees a big opportunity. It expects OEMs to spend $40 billion annually over the next 5-7 years to build centralized software architecture.

Market share gains, capacity additions to boost Blue Star’s growth

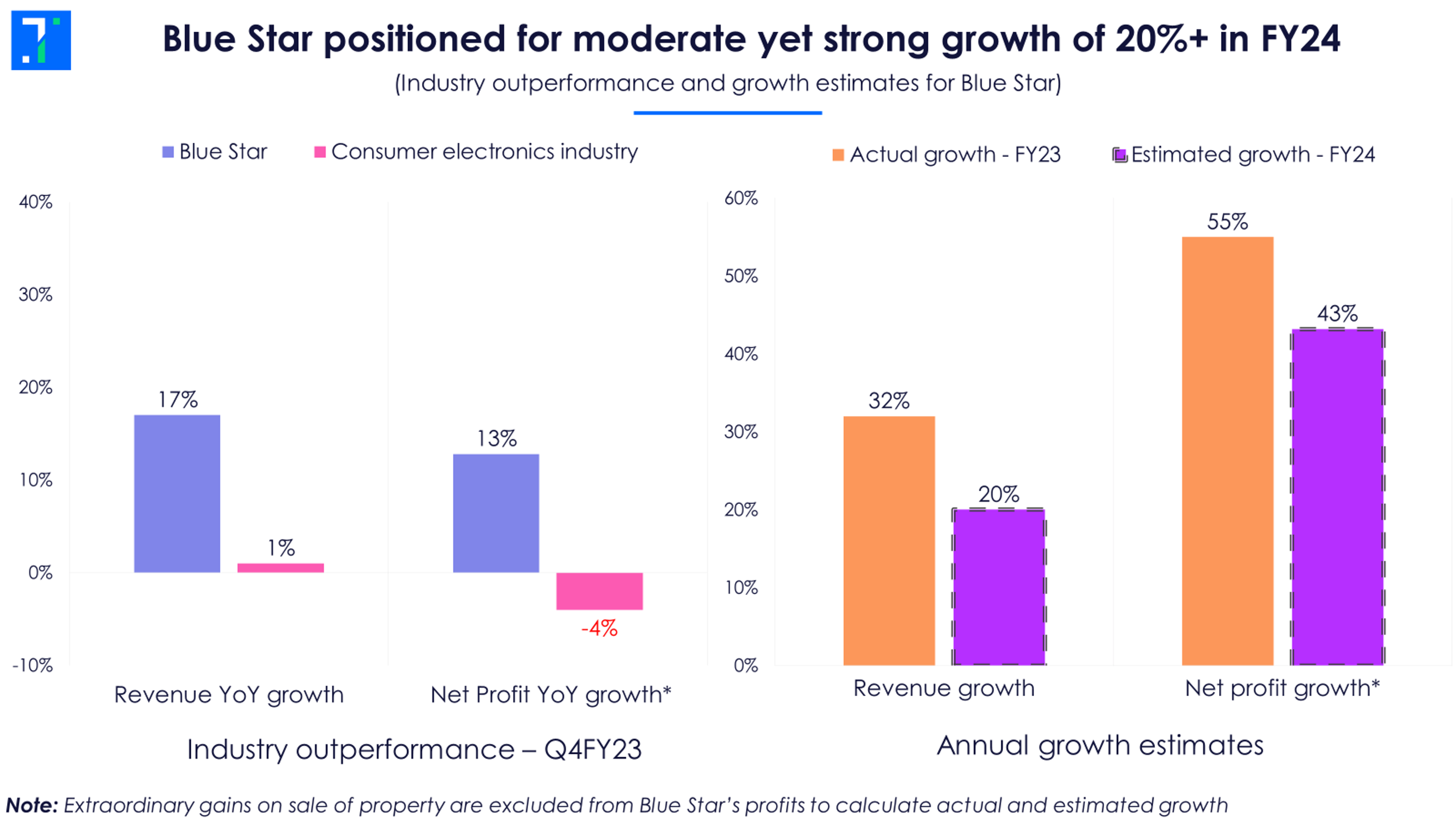

Blue Star surpassed its industry’s revenue and net profit growth by over 15 percentage points (excluding extraordinary gains) in Q4. Its growth was driven by its unitary products segment, which includes room ACs and commercial refrigerators.

The company sees the room AC market growing at a CAGR of 20% in the next three years, as summers keep getting hotter. Its own business will grow even faster aided by market share gains. To capture a higher share, Blue Star plans to spend Rs 500-600 crore in capex in the next two years.

Analysts are optimistic about the company and expect it to clock bottom-line growth of over 40% in FY24, backed by healthy sales and margin improvement.

Craftsman Automation set to see growth in all segments in FY24

Craftsman outperformed the auto parts industry’s net profit growth by over 90 percentage points in Q4FY23. This was partly due to the acquisition of DR Axion India in the quarter.

Going forward, the company sees all its segments - powertrain, aluminum die-casting, and industrial engineering - growing by at least 20% in FY24. The demand for off-highway commercial vehicles and trucks is expected to be the driver for its powertrain business.

Analysts predict over 40% top-line and bottom-line growth in FY24. Their estimates are high as they see DR Axion contributing an additional 20-25% to its revenues.

Glenmark Life set for a turnaround in FY24

Glenmark Life delivered an impressive earnings performance in Q4. It beat analyst estimates on net profit growth by 35%. However, the API maker posted lackluster growth in FY23, due to inventory rationalization undertaken by its parent company, and contract manufacturing clients.

During a recent earnings call, Yasir Rawjee, Managing Director at Glenmark Life, commented, “Glenmark Pharma was in inventory tightening mode. But they have finished that. So, we began to see very good demand from them in Q4, which will be sustainable.”

The company’s management has guided for 12%-14% top-line growth in FY24 and plans to double its reactor capacity by FY26. Analysts' growth expectations are similar.

Newgen focuses on larger deal wins

Newgen Software beat the IT industry’s net profit growth by over 35 percentage points in Q4. It also delivered a double-digit earnings surprise. Its growth was driven by the India and Middle East markets.

The company is now focussing on winning more business from existing clients and pulling in larger accounts. Commenting on the latter strategy, Virender Jeet, CEO at Newgen, said, “Initially in the US, we focused on banks which were sized from $1 billion and up to $20 billion. We have now started focusing on banks which are at least $10 billion”.

Newgen has set a minimum revenue growth target of 20% in FY24. However, analysts are slightly conservative here.

Stylam Industries announces new capex plans

This laminates maker outperformed its industry’s net profit growth by over 50 percentage points in Q4. Growth was fueled by a jump in exports and healthy growth in the domestic markets.

Stylam is planning a greenfield expansion involving an outlay of Rs 150 crore in FY24. This has a sales potential of Rs 500 crore. Including Stylam’s ongoing brownfield expansion, its overall capex spends will be around Rs 170-176 crore.

Going forward, the company sees a resilient export market and expects strong demand from new home construction in the domestic market. Analysts expect the company’s bottom line to rise over 25% in FY24.

Screener: Stocks which saw recent broker target price or recommendation upgrades

This screener shows stocks which have received broker upgrades for target price and recommendationin the past month, while also boasting a high analyst rating.

Stocks from the banking, NBFC, hotels, gems & jewellery and personal products industries feature in the screener. Major stocks in the screener are Cholamandalam Finance, ICICI Bank, Titan, Indian Hotels and SRF.

Chola Finance stands out with seven target price upgrades from brokers over the past month. These upgrades were driven by the company’s impressive growth in Q4 and improving asset quality. With an average broker rating of 4.6, it leans towards a ‘Strong Buy’ consensus.

ICICI Bank has received six target price upgrades from brokers in the past month. This comes as a result of its strong growth in Q4 net profit and continued investments in its digital capabilities. The stock has an average broker target price upside of nearly 20%.

Titan has six target price upgrades and one recommendation upgrade from brokers in the past month. Brokers remain positive on the stock following the Q4 results, citing strong demand trends in jewellery and scalability in wearables, eyewear and Taneira.

You can find some popular screenershere.