Nifty 50 closed at 21,957.50 (-345, -1.6%), BSE Sensex closed at 72,404.17 (-1062.2, -1.5%) while the broader Nifty 500 closed at 20,344.80 (-360.1, -1.7%). Market breadth is overwhelmingly negative. Of the 2,069 stocks traded today, 277 showed gains, and 1,761 showed losses.

Indian indices extended the losses from the afternoon session and closed in the red. The volatility index, Nifty VIX, rose by 6.5% and closed at 18.2 points. Hindustan Petroleum Corp’s Q4FY24 net profit declined by 24.9% YoY to Rs 2,709.3, while revenue grew by 6% YoY.

Nifty Midcap 100 and Nifty Smallcap 100 closed lower following the benchmark index. Nifty Auto closed higher than Wednesday’s closing level. According to Trendlyne’s sector dashboard, hardware technology & equipment emerged as the top-performing sector of the day, with a rise of over 0.4%.

Most European indices trade in the red, except for Germany’s DAX trading higher. US indices futures trade lower, indicating a negative start. Brent crude prices trade above $84 per barrel as a report published by Goldman Sachs suggested that OPEC+ might extend the voluntary production cuts beyond June.

Money flow index (MFI) indicates that stocks like Escorts Kubota, Tube Investments of India, Emami and Blue Dart Express are in the overbought zone.

Hindustan Petroleum Corp is falling as its Q4FY24 net profit declines 24.9% YoY to Rs 2,709.3 crore. The decline is due to higher material costs, employee benefit expenses and finance costs. However its revenue grows by 6% YoY.

Bank of Baroda is rising as the Reserve Bank of India (RBI) lifts restrictions on the bank's app, BoB World, allowing it to onboard customers.

Alkyl Amines Chemicals falls sharply as its net profit declines by 20.9% YoY to Rs 38.5 crore in Q4FY24. Revenue decreases by 13.5% YoY to Rs 356.6 crore during the quarter. It shows up in a screener of stocks with declining return on equity (RoE) over the past two years.

Jefferies has a ‘Buy’ rating on TVS Motor Co with a target price of Rs 2,525. The brokerage sees strong growth for India’s two-wheeler segment and says that the export market is recovering. Jefferies highlights the company's improved margins, which reached 11.1% in FY24, and its gains in market share.

TVS Motors ????

Jefferies on TVS Motors

TP at 2525 ????

Margins ????11.9-12.9% in FY25-27E

EPS ????3x in the last 3yrs, but expected to double over the next 3 years

Valuations????Trades at 35x FY25E PE but believe premium multiples will sustain

1. Key Beneficiary ???? 2W demand revival in…— Nigel D'Souza (@Nigel__DSouza) May 9, 2024

TBO Tek's Rs 1,550.8 crore IPO gets bids for 2.6X the available 92.9 lakh shares on offer on the second day of bidding. The retail investor quota gets bids for 7.4X the available 16.8 lakh shares on offer.

Aadhar Housing Finance's Rs 3,000 crore IPO gets bids for 1.1X the available 7 crore shares on offer on the second day of bidding. The retail investor quota gets bids for 0.7X the available 3.5 crore shares on offer.

Venus Pipes & Tubes' Q4FY24 net profit rises 86.5% YoY to Rs 25 crore and its revenue increases 26.8% YoY. Its margin also improves 786 basis points YoY to 20.1%. The company appears in a screener for stocks trading near their 52-week high.

Mutual Funds' net inflow stands at Rs 2.4 crore in April, compared to an outflow of Rs 1.6 crore in March, according to data released by the Association of Mutual Funds in India (AMFI). Net AUM stands at Rs 52.2 lakh crore during the same period.

Mutual fund industry net inflows at Rs 2.39 lakh crore versus outflow of Rs 1.59 lakh crore month-on-month.

For the latest news and updates, visit: https://t.co/by4FF5o0Ewpic.twitter.com/JX5KeSjhDN— NDTV Profit (@NDTVProfitIndia) May 9, 2024

Oil & gas stocks like GAIL (India), Oil India, Castrol India and Oil & Natural Gas Corp fall sharply in trade today. All constituents of the broader Nifty Oil & Gas index are also trading in the red, causing the index to fall more than 2%.

SKF India rises sharply as its Q4FY24 net profit grows by 42.5% YoY to Rs 175.2 crore, owing to inventory sales. Revenue increases by 9.9% YoY to Rs 1,203.4 crore during the quarter. The company appears in a screener of stocks where FIIs are increasing their shareholding.

Sula Vineyards is falling as its Q4FY24 net profit falls 4.9% YoY to Rs 13.6 crore, despite a 10.7% YoY rise in revenue. EBITDA margin falls 110 basis points to 30.2% during the quarter. The company appears in a screener for stocks with increasing revenue for the past two quarters.

Sharad Mahendra, Joint MD and CEO of JSW Energy, notes that the renewable energy segment performed below expectations in FY24. However, he expects the company to exceed its 10 GW renewable energy target for FY25. Mahendra also predicts a power demand increase of 7.5-8% in FY25.

#OnETNOW | "Confident that we will surpass 10GW RE guidance in FY25" says Sharad Mahendra of JSW Energy@mahendra_sharad@JSWEnergypic.twitter.com/YtXKdjXV2g

— ET NOW (@ETNOWlive) May 9, 2024

EMS emerges as the lowest bidder for a project worth Rs 148.1 crore. The contract includes the supply, installation, testing, and commissioning of infrastructure works under the Revamped Reforms Linked Distribution Sector Scheme in Rural Dehradun.

ICICI Direct initiates coverage on Gujarat Fluorochemicals with a 'Buy' rating and a target price of Rs 3,320 per share. This indicates a potential upside of 22%. The brokerage believes that the company will receive traction in the fluoropolymers and battery materials segments in the medium term. It expects the company's revenue to grow at a CAGR of 23.6% Over FY24-26.

Nifty Auto hits an all-time high of 22,994.6. Auto stocks like TVS Motor, Hero MotoCorp, Tata Motors and Mahindra & Mahindra are rising in trade.

The RBI reportedly sends an advisory on cash disbursal of loans to NBFCs, particularly targeting those providing gold loans like Manappuram Finance and Muthoot Finance. The central bank has mandated that no NBFC should disburse loans exceeding Rs 20,000 in cash. It has also instructed these companies to ‘strictly adhere' to the provisions of the IT Act concerning cash disbursements.

#Manappuram, #MuthootFinance shares fall up to 8% post-RBI advisory on cash disbursalhttps://t.co/G4tTKNSH6P

— CNBC-TV18 (@CNBCTV18Live) May 9, 2024

Bajaj Consumer Care falls sharply as its Q4FY24 net profit declines by 12.1% YoY to Rs 35.6 crore due to an increase in employee benefit expenses. Revenue decreases by 4.9% YoY to Rs 234.2 crore on reduced rural sales. It appears in a screener of stocks with declining net cash flow.

TVS Motor rises as its Q4FY24 net profit increases by 15.1% YoY to Rs 387 crore and revenue grows by 23.5% YoY. EBITDA margin also improves by 100 bps to 11.3%. The company appears in a screener for stocks that have received broker price or recommendation upgrades in the past month.

Kirloskar Oil Engines rises sharply to its all-time high of Rs 1,169.9 as its Q4FY24 net profit surges by 88.3% YoY to Rs 148.6 crore. Revenue increases by 20% YoY to Rs 1,660 crore, owing to improvements in the B2B and B2C segments. It features in a screener of stocks where mutual funds have increased their shareholding in the past month.

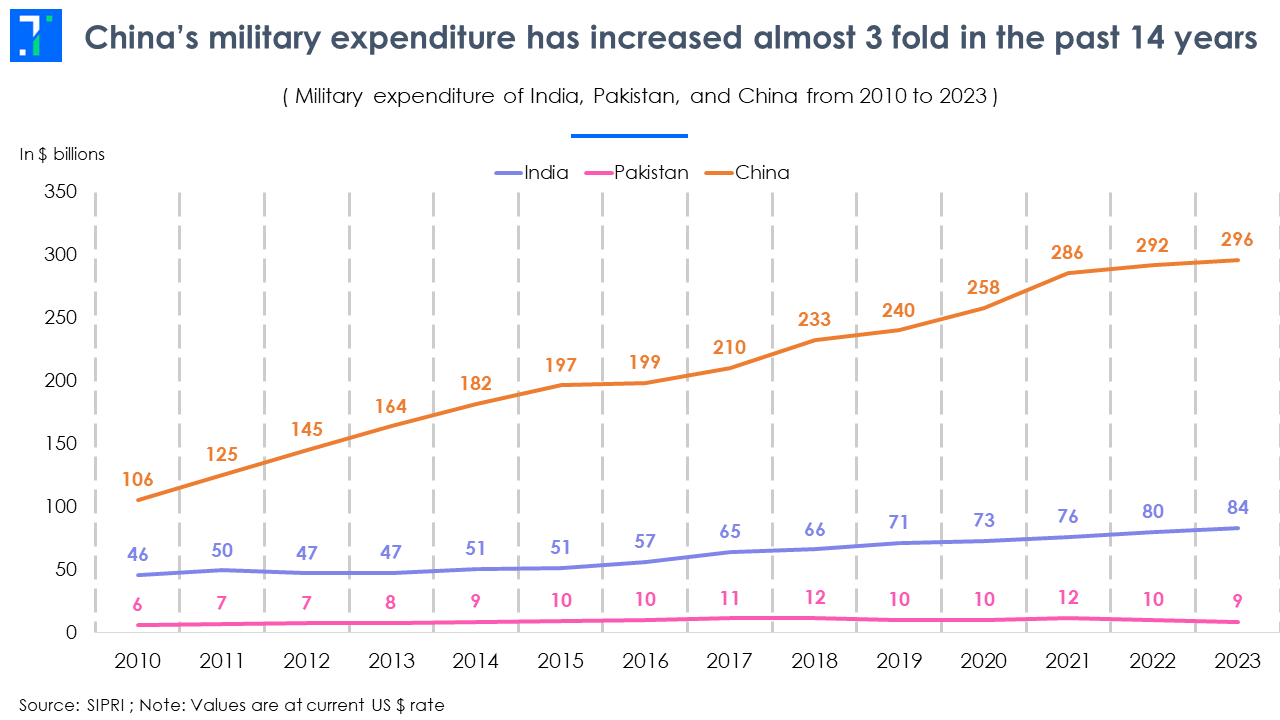

Nomura initiates coverage on Hindustan Aeronautics and Bharat Electronics with a ‘Buy’ rating and target prices of Rs 4,750 and Rs 300, respectively. The brokerage projects significant growth for India’s defence sector, driven by increasing defence budgets, modernization, and the Centre’s focus on indigenous manufacturing. Nomura sees a $138 billion opportunity for the industry over FY24-32.

Defence stocks Hindustan Aeronautics (#HAL) and Bharat Electronics (#BEL) shares gained over 2% in early trade today after foreign brokerage Nomura initiated coverage on these stocks.#StockMarketindiahttps://t.co/9IxzPKKuwH

— Mint (@livemint) May 9, 2024

Alembic Pharmaceuticals receives US FDA approval for multiple products, including diazepam injections for managing anxiety disorders, selexipag tablets for treating pulmonary arterial hypertension, and binimetinib tablets, a kinase inhibitor.

DLF announces approximately Rs 5,590 crore in sales from its luxury residential project, DLF Privana West. The development spans over 12.6 acres and includes 795 residences across five towers.

Rail Vikas Nigam bags an order worth Rs 167.3 crore from South Eastern Railway to upgrade the electric traction system at the Chakradharpur division.

NBCC (India) is rising as it bags work orders worth Rs 400 crore from the Supreme Court for constructions in Chhattisgarh and Kerala.

Nifty 50 was trading at 22,300.15 (-2.4, 0.0%), BSE Sensex was trading at 73,324.97 (-141.4, -0.2%) while the broader Nifty 500 was trading at 20,726 (21.1, 0.1%).

Market breadth is overwhelmingly positive. Of the 1,805 stocks traded today, 1,241 showed gains, and 509 showed losses.

Riding High:

Largecap and midcap gainers today include Adani Power Ltd. (612.80, 5.5%), One97 Communications Ltd. (333, 5%) and TVS Motor Company Ltd. (2,063.60, 3.4%).

Downers:

Largecap and midcap losers today include Larsen & Toubro Ltd. (3,275.45, -6.1%), NHPC Ltd. (93.65, -5.3%) and United Breweries Ltd. (1,910.70, -5.2%).

Volume Rockets

28 stocks in BSE 500 are trading on high volumes today.

Top high volume gainers on BSE included SKF India Ltd. (4,935, 8.0%), Adani Power Ltd. (612.80, 5.5%) and Tata Investment Corporation Ltd. (6,874.10, 5.0%).

Top high volume losers on BSE were Piramal Enterprises Ltd. (815.80, -8.9%), Manappuram Finance Ltd. (165.80, -7.9%) and Larsen & Toubro Ltd. (3,275.45, -6.1%).

Prism Johnson Ltd. (154.05, 0.2%) was trading at 14.6 times of weekly average. Campus Activewear Ltd. (253.20, 2.4%) and Jupiter Wagons Ltd. (420.25, 2.9%) were trading with volumes 12.8 and 9.9 times weekly average respectively on BSE at the time of posting this article.

BSE 500: highs, lows and moving averages

11 stocks made 52 week highs, while 9 stocks were underachievers and hit their 52 week lows.

Stocks touching their year highs included - Eicher Motors Ltd. (4,568.05, -0.7%), Mahindra & Mahindra Ltd. (2,212.55, 1.4%) and State Bank of India (819.80, 1.1%).

Stocks making new 52 weeks lows included - Asian Paints Ltd. (2,710.10, -4.7%) and Bata India Ltd. (1,298.55, -1.7%).

5 stocks climbed above their 200 day SMA including SKF India Ltd. (4,935, 8.0%) and CSB Bank Ltd. (356.85, 0.9%). 28 stocks slipped below their 200 SMA including Orient Electric Ltd. (214.70, -6.6%) and Chemplast Sanmar Ltd. (457.45, -5.3%).