The FY25 Budget marked a volatile day for Indian equity markets. All major indices nosedived after Finance Minister Nirmala Sitharaman, in her Budget speech, proposed increasing taxes on stock market gains. Long-term capital gains will now attract a tax of 12.5% compared to 10% earlier, while short-term capital gains tax was raised from 15% to 20%. Taxes were also hiked on F&O transactions.

Meanwhile, Sitharaman proposed reducing the corporate tax rate on foreign companies from 40% to 35% to become the top alternative in the “China plus one” strategy, and attract foreign capital.

Post-elections, the Indian equity markets in June and the first fortnight of July witnessed a total inflow of Rs 47,284 crore in equities. Before that, Foreign Portfolio Investors (FPIs) had withdrawn Rs 34,286 crore in April and May due to poll jitters and concerns over sticky inflation. Since then, a better-than-expected earnings season has helped build investor confidence and attract FPIs back to Indian equity markets.

In this week’s Chart of the Week, we take a look at sectors with the highest FPI activity over the past year. FPIs consistently poured money into capital goods companies, with a total inflow of Rs 47,422 crore. The consumer services sector was the second favourite among FPIs, attracting a net investment of Rs 36,570 crore.

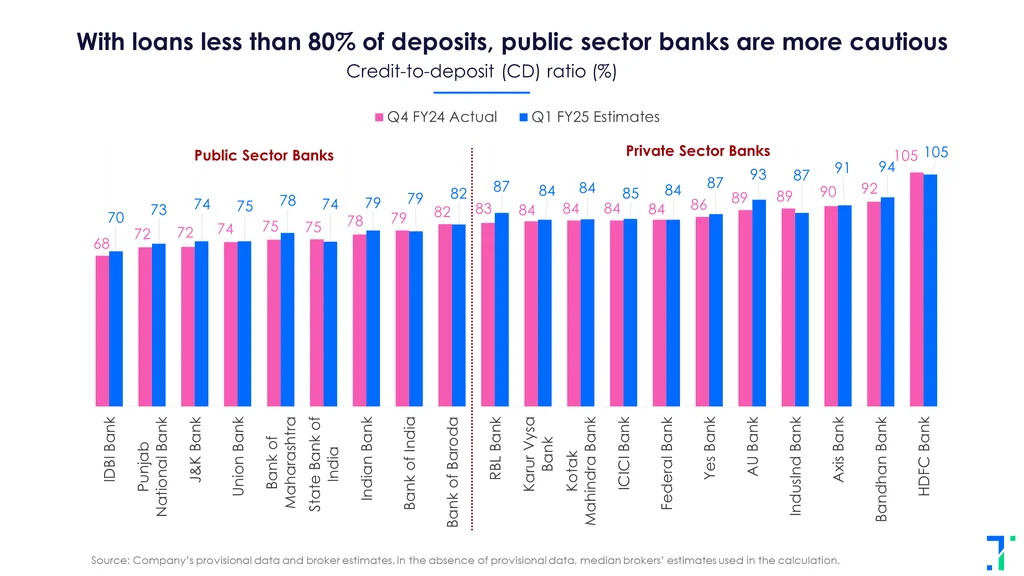

The financial services sector, on the other hand, witnessed the highest FPI outflow of Rs 35,066 crore in the past year. The sector has recently underperformed due to high borrowing rates, resulting in lower net interest margins as advance growth outpaced deposit growth over the past year.

Capital goods, consumer services and telecom emerge as FPI favourites

More than half of the total investment of around Rs 2 lakh crore by FPIs went into capital goods, consumer services and telecom sectors. Capital goods companies have benefited from a robust order backlog and a steady inflow of fresh orders. This growth was supported by stable commodity prices and increased government infrastructure spending, as well as production-linked incentive (PLI) schemes. The “China plus one” strategy has also helped the order surge.

The consumer services sector ranked second in FPI interest, with net positive inflows even during highly volatile months leading up to the election. Higher discretionary spending over the past year has boosted investor confidence in the sector. The telecom sector caught the attention of FPIs, attracting investments worth Rs 28,461 crore, with over 90% of the total investment coming in the last five months. The recent tariff hike by telecom companies is expected to drive growth in average revenue per user and expand their net profit margins in the coming quarters.

IT sector is gaining traction post surprise outperformance in Q1 results

The information technology sector also saw a notable shift, with FPIs turning net buyers and investing Rs 2,765 crore from July 1 to 15. This was a reversal from the net selling of Rs 981 crore observed in June. The IT sector showed early signs of recovery in their Q1FY25 results, driven by opportunities in the GenAI segment and potential rate cuts in the US in September. This recovery could boost orders from the BFSI segment, which constitutes around 50% of revenue for IT companies.

Similarly, the auto sector has also seen net FPI inflows post-elections. With expectations of a good monsoon this year, analysts are predicting a volume uptick in the sales of two-wheelers and three-wheelers. The EV sector, however, received no direct subsidies or announcements in the Union Budget for FY25.

Healthcare and FMCG sectors witness turnaround post elections

The healthcare sector, comprising the pharma and hospital industries, witnessed an inflow of Rs 14,822 crore over the past year. Analysts expect the pharma industry to deliver earnings growth driven by better product mix, and improved margins. Over the past year, hospitals saw growth in average revenue per occupied bed, alongside steady capacity additions, leading to higher net income and revenue visibility.

The FMCG sector, on the other hand, has seen net outflows of over Rs 20,000 crore in the past year. However, during the first July fortnight (i.e. first half of the month), the sector saw a net inflow of Rs 1,809 crore. This turnaround for FMCG came as reports surfaced of a recovery in rural demand in recent months. Tobacco company ITC rallied after the government, in the 2024 Budget, decided to maintain the current tax rates on cigarette and tobacco products, which contributed around 75% to its profit before taxes as of Q4FY24.

Stocks that have seen the highest increase in FII holdings in the past quarter

Banks & telecom sector stocks witness a sharp rise in FII holdings

The above chart represents the top eight Nifty500 stocks that saw the highest jump in FII holdings in terms of percentage points on a QoQ basis. You can take a look at all the stocks where FIIs have increased their shareholding in the past quarter in the “FII/FPI increasing their shareholding” screener.

Telecom company Vodafone Idea (VI) has seen its share price surge from Rs 13 at the time of FPO to Rs 19 in the past month, following a fundraise of Rs 18,000 crore through the FPO. The company plans to use the proceeds for 5G expansion and to clear dues of around Rs 10,000 crore to the tower company Indus Towers. FPIs have significantly increased their shareholding in both companies in the past quarter.

Meanwhile, FPIs have also increased their stake in Ujjivan Small Finance Bank and CSB Bank by 21.2 and 7.4 percentage points respectively. Both banks are currently trading at fair valuations as they have a Trendlyne valuation score of around 70.

These FPI trends in different sectors reflect both global economic trends, changing investor preferences and sector-specific challenges/policies in India. Right now, the overall sentiment surrounding India is increasingly positive, and this has shown up in the return of foreign funds in recent months.