Global trade tensions have flared up again, and India is right in the middle of the storm. President Trump has imposed 25% tariffs and an additional 25% penalty on Indian goods, citing the country’s continued purchase of Russian oil. Interestingly, the penalty does not apply to other nations such as China, the largest importer of Russian crude.

For Indian exporters, this move threatens their business relationships with US customers and has made their near-term growth outlook uncertain.

Markets took comfort when reports after the Trump–Putin meeting suggested that Washington may relax the extra penalties on India’s Russian oil imports. But exporters are cautious, aware that US policy under Trump can shift quickly, and the outlook can change overnight.

The Reserve Bank of India reflected this uncertainty in its April 9 forecast. It trimmed the FY26 growth projection when the US first threatened a 26% tariff, but it left the estimate unchanged after the steeper 50% tariff announcement on August 6, not foreseeing a significant additional impact. RBI Governor Sanjay Malhotra said, “We don't see a major impact of US tariffs on the Indian economy unless there is a retaliatory tariff,” said RBI Governor Sanjay Malhotra. But he added that “the global environment continues to be challenging.”

International institutions have echoed this view, with the IMF raising its growth forecast slightly and S&P Global judging the tariff impact as manageable. The US buys only a sixth of Indian goods, and the Indian government has been reaching out to its BRICS partners to boost trade ties after the new tariffs. The BRICS countries already trade more goods with one another than with the US.

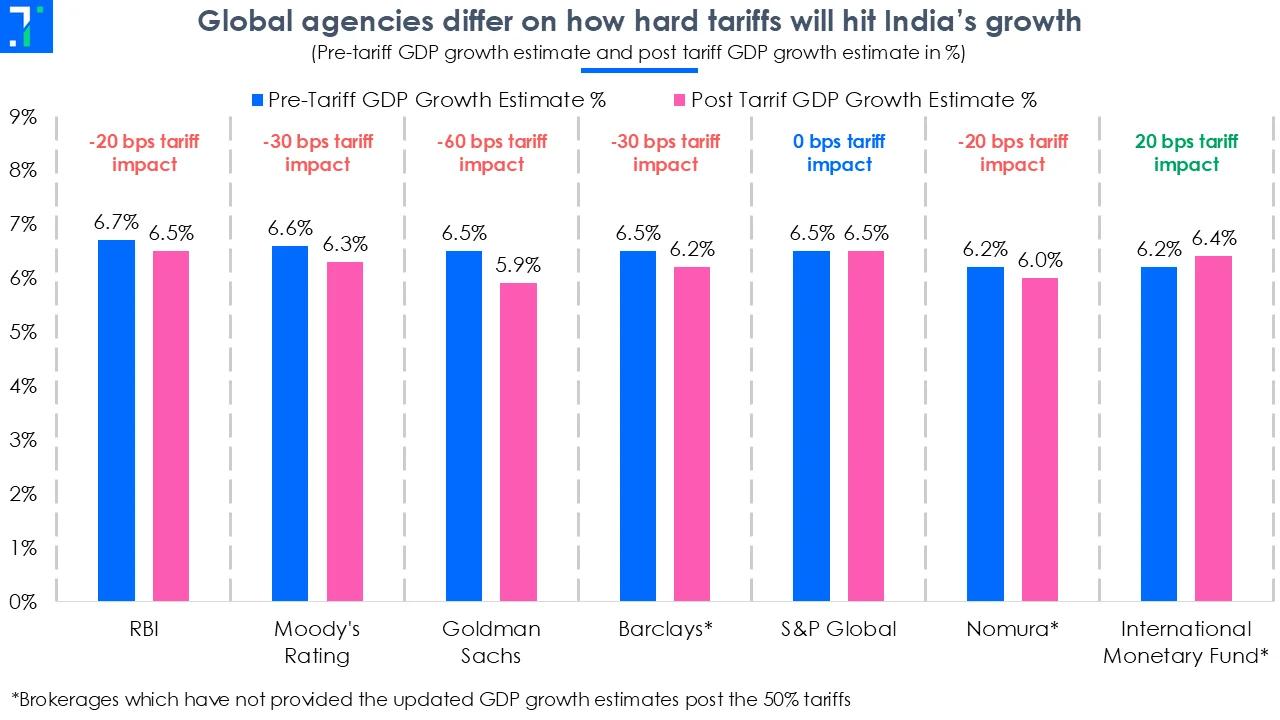

Other global agencies, however, take a more cautious view. Goldman Sachs believes that higher tariffs will weigh more heavily on exports and company earnings than official forecasts suggest. It estimates that GDP growth could decline by as much as half a percentage point, more severe than the RBI anticipates.

In this edition of Chart of the Week, we look at how analysts see US tariffs impacting India’s growth. Some global agencies see them as a serious threat, while others point out that strong domestic demand limits the overall effect.

From manageable slowdown to sectoral shock: mixed views on tariff impact on sectors

Moody’s Ratings and Barclays remain cautious, though not overly worried about the tariff shock. Moody’s estimates that the 50% US tariff could trim India’s GDP by around 30 bps, mainly because of a lower contribution from exports. It believes the overall hit will be limited, citing strong domestic demand and a resilient services sector.

Barclays offers a similar estimate of a 30 bps slowdown, pointing out that India’s growth is driven more by domestic consumption than by exports. Both agree that some export-heavy sectors, such as textiles and jewellery, will feel the pressure, but the broader economy should hold up.

Nomura takes a different angle. While it expects the overall hit to growth to be smaller—around 20 bps compared with Moody’s and Barclays’ 30 bps—it warns that the sectoral fallout could be more severe. Calling the 50% tariff “almost like a trade ban,” it highlights that smaller industries such as textiles and jewellery, already operating on thin margins, could be disproportionately affected. At the same time, Nomura sees a possible cushion: India may be able to redirect some exports to Europe, the UK, and New Zealand.

Goldman Sachs sees the most severe risk. It estimates that tariffs could shave as much as 60 bps off India’s growth if they remain in place. More than the immediate slowdown, Goldman Sachs cautions that the bigger threat lies in uncertainty. Prolonged tariffs, it argues, may discourage companies from making new investments or planning expansions.

Industry leaders echo these concerns. Siva Ganapathi, MD of Gokaldas Exports, says that the 50% tariff feels “more like a ban than a tax” and warns it could disrupt supply chains, pushing buyers to shift away from India. Shrenik Ghodawat, MD of the Sanjay Ghodawat Group, adds that sectors like textiles, gems, and seafood must quickly find alternative markets to cushion the blow. He estimates that if tariffs persist, India’s GDP could slow by 0.4 to 1 percentage point.

Domestic demand expected to keep growth outlook intact

The RBI has kept its outlook largely steady. The signal is clear: the central bank expects strong spending to continue supporting the economy despite external pressures.

S&P Global has taken an even more upbeat stance. The ratings agency recently upgraded India’s sovereign credit rating from BBB- to BBB, calling the impact of the 50% US tariff “manageable” or even “marginal.” It reasons that exports to the US make up only about 2% of India’s GDP, and with key sectors such as pharma and electronics exempt, the actual exposure is closer to 1.2% of GDP.

S&P also highlights that India’s economy is powered mainly by its consumers, with nearly 60% of growth driven by domestic spending. On top of that, the “China-plus-one” shift is drawing global companies to India—not just for exports, but to tap into its fast-growing home market. Together, these factors give India an added cushion and make growth more resilient.

The IMF is similarly optimistic. It raised India’s growth forecast to 6.4% for both FY26 and FY27, up from 6.2% and 6.3% earlier. While acknowledging that a 50% US tariff could trim growth by 20–30 basis points, it expects strong household demand and continued government investment to offset much of the drag. The fund stresses that because India’s economy depends more on domestic consumption and public investment than on external trade, it is less vulnerable to shocks like tariffs.

The RBI, S&P, and IMF all share a common view: India’s growth story rests on domestic demand rather than exports. Tariffs may pinch a few export-oriented sectors, but they are unlikely to derail the broader economy. The real test lies in how long the tariffs last. A short disruption may sting exporters without affecting overall growth, while a prolonged 50% tariff could add pressure. Even at the lower 25% rate, the impact would still be noticeable, though far more contained.