Trendlyne Analysis

Nifty 50 closed at 16,951.70 (-34, -0.2%) , BSE Sensex closed at 57,613.72 (-40.1, -0.1%) while the broader Nifty 500 closed at 14,211.80 (-50.9, -0.4%). Of the 1,975 stocks traded today, 476 showed gains, and 1,466 showed losses.

Indian indices extend losses and close in the red on a volatile day of trade. The Nifty 50 fell 30 points and closed below the 17,000 mark. The volatility index, India VIX, also fell, declining below 15.

Nifty Smallcap 100 and Nifty Midcap 100 closed in the red, tailing the benchmark index. The Nifty Bank index closed higher than Monday’s levels. All other major sectoral indices close in red. Securities and Exchange Board of India approves JG Chemicals' IPO for a fresh issue of equity worth Rs 202.5 crore. The Home Minister of India Amit Shah stated that the government is working to reduce logistics cost to GDP to 7.5% in the next five years.

European indices traded higher led by regional banking stocks. The sentiment was boosted by comments from Eurozone Governing Council Member Gediminas Simkus stating the banks in the eurozone have high capital buffers, high liquidity and high profitability in a rising interest rate cycle.

Brent crude oil futures rallied after reports stating that 450,000 barrels per day of oil supply from Kurdistan was stopped due to an arbitration case that requires Iraq’s consent to ship oil from Turkey.

Relative strength index (RSI) indicates that stocks like Anupam Rasayan India and Aurobindo Pharma are in the overbought zone.

Centre sanctions Rs 800 crore to Indian Oil, Bharat Petroleum and Hindustan Petroleum for setting up 7,432 fast-charging stations under the EV scheme, say reports.

Computer Age Management Services (CAMS) and C.E. Info Systems (MapmyIndia) hit their 52-week lows of Rs 2,014 and Rs 993.6 respectively. CAMS has fallen 14.7% in the past year, while the other is down 35.1%.

Securities and Exchange Board of India approves JG Chemicals' IPO worth Rs 202.5 crore. The IPO will consist of a fresh issue of Rs 202.5 crore and an offer for sale of 57 lakh shares.

Emami is up more than 3.5% in trade today. The average broker target price indicates a 39.7% upside from the current price. It shows up in a screener for stocks with strong annual EPS growth.

- The Centre allocates 39,600 MW of domestic solar PV module manufacturing capacity to 11 companies, including Reliance Industries, JSW Energy and Tata Power Solar. The allocation comes under the PLI scheme for high-efficiency solar PV modules (Tranche-II), with an outlay of Rs 14,007 crore.

Govt On Solar PV PLI

— CNBC-TV18 (@CNBCTV18Live) March 28, 2023

????11 Companies Including Reliance, JSW & Tata Power Solar selected for Solar PV PLI

????Capacity of 39,600 MW of Solar PV module mfg capacity Allocated

????Total outlay for the tranche-II of Solar PV PLI is at 14,007 cr pic.twitter.com/869YBOnjTU The industries of advertising & media, iron & steel products and other leisure facilities rise by more than 13% over the past 90 days.

Promoter group Madhuraj Foundation acquires 1.2 crore shares (0.24% stake) in Trident for Rs 31.9 crore via a block deal on Monday. The stock is rising in trade today.

G R Infraprojects emerges as the lowest bidder for projects worth Rs 1,613.84 crore from the National Highways Authority of India for the construction of a 4/6-lane bypass in Belagavi City and a four-lane with paved shoulders on the Belgaum-Raichur section.

- Reports suggest that 5.65 lakh shares (0.21% equity) of Eicher Motors, amounting to Rs 162.13 crore, change hands in a large trade.

Eicher Motors Large Trade | 5.65 lakh #shares (0.21% equity) worth ?162.13 crore change hands at an average of ?2,869/share#BlockDeal#LargeTradepic.twitter.com/Ip7DTYArce

— CNBC-TV18 (@CNBCTV18Live) March 28, 2023 Embassy Office Parks Management Services, the Manager of Embassy Office Parks REIT, approves the acquisition of Embassy Business Hub, Bengaluru, for an aggregate enterprise value of Rs 334.8 crore and exclusive ownership rights.

Media stocks like Dish TV India, New Delhi Television, Sun TV Network and PVR are falling in trade. The broader sectoral index Nifty Media is also trading in the red.

JP Morgan remains cautious on the telecom space in India due to the 5G capex cycle, incremental competition and any delay in tariff hikes, says Ankur Rudra, Head of APAC Telecoms & India TMT Research. The brokerage adds that tariff hikes will likely be implemented at the end of CY24.

#OnCNBCTV18 | Cautious on #telecom due to rise in #5G capex, competition & delays in tariff hikes, says Ankur Rudra of @jpmorgan. Tells @_prashantnair, @_soniashenoy & @Nigel__DSouza that they don’t expect tariff increases till the general election. pic.twitter.com/e8jbmntKsO

— CNBC-TV18 (@CNBCTV18News) March 28, 2023ICICI Direct maintains its ‘Buy’ rating on HG Infra Engineering with a target price of Rs 915, implying an upside of 20.4%. The brokerage expects the company’s robust execution pace and healthy order book to drive strong revenue growth in the coming quarters. It estimates the firm’s revenue to increase at a CAGR of 18% over FY22-25.

Sterlite Technologies is falling as it inks a business transfer agreement to sell its telecom products and software business to Skyvera LLC for $15 million.

Kalyan Jewellers falls over 8% in trade. Reports suggest that 2.8 crore shares (2.74% equity) of the company, amounting to Rs 312.17 crore, change hands.

Kalyan #LargeTrade | 2.8 cr shares (2.74% equity) worth ?312.17 cr change hands at an average of ?108/sh pic.twitter.com/eJgcnL22gr

— CNBC-TV18 (@CNBCTV18Live) March 28, 2023Allcargo Logistics is rising as it is set to acquire 1.5 lakh shares (30% stake) of Gati-Kintetsu Express for Rs 406.7 crore. The company will purchase 1.3 lakh shares (26% stake) from KWE Kintetsu World Express and 20,000 shares (4% stake) from KWE-Kintetsu Express.

Aditya Birla Capital is rising as it decides to sell its entire stake of 50% (25.65 lakh shares) in Aditya Birla Insurance Brokers (ABIBL) to Edme Services, a part of Samara Capital Group. Another stakeholder of ABIBL, Infocyber India Private, will also sell its entire stake to Edme Services. The total value of this transaction is Rs 455 crore.

- Indian rupee appreciates to 82.15 from the previous close of 82.37 against the US dollar in early trade today amid a weak dollar.

#Rupee opens higher against US dollar pic.twitter.com/W3Adxw8kaa

— CNBC-TV18 (@CNBCTV18Live) March 28, 2023 Transformers & Rectifiers (India) rises as it receives an order worth Rs 184 crore from a central utility for the supply of transformers.

Porinju Veliyath's wife Litty Thomas buys a 0.98% stake in Ansal Buildwell for approx Rs 50.8 lakh on Monday.

SJVN secures GREEN Financing worth Rs 915 crore (15 billion Japanese yen) from Japan Bank of International Cooperation for the development of solar power projects in Madhya Pradesh and Gujarat. The estimated cost for the projects is Rs 1,288.35 crore. SJVN shows up in a screener of stocks with improving cash flow from operations in the past two years.

Dilip Buildcon is rising as it wins a tender floated by the National Highway Authority of India to build a six-lane highway on the Bangalore-Vijayawada corridor for Rs 780.12 crore. The project will be completed in 24 months. The stock has hit a 52-week low in the past week.

PNC Infratech emerges as the lowest bidder for the construction of a four-lane highway in Uttar Pradesh. The project is worth Rs 819 crore and will be built in 24 months. The stock shows up in a screener for companies with high TTM EPS growth.

Riding High:

Largecap and midcap gainers today include Torrent Power Ltd. (511.35, 4.96%), Emami Ltd. (365.40, 4.50%) and Bank of India (71.55, 3.62%).

Downers:

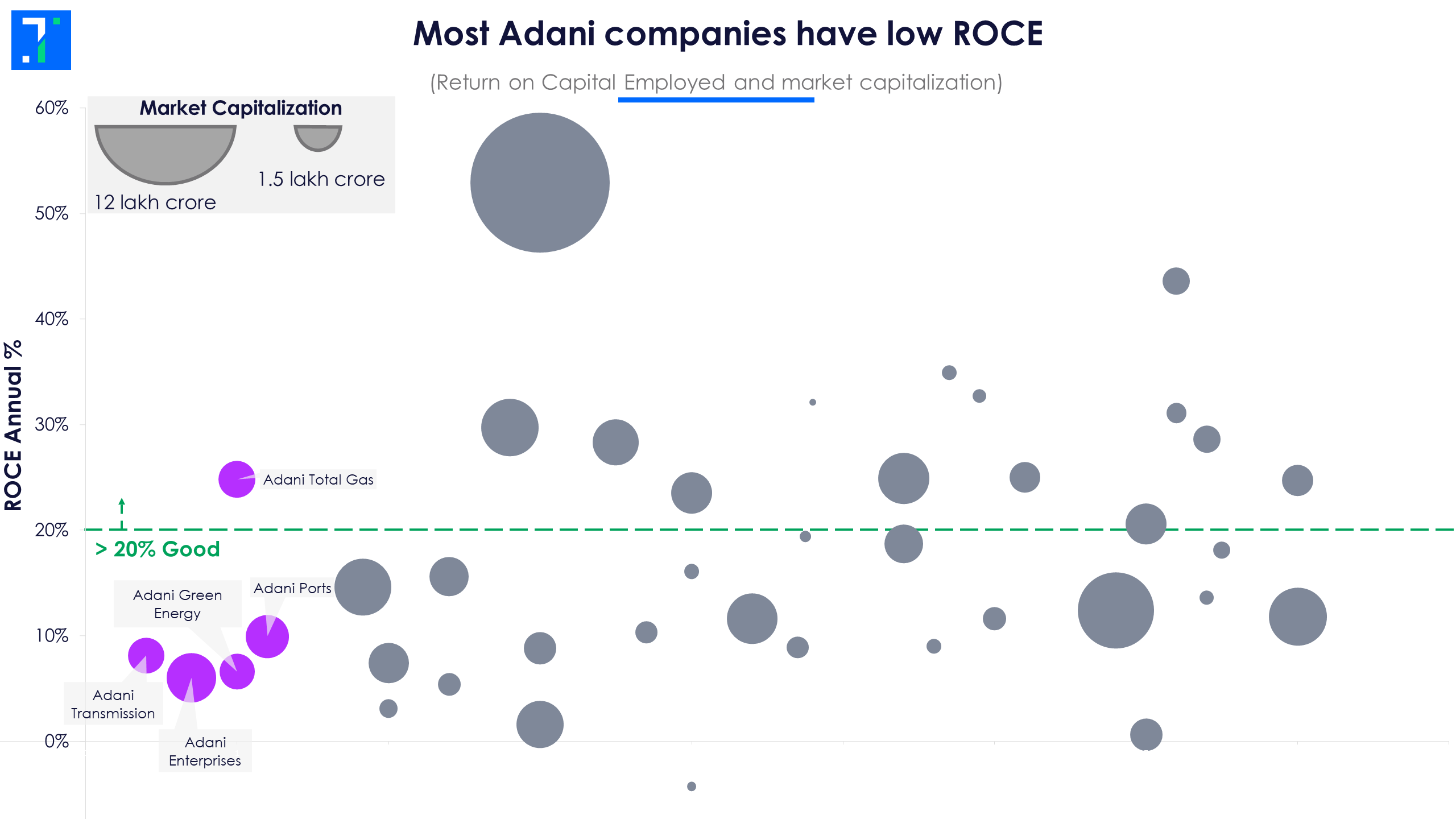

Largecap and midcap losers today include Adani Enterprises Ltd. (1,600.85, -7.09%), Adani Ports & Special Economic Zone Ltd. (593.40, -5.67%) and Bandhan Bank Ltd. (187.45, -5.23%).

Volume Shockers

13 stocks in BSE 500 are trading on high volumes today.

Top high volume gainers on BSE included PNC Infratech Ltd. (282.00, 6.37%), Torrent Power Ltd. (511.35, 4.96%) and Tanla Platforms Ltd. (523.05, 2.60%).

Top high volume losers on BSE were Kalyan Jewellers India Ltd. (107.15, -9.69%), Raymond Ltd. (1,109.20, -5.86%) and Adani Ports & Special Economic Zone Ltd. (593.40, -5.67%).

Sun TV Network Ltd. (397.95, -2.83%) was trading at 4.7 times of weekly average. United Breweries Ltd. (1,406.70, -0.51%) and ZF Commercial Vehicle Control Systems India Ltd. (9,982.25, -0.18%) were trading with volumes 4.4 and 4.0 times weekly average respectively on BSE at the time of posting this article.

BSE 500: highs, lows and moving averages

2 stocks overperformed with 52 week highs, while 77 stocks hit their 52 week lows.

Stocks touching their year highs included - Zydus Lifesciences Ltd. (484.75, 0.59%) and UltraTech Cement Ltd. (7,403.10, -0.63%).

Stocks making new 52 weeks lows included - ACC Ltd. (1,613.95, -4.21%) and Avanti Feeds Ltd. (329.05, -0.29%).

12 stocks climbed above their 200 day SMA including PNC Infratech Ltd. (282.00, 6.37%) and Torrent Power Ltd. (511.35, 4.96%). 23 stocks slipped below their 200 SMA including Minda Corporation Ltd. (199.15, -7.16%) and Shipping Corporation of India Ltd. (117.15, -6.91%).