Trendlyne Analysis

Nifty 50 closed at 17,359.75 (279.1, 1.6%), BSE Sensex closed at 58,991.52 (1031.4, 1.8%) while the broader Nifty 500 closed at 14,557.85 (212.3, 1.5%). Of the 1,964 stocks traded today, 1,301 were gainers and 618 were losers.

Indian indices extended their gains in the final hour of the trading session and closed in the green. The Nifty 50 rose nearly 250 points and closed above the 17,300 mark. Reliance Industries will conduct a shareholder meeting to demerge its financial services business.

Nifty Smallcap 100 and Nifty Midcap 100 closed in the green, following the benchmark index. Nifty Energy and Nifty Bank closed higher than Wednesday’s levels. All other major sectoral indices close in the green. Nifty IT gained 2.4% at close, following the tech-heavy Nasdaq 100 index closing 0.91% higher on Thursday.

European indices trade in the green, in line with the Asian indices, which closed higher. US indices futures also traded in the green, led by the tech-heavy Nasdaq 100 index futures.

Zydus LifesciencesbeatsAbbott India in YoY revenue and net profit growth, FII holdings and broker average target upside. But it lags in Trendlyne durability score and mutual fund holding.

AIA Engineering and KEI Industries reach their all-time highs of Rs 2,960 and Rs 1,744 per share respectively. AIA Engineering has risen 11.5% in the past month, while KEI Industries grew 5.8%. They show up in a screener for stocks with new 1-year highs.

Crisil expects IT firms’ revenue to fall to 10-12% in FY24. In FY22, revenue growth for the sector was 19% and in FY23, it is expected to be around 18-20%. The reason for the fall is a slowdown in the BFSI sector, which accounts for 30% of its revenues.

Torrent Power is one of the top loser stocks in trade today. It shows up in a screener with declining ROE in the past two years. The stock, however, has gained 6% in the past six months.

Avalon Technologies, a vertically-integrated electronic manufacturing services provider, opens for IPO subscription on Monday. The price band for the issue is Rs 415-436 per share. The size of the issue is Rs 865 crore, comprising a fresh issue of Rs 320 crore and an offer for sale for Rs 545 crore.

Anupam Rasayan, Manappuram Finance and Rail Vikas Nigam outperform the Sensex by 32.4%, 20.2% and 18.6% respectively in the past month.

Tata Consultancy Services, Infosys, HCL Technologies, MphasiS and LTIMindtree are rising in trade. All constituents of the broader sectoral index Nifty IT are also trading in the green.

Shriram Properties rises as strategic investors grab a 14.3% stake in the company through a block deal. It shows up in a screener for high-volume stocks today.

HDFC Securities maintains its ‘Buy’ rating on Aether Industries with a target price of Rs 1,121, indicating an upside of 20.6%. The brokerage remains positive about the firm due to its capacity expansion-led growth, advanced R&D capabilities, strong product pipeline and market leadership in most of its products. It expects the company’s revenue to grow at a CAGR of 37.1% over FY22-25.

- Jefferies maintains its ‘Buy’ rating on Sun Pharmaceutical Industries with a target price of Rs 1,200. This comes after Sun Pharma completed the acquisition of US-based Concert Pharmaceuticals.

Drug major #SunPharma earlier this month completed the acquisition of #US-based Concert Pharmaceuticals, after inking a pact to acquire the firm in a $576 million deal in January.https://t.co/3Fn3M6akBP

— Mint (@livemint) March 31, 2023 Alembic Pharma rises more than 6% in trade as the US FDA approves its ophthalmic solution used to treat glaucoma. It is trading above its third resistance or R3 level and is a high-volume high-gainer stock.

Garden Reach Shipbuilders & Engineers is surging as it signs a contract with the Ministry of Defence for the construction of four next-generation offshore patrol vessels for Rs 3,500 crore. The first vessel will be delivered 44 months after signing the contract.

- Indian rupee appreciates 24 paise to 82.19 against the US dollar in early trade today. The rise is on the back of foreign fund flow inflows and fall in crude oil prices.

The rupee appreciated by 24 paise to 82.10 in early trade on Friday following foreign fund inflows and a fall in crude oil prices. #DollarVsRupee | #RupeeVsDollarhttps://t.co/UcNVQ3Kl8B

— Economic Times (@EconomicTimes) March 31, 2023 Commodity trading & distribution, electric utilities and oil equipment & services industries rise more than 16% over the past month.

Larsen & Toubro is rising as its power transmission and distribution business bags multiple contracts worth Rs 1,000-2,500 crore to establish gas- and air-insulated substations in the Khavda RE zone and Kurnool.

ICICI Bank, Federal Bank, Bank of Baroda, IDFC First Bank and Bandhan Bank are rising in trade. All constituents of the broader sectoral index Nifty Bank are also trading in the green.

- Morgan Stanley upgrades India to ‘Equalweight’ from ‘Underweight’ amid a narrowing valuation premium and a strong economy. The brokerage is positive about India’s structural growth outlook.

Morgan Stanley upgrades India to equalweight on narrowing valuation premium: @hormaz_fatakiahttps://t.co/8wPywXYkJZ

— CNBC-TV18 (@CNBCTV18Live) March 31, 2023 Bharat Electronics is rising as it signs two contracts worth Rs 2,696 crore with the Ministry of Defence to supply fire control systems worth Rs 1,705 crore to the Indian Navy and procure automated air defence control and reporting system worth Rs 991 crore for the Indian Army.

Foreign institutional investors invest Rs 253.8 crore in the equity market over the past week, according to Trendlyne's FII dashboard. Meanwhile, index options witness the highest inflow of Rs 39,707.7 crore from foreign investors. Mutual funds also invest Rs 5,184.9 crore in the Indian markets.

G R Infraprojects is rising as it receives an order worth Rs 740.8 crore from the National Highways Authority of India to construct a four-lane highway in Karnataka.

Va Tech Wabag is surging as its joint venture with Metito Overseas secures a design build operate (DBO) order worth Rs 4,400 crore from the Chennai Metropolitan Water Supply and Sewerage Board. The DBO order is for building a 400 million litres per day (MLD) sea water reverse osmosis desalination plant.

- Reports suggest that 2.06 crore shares (0.55% equity) of Vedanta, amounting to Rs 585.64 crore, change hands in a large trade.

Vedanta Large Trade | 2.06 crore shares (0.55% equity) worth `585.64 crore change hands at Rs 284/share pic.twitter.com/d37aJynTl4

— CNBC-TV18 (@CNBCTV18Live) March 31, 2023 Hero MotoCorp appoints Niranjan Gupta as Chief Executive Officer, effective from May 1, 2023. Gupta has been promoted from his current position as Chief Financial Officer.

Jefferies initiates coverage on SBI Cards and Payment Services with a ‘Buy’ rating and a target price of Rs 900. This implies an upside of 25%. The brokerage expects a 23% CAGR in card spends and improvement in net interest margins over FY23-26E.

Jefferies has initiated a buy on SBI Cards and Payment Services Limited for a price target of Rs 900 relying on SBI Card’s potential to engineer growth in card spends over FY 2023-26.https://t.co/z2DkZXLgHN

— ETMarkets (@ETMarkets) March 30, 2023Share prices of Bajaj Auto, Mahindra CIE Automotive and UTI Asset Management fall over the week ahead of their Q4FY23 results in April.

Rail Vikas Nigam bags a project from the Ministry of Railways for the manufacture and maintenance of Vande Bharat trainsets, including the upgradation of government manufacturing units & trainset depots. It has to deliver 200 trainsets for a cost of Rs 120 crore each.

Bandhan Bank will transfer loans, a written-off portfolio and non-performing assets worth Rs 4,930.3 crore to an asset reconstruction company for Rs 739.8 crore. After hitting a 52-week low in the past week, the stock is up 3.5% in trade today.

Bharat Dynamics signs a contract worth Rs 8,161 crore with the Ministry of Defence for the production and supply of Akash weapon system to the Indian Army. It will be supplied to two regiments and executed in three years. The stock shows up in a screener for stocks with strong annual EPS growth.

Riding High:

Largecap and midcap gainers today include Macrotech Developers Ltd. (930.30, 7.36%), Bharat Electronics Ltd. (97.55, 6.55%) and Adani Wilmar Ltd. (405.85, 4.99%).

Downers:

Largecap and midcap losers today include Oil India Ltd. (251.65, -4.30%), Torrent Power Ltd. (510.40, -3.74%) and NHPC Ltd. (40.20, -3.37%).

Volume Shockers

25 stocks in BSE 500 are trading on high volumes today.

Top high volume gainers on BSE included Sonata Software Ltd. (836.30, 11.26%), Capri Global Capital Ltd. (661.15, 9.91%) and HLE Glasscoat Ltd. (504.80, 8.06%).

Top high volume losers on BSE were Sterling and Wilson Renewable Energy Ltd. (291.60, -5.55%), Bajaj Electricals Ltd. (1,051.90, -4.28%) and Phoenix Mills Ltd. (1,300.95, -2.96%).

Aptus Value Housing Finance India Ltd. (241.50, 0.19%) was trading at 10.2 times of weekly average. PNB Housing Finance Ltd. (513.15, 5.72%) and Alembic Pharmaceuticals Ltd. (496.35, 5.91%) were trading with volumes 8.2 and 7.7 times weekly average respectively on BSE at the time of posting this article.

BSE 500: highs, lows and moving averages

11 stocks hit their 52-week highs, while 7 stocks tanked below their 52-week lows.

Stocks touching their year highs included - AIA Engineering Ltd. (2,908.00, 0.09%), Bosch Ltd. (19,369.90, 2.07%) and Zydus Lifesciences Ltd. (491.55, 0.24%).

Stocks making new 52 weeks lows included - Johnson Controls-Hitachi Air Conditioning India Ltd. (1,009.15, -1.54%) and Vodafone Idea Ltd. (5.80, -1.69%).

44 stocks climbed above their 200 day SMA including Bharat Electronics Ltd. (97.55, 6.55%) and Hitachi Energy India Ltd. (3,343.40, 5.47%). 8 stocks slipped below their 200 SMA including Hindustan Zinc Ltd. (293.35, -1.89%) and Apollo Hospitals Enterprise Ltd. (4,310.90, -1.19%).

The first few months of 2023 have been anything but positive as the Nifty 500 fell by nearly 8% in the past 90 days. This week, we take a look at the outperforming and underperforming sectors over the past quarter and their best and worst-performing companies.

Sectors like food, beverages & tobacco, healthcare equipment and consumer durables have surpassed the Nifty 500, despite a weak quarter for markets. These are defensive sectors which remain stable regardless of the economy, as consumer spending here stays steady. The general industrials sector returned 2.9% in this period, backed by the capex push of the central government.

The outperforming screener shows stocks from the top-performing sectors. These are high-growth stocks which outperformed Nifty 500 by over 20% in the past year and by over 10% in the past quarter. Notable stocks in the screener are ITC, Siemens, Varun Beverages, Polycab India and KEI Industries.

Sectors like commercial services, utilities, media and retailing were underperformers and fell by over 15% in the past quarter. The utilities sector was dragged down by Adani group stocks, which plunged after Hindenburg’s explosive report on the group’s corporate governance issues.

The underperforming screener has stocks from the worst-performing sectors. Companies in this screener are Adani Total Gas and Adani Transmission, which underperformed Nifty 500 by over 50 percentage points. It also includes players like Aditya Birla Fashion, Concor and Sun TV Network.

You can find some popular screenershere.

Interest rate hikes by central banks across the world have put banks under pressure, and the collapse of Silicon Valley Bank (SVB) and Credit Suisse signal the dangers ahead.

SVB bought billions of dollars worth of treasury bonds using customers’ deposits when the interest rate was low. However, as the US Fed increased interest rates aggressively over the past year, the value of these bonds plummeted, causing the bank to sell the bonds at high losses and eventually collapse.

This raises the question of how Indian lenders are operating in an environment of rising repo rates.

In this edition of chart of the week, we take a look at the cost of funds (COF) of Indian non-banking financial companies (NBFC). COF is the interest rate at which a bank borrows money from the central bank and other financial institutions to lend to its customers. The general trend is that the higher the repo rate, the higher the cost of funds for banks.

Most NBFCs which witnessed a rise in COF in the past two quarters have been able to maintain their net interest margin (NIM) by increasing customers’ effective interest rates.

Even though Bajaj Finance’s COF has risen for the past two quarters (a QoQ increase of 30 bps in Q3FY23), the lender managed to keep its NIM at Q2 levels. The company’s assets under management (AUM) improved by 27% YoY to Rs 2.3 lakh crore in the same quarter, while its net interest income (NII) grew by 24% YoY.

Cholamandalam Investment & Finance’s COF has also increased by 40 bps QoQ to 6.4% in Q3, for the second consecutive quarter since Q1FY23. However, the lender was able to offset this rise by increasing customers’ effective lending rates and a staggered hike in interest rates across its segments. Its loan disbursements increased by 68% YoY to Rs 17,559 crore in Q3FY23.

Poonawala Fincorp also managed to improve its NIM by 33 bps QoQ in Q3FY23 and loan book by 34.2% YoY to Rs 17,682 crore despite its COF rising 30 bps QoQ to 7.5%.

Piramal Enterprises and Muthoot Finance were the only exceptions to this trend as their COF fell 40 bps and 20 bps QoQ respectively in Q3FY23. This is despite the Reserve Bank of India (RBI) hiking policy repo rates by 40 bps. Muthoot Finance managed to improve its COF by reducing borrowings from bonds while increasing them from banks and financial institutions.

Trendlyne Analysis

Nifty 50 closed at 17,080.70 (129, 0.8%), BSE Sensex closed at 57,960.09 (346.4, 0.6%) while the broader Nifty 500 closed at 14,345.60 (133.8, 0.9%). Of the 1,967 stocks traded today, 1,339 were on the uptrend, and 573 went down.

Indian indices extended their gains in the final hour of the trading session and closed in the green. The Nifty 50 rose nearly 130 points and closed above the 17,000 mark. Zee Entertainment closed sharply higher after it reached a settlement agreement with IndusInd Bank and paid the first tranche of the settlement amount.

Nifty Smallcap 100 and Nifty Midcap 100 closed in the green, following the benchmark index. Nifty Pharma and Nifty Bank closed higher than Tuesday’s levels. Nifty Auto rose over 1.7%, led by heavyweights Maruti Suzuki India and Tata Motors.

European indices traded in the green, in line with the Asian indices, which closed higher. US indices futures also traded in the green, led by the tech-heavy Nasdaq 100 index futures. Brent crude oil futures traded in the green for a third straight trading session after industry data released on Tuesday showed a surprisingly large draw in US crude stocks, which could lead to tighter supply in the near term.

Money flow index (MFI) indicates that stocks like Anupam Rasayan India and Aurobindo Pharma are in the overbought zone.

Macrotech Developers is up 10% in trade today. The company shows up in a screener for stocks with book value per share improving over the past two years. The firm is also ranked high on Trendlyne’s checklist with a score of 50%.

Rainbow Children's Medicare rises 14% in six months. ICICI Direct has a ‘Buy’ rating on the stock with a target price of Rs 840. The stock gains 74% from its 52-week low.

JSW Steel, TVS Motor and Crisil are trading above their third resistance or R3 level.

Media stocks like Dish TV India, New Delhi Television, Zee Entertainment Enterprises, TV18 Broadcast and Network 18 Media & Investments are rising in trade. The broader sectoral index Nifty Media is also trading in the green.

Maruti Suzuki rises as it achieves exports of 25 lakh vehicles to date. The stock has gone up 10% in the past year. It features in a screener for stocks with upgraded broker recommendations or target prices in the past three months.

- Zee Entertainment rises over 4% after it reaches a settlement agreement with IndusInd Bank and pays the first tranche of the settlement amount.

Zee-IndusInd Bank Case | Settlement agreement reached between Zee-IndusInd today morning. Under settlement agreement, Zee Ent has paid first tranche of settlement amount today. #IndusIndBank to withdraw objection from NCLT Mumbai to Sony-Zee Merger

— CNBC-TV18 (@CNBCTV18Live) March 29, 2023

Here's more #ZeeEnt#IndusIndpic.twitter.com/LGmycNhUQa PSU banks like UCO Bank, Indian Overseas Bank, Punjab & Sind Bank, Central Bank of India and Bank of Maharashtra are rising in trade. All constituents of the broader sectoral index Nifty PSU Bank are also trading in the green.

PNB Housing Finance is rising as its board approves a rights issue of 9.06 crore fully paid-up equity shares amounting to Rs 2,500 crore. The issue price is set at Rs 275, including a premium of Rs 265. The rights issue will open on April 13 and close on April 27.

- The Department of Economic Affairs, in its Monthly Economic Report, states that India’s current account deficit will narrow in FY23. It also discusses the possibility of extreme weather conditions affecting food grain output.

News Alert | Department of Economic Affairs - Monthly Economic Report for Feb - Here are the observations on pent-up demand, current account deficit and weather (From Agencies)@FinMinIndia#Economypic.twitter.com/LF1yvvyYEj

— ET NOW (@ETNOWlive) March 28, 2023 Zydus Lifesciences and Gujarat Pipavav Port touch their 52-week highs of Rs 489.3 and Rs 115.5 respectively in a weak market. Zydus has risen 4.4% over the past month, while Gujarat Pipavav rose 9.6%.

Larsen & Toubro’s minerals & metals business secures two orders worth Rs 2,500-5,000 crore from the Vedanta group to set up a fertilizer plant for Hindustan Zinc and expand the capacity of an aluminium smelter complex at Korba, Chhattisgarh, for Bharat Aluminium Co.

Himachal Futuristic Communications (HFCL) is rising as it bags an order worth Rs 282.61 crore from the Gujarat Metro Rail Corporation to design, manufacture and supply telecommunication systems for the Surat Metro Rail Project.

Axis Direct maintains its ‘Buy’ rating on Dalmia Bharat and raises the target price to Rs 2,260 from Rs 2,120. This indicates an upside of 19.9%. The brokerage is optimistic about the company’s prospects due to increased production capacity, rising cement demand and cost optimisation measures. It expects the firm’s revenue to grow at a CAGR of 14% over FY22-25.

Hindustan Construction Co (HCC) is up more than 8% as it sells its entire stake in Baharampore-Farakka Highways, its wholly owned subsidiary, to Cube Highways, a Singapore-based company. The expected payout to be received by HCC is Rs 941 crore.

ICICI Bank and UltraTech Cement are rising ahead of their results on April 22 and April 28.

- BofA Securities maintains its ‘Buy’ rating on HCL Technologies, while it has a 'Neutral' stance on Tata Consultancy Services & Info Edge and an ‘Underperform’ on Wipro and Tech Mahindra. The brokerage expects an incremental slowdown for the IT space in Q4FY23.

Brokerage Radar | BofA on I.T. preview: Q4 for the sector will be a quarter of incremental slowdown#IT#TechMahindra#Wipro#HCLpic.twitter.com/J7kxfMULcR

— ET NOW (@ETNOWlive) March 29, 2023 RHI Magnesita India's board will meet on April 1, 2023, to consider and approve fundraising through preferential allotment. They plan to issue equity shares for an aggregate amount not exceeding Rs 200 crore.

- Reports suggest that 6.48 lakh shares (0.35% equity) of Mphasis, amounting to Rs 109.39 crore, change hands in a large trade.

#Mphasis Large Trade | 6.48 lakh shares (0.35% equity) worth ?109.39 crore change hands at an average of ?1,686.52/share#BlockDeal#LargeTradepic.twitter.com/jeRHAlO9yt

— CNBC-TV18 (@CNBCTV18Live) March 29, 2023 G R Infraprojects is rising as it bags a project for the construction of tunnels worth Rs 587.6 crore for the Khurda-Bolangir new rail line project. It shows up in a screener for stocks with zero promoter pledges.

Share prices of Infosys, HCL Technologies and MphasiS fall over the week ahead of their Q4FY23 results in April.

Quess Corp is rising as 6.6 crore shares (4.5% equity) amounting to Rs 251 crore change hands in a large trade, according to reports.

Quess Corp #LargeTrade | 6.6 cr shares (4.5% equity) worth ?251 cr change hands at an average of ?377.5/sh pic.twitter.com/YcGHQ8NLal

— CNBC-TV18 (@CNBCTV18Live) March 29, 2023Porinju Veliyath buys a 0.56% stake in Shalby for Rs 7.1 crore in a bulk deal on Tuesday.

NBCC bags an order worth Rs 100 crore to reconstruct and redevelop Small Industries Development Bank of India. It also receives an order for phase 2 development of an engineering institute in West Bengal for Rs 46.39 crore. The stock is up 2% in early trade today.

Jindal Stainless acquires a 49% stake in Indonesian nickel pig iron company, New Yaking, for $157 million (Rs 1,289.8 crore). The acquisition offers the benefits of backward integration to the company.

Riding High:

Largecap and midcap gainers today include Macrotech Developers Ltd. (866.50, 9.98%), Adani Enterprises Ltd. (1,740.40, 8.72%) and Indian Overseas Bank (22.75, 7.82%).

Downers:

Largecap and midcap losers today include Hindustan Zinc Ltd. (299.00, -9.06%), Adani Green Energy Ltd. (894.35, -4.41%) and Adani Total Gas Ltd. (871.70, -4.20%).

Movers and Shakers

42 stocks in BSE 500 are trading on high volumes today.

Top high volume gainers on BSE included NBCC (India) Ltd. (35.25, 13.34%), Suzlon Energy Ltd. (7.95, 12.77%) and Cochin Shipyard Ltd. (459.00, 9.95%).

Top high volume losers on BSE were Symphony Ltd. (1,022.55, -5.75%), Bajaj Holdings & Investment Ltd. (5,866.75, -3.22%) and AstraZeneca Pharma India Ltd. (3,241.95, -3.14%).

Quess Corp Ltd. (357.50, 4.12%) was trading at 57.6 times of weekly average. Cholamandalam Financial Holdings Ltd. (525.00, 0.76%) and Borosil Renewables Ltd. (414.65, 6.16%) were trading with volumes 14.8 and 7.6 times weekly average respectively on BSE at the time of posting this article.

BSE 500: highs, lows and moving averages

6 stocks overperformed with 52-week highs, while 48 stocks hit their 52-week lows.

Stocks touching their year highs included - Bosch Ltd. (18,977.15, 2.40%), Zydus Lifesciences Ltd. (490.35, 1.16%) and Godrej Consumer Products Ltd. (966.30, 0.80%).

Stocks making new 52 weeks lows included - ACC Ltd. (1,625.90, 0.74%) and Alembic Pharmaceuticals Ltd. (468.65, -2.07%).

34 stocks climbed above their 200 day SMA including NBCC (India) Ltd. (35.25, 13.34%) and Cochin Shipyard Ltd. (459.00, 9.95%). 11 stocks slipped below their 200 SMA including Hindustan Zinc Ltd. (299.00, -9.06%) and Bajaj Holdings & Investment Ltd. (5,866.75, -3.22%).

- Krishna Institute of Medical Sciences: Prabhudas Lilladher maintains its ‘Buy’ rating on this healthcare facilities company with a target price of Rs 1,660. This implies an upside of 22.6%. Analysts Param Desai and Sanketa Kohale are optimistic about the company as they expect its occupancy rates, profitability and scalability to rise in the coming quarters. They also see the firm’s plans to expand its operations in Karnataka and Maharashtra as key positives.

The analysts expect an operational turnaround and a rise in occupancy rate in KIMS’ Kingsway unit in Nagpur as it plans to add more clinical talent and fill in therapeutic gaps like oncology radiation. They also anticipate the occupancy rate to increase in the firm’s new Sunshine unit in Secunderabad, Telangana.. “The new Sunshine unit will be moved to a new state-of-the-art facility in a prime location by the end of Q1FY24. This would attract clinical talent across other therapies,” they added. Desai and Kohale estimate the hospital chain’s revenue to grow at a CAGR of 21.9% over FY22-25.

Shree Cements: ICICI Securities maintains its ‘Buy’ rating on this cement manufacturer and increases its target price to Rs 29,130 from Rs 27,550. This implies an upside of 15.6%. Analyst Harsh Mittal is positive about the company’s prospects on the back of strong capacity additions and increased demand due to the upcoming general elections. He sees the firm’s plan to increase the share of premium cement sales to 15% from 7% in 12-15 months, as a key positive.

He also believes that the company will be able to improve its realisations with the help of cost-saving initiatives such as increased use of alternative fuels. “Consumption cost for alternate fuels is around Rs 1.3-1.5 per kilocalorie (kcal). Shree Cements’ current fuel consumption cost is Rs 2.3 per kcal at its current thermal substitution rate of 4.5%, and the company aims to increase it to 15% in the next 12 months,” he added.

Mittal expects sales volumes to rise, and the firm’s expansion plans are on track. He expects the cement company’s net profit to grow at a CAGR of 18.3% over FY22-25.

State Bank of India: Motilal Oswal gives a ‘Buy’ call to this bank with a target price of Rs 725, indicating an upside of 43.1%. Following an interactive session with State Bank of India’s Chairman Dinesh Kumar Kharato to discuss the bank’s growth and margin outlook, analysts Nitin Aggarwal and Yash Agarwal say, “The bank’s robust performance has been aided by strong loan growth, margin expansion and lower provisions.”

They believe that a high mix of floating loans will continue to aid net interest income and earnings, even though the cost of deposits may increase. According to the analysts, manufacturing, export, renewables, batteries and EV segments are likely to be the key growth drivers for the bank. Aggarwal and Agarwal say, “Asset quality performance remains strong, with consistent improvements in headline asset quality ratios while the restructured book is under control at 0.9%.’

Zydus Lifesciences: Sharekhan maintains its ‘Buy’ rating on this pharmaceutical company with a target price of Rs 572, implying an upside of 18.8%. Analysts at the brokerage believe the company’s growth will be driven by new product launches and volume growth in the US and India. They also expect input and freight costs to stabilise, leading to better profitability.

The analysts believe the firm will outperform the Indian pharma market in the long term by penetrating newer geographies, launching new products and improving institutional sales. “The company has one of the largest pipelines of biosimilar products among Indian players, as it has so far launched 14 products in India,” they add.

Sharekhan’s analysts anticipate strong demand in the US market on the back of robust product approvals in the recent past. The management is optimistic about maintaining the sales growth momentum in the US, driven by new launches, as well as volume expansion of existing products. The analysts expect the company’s net profit to grow at a CAGR of 12% over FY22-25.

Jyothy Labs: Hem Securities initiates a ‘Buy’ call on this personal products company with a target price of Rs 225. This indicates an upside of 20.9%. In Q3FY23, the company’s profit and revenue have grown 75.4% YoY to Rs 67.4 crore and 15.7% YoY to Rs 627.9 crore respectively. Analyst Chinmay Bhandari says that the company has posted good results in the past few quarters despite input price inflation and slowdown in volume growth.

According to Bhandari, brands such as Ujala and Henko continue to register strong growth, while Exo Bar and Pril increase their market share. The analyst believes that falling crude prices will help the company post better margins and points out that the management is trying to increase its distribution network of key brands in newer markets to improve its topline.

Note: These recommendations are from various analysts and are not recommendations by Trendlyne.

(You can find all analyst picks here)

Trendlyne Analysis

Nifty 50 closed at 16,951.70 (-34, -0.2%) , BSE Sensex closed at 57,613.72 (-40.1, -0.1%) while the broader Nifty 500 closed at 14,211.80 (-50.9, -0.4%). Of the 1,975 stocks traded today, 476 showed gains, and 1,466 showed losses.

Indian indices extend losses and close in the red on a volatile day of trade. The Nifty 50 fell 30 points and closed below the 17,000 mark. The volatility index, India VIX, also fell, declining below 15.

Nifty Smallcap 100 and Nifty Midcap 100 closed in the red, tailing the benchmark index. The Nifty Bank index closed higher than Monday’s levels. All other major sectoral indices close in red. Securities and Exchange Board of India approves JG Chemicals' IPO for a fresh issue of equity worth Rs 202.5 crore. The Home Minister of India Amit Shah stated that the government is working to reduce logistics cost to GDP to 7.5% in the next five years.

European indices traded higher led by regional banking stocks. The sentiment was boosted by comments from Eurozone Governing Council Member Gediminas Simkus stating the banks in the eurozone have high capital buffers, high liquidity and high profitability in a rising interest rate cycle.

Brent crude oil futures rallied after reports stating that 450,000 barrels per day of oil supply from Kurdistan was stopped due to an arbitration case that requires Iraq’s consent to ship oil from Turkey.

Relative strength index (RSI) indicates that stocks like Anupam Rasayan India and Aurobindo Pharma are in the overbought zone.

Centre sanctions Rs 800 crore to Indian Oil, Bharat Petroleum and Hindustan Petroleum for setting up 7,432 fast-charging stations under the EV scheme, say reports.

Computer Age Management Services (CAMS) and C.E. Info Systems (MapmyIndia) hit their 52-week lows of Rs 2,014 and Rs 993.6 respectively. CAMS has fallen 14.7% in the past year, while the other is down 35.1%.

Securities and Exchange Board of India approves JG Chemicals' IPO worth Rs 202.5 crore. The IPO will consist of a fresh issue of Rs 202.5 crore and an offer for sale of 57 lakh shares.

Emami is up more than 3.5% in trade today. The average broker target price indicates a 39.7% upside from the current price. It shows up in a screener for stocks with strong annual EPS growth.

- The Centre allocates 39,600 MW of domestic solar PV module manufacturing capacity to 11 companies, including Reliance Industries, JSW Energy and Tata Power Solar. The allocation comes under the PLI scheme for high-efficiency solar PV modules (Tranche-II), with an outlay of Rs 14,007 crore.

Govt On Solar PV PLI

— CNBC-TV18 (@CNBCTV18Live) March 28, 2023

????11 Companies Including Reliance, JSW & Tata Power Solar selected for Solar PV PLI

????Capacity of 39,600 MW of Solar PV module mfg capacity Allocated

????Total outlay for the tranche-II of Solar PV PLI is at 14,007 cr pic.twitter.com/869YBOnjTU The industries of advertising & media, iron & steel products and other leisure facilities rise by more than 13% over the past 90 days.

Promoter group Madhuraj Foundation acquires 1.2 crore shares (0.24% stake) in Trident for Rs 31.9 crore via a block deal on Monday. The stock is rising in trade today.

G R Infraprojects emerges as the lowest bidder for projects worth Rs 1,613.84 crore from the National Highways Authority of India for the construction of a 4/6-lane bypass in Belagavi City and a four-lane with paved shoulders on the Belgaum-Raichur section.

- Reports suggest that 5.65 lakh shares (0.21% equity) of Eicher Motors, amounting to Rs 162.13 crore, change hands in a large trade.

Eicher Motors Large Trade | 5.65 lakh #shares (0.21% equity) worth ?162.13 crore change hands at an average of ?2,869/share#BlockDeal#LargeTradepic.twitter.com/Ip7DTYArce

— CNBC-TV18 (@CNBCTV18Live) March 28, 2023 Embassy Office Parks Management Services, the Manager of Embassy Office Parks REIT, approves the acquisition of Embassy Business Hub, Bengaluru, for an aggregate enterprise value of Rs 334.8 crore and exclusive ownership rights.

Media stocks like Dish TV India, New Delhi Television, Sun TV Network and PVR are falling in trade. The broader sectoral index Nifty Media is also trading in the red.

JP Morgan remains cautious on the telecom space in India due to the 5G capex cycle, incremental competition and any delay in tariff hikes, says Ankur Rudra, Head of APAC Telecoms & India TMT Research. The brokerage adds that tariff hikes will likely be implemented at the end of CY24.

#OnCNBCTV18 | Cautious on #telecom due to rise in #5G capex, competition & delays in tariff hikes, says Ankur Rudra of @jpmorgan. Tells @_prashantnair, @_soniashenoy & @Nigel__DSouza that they don’t expect tariff increases till the general election. pic.twitter.com/e8jbmntKsO

— CNBC-TV18 (@CNBCTV18News) March 28, 2023ICICI Direct maintains its ‘Buy’ rating on HG Infra Engineering with a target price of Rs 915, implying an upside of 20.4%. The brokerage expects the company’s robust execution pace and healthy order book to drive strong revenue growth in the coming quarters. It estimates the firm’s revenue to increase at a CAGR of 18% over FY22-25.

Sterlite Technologies is falling as it inks a business transfer agreement to sell its telecom products and software business to Skyvera LLC for $15 million.

Kalyan Jewellers falls over 8% in trade. Reports suggest that 2.8 crore shares (2.74% equity) of the company, amounting to Rs 312.17 crore, change hands.

Kalyan #LargeTrade | 2.8 cr shares (2.74% equity) worth ?312.17 cr change hands at an average of ?108/sh pic.twitter.com/eJgcnL22gr

— CNBC-TV18 (@CNBCTV18Live) March 28, 2023Allcargo Logistics is rising as it is set to acquire 1.5 lakh shares (30% stake) of Gati-Kintetsu Express for Rs 406.7 crore. The company will purchase 1.3 lakh shares (26% stake) from KWE Kintetsu World Express and 20,000 shares (4% stake) from KWE-Kintetsu Express.

Aditya Birla Capital is rising as it decides to sell its entire stake of 50% (25.65 lakh shares) in Aditya Birla Insurance Brokers (ABIBL) to Edme Services, a part of Samara Capital Group. Another stakeholder of ABIBL, Infocyber India Private, will also sell its entire stake to Edme Services. The total value of this transaction is Rs 455 crore.

- Indian rupee appreciates to 82.15 from the previous close of 82.37 against the US dollar in early trade today amid a weak dollar.

#Rupee opens higher against US dollar pic.twitter.com/W3Adxw8kaa

— CNBC-TV18 (@CNBCTV18Live) March 28, 2023 Transformers & Rectifiers (India) rises as it receives an order worth Rs 184 crore from a central utility for the supply of transformers.

Porinju Veliyath's wife Litty Thomas buys a 0.98% stake in Ansal Buildwell for approx Rs 50.8 lakh on Monday.

SJVN secures GREEN Financing worth Rs 915 crore (15 billion Japanese yen) from Japan Bank of International Cooperation for the development of solar power projects in Madhya Pradesh and Gujarat. The estimated cost for the projects is Rs 1,288.35 crore. SJVN shows up in a screener of stocks with improving cash flow from operations in the past two years.

Dilip Buildcon is rising as it wins a tender floated by the National Highway Authority of India to build a six-lane highway on the Bangalore-Vijayawada corridor for Rs 780.12 crore. The project will be completed in 24 months. The stock has hit a 52-week low in the past week.

PNC Infratech emerges as the lowest bidder for the construction of a four-lane highway in Uttar Pradesh. The project is worth Rs 819 crore and will be built in 24 months. The stock shows up in a screener for companies with high TTM EPS growth.

Riding High:

Largecap and midcap gainers today include Torrent Power Ltd. (511.35, 4.96%), Emami Ltd. (365.40, 4.50%) and Bank of India (71.55, 3.62%).

Downers:

Largecap and midcap losers today include Adani Enterprises Ltd. (1,600.85, -7.09%), Adani Ports & Special Economic Zone Ltd. (593.40, -5.67%) and Bandhan Bank Ltd. (187.45, -5.23%).

Volume Shockers

13 stocks in BSE 500 are trading on high volumes today.

Top high volume gainers on BSE included PNC Infratech Ltd. (282.00, 6.37%), Torrent Power Ltd. (511.35, 4.96%) and Tanla Platforms Ltd. (523.05, 2.60%).

Top high volume losers on BSE were Kalyan Jewellers India Ltd. (107.15, -9.69%), Raymond Ltd. (1,109.20, -5.86%) and Adani Ports & Special Economic Zone Ltd. (593.40, -5.67%).

Sun TV Network Ltd. (397.95, -2.83%) was trading at 4.7 times of weekly average. United Breweries Ltd. (1,406.70, -0.51%) and ZF Commercial Vehicle Control Systems India Ltd. (9,982.25, -0.18%) were trading with volumes 4.4 and 4.0 times weekly average respectively on BSE at the time of posting this article.

BSE 500: highs, lows and moving averages

2 stocks overperformed with 52 week highs, while 77 stocks hit their 52 week lows.

Stocks touching their year highs included - Zydus Lifesciences Ltd. (484.75, 0.59%) and UltraTech Cement Ltd. (7,403.10, -0.63%).

Stocks making new 52 weeks lows included - ACC Ltd. (1,613.95, -4.21%) and Avanti Feeds Ltd. (329.05, -0.29%).

12 stocks climbed above their 200 day SMA including PNC Infratech Ltd. (282.00, 6.37%) and Torrent Power Ltd. (511.35, 4.96%). 23 stocks slipped below their 200 SMA including Minda Corporation Ltd. (199.15, -7.16%) and Shipping Corporation of India Ltd. (117.15, -6.91%).

Trendlyne Analysis

Nifty 50 closed at 16,985.70 (40.7, 0.2%), BSE Sensex closed at 57,653.86 (126.8, 0.2%) while the broader Nifty 500 closed at 14,262.70 (-16.3, -0.1%). Of the 1,986 stocks traded today, 372 were on the uptick, and 1,579 were down.

Indian indices fall from their day's high but closed in the green on a volatile day of trade. The Nifty 50 rose 40 points but closed below the 17,000 mark. S&P Global maintained India's economic growth forecast unchanged at 6% in FY24.

Nifty Smallcap 100 and Nifty Midcap 100 closed in the red, despite the benchmark index closing in the green. Nifty Pharma closed higher than Friday’s levels. Larsen & Toubro's power transmission & distribution business bags orders worth Rs 2,500-5,000 crore in India and overseas.

European indices traded higher as market sentiment improved after European Central Bank President Christine Lagarde assured European Union leaders that the euro-area banking sector remains healthy. Brent crude oil futures traded in the green, extending their gains from last week as traders assess the impact of the banking crisis on the wider economy.

Avenue SupermartsbeatsTrent in PE ratio, annual RoE and broker average target upside. But it lags in YoY revenue & net profit growth, FII holdings and one-year dividend yield.

Analysts at HSBC expect Zomato’s stock price to touch Rs 87, a 64% rise from its current level. They say the company's market share will increase to 57% by FY24. The company shows up in a screener for stocks with increasing revenue over the past four quarters.

- Dalmia plans to further cut its stake in Indian Energy Exchange and eventually exit the company. Dalmia Group currently holds a 14.8% stake in the company through three entities.

Stocks to Watch | Dalmia Group, which has a 14.81% stake in IEX, plans to reduce and finally exit its entire stake in the company #IEX#DalmiaGroup#StockMarket@DalmiaBharat@IEX_India_pic.twitter.com/9nztmhy9xy

— ET NOW (@ETNOWlive) March 27, 2023 FSN E-Commerce Ventures (Nykaa) falls more than 2% in trade today. According to reports, Jefferies maintains its target price on the stock at Rs 200 despite the recent resignations of 5 senior executives. The management indicates that the number of exits is minor compared to the company's size.

Hardware technology & equipment, forest materials and telecommunications equipment sectors fall by more than 7% over the past month.

Healthcare stocks like Biocon, Lupin, Alkem Laboratories and Glenmark Pharmaceuticals are rising in trade. The broader sectoral index Nifty Healthcare is also trading in the green.

ICICI Securities maintains its ‘Buy’ rating on KEC International and raises the target price to Rs 540 from Rs 528. This indicates an upside of 18.2%. The brokerage keeps a positive outlook on the firm as it expects robust pick-up of orders across segments, balance sheet improvement and lower commodity prices.

One97 Communications (Paytm) is rising as the RBI extends the time to resubmit the application for a payment aggregator license. The company can continue its online payment aggregation business while the RBI awaits approval from the Centre for the past investments from the company into Paytm as per FDI guidelines.

Bank of America Securities remains constructive on the metals and mining sector in the near term. According to the brokerage, steel prices will rise on the back of high demand and increase in export opportunities after the removal of export duty on steel products.

#OnETNOW | Bank of America is keeping metals on its radar and remains constructive on the sector in the near term, @Ashesha_A is here with the details @BofA_News#Metalspic.twitter.com/0ASXgzI8TF

— ET NOW (@ETNOWlive) March 27, 2023Larsen & Toubro’s power transmission & distribution business bags orders worth Rs 2,500-5,000 crore in India and overseas. The stock shows up in a screener for companies with book value per share increasing over the past two years.

Rites and a joint venture partner win a project management consultancy work worth Rs 122 crore under the Assam health system strengthening project.

Sun Pharmaceutical Industries says that the ransomware attack on the company on March 2 has impacted its business operations and expects reduced revenues in some businesses. However, the company's guidance for FY23 remains intact.

Stocks In Focus | IT security incident to impact #Revenue for some businesses of @SunPharma_Live. Company would incur expenses due to the ransomware attack & remediation. @ekta_batra with the details pic.twitter.com/1qV2WlUinR

— CNBC-TV18 (@CNBCTV18News) March 27, 2023ISGEC Heavy Engineering wins an order worth Rs 197.25 crore from Maharashtra State Power Generation to renovate and modernise electrostatic precipitators at Chandrapur thermal power station.

Butterfly Gandhimathi falls in trade as it announces a merger with Crompton Greaves Consumer. Upon merger, Crompton Greaves will issue 22 fully paid shares for every five fully paid share of Butterly Gandhimathi. This will result in Butterfly Gandhimathi dissolving after the merger.

Grasim Industries leases 220 acres in Gujarat Industrial Development Corp from Century Textiles & Industries for Rs 254.7 crore to set up manufacturing facilities. The stock shows up in a screener for companies with RoCE improving over the past two years.

TPG Growth III Fund sells a 7.6% stake (2.3 crore shares) in Campus Activewear for Rs 805.8 crore in a bulk deal on Friday. Fidelity Investments Trust and Societe Generale, among others, pick up the shares. Campus Activewear falls 48% from its 52-week high.

Promoter Sanjay Mohan Labroo sells a 0.16% stake (4 lakh shares) in Asahi India Glass for Rs 18.6 crore in a block deal on Friday. In another block deal, BNP Paribas Arbitrage sells a 0.02% stake (13.8 lakh shares) in Bharti Airtel for Rs 105.4 crore.

India's credit card transactions decline marginally but remain above the Rs 1 lakh crore level in February, suggests data released by the Reserve Bank of India.

#Creditcard spends marginally declined on a month-on-month basis in February even as they remained above Rs 1 trillion for the 12th straight month, according to #RBI data. https://t.co/VHo8gYmYE3

— Financial Express (@FinancialXpress) March 27, 2023Zydus Family Trust, promoter of Zydus Wellness, buys a 0.8% stake in the company on Friday. It now holds an 8.83% stake in the company.

Godawari Power & Ispat is rising as its sponge iron plants, steel melting shop, rolling mills and wire drawing plants at Siltara and Raipur resume partial operations on Friday. The plants will work at full capacity from April 1. The stock shows up in a screener of consistent returns over the past five years.

Morgan Stanley initiates coverage on Phoenix Mills with an ‘Overweight’ rating and a target price of Rs 1,700. It expects the company to more than double its rental portfolio in the next 3-4 years and expansion to improve EBITDA CAGR to 27% over FY24-25.

CNBC-TV18 Stocks Board | @MorganStanley initiates an #Overweight call on #PhoenixMills with a target price of Rs 1,700. Likes the fact that co aims to more than double its #rental portfolio over the next 3-4 yrs. @sonalbhutra with more details pic.twitter.com/b1Nlfxjfdm

— CNBC-TV18 (@CNBCTV18News) March 27, 2023Sunil Singhania's Abakkus Fund buys a 1.75% stake in TTK Healthcare for Rs 22.5 crore in multiple bulk deals on Friday.

Karur Vysya Bank falls in trade as the Reserve Bank of India imposes a fine of Rs 30 lakh on the bank for failure to report a few accounts as fraud. The stock is trading below its third support or S3 level.

Sun Pharmaceuticals is rising after signing an agreement with Vivaldis Health and Foods to acquire a 60% stake in the company for Rs 143.3 crore. It will acquire the remaining 40% stake in the future, as per the terms of agreement.

Bharat Electronics (BEL) wins orders worth Rs 4,300 crore from the Indian Army and Indian Navy. BEL has signed a contract worth Rs 3,000 crore with the Ministry of Defence (MoD) to supply electronic warfare systems for the Indian Army. Also, it received contracts worth Rs 1,300 crore for the supply of gun fire control, surveillance and sonar systems, among others, to the Indian Navy.

Riding High:

Largecap and midcap gainers today include UNO Minda Ltd. (455.10, 3.64%), Biocon Ltd. (205.50, 3.42%) and Lupin Ltd. (658.75, 2.93%).

Downers:

Largecap and midcap losers today include Adani Transmission Ltd. (1,068.40, -4.99%), Adani Power Ltd. (183.00, -4.98%) and Adani Wilmar Ltd. (387.50, -4.95%).

Volume Rockets

18 stocks in BSE 500 are trading on high volumes today.

Top high volume gainers on BSE included EPL Ltd. (161.30, 3.20%), Lupin Ltd. (658.75, 2.93%) and SJVN Ltd. (30.85, 0.98%).

Top high volume losers on BSE were Aditya Birla Sun Life AMC Ltd. (312.25, -8.09%), Wockhardt Ltd. (151.20, -6.12%) and Praj Industries Ltd. (308.55, -4.99%).

Thyrocare Technologies Ltd. (421.10, -2.80%) was trading at 6.9 times of weekly average. Timken India Ltd. (2,765.00, -1.21%) and Procter & Gamble Hygiene & Healthcare Ltd. (13,700.00, -0.31%) were trading with volumes 5.4 and 5.2 times weekly average respectively on BSE at the time of posting this article.

BSE 500: highs, lows and moving averages

4 stocks overperformed with 52-week highs, while 57 stocks hit their 52-week lows.

Stocks touching their year highs included - AIA Engineering Ltd. (2,890.95, 1.68%), Cyient Ltd. (1,008.20, 0.70%) and Godrej Consumer Products Ltd. (961.60, 1.09%).

Stocks making new 52 weeks lows included - Avanti Feeds Ltd. (330.00, -1.60%) and Bombay Burmah Trading Corporation Ltd. (810.45, -2.47%).

9 stocks climbed above their 200 day SMA including EPL Ltd. (161.30, 3.20%) and Grasim Industries Ltd. (1,623.90, 1.86%). 27 stocks slipped below their 200 SMA including Hitachi Energy India Ltd. (3,146.65, -5.61%) and PNC Infratech Ltd. (265.10, -4.62%).

- UltraTech Cement: With a capacity of 121.35 metric tonnes per annum (mtpa), thiscement and construction company has plans to increase its capacity to 153.85 mtpa by FY25/FY26.

UltraTech Cements reported revenue growth of 19.5% YoY in Q3FY23, but its EBITDA margins declined 33bps YoY. The rise in revenue was led by an increase in volumes, while margins contracted due to the higher cost of raw materials. The price hike undertaken by UltraTech lagged cost increases, and the increase in energy costs adversely impacted the margins of the firm.

Energy costs (petcoke/coal) have decreased by 30% in CY23. The benefit of this will start to reflect in Q4FY23. FY24 being an election year, government spending on infra projects is expected to be high. UltraTech might see a jump in volumes due to this. However, in the near term, the company is more focused on volumes and will restrict its price hikes. The stock hasgained 4.27% in the past three trading sessions and shows up in a screener for growth in net profit with an increasing profit margin.

Geojit BNP Paribas says demand for cement remains strong despite inflationary headwinds led by infrastructure and housing sector initiatives. Furthermore, a drop in raw material costs will enhance the company’s margins. Ultratech’s premium brand positioning, pan-India presence and efficient capacity utilization will aid bottom-line growth.

- One97 Communications (Paytm): This internet & software services stock rose 6.9% on Wednesday after Macquarie upgraded its rating to ‘Outperform’ from ‘Underperform’ and revised the target price to Rs 800 from Rs 450 per share. This implies a potential share price upside of 28.4%. During previous broker downgrades, Macquarie was one of the first brokerages to slash Paytm’s target price to Rs 450 and recommendation to ‘Underperform’. However, Macquarie appears to have changed its mind and turned bullish on the stock. The recent upward target price revision has helped Paytm to show up in a screener of stocks with upgraded recommendation or target price in the past three months. The stock is currently trading 245.1% below its issue price of Rs 2,150 per share.

According to the brokerage, the company has outperformed on the distribution of financial services revenue by a huge margin, while also controlling the overall expenses and charges. This can be observed in its strong operating performance in January-February. The company’s loan disbursement increased by 286% YoY to Rs 8,086 crore, while its gross merchandise value (GMV) witnessed a growth of 41% YoY. Its average monthly transacting users (MTU) also rose 28% YoY in January-February.

Owing to this strong operational performance, Trendlyne’s forecaster estimates the company’s annual revenue to grow by 37.6% to Rs 7,969 crore and its losses to contract by 21.7% to Rs 1,966.9 crore. However, one thing to keep an eye on is Paytm’s NPA levels on loans, as interest rates continue to increase.

- Phoenix Mills: This realty company has risen 5.8% over the past week on the back of the street’s positive outlook on its prospects. Post the second Covid wave, the company has witnessed a gradual recovery in demand and footfall across its retail, office and commercial spaces. The firm’s mall portfolio is expected to increase to 14 million square feet (msf) by FY27, from 9 msf in March 2023. The realty company aims to add at least one million square feet of retail space every year. By June this year, the company will be adding three more malls to its portfolio of 11 now. According to reports, the management claims leasing occupancy rates across its malls have improved to 94%-99% as retail consumption improves. The stock shows up in a screener for companies with improving cash flow and high durability.

Motilal Oswal recently re-initiated its coverage on Phoenix Mills with a ‘Buy’ rating. The brokerage believes that healthy pre-leasing trends across its upcoming malls provide strong near-term visibility on rental growth. It is also especially positive about the firm’s mixed-use strategy, where the company plans to add office spaces on top of or adjacent to its existing and upcoming malls, to improve the blended yield of the assets.

The company expects a consumption boom in India over the coming quarters and plans to expand into newer urban markets across the country. However, medium-term risks like a slowdown in consumption recovery and lower-than-expected leasing demand can impact the company’s expansion plans.

- Anupam Rasayan India: This agrochemicals company rose over 2.5% in trade on Thursday after it signed a letter of intent (LoI) worth $120 million (Rs 984 crore) with a Japanese chemical company. The LoI is for the supply of new-age advance intermediates for life science ingredients over six years. Commenting on the same, Managing Director Anand Desai says, "This LoI demonstrates the company’s ability to work on a niche molecule with Japanese customers, and strengthens the revenue growth visibility in the coming years.” Trendlyne’s forecaster estimates Anupam’s revenue to grow by 28.2% in FY23.

The company has been on an uptrend recently, rising around 33% in the past month on the back of a strong outlook. As a result of the uptick in share price, the company features in a screener of stocks with strong momentum. It has also risen around 56% from its 52-week low of Rs 546.7. Anupam Rasayan has focused on expanding its product portfolio in fluorination chemistry, and plans to launch 14 molecules in the next 12-18 months, and five molecules in Q4FY23. The company also has a robust pipeline of contracts worth Rs 2,620 crore, says KRChoksey.

In addition, Anupam Rasayan has signed a Memorandum of Understanding (MoU) worth Rs 670 crore with the Government of Gujarat to set up three chemical plants, according to media reports. These plants will focus on manufacturing fluorochemicals.

- Indian Oil Corporation (IOC): This oil marketing & distribution stock has fallen 1.13% in the past week despite announcing new ventures and improving refining capabilities. On Monday, IOC inked a pact with NTPC’s arm to form a joint venture for setting up a renewable energy power plant to meet IOC’s power requirements. Reports suggest that the transition of energy production from fossil-based systems to renewable energy is a good move, given that demand for petrol and diesel will slowly fall as companies shift to renewable energy sources. This is also in line with IOC’s target to increase its green energy share to 12% by 2030 from the current 9%.

On Tuesday, IOC’s board gave in-principle approval to prepare a feasibility report to set up a petrochemical complex at Paradip, Odisha. The estimated cost of the project is Rs 61,077 crore. The project in Paradip will help IOC improve its petrochemical intensity (% of crude oil converted to chemicals) and also reduce import dependency.

IOC’s Chairman Shrikant Madhav Vaida says that the company’s petrochemical intensity is currently at 5%-6%, and it plans to increase it to 10%-12%. He adds that refineries at locations like Panipat and Odisha will see the intensity go as high as 25%. Despite the announcement, the stock fell 1.3% in trade on Tuesday.

However, it has gained 8.2% in the past three months, thanks to a steady fall in crude prices. ICICI Direct maintains its ‘Buy’ call on the company with a target price of Rs 79.9. It recommends keeping the stop loss at Rs 77.7. Geojit BNP Paribas maintains a ‘Hold’ on the stock and expects effective cost optimization and enhanced utilization to aid earnings in the near term. Trendlyne’s consensus recommendation has 16 analysts recommending a ‘Buy’, 8 suggesting ‘Hold’ and 4 ‘Sell’.

Trendlyne's analysts identify stocks that are seeing interesting price movements, analyst calls, or new developments. These are not buy recommendations.

The top three companies by market cap in the US - Apple, Microsoft and Alphabet - were all started by first-generation entrepreneurs. In India however, two of the top three companies by market cap - Reliance and TCS - are part of family conglomerates. This pattern continues as we go down the list of Indian businesses.

Tata, Birla and Ambani are well-known names and family-run Indian conglomerates with a significant share of the economy. But do these family-owned businesses do better or worse than average, in financial performance? Do companies whose top management are all in the family, see different outcomes?

Here we take a look at India’s largest family-run businesses, and how they perform compared to the overall industry.

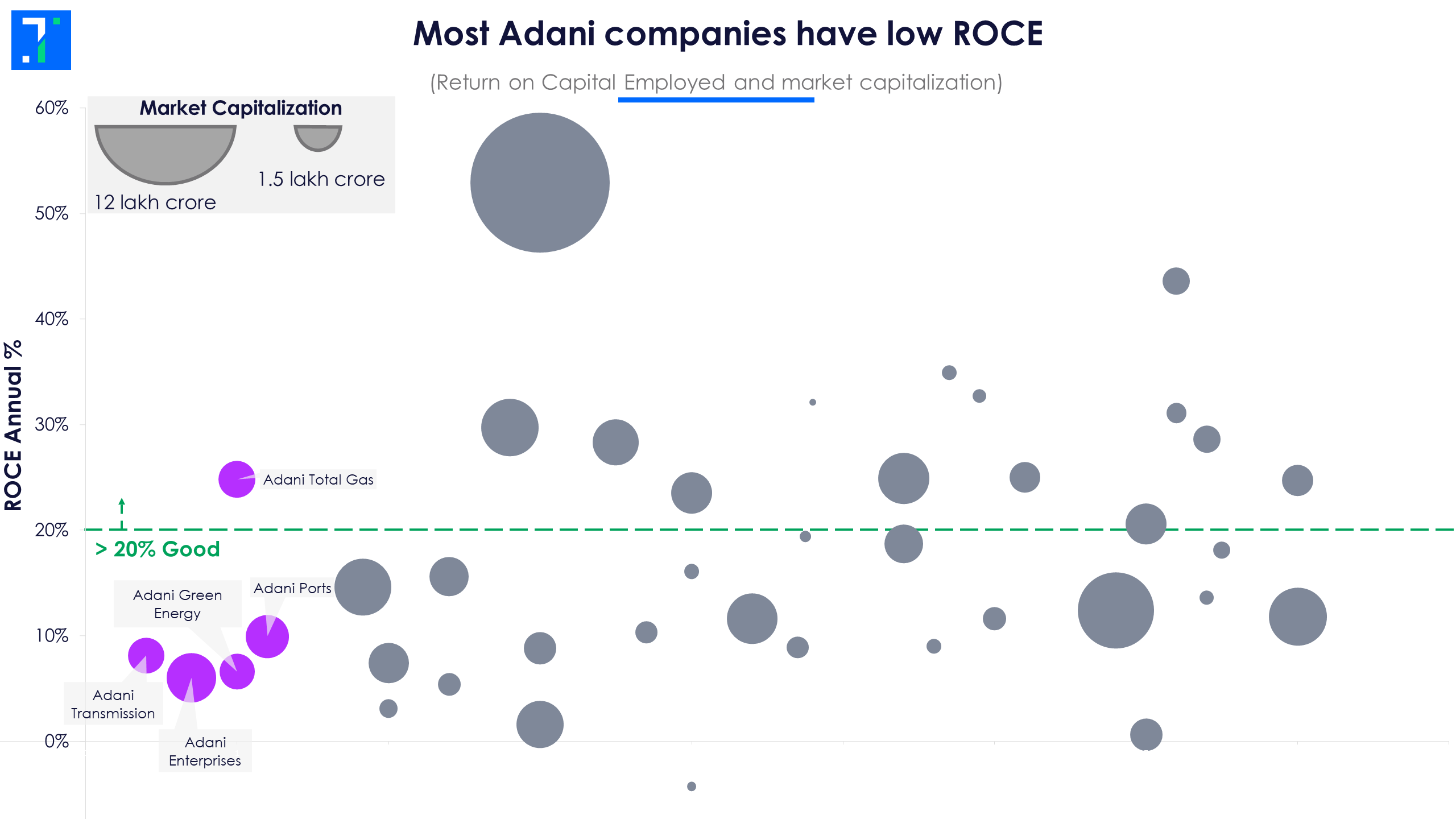

To do this comparison, we looked at the Return on Capital Employed (ROCE). The ROCE is a ratio used to evaluate a company’s capital efficiency and profitability, is an effective parameter to compare the performance of companies. It helps us understand how good a company is at generating profits from its capital.

Investors prefer stocks with stable and rising ROCE (above 20%) over stocks with weak and volatile ROCE (below 10%). Another advantage with the ROCE ratio is that unlike return on equity (ROE), which analyses only profitability on equity, it considers debt along with equity. The companies in focus are capital-intensive and ROCE therefore, offers better insights.

The chart above depicts the ROCE percentage on the Y-axis. The bubble size is linked to the market cap of the company. Five major companies from each family group have been chosen and analysed. 20% ROCE, which is considered a good ratio, has been highlighted on the chart so that we can see which companies perform better or worse.

We also checked how family groups perform as compared to their sector’s average ROCE.

Fertilizers, software and services and FMCG are among the sectors with strong ROCE ratios.

Murugappa Group companies log high ROCE

Murugappa Group, founded in 1900, has a presence in auto, sugar, fertilizers, etc. The Tamil Nadu based group is headed by M M Murugappan and currently has the fourth generation of the Murugappa family on the board.

Most companies in the group, except for Carborundum Universal (18.1%), have very strong returns. Companies with high returns are Cholamandalam Investment & Finance (24.7%), Tube Investments of India (28.6%) and CG Power and Industrial Solutions (43.6%). All three companies have also outperformed their respective sectors by a minimum of 15%. Coromandel International has a high ROCE of 31.1% but did not outperform the fertilizer sector.

Adani Group struggles in ROCE, Adani Total Gas is the outlier

Founded by Gautam Adani in 1988 for trading commodities, the Adani Group has over the decades, turned into a multinational conglomerate involving multiple businesses. Their meteoric rise has been attributed to the rapid increase in debt the group has taken on, and their closeness to the current government. However, the recent Adani-Hindenburg row made investors cautious about the group.

As seen in the chart, four of the top five companies have weak ROCE values and underperform their respective sectors. Adani Total Gas is the only company with a high ROCE of 24.8%, and that has outperformed its sector, utilities (by 12.1%). Adani Enterprises, Adani Ports & Special Economic Zone, Adani Transmission and Adani Green Energy have ROCE lower than 10%.

Aditya Birla Group: UltraTech Cement, Aditya Birla Sun Life outperform sector ROCE

Aditya Birla group, founded by Seth Shiv Narayan Birla in 1857, is currently chaired by Kumar Mangalam Birla. The group is engaged in sectors like metals, cement and telecom. The major five stocks under the Birla Group have ROCE on the lower spectrum. Hindalco and UltraTech Cement have fairly high returns of 15.6% and 14.6% respectively. UltraTech’s ROCE has outperformed the cement and construction sector by 1.8%.

Aditya Birla Sun Life AMC, which is not in the top five companies in terms of market cap, outperformed its sector with a strong ROCE of 39.4%.

Tata Group performs better than its sectors

Established by Jamsetji Tata in 1868, Tata group is India's largest conglomerate. It is currently looked after by the parent company, Tata Sons. Key people in Tata Sons are Ratan Tata and Natarajan Chandrasekaran, among others.

With strong returns, three of the top five companies in the Tata group have outperformed their respective sectors. Tata Consultancy Services, an IT behemoth, has a ROCE of 52.9%, higher than its sector’s 37.6%, which in itself is a strong percentage. Titan and Tata Steel also have high returns of 29.7% and 28.3% respectively, whereas Tata Motors’s is very low at 1.6%.

Mahindra Group’s Mahindra Lifespace Developers has negative ROCE

Mahindra & Mahindra, incorporated as Mahindra & Mohammed in 1945 by Jagdish Chandra Mahindra and Kailash Chandra Mahindra, is currently chaired by Anand Mahindra. Besides auto, the Mahindra group is also engaged in IT and finance businesses. Mahindra & Mahindra, Mahindra & Mahindra Financial Services and Mahindra CIE Automotivehave returns above 10% but below 20%.

Tech Mahindra has a strong ROCE of 23.5%, yet underperformed the software and services sector by 14.1%. On the other hand, Mahindra Lifespace Developers has a negative ROCE of -4.3%, even though it has a positive ROE of 8.6%. The company logged below zero returns on capital as it had negative EBIT for the past three years.

Most stocks from the Godrej Group underperform their sectors

Godrej Group was founded by Ardeshir Godrej and Pirojsha Burjorji Godrej in 1897. Its current chairman is Adi Godrej. Only one of the listed companies in the group - Astec Lifesciences - has outperformed its respective sector with strong returns. The other four have returns lower than 20%. The only stock with a high ROCE is Astec Lifesciences (32.1%), a chemicals manufacturer, and it has outperformed its sector by 9.1%. Godrej Agrovet and Godrej Consumer Products come close to the 20% mark with 19.4% and 18.7% respectively.

Most companies in the Jindal Group have strong returns

The Jindal group was founded in 1952 by B C Jindal for the manufacture of steel pipes and pipe fittings. Since then, it has diversified into packaging films, power generation, etc. Most companies under Jindal have strong returns. JSW Steel, Jindal Steel & Power, Jindal Stainless and Jindal Stainless (Hisar) stand at 24.9%, 25%, 34.9% and 32.7% respectively. But only the latter two have outperformed the metal and mining sector (26.9%). JSW Energy has a ROCE of 11.6%.

Bajaj Group’s Bajaj Auto manages to make the cut above 20%

Bajaj Group, founded by Jamnalal Bajaj in 1926, is currently headed by Niraj Bajaj, Rahul Bajaj and Madhur Bajaj, among others. The group is involved in automobiles, home appliances, insurance, travel and finance. Three of its top five companies have outperformed their sectors.

Bajaj Auto is the only stock that managed to cross the 20% ROCE threshold. It also outperformed the auto sector by 7%. Bajaj Finance (12.4%) and Bajaj Finserv (11.8%) did better than their sectors by 3.9% and 2% respectively. Bajaj Holdings & Investment has a very low ROCE of 0.6%.

Murugappa Group performs better than other family conglomerates

Among all the groups in focus, Murugappa Group has performed the best in terms of ROCE with most of its companies logging high returns on capital, and also outperforming their sectors. Among the rest, Tata and Jindal group companies have stronger returns on capital, unlike Birla. Adani, Godrej, Mahindra and Bajaj.

.png)