By Melissa Koshy

The market continued the uptrend from the previous week, with the Nifty 50 gaining around 1% last week. This rise was driven by optimism surrounding the Prime Minister’s announcement on lower GST rates.

India’s Flash PMI (Purchasing Managers Index) hit a new high in August, reaching 65.2 from 61.1 in July. A PMI above 50 shows growth, and this jump reflects stronger demand in the economy. Both manufacturing companies and service providers reported more new orders. Export orders surged at the fastest rate since 2014, driven by higher inflows from Asia, the Middle East, Europe, and the US.

Vinod Nair, Head of Research at Geojit Investments, says, "A record-high composite PMI and early signs of an urban demand revival are expected to support the market. The consumption sector will likely benefit from a favourable monsoon, low interest rates, and indirect tax reliefs."

Meanwhile, the US Federal Reserve Chair Jerome Powell signalled a rate cut in the September policy meeting at the Jackson Hole symposium. However, he highlighted that the decision will depend on the upcoming jobs and inflation data. Additionally, a key factor to watch is any fresh update from the US on the additional 25% tariffs on Indian goods, which are set to take effect on August 27.

The IPO market keeps its momentum this week, with ten issues set to open, including two from the mainboard segment. In addition, ten companies will make their stock market debut, following five listings last week.

Five new companies debuted on the bourses in the past week

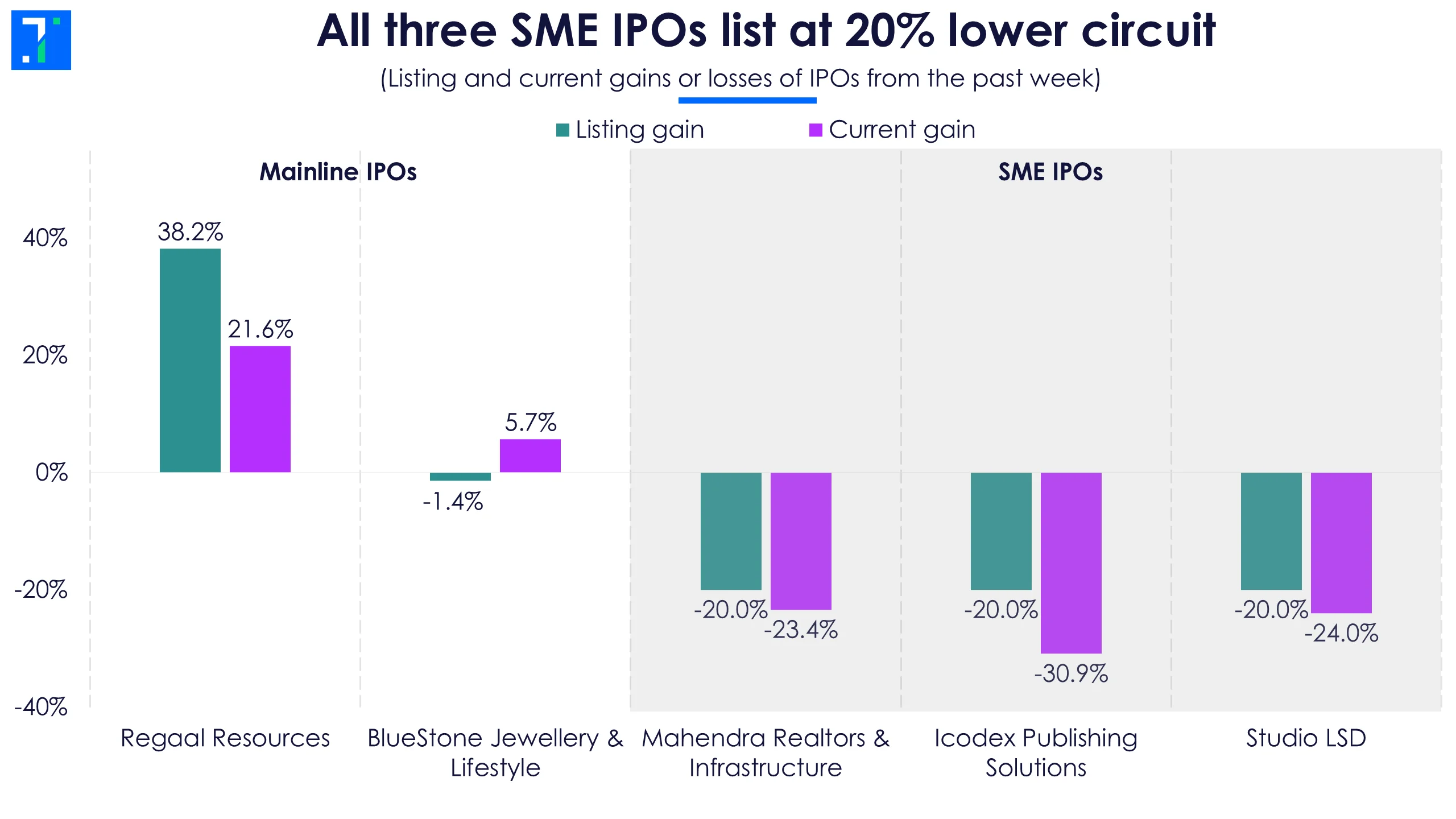

Regaal Resources led the mainline listings last week with a 38.2% gain over its issue price of Rs 102. This maize-based specialty products maker saw strong demand for its IPO and received bids for 159.9X the shares on offer. The HNI category was the most active at 356.7X, while retail investors subscribed 57.8X. The stock currently trades 21.6% above its issue price.

BlueStone Jewellery & Lifestyle, a jewellery maker, listed at a 1.4% discount but is now up 5.7% from its issue price. The company had received bids for 2.7X the shares on offer. The QIB category saw the highest interest at 4.3X, while the HNI portion was undersubscribed at 0.6X.

All three SME IPOs list at 20% lower circuit

In the SME segment, Mahendra Realtors, Icodex Publishing Solutions, and Studio LSD all listed at a 20% discount. The three companies are currently trading 23.4%, 30.9%, and 24% below their issue prices.

Ten new offerings to hit the market this week; SMEs lead the pack

The primary market is set for another busy week, with ten IPOs opening for subscription. Two mainline IPOs are scheduled to open on August 26, close on August 29, and will list on September 3.

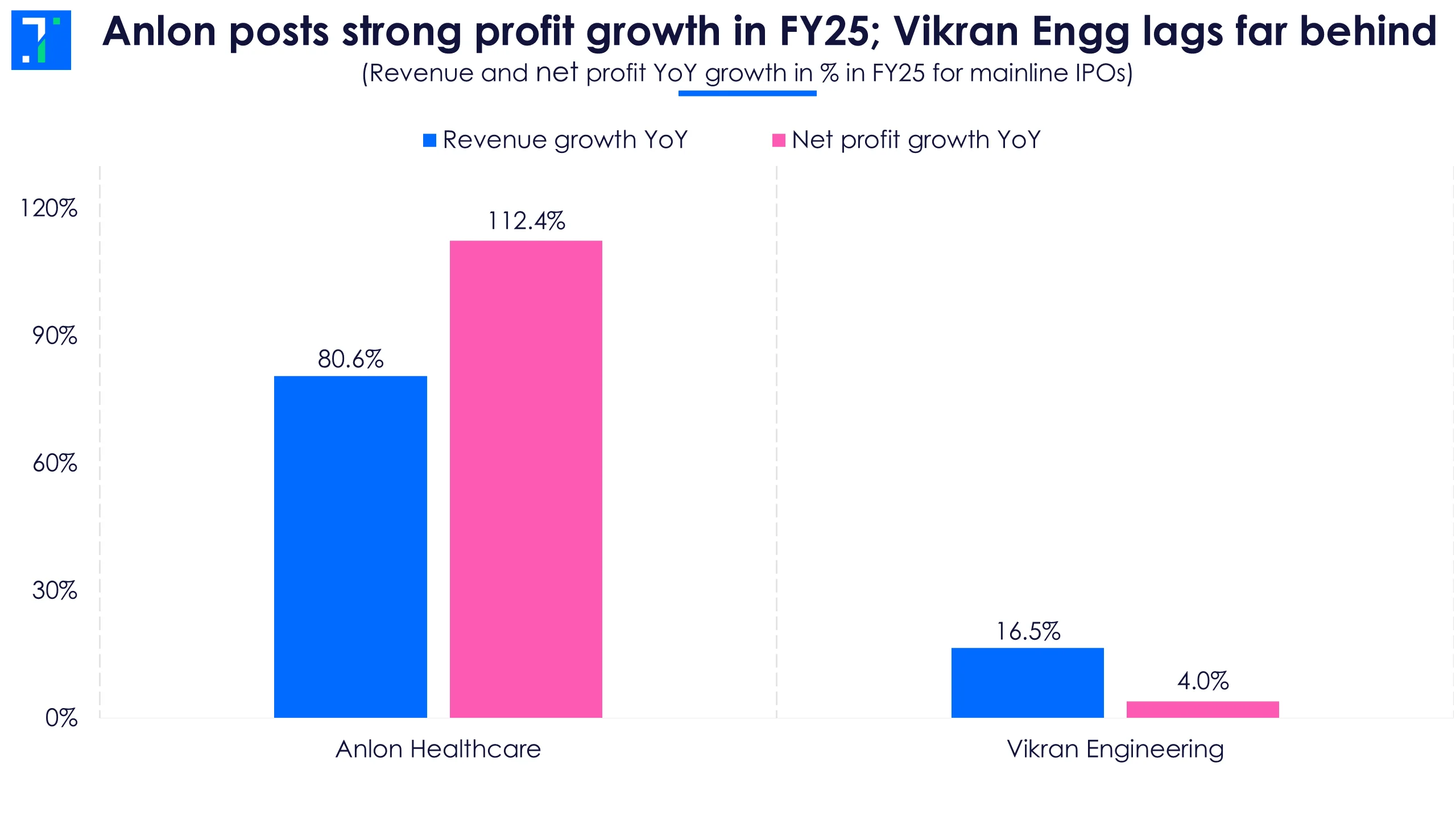

Anlon Healthcare: A pharma company that manufactures intermediates and active pharmaceutical ingredients (APIs) for medicines, nutraceuticals (foods that provide medical or health benefits), personal care, and veterinary products. It plans to raise Rs 121 crore via a fresh issue, priced at Rs 86–91. IPO proceeds will go towards capital expenditure to expand a manufacturing facility, debt repayment and working capital requirements.

Vikran Engineering: A heavy electrical equipment maker, with a diversified project portfolio, majorly focused on energy and water infrastructure sectors. The company offers end-to-end services, including conceptualisation, design, supply, installation, testing, and commissioning, serving the power, water, and railway sectors.

The company is looking to raise Rs 772 crore via a fresh issue, with Rs 721 crore coming from a fresh issue and the rest through an offer-for-sale (OFS). The price band is set at Rs 92 - 97 per share. The IPO funds will be used for working capital needs and general corporate purposes.

All mainline IPOs witness net profit growth in FY25

Along with these two mainboard IPOs, eight SME IPOs are also lined up this week.

- Globtier Infotech and NIS Management opened its IPO on August 25, will close on August 28, and list on September 2. Globtier aims to raise around Rs 31.1 crore at Rs 72 per share, while NIS Management plans to raise Rs 60 crore with a price band of Rs 105-111.

- Current Infraprojects and Sattva Engineering Construction will be open on August 26, close on August 29, and are set to list on September 3. Current Projects aims to raise Rs 41.8 crore with a price band of Rs 76–80, while Sattva Engineering plans to raise Rs 35.4 crore with a price band of Rs 70-75.

- Oval Projects Engineering will open for subscription on August 28, close on September 1, and list on September 4. The company plans to raise Rs 46.7 crore, with a price band of Rs 80-85 per share.

- Sugs Lloyd, Snehaa Organics and Abril Paper Tech are scheduled to open their IPOs on August 29, close on September 2, and debut on the bourses on September 5. Sugs Lloyd plans to raise Rs 85.7 crore with a price band of Rs 117-123, and Snehaa Organics aims to raise Rs 32.7 crore priced at Rs 115-122 per share. Meanwhile, Abril Paper is set to raise Rs 13.4 crore at Rs 61 per share.

A busy week ahead with ten new listings

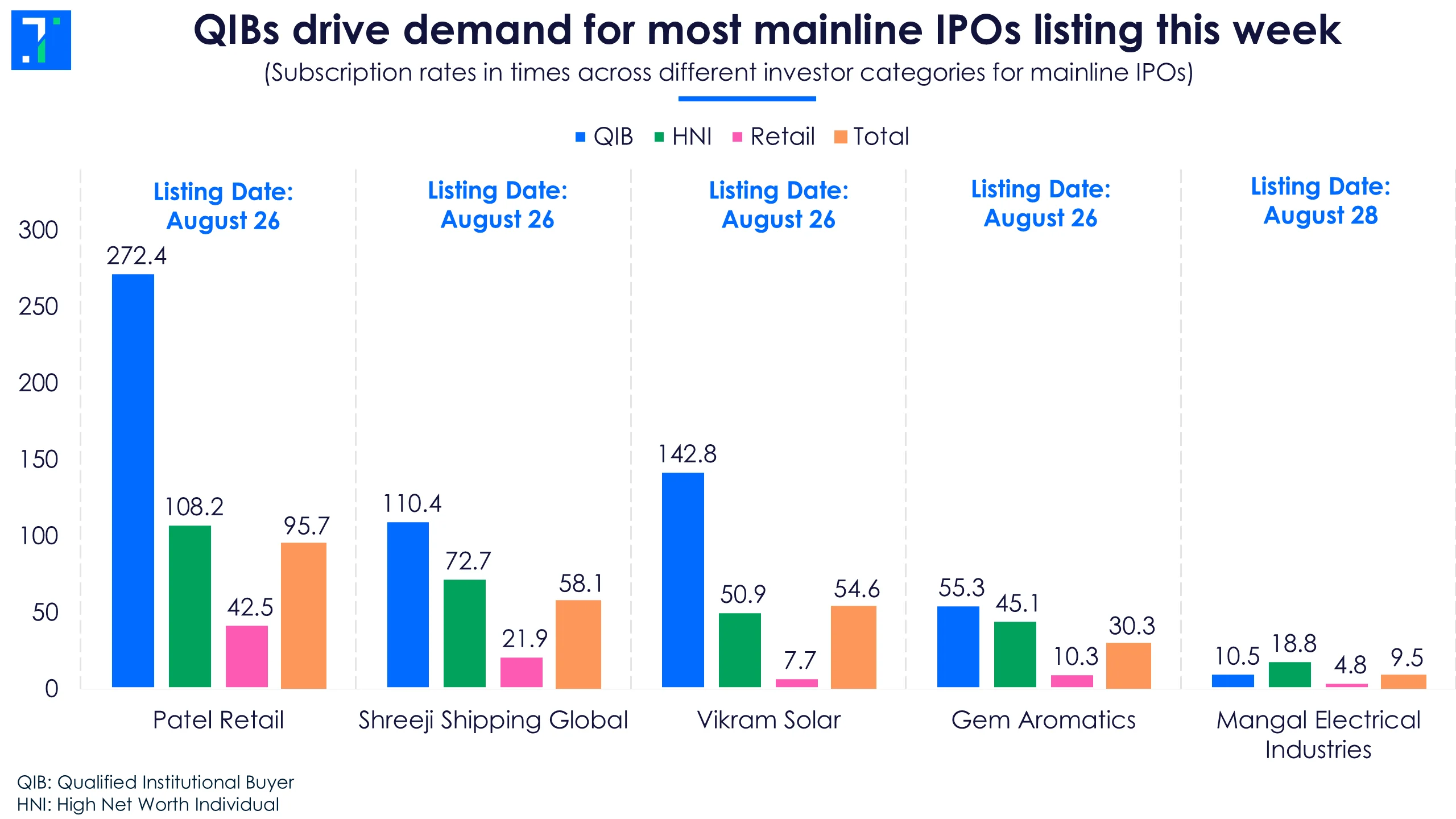

Patel Retail received bids for 95.4X the shares on offer. The QIB category saw the highest interest at 272.4X, while the retail portion was subscribed at 42.5X. The company will list on August 26. The department store chain mainly serves tier-III cities and nearby towns such as Thane, Raigad, Ambernath, etc. It sells food, FMCG products, general merchandise, and apparel.

QIBs drive demand for most mainline IPOs listing this week

Shreeji Shipping Global’s saw its IPO subscription reach 58.1X. The QIB category was the most active at 110.4X, while HNIs subscribed 72.2X. The company is a logistics player that handles dry-bulk cargo at non-major (smaller) ports and jetties in India and Sri Lanka. It is set to list on August 26.

Vikram Solar and Gem Aromatics were subscribed by 54.6X and 30.3X, and are also set to debut on the bourses on August 26. Vikram Solar is a solar module manufacturer, while Gem is a chemicals manufacturer that produces essential oils, aroma chemicals, and other specialty ingredients.

Mangal Electrical Industries’ IPO was subscribed at 9.5X. The company manufactures transformers used in electricity distribution and transmission. It also makes key transformer parts such as laminations, coils, cores, and oil-immersed circuit breakers. It is set for listing on September 1.

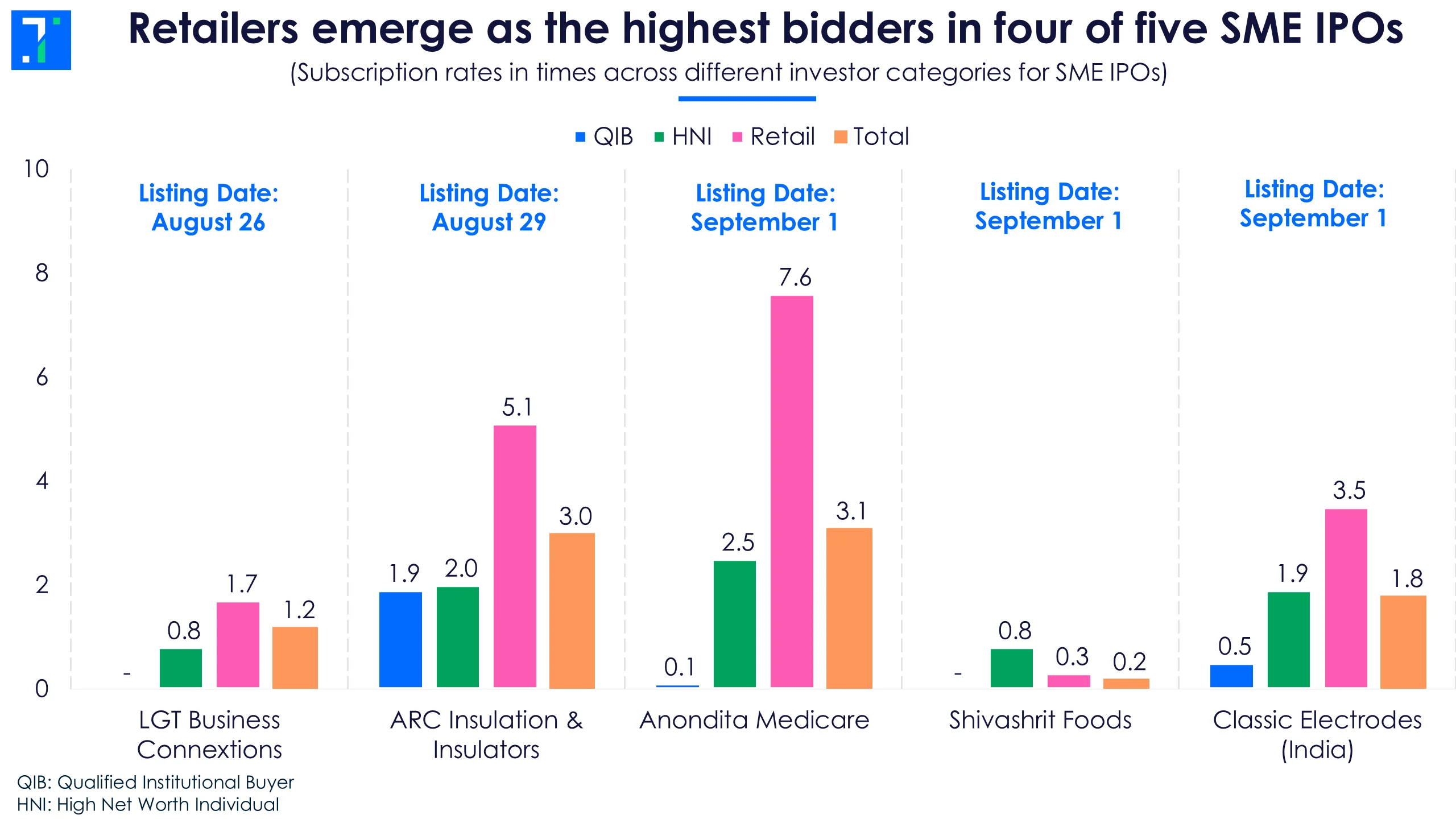

Retailers emerge as the highest bidders in four of five SME IPOs

Five SMEs are also scheduled to hit the market this week:

LGT Business Connextions will list on August 26. Its IPO was subscribed by 1.2X. Meanwhile, ARC Insulation & Insulators is set for listing on August 29. The IPO was subscribed 3X by day 2.

Shivashrit Foods, Classic Electrodes and Anondita Medicare will close on August 26 and list on September 1. The IPOs of these companies were subscribed by 0.2X, 1.8X and 3.1X as of day 1.