The first quarter of FY26 was marked by market volatility, largely driven by global trade tensions. During these months, the US and India were busy negotiating the first phase of a Bilateral Trade Agreement, to improve trade between the two countries, and bring down tariffs on both sides.

But President Trump blew up the negotiations, complaining about India’s imports on Russian oil, and imposed a 50% import tariff on Indian goods. The move prompted a warning from Moody's about a potential slowdown in India's manufacturing sector and overall economic growth. However, S&P Global Ratings expects the tariffs to have limited impact on the economy, noting that exports to the US are small and key sectors like pharma and consumer electronics are largely exempt. The agency also upgraded India’s sovereign rating from ‘BBB-’ to ‘BBB’.

To invest in markets as volatile as this, people follow superstar investors like RARE Enterprises, Ashish Kacholia, Sunil Singhania, and Vijay Kedia for insights. Their buying and selling activity helps retail investors identify promising sectors and stocks. We take a look at their top buys in Q1FY26.

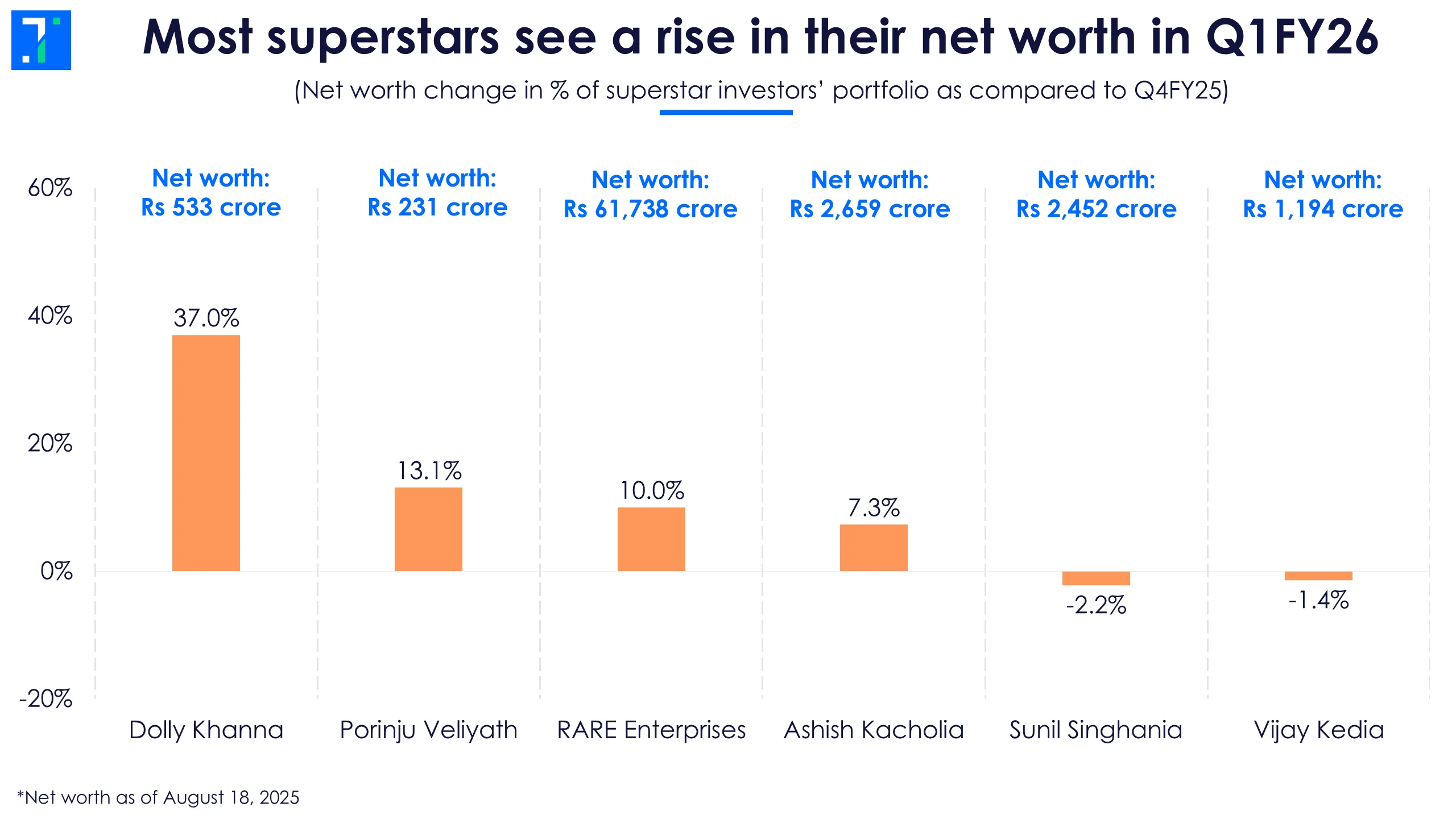

In Q1, most superstar investors remained cautious due to market volatility. They made fewer additions and more stake sales, continuing the pattern seen from the March quarter. The chart below shows changes in their current public portfolio net worth.

Despite limited buying, several of their existing holdings delivered strong gains during the quarter, leading to a rise in net worth for most of these investors. Note that superstar net worth includes current holding changes, as well as new buys and sells.

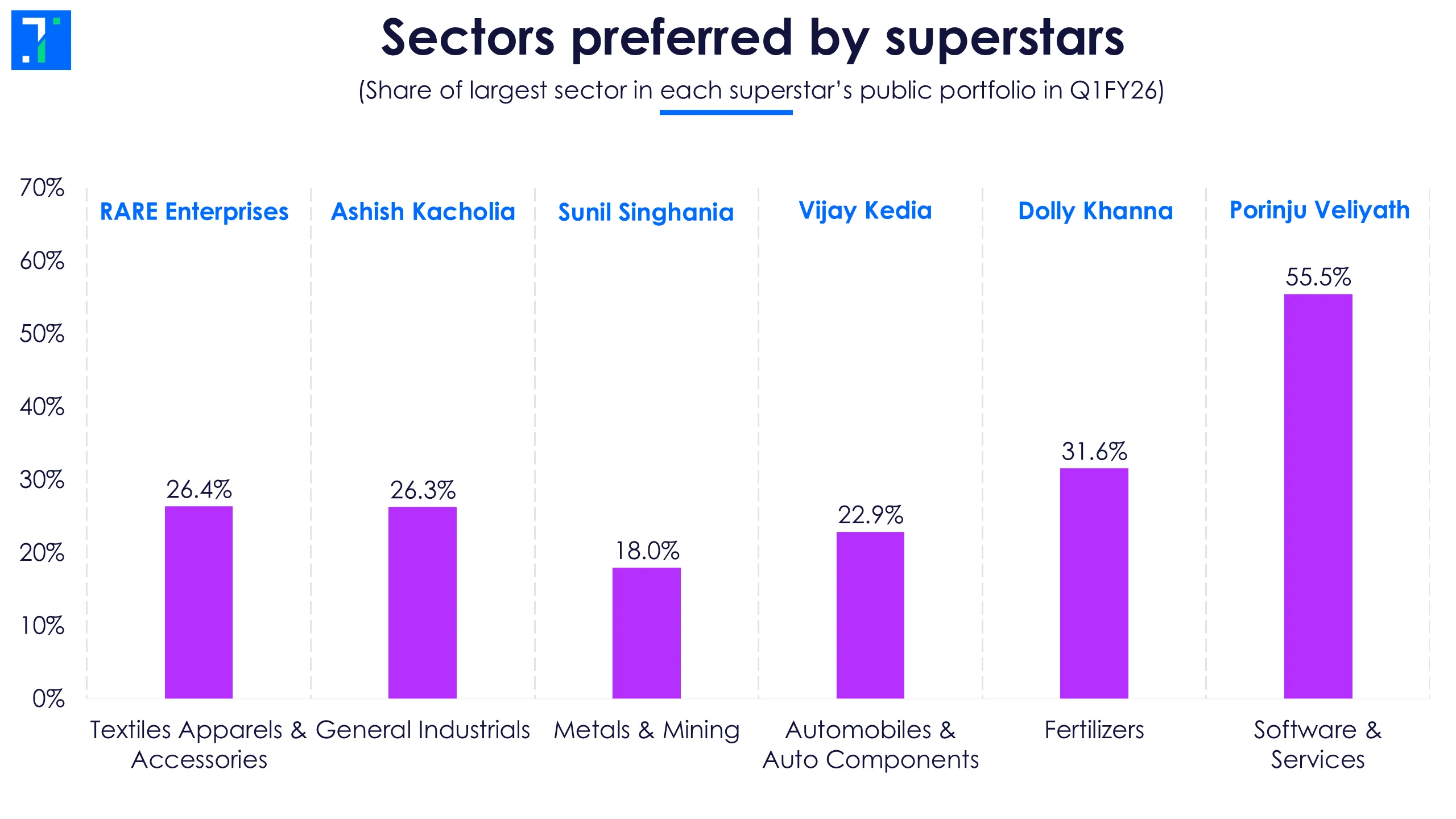

Each superstar investor's portfolio reflects their unique investing style and sector preferences. The chart below highlights the dominant sectors in each investor’s public portfolio.

Sector preferences vary among superstar investors – RARE Enterprises leans towards the Textiles Apparels & Accessories, while Ashish Kacholia favours general industrials. Sunil Singhania focuses on the metals & mining sector, and Vijay Kedia’s preferred industry is automobiles & auto components. Dolly Khanna leans more towards the fertilizers industry, and Porinju Veliyath’s top sector is software & services.

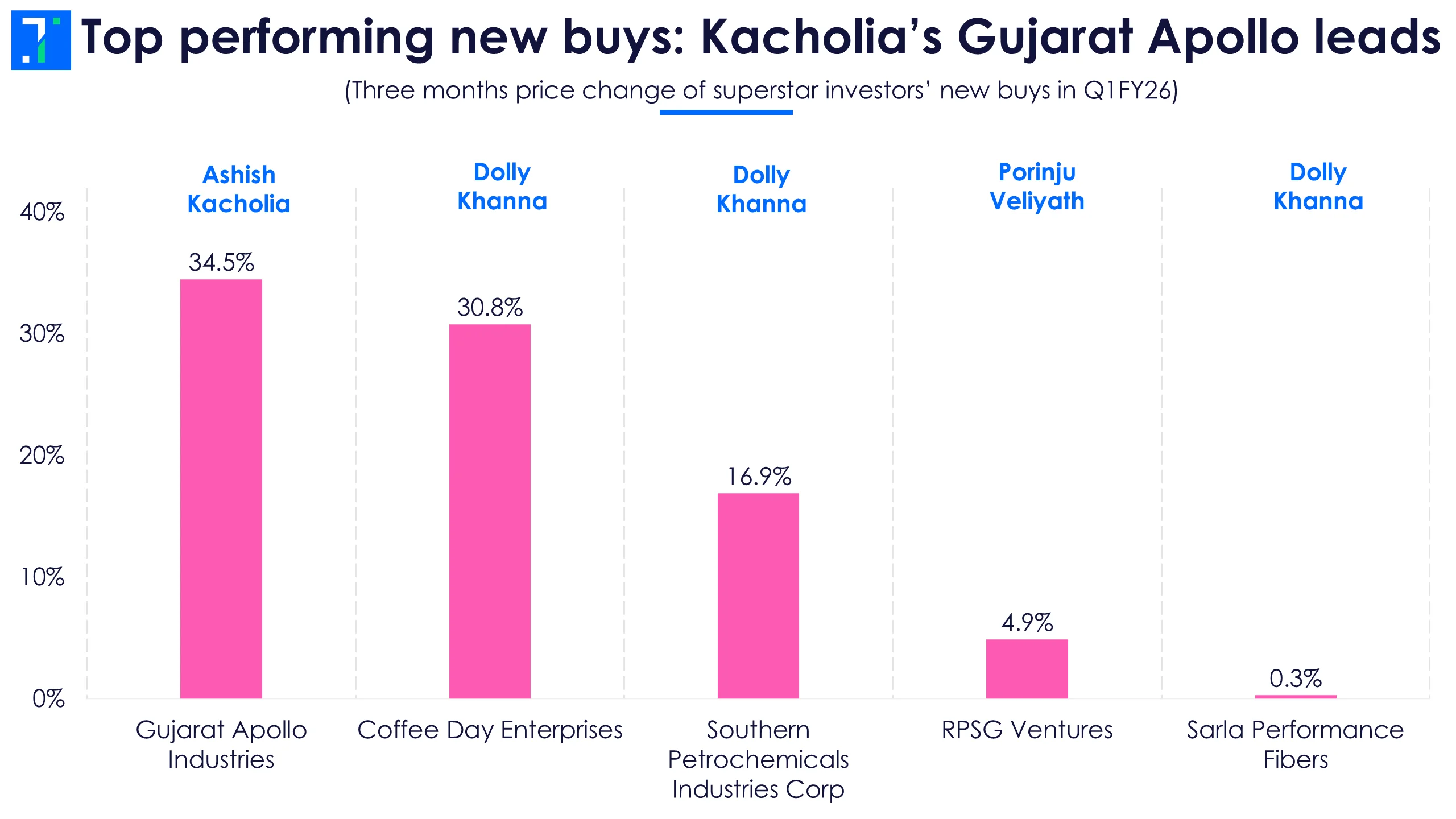

Ashish Kacholia added just one new stock to his portfolio in Q1, which topped the list of best-performing stocks for the quarter. Dolly Khanna made the most new investments during this period, with Coffee Day Enterprises emerging as her top-performing stock. Here’s a look at the key stocks held by these superstar investors.

Kacholia’s Gujarat Apollo Industries topped the list with a 34.5% rise over the past quarter. Among Dolly Khanna’s holdings, Coffee Day Enterprises rose 30.8%, followed by Southern Petrochemicals Industries and Sarla Performance Fibers. Porinju’s RPSG Ventures also appears in the list, gaining 4.9% in Q1.

RARE Enterprises records no new buys in Q1

Rakesh Jhunjhunwala’s portfolio, currently managed by Rekha Jhunjhunwala and RARE Enterprises, has risen by 10% to Rs 61737.8 crore as of August 18. The fund has stayed relatively quiet in recent months, making no new purchases or stake increases during the quarter. However, RARE has fully sold its stake in Nazara Technologies.

Net worth has increased despite no stake additions, driven by strong performance in key holdings such as Star Health and Allied Insurance, Concord Biotech, Fortis Healthcare, etc. However, its two largest holdings, Inventurus Knowledge Solutions and Titan Company, recorded nearly flat performance in the past quarter.

Ashish Kacholia adds a new company in Q4, raises stake in three

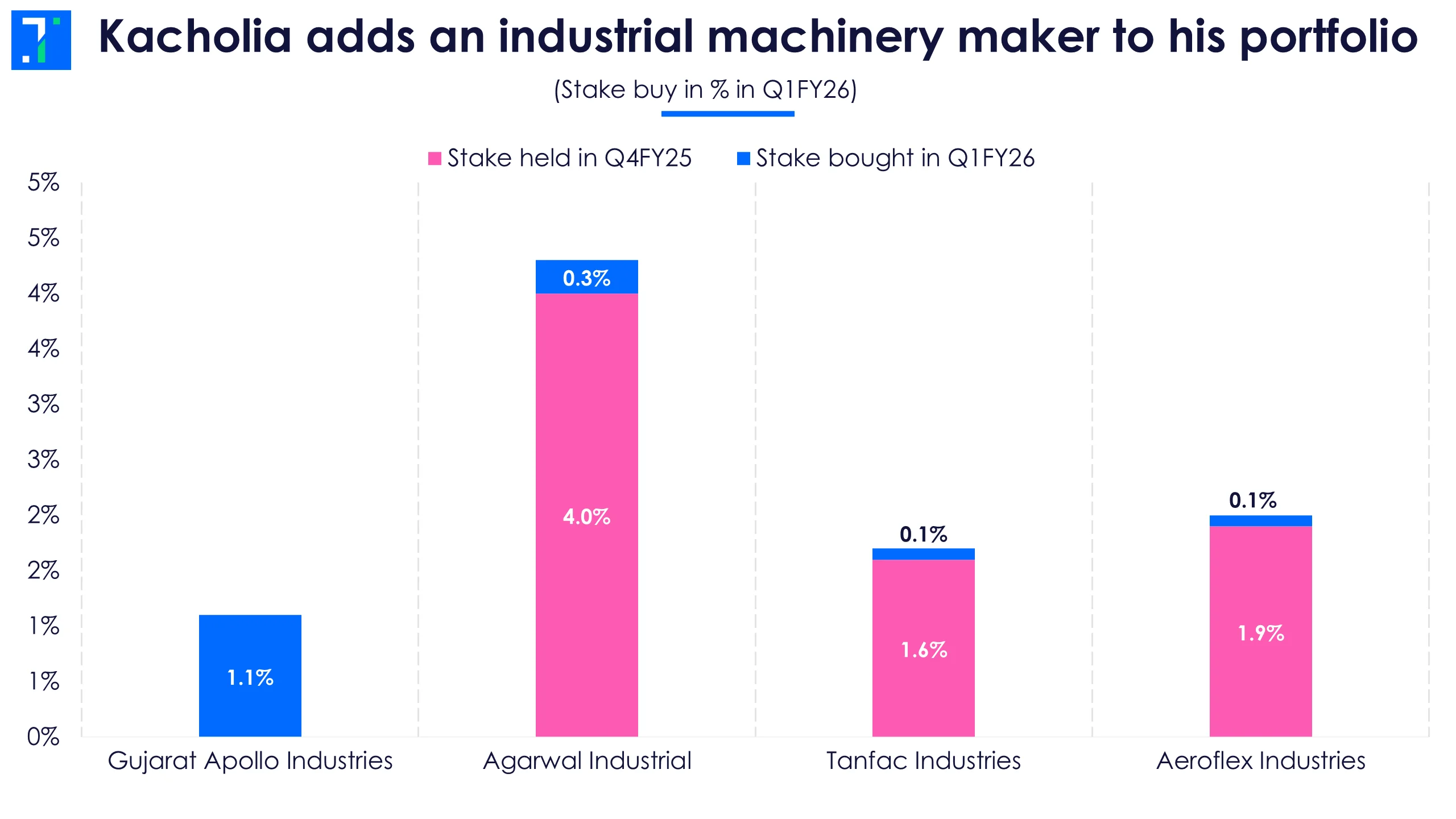

Ashish Kacholia’s net worth rose 7.3% to Rs 2,659 crore as of August 18. During the quarter, the ace investor added Gujarat Apollo Industries, a small-cap industrial machinery maker, to his portfolio, investing about Rs 5 crore for a 1.1% stake.

FIIs also increased their holding in the company, from a mere 0.01% to 0.14% during the quarter. The stock appears in a screener of stocks that outperformed their industry during the quarter. It has risen by 73.8% over the past year.

Kacholia also bought a 0.3% stake in Agarwal Industrial Corp during Q1, increasing his holding to 4.3%. The stock ranks high on Trendlyne’s checklist with a score of 56.5%. However, it has declined by 32.3% over the past year.

He also made small additions of 0.1% each to his holdings in Tanfac Industries and Aeroflex Industries. Both companies have strong Durability scores and rank high on Trendlyne’s checklist. They also turn up in a screener of stocks that have delivered consistently high returns over the past five years.

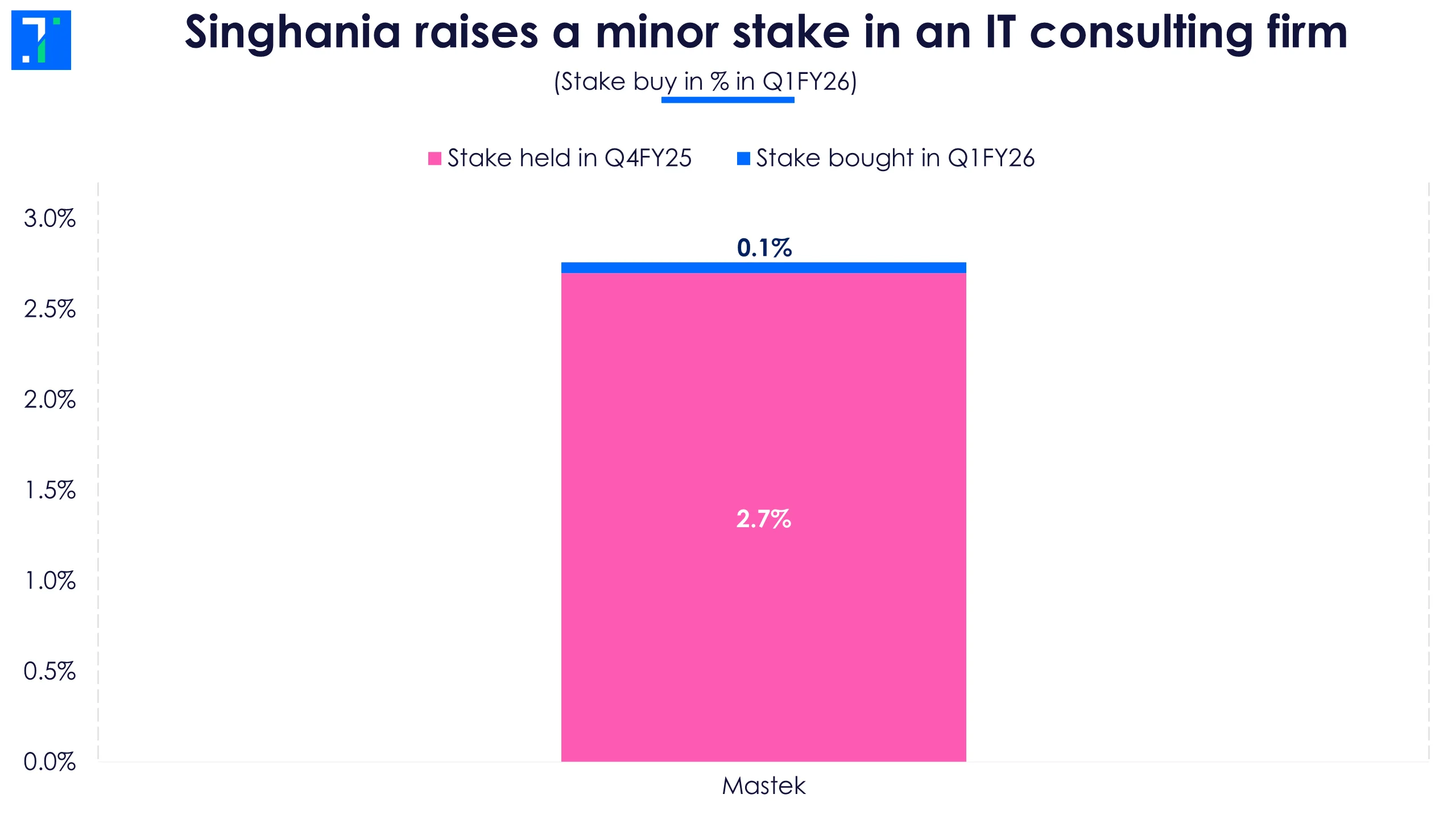

Sunil Singhania slightly increases his stake in Mastek

Sunil Singhania’s Abakkus Fund saw its net worth drop 2.2% to Rs 2,452.3 crore as of August 18. Singhania’s fund remained cautious during the quarter, making more stake sales and adding only a small 0.1% stake in Mastek.

The fund now holds a 2.8% stake in the IT consulting firm. However, this is down from 3% stake in the June quarter last year.

Trendlyne classifies Mastek as a Mid-range Performer, driven by its high Durability score but average Valuation and Momentum scores. The stock is undervalued based on both current PE and future earnings estimates.

Analysts estimate the stock could rise around 22% over the next year, with an average target price of Rs 3,072. It has already gained 7.3% in the past quarter.

Vijay Kedia makes no new buys in Q1

Vijay Kedia's net worth has fallen by 13.4%, reaching Rs 1,193.8 crore as of August 18. He has been relatively quiet in recent months, making no new purchases or stake increases during the quarter, but has sold stakes in a few companies.

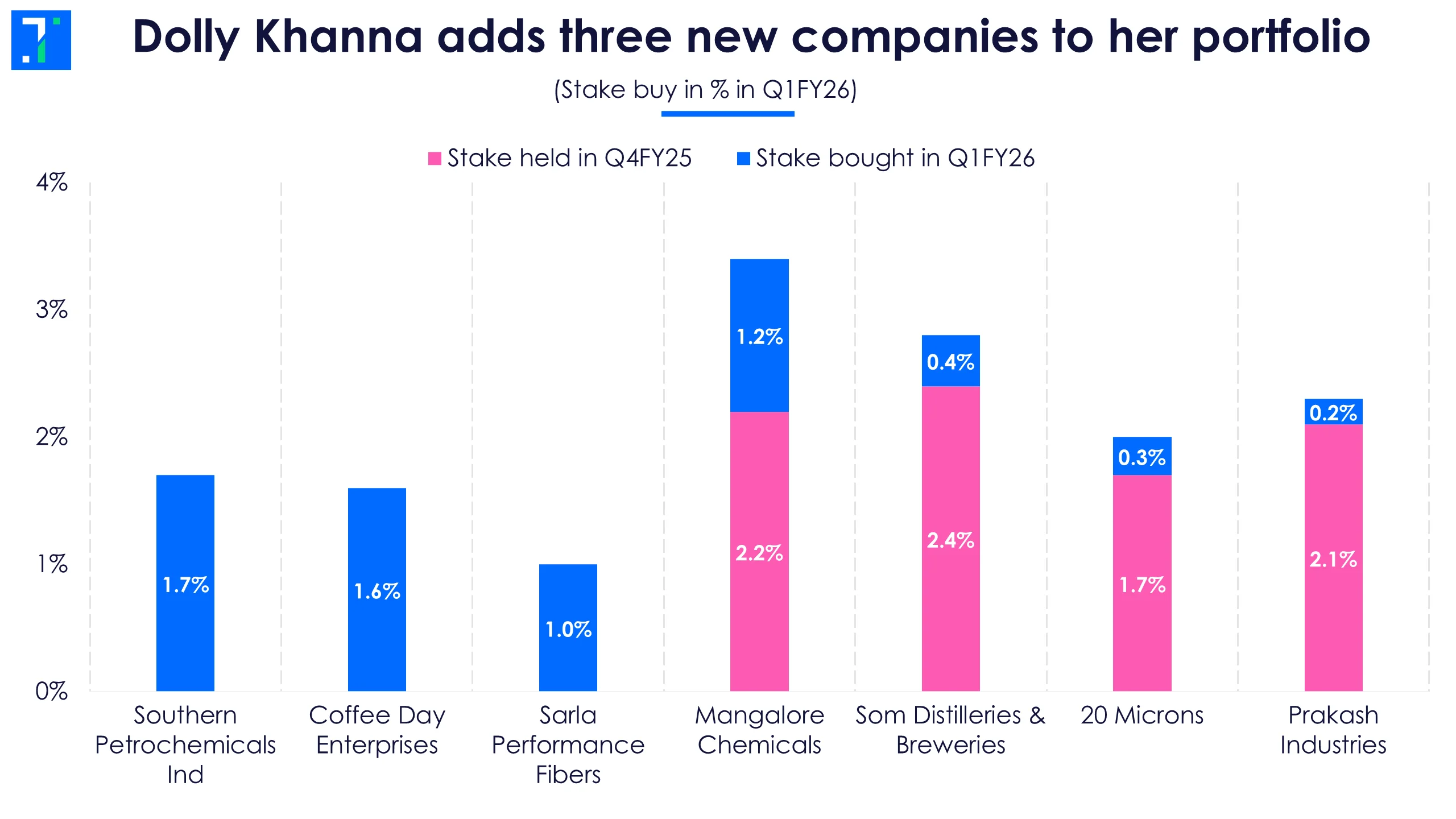

Dolly Khanna adds three new companies in Q1

Dolly Khanna's net worth increased by 37%, reaching Rs 533.3 crore as of August 18. She publicly holds 17 companies and continued to expand her portfolio in Q1 by adding three new companies and increasing stakes in another seven.

Her new investments include a 1.7% stake in Southern Petrochemicals Industries Corp, a fertilizer manufacturer, and a 1.6% stake in Coffee Day Enterprises, which runs coffee outlets. She also bought a 1% stake in Sarla Performance Fibers, a textiles firm.

Over the past quarter, Southern Petrochemicals’ share price has risen by 16.9%, Coffee Day has gained 30.8%, while Sarla Performance has increased by 0.3%.

Khanna increased her stake in Mangalore Chemicals & Fertilizers by acquiring 1.1%, taking her holding to 3.3%. This is the fourth consecutive quarter where she has raised her stake in the company. It has surged 158.9% over the past year, outperforming its industry by 59 percentage points.

Khanna also bought minor stakes in Som Distilleries & Breweries (0.4%), 20 Microns (0.3%), and 0.2% each in Prakash Industries and Rajshree Sugars & Chemicals. Additionally, she made small purchases in KCP Sugar, Zuari Industries, and GHCL.

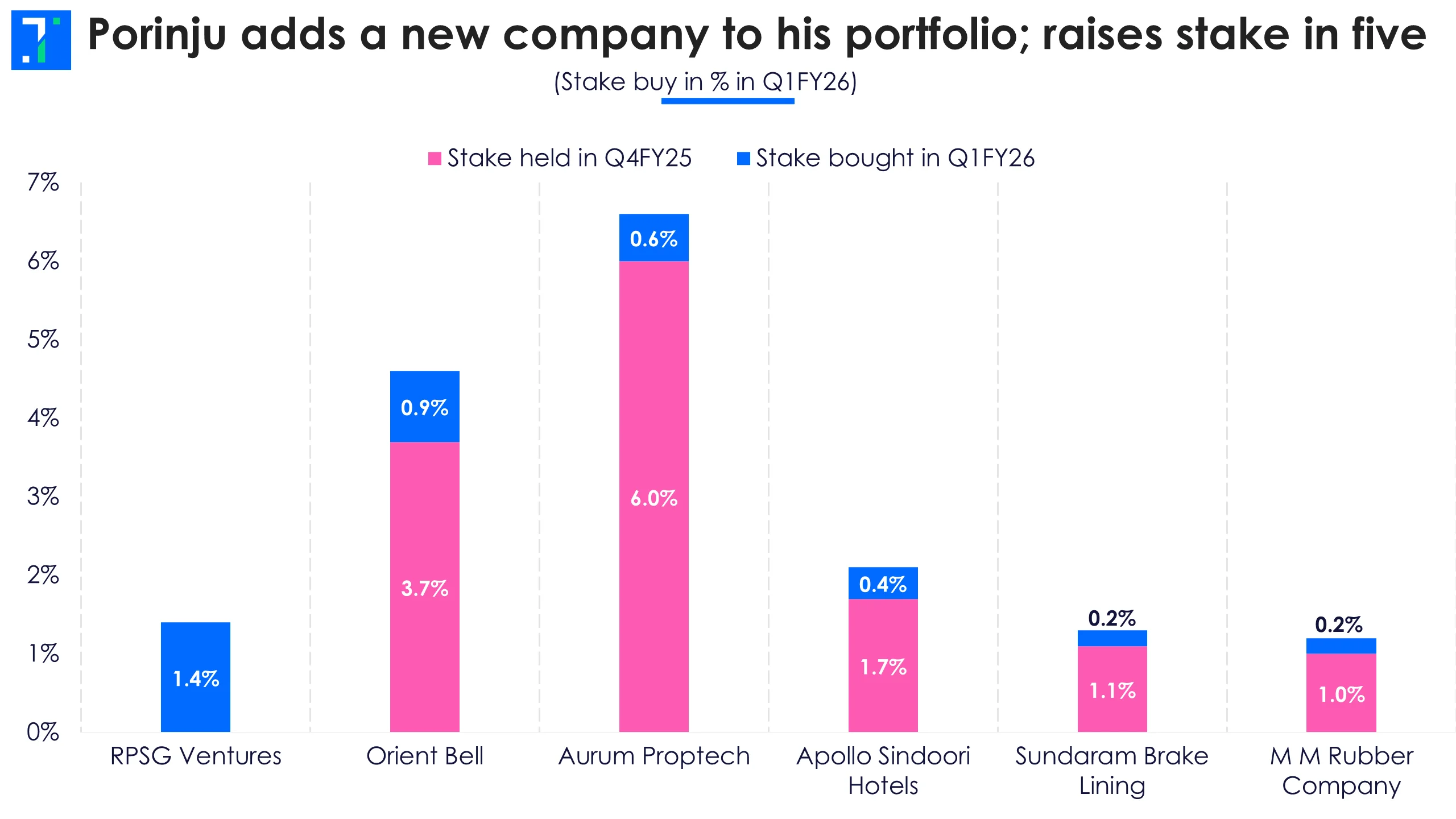

Porinju Veliyath adds an IT consulting firm to his portfolio in Q1

Porinju Veliyath's net worth increased by 13.5%, reaching Rs 232.2 crore. During the June quarter, he added RPSG Ventures to his portfolio, acquiring a 1.4% stake in the IT consulting & software company. The company’s share price has increased by 12.2% over the past year, outperforming its industry by 23.6 percentage points.

During Q1FY26, Porinju increased his stake in Orient Bell by 0.9%, taking his holding to 4.6% in the ceramics manufacturer. The stock has strong Durability and Valuation scores of 85 and 61.3. The company has gained 3.9% over the past quarter.

He also picked up a 0.4% stake in Apollo Sindoori Hotels and now holds 2.1% in the hotels stock. The company has gained 8.7% over the past quarter, outperforming the industry by 8.4 percentage points. It also has a high Durability score of 65.

Porinju bought a 0.2% stake each in Sundaram Brake Lining and M M Rubber Company. He has a 1.3% stake in both the auto parts maker as well as the auto tyres manufacturer. These companies feature in a screener of stocks with zero promoter pledge.