Nifty 50 closed at 24,625.05 (198.2, 0.8%), BSE Sensex closed at 80,364.49 (554.8, 0.7%) while the broader Nifty 500 closed at 22,713.55 (250.6, 1.1%). Market breadth is overwhelmingly positive. Of the 2,560 stocks traded today, 1,728 were in the positive territory and 788 were negative.

Indian indices closed higher after extending gains throughout the day. The Indian volatility index, Nifty VIX, fell 3.9% and closed at 11.3 points. India’s Manufacturing Purchasing Managers’ Index (PMI) rose to 59.3 in August from 59.1 in July, reaching its highest level since February 2008, driven by strong demand and higher factory orders.

Nifty Smallcap 100 and Nifty Midcap 100 closed higher. Nifty Auto and Nifty Capital Markets were among the top index gainers today. According to Trendlyne’s sector dashboard, Automobiles & Auto Components emerged as the best-performing sector of the day, with a rise of 2.5%.

Asian indices closed mixed. European indices are trading in the green, except for Spain’s IBEX 35. US index futures are trading flat. US markets are closed today due to Labor Day. Brent crude futures are trading higher amid concerns over Russian oil supply disruptions from Ukraine attacks and US sanctions, despite increased production from other countries.

Money flow index (MFI) indicates that stocks like Maruti Suzuki, HBL Power Systems, UNO Minda, and Eicher Motors are in the overbought zone.

Nuvoco Vistas Corp rises as it plans to add a 4 million metric tonnes per annum (MMTPA) grinding mill at Arasmeta Cement Plant with a capex of Rs 200 crore. The new facility is expected to be operational by Q3FY27.

Eicher Motors rises sharply as its sales increase 55% YoY to 1.1 lakh units in August, driven by a 57% rise in domestic sales and a 39% growth in exports.

Ashok Leyland is rising as it plans to invest Rs 5,000 crore over the next seven to ten years to develop and manufacture next-generation batteries in India. The investment supports its electric vehicle portfolio and also serve the wider automotive and energy storage sectors.

EV two-wheeler makers like Ola Electric and Ather Energy rise sharply following positive developments at the Shanghai Cooperation Organization (SCO) summit in China and optimism around proposed GST reforms that could boost sales. China has started easing export restrictions on rare earth metals and critical minerals, indicating a possible thaw in trade relations.

#MarketsWithMC | EV makers Ola, Ather’s shares soar on hopes of easier access to Chinese rare earth magnets, GST reform benefits#EV#Ola#Ather#Shares#RareEarthMagnet@DebarotiAd reports ??https://t.co/SHr1Eiam9N

— Moneycontrol (@moneycontrolcom) September 1, 2025Sterlite Technologies is falling sharply as its US subsidiary receives a $96.5 million (~ Rs 582 crore) penalty from the US District Court. This comes after Prysmian Cables and Systems USA filed a complaint against the arm and its employee, Stephen Szymanski, alleging violations of non-compete and confidentiality agreements by disclosing information to Sterlite.

Ather Energy surges to a new all-time high of Rs 512.8 following the launch of its new scooter platform, EL, designed to boost manufacturing efficiency. The EL architecture will reduce production man-hours by 15%. The company expects the electric two-wheeler (E2W) market to grow at a 41% CAGR, with E2Ws anticipated to account for 35% of overall two-wheeler sales by FY31.

TVS Motor surges to its all-time high of Rs 3,373.7 as its total wholesales grow 30% YoY to 3.9 lakh units in August, driven by a 30% YoY increase in two-wheelers and a 35% YoY growth in international business.

Jairam Sampath, Whole Time Director & CFO of Kaynes Technology, says outsourced semiconductor assembly and test (OSAT) pilot production is underway, with chip shipments set to begin by Q4FY26. He projects semiconductor revenue to reach Rs 1,500 crore by FY28, driven by government initiatives. Currently, all electronics exports are exempt from US tariffs, and exports are expected to contribute 25% of revenue by FY27. He estimates PAT to reach Rs 1,800–2,000 crore by FY30.

Kaynes Technology India says

— Nigel D'Souza (@Nigel__DSouza) September 1, 2025

1? OSAT biz pilot production is underway. Revenue will hit Rs.1500 cr by FY28

2? ?Export to be 25% by FY27. Specific to US, bulk of it is exempted

3? ?By FY30, PAT will be approx Rs.1800-2000crhttps://t.co/bN6eRacNYSDeven Choksey maintains its 'Buy' call on ACC, with a target price of Rs 2,128 per share. This indicates a potential upside of 17.3%. The brokerage expects strong growth going forward, led by an increase in capacity, helping its market positioning and cost optimisation, yielding higher operational benefits. It expects the firm's revenue to grow at a CAGR of 7.7% over FY26-27.

Aditya Birla Capital is rising as it plans to invest Rs 250 crore in Aditya Birla Housing Finance (ABHFL) to fund its growth and improve its leverage ratio.

Adani Power is rising as it secures a letter of award (LoA) from MP Power Management (MPPMCL) to supply electricity at a tariff of Rs 5.8 per unit. The company will set up a new 800 MW ultra-supercritical thermal power plant in Madhya Pradesh with a capex of Rs 10,500 crore.

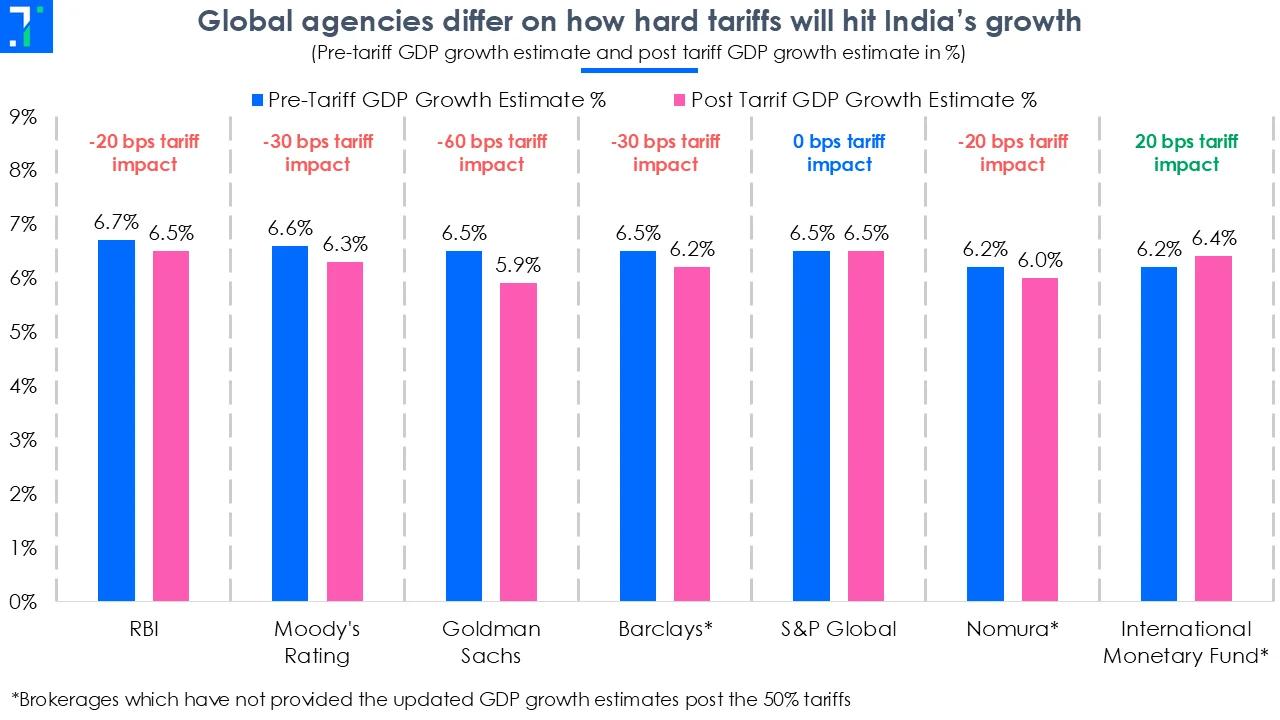

Pranjul Bhandari, Chief India Economist at HSBC, highlights that India’s real GDP growth stands at 6.8% after accounting for an inflation deflator impact of around 1%. This suggests strong economic resilience despite global trade pressures, including recent US tariffs on Indian goods. She expects the RBI to cut rates to counter the drag from tariffs and adds that it will be worth watching how GST reforms influence revenue and fiscal planning.

#OnCNBCTV18 | Real GDP growth number is close to 6.8% adj for #deflator, still a strong number, Inflation deflator impact was to the tune of 1%

Still expect RBI to cut rates to address tariff related drag

Pranjul Bhandari, HSBC to CNBC-TV18 pic.twitter.com/HE6LaTxTGD— CNBC-TV18 (@CNBCTV18Live) September 1, 2025

Bajaj Auto is rising as its total wholesales grow 5% YoY to 4.2 lakh units in August, driven by a 29% increase in exports. However, the company's domestic wholesales fall 8% YoY to 2.3 lakh units during the month.

NCC surges as it receives orders worth Rs 788 crore in August from state government agencies. The orders come under the company’s water division.

Aurobindo Pharma receives Form 483 with three observations from the US FDA after an inspection at its subsidiary, Apitoria Pharma's active pharmaceutical drug (API) manufacturing facility in Telangana.

India's Manufacturing PMI rises to 59.3 in August, up from 59.1 in July, reaching its highest level since February 2008. The increase was fueled by strong demand, a surge in factory orders, and solid output growth.

#HSBC India Manufacturing PMI indicates the fastest improvement in operating conditions for 17-and-a-half years.

For the latest news and updates, visit https://t.co/by4FF5oyu4pic.twitter.com/t7rtGYfrHl— NDTV Profit (@NDTVProfitIndia) September 1, 2025

Premier Energies is rising as its subsidiaries, Premier Energies Photovoltaic, Premier Energies Global Environment and Premier Energies International, bag orders worth Rs 2,703 crore. The orders are to supply solar photovoltaic (PV) modules and cells, with an aggregate capacity of 2,059 MW.

Gujarat Industries Power is rising sharply as it receives approval from the Energy and Petrochemicals Department, Government of Gujarat, to establish a 700–750 MW lignite-based power plant at Valia. Gujarat Urja Vikas Nigam (GUVNL) also approves procuring power from the plant for 25 years.

AXISCADES Technologies is rising as its subsidiary, Mistral Solutions, secures an order worth Rs 150 crore from Combat Aircraft Systems Development & Integration Centre (CASDIC), Ministry of Defence. The order is The order is for developing 10 electronic control units for the cooling system in the Su-30 MKI fighter jet upgrade.

India's Q1FY26 GDP grows 7.8% YoY, a 5-quarter high, driven by government reforms and fiscal prudence. Industry leaders remain confident in the economy’s resilience amid US tariffs, citing strong domestic demand. FICCI President Harsha Vardhan Agarwal says income tax cuts, a lower repo rate, a good monsoon, and the upcoming GST rate rationalisation will support demand and offset export weakness.

Govt reforms, fiscal prudence played key role in GDP hitting 5-qtr high of 7.8 pc: India Inchttps://t.co/m1mBTZRRyn

— Economic Times (@EconomicTimes) August 31, 2025

Torrent Power is rising as it bags a letter of award (LoA) from MP Power Management (MPPMCL) for the long-term procurement of power from a 1,600 MW new coal-based power plant, at a tariff of Rs 5.8 /kWh. The company will set up 2x 800 MW of ultra-supercritical power plants in Madhya Pradesh with a capex of Rs 22,000 crore.

Escorts Kubota is rising as its total wholesales grow 27.1% YoY to 8,456 units in August. Exports surge 35.5% to 554 units, while domestic wholesales increase 26.6% to 7,902 units.

PG Electroplast is rising as its, step-down subsidiary, Next Generation Manufacturers, signs a memorandum of understanding with the Government of Maharashtra to invest Rs 1,000 crore in a greenfield project at Kamargaon, Ahilyanagar. The project sets up integrated manufacturing facilities for air conditioners, washing machines, refrigerators, and related products.

Zydus Wellness rises as its subsidiary, Alidac UK, approves the acquisition of a 100% stake in Comfort Click for a cash consideration of GBP 239 million (~ Rs 2,851 crore).

Nifty 50 was trading at 24,523.50 (96.7, 0.4%), BSE Sensex was trading at 79,828.99 (19.3, 0.0%), while the broader Nifty 500 was trading at 22,558.40 (95.5, 0.4%).

Market breadth is highly positive. Of the 2,128 stocks traded today, 1,544 showed gains, and 515 showed losses.

Riding High:

Largecap and midcap gainers today include Tube Investments of India Ltd. (3,150, 6.4%), Dixon Technologies (India) Ltd. (17,582, 5.3%) and MphasiS Ltd. (2,921.50, 4.8%).

Downers:

Largecap and midcap losers today include Waaree Energies Ltd. (3,200.50, -5.9%), United Breweries Ltd. (1,795.80, -2.9%) and Sun Pharmaceutical Industries Ltd. (1,563.30, -2.0%).

Crowd Puller Stocks

16 stocks in BSE 500 are trading on high volumes today.

Top high volume gainers on BSE included Zydus Wellness Ltd. (2,217.80, 9.9%), Kaynes Technology India Ltd. (6,600, 7.8%) and Gujarat Mineral Development Corporation Ltd. (431.40, 6.8%).

Top high volume losers on BSE were United Breweries Ltd. (1,795.80, -2.9%) and Jyoti CNC Automation Ltd. (896.85, -1.6%).

Chennai Petroleum Corporation Ltd. (687.05, 6.5%) was trading at 7.1 times of weekly average. Torrent Power Ltd. (1,262, 2.8%) and Rites Ltd. (258.48, 6.0%) were trading with volumes 6.4 and 5.6 times weekly average respectively on BSE at the time of posting this article.

BSE 500: highs, lows and moving averages

8 stocks made 52 week highs, while 4 stocks were underachievers and hit their 52 week lows.

Stocks touching their year highs included - Eicher Motors Ltd. (6,280, 2.9%), Maruti Suzuki India Ltd. (14,887, 0.7%) and TVS Motor Company Ltd. (3,356.20, 2.4%).

Stocks making new 52 weeks lows included - United Breweries Ltd. (1,795.80, -2.9%) and Deepak Nitrite Ltd. (1,788.90, 0.1%).

31 stocks climbed above their 200 day SMA including Ola Electric Mobility Ltd. (62.48, 15.6%) and Tube Investments of India Ltd. (3,150, 6.4%). 5 stocks slipped below their 200 SMA including Esab India Ltd. (5,092, -0.9%) and Divi's Laboratories Ltd. (6,093, -0.6%).