The Godrej steel almirah, first launched in 1923, came with a sturdy inside locker for storing valuables: jewellery, cash bundles, land deeds, letters from faraway family members. The almirah was just one signifier of a country of savers. Indian households have long been reluctant to take on debt.

That however, is changing fast. India's household debt has grown steadily, hitting new highs of over 39% of India's GDP in FY24. The biggest growth has been in non-housing loans.

With household debt rising and and corporate borrowings also up, banks have seen a big shift over the past two years, with their credit growth surpassing deposit growth. While the credit surge in a typically credit-starved country should be celebrated, the falling savings rates and rising household debt are red flags.

Banks make money from the difference between the interest they earn on loans, and the interest they pay to depositors. So a rising credit deposit gap should be good news for their profts, right? The reality is more complicated. Let's take a closer look.

In this week's Analyticks:

- The credit boom for banks: Is rising credit growth turning into a pain point?

- Screener: Bank stocks with falling non performing assets

Are banks getting stressed with high credit growth?

From April 2022 onwards, banks have seen credit growing at an average rate of 16% YoY, surpassing deposit growth of 11% YoY. The figures exclude the merger of HDFC Ltd. with HDFC Bank.

Credit growth has even outpaced India's nominal GDP growth rate for 7 consecutive quarters. In the June monetary policy statement, RBI governor Shaktikanta Das said that bank management should try to address this persisting gap.

RBI’s Financial Stability Report (FSR) cautioned that credit growth beyond current levels may not be sustainable. As of 28th June 2024, credit growth slowed to 14% while deposit growth was at 11%. RBI's previous analysis showed that these high-credit cycles usually last for 41 months on average.

Banks’ provisional data and estimates from brokers also suggest that the unwinding of credit growth may have begun from Q1 FY25. But the credit-deposit gap still persists, and public sector banks in particular have been struggling with deposit growth.

Walking the tightrope

The credit-to-deposit (CD ratio) tells us how much money banks have lent out, compared to their deposits. A very low ratio means banks are not lending enough, while too high a ratio could mean that banks have few liquid assets (deposits) left.

The problem with a too-high ratio is also that if depositors suddenly withdraw their funds in large amounts, banks may face liquidity challenges, making it difficult to meet short-term obligations. It's a tightrope that banks need to walk.

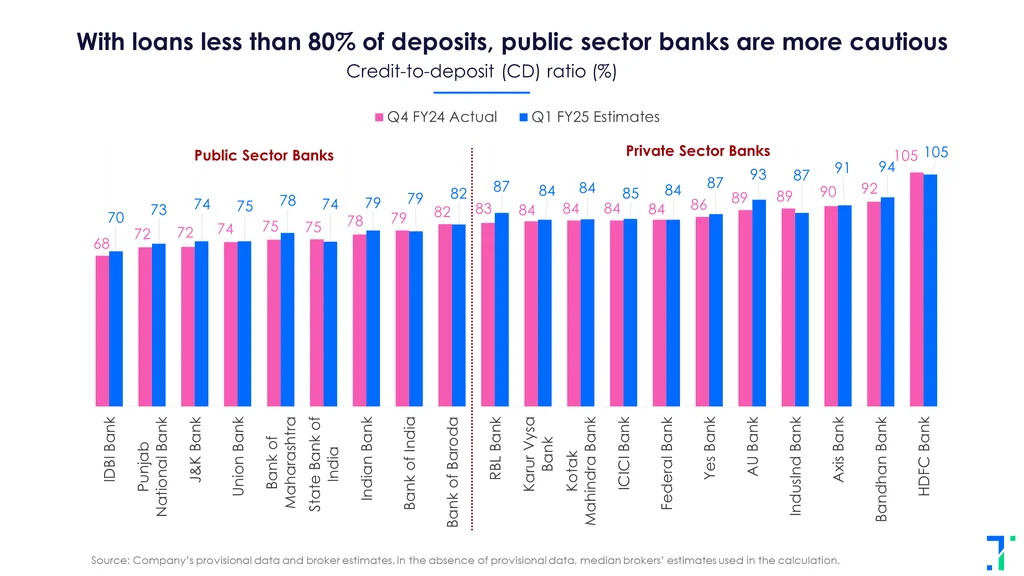

The tolerable or 'normal' range for the CD ratio is around 80%. RBI does not prescribe any ideal level. The ratio has been in general, lower for public sector banks indicating better asset-liability management systems, compared to their private counterparts.

The incremental CD ratio - the ratio of additional credit and deposits over a particular period - crossed 100% in FY24, raising eyebrows. While public sector banks have been able to bring it down, private sector banks have pushed it even higher. This indicates aggressive lending techniques in the private sector, and the merger’s impact on HDFC Bank.

Some banks in the public sector have started raising the term deposit rates they offer to attract depositers. But private banks, on average, have reduced these rates as per the latest available data.

Margins are likely to see a hit if banks are pushing deposit rates higher without changing their lending rates. Brokers estimate that bank net interest margins will take a hit of 10-15 bps in Q1FY25. Although public sector banks fare better in most parameters, NIM compression as they raise deposit rates will hit their profitability.

Right now, public sector banks are at the top

It is banks with lower CD ratios, higher liquidity coverage (LCR), good fundamentals (higher Durability score) and appropriate valuations (higher Valuation score) will be able to sail through volatile times ahead.

Our analysis finds public-sector banks such as Bank of Maharashtra and Karur Vysya Bank are in better shape than the private sector. State Bank of India and ICICI Bank, also have a good trajectory.

- Bank of Maharashtra:

The bank’s credit growth has been remarkable at 3% QoQ during the quarter ending June 2024. With an ROE of more than 20%, a healthy CD ratio and liquidity (LCR), and favourable Trendlyne scores, BoM emerges as a strong performer compared to its peers.

- Karur Vysya Bank:

A bank that has maintained an LCR of more than 200% for a long time is worth adding to the watchlist. A recent ICICI Securities report highlighted that it has the lowest cost of deposit and net NPAs, compared to its peers. Provisional data for the quarter ended June 2024 showed a 4% QoQ increase in loans and deposits, one of the highest amongst peers.

Risks are rising, favouring the most cautious bank players

A strong economic outlook, a possible interest rate cut and a good monsoon all point to a booming bank sector. However, we cannot ignore a key risk: rising credit.

Considering over-leveraged households, weak consumption growth and weak rural incomes, the RBI has been taking actions to safeguard the banking system. But risks like seasonal slippages in the agricultural and microfinance sectors, lower recoveries, and NIM compression will haunt banks for at least a couple of quarters.

In such times, investors need to be cautious. Any one or a combination of these factors can shake up the sector.

Screener: Banking stocks rising over the past quarter with falling NPAs in Q4FY24

PSU and small finance banks see a decline in gross NPAs

With the start of the Q1FY25 results season, we take a look at banks and financial institutions that saw a fall in their non-performing assets (NPAs) YoY in Q4FY24. This screener shows banking and finance companies that rose over the past quarter with a YoY decrease in gross and net non-performing assets (NPAs) in Q4FY24.

The screener primarily consists of PSU and small finance banks. Major stocks that appear in the screener are Jana Small Finance Bank, Federal Bank, Indian Bank, Bank of Maharashtra, Bandhan Bank, Yes Bank, Punjab & Sind Bank and Central Bank of India.

Jana Small Finance Bank has surged 58.1% in the past quarter. Its gross NPAs contracted by 180 bps YoY to 2.1% in Q4FY24, while its net NPAs fell by 208 bps YoY to 0.6% during the quarter. This helped the bank’s provisions to decline by 12.1% YoY to Rs 175.4 crore. The decline in NPAs was helped by a low gross NPA of 0.3% in the affordable housing segment which contributes to 18% of the bank’s total advances. Systematix expects the company’s deposits to grow on the back of its strategy to relocate branches to areas with potential for higher deposits.

Indian Bank has risen 14.6% over the past quarter on the back of strong Q4FY24 results. Its gross NPAs declined by 200 bps YoY to 4% in Q1FY24, net NPAs also contracted by 47 bs YoY to 0.4% due to a moderation in slippages and a reduction in booking loans. This decline in gross and net NPAs helped the bank’s provisions to reduce by 51.3% to Rs 1,247.8 crore during the quarter. According to ICICI Direct, the company’s focus on improving asset quality, stable margins, healthy fee income, and low operational expenses will help sustain its performance.

You can find more screeners here.