After the Russia-Ukraine war, PM Modi, in a conversation with Vladimir Putin, said, “This is not a time of war”. But while global leaders welcomed the statement, military spending has shot up worldwide.

Military spending has jumped on the back of rising 'tensions' - the word we use for worsening relationships between heavily armed states. Russia-Ukraine and Israel-Gaza have already caused thousands of deaths. Risky face-offs have been happening between China and its East Asian neighbours, between India and China, and between Israel and Iran.

Each time, these countries backed off from the cliff's edge, before these fights could blow up into a bigger war. But heads of state have recently exchanged increasingly aggressive statements. When Phillipines President Ferdinand Marcos Jr congratulated the winner of Taiwan's election (who the Chinese disliked), China summoned the Filipino ambassador and warned him, "don't play with fire". After China's renaming of various parts of Arunachal Pradesh, Defence Minister Rajnath Singh asked recently, "What if we rename parts of China? Don't try to hurt our self-respect."

As the situation grows more volatile, countries are busy forming military alliances and building in-house defence systems. Heads of state continue to say that peace is crucial, but money talks: global military spending has increased to $2,443 billion in 2023, a 6.3% rise from 2022. This is the highest jump since 2009.

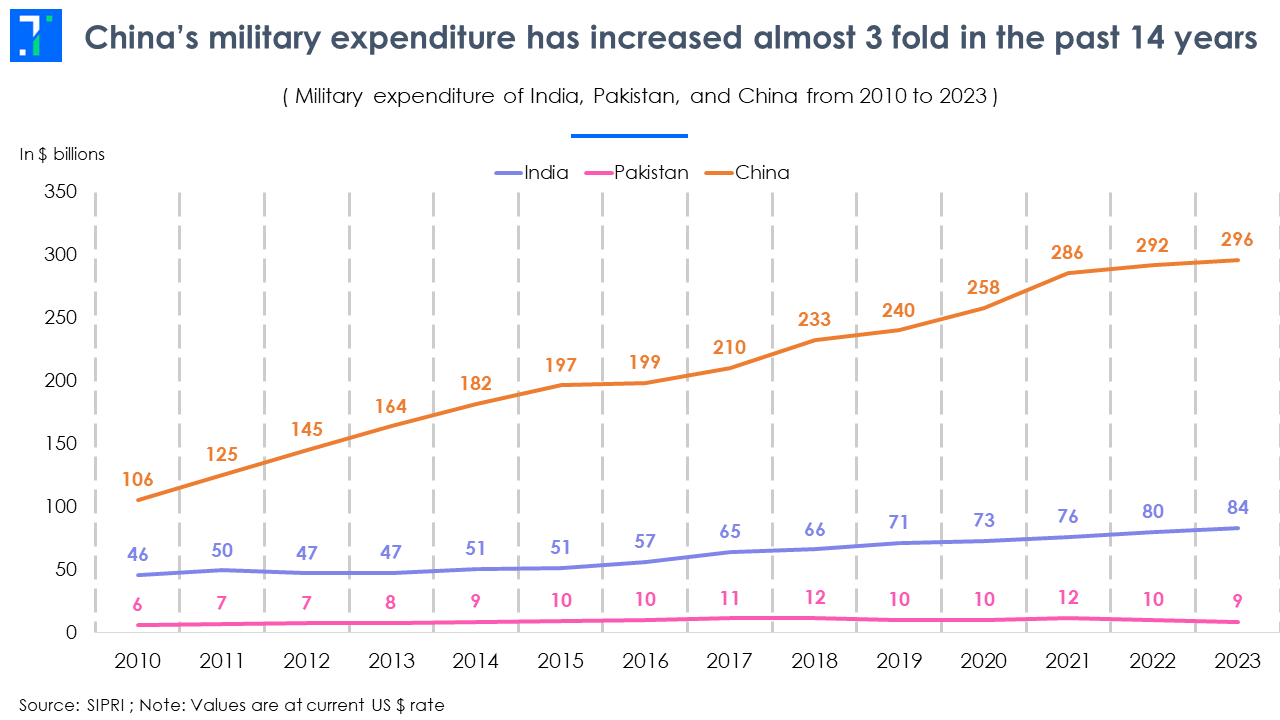

Military spending by the US ($916 billion) and China ($296 billion) account for nearly half of global spending. India spends around $83.6 billion, making it the fourth largest. But unofficial numbers of China's military spend are even higher. According to the American Enterprise Institute, China spent $710 billion - more than twice its official figure - on its military.

To counter the threat of a China that is busy arming itself with long-range drones, nuclear warheads and AI systems, smaller Asian countries are partnering with India, the US and key regional powers like Japan and South Korea. Over the past decade, India has shifted from a non-aligned player to a strategic ally for the US, Japan and Australia. Australian PM Anthony Albanese noted, “China has amassed the greatest military build-up of any nation since World War II. So the regional defence cooperation of India, Japan and Australia is key to bringing stability to the South China Sea”.

While India’s defence manufacturing is small compared to the G20 countries, our defence exports have already risen by 32% to Rs 21,083 crore in FY24. These exports are boosting domestic defence players.

In this week’s Analyticks:

- Defence sector boom: India’s rising defence exports are a win for the domestic industry

- Screener: Rising defence stocks with high Forecaster growth estimates for revenue and EPS in FY24

Let’s get into it.

India’s military expenditure is rising in an uneasy world

India’s skirmishes with China in the Galwan Valley, and the Balakot strikes in Pakistan brought India close to war-like scenarios. As the borders become uneasy, India is ramping up military expenditure by modernising its weapon systems. Most of the spending has been towards procuring more fighter aircraft, unmanned capabilities, helicopters, tanks and artillery guns.

India’s military spending is 28% of China’s official military spending, and just 11% of unofficial numbers. China has also been spending (nearly $43 billion) on R&D and in-house systems.

China’s military expenditure has increased almost 3 fold in the past 14 years

China has developed 5th generation J-20 fighter planes, which are far superior to India’s indigenous Tejas (developed by HAL). To counter China, India is buying foreign aircraft like Rafael along with existing MIGs.

Pakistan's military expenditure of around $8.5 billion has been constrained due to its economic crisis. Pakistan is spending around 14.5% of its GDP towards its military, and has strengthened its China relationship by increasing defence imports from China by 43%.

Pakistan is spending nearly 15% of its GDP on military

Old relationships are also fraying and countries are finding new friends. India’s military partnership with Russia has weakened as China, Pakistan and Russia have grown closer, especially after the Russia-Ukraine war. Russia has been supplying defence systems to both Pakistan and China, which is a serious threat as major Indian defence systems are Russian.

So India is quickly changing its defence strategy - Russia accounted for 76% of India’s procurement in 2014, but only 36% today. Indian defence deals are now being signed with France, the US, Israel, Spain and Germany.

India is building military alliances while increasing defence exports

India is no longer a 'non aligned' country. It has been building alliances with key players and providing military assistance to countries in distress.

The Quad group, comprising India, the US, Japan, and Australia is working for security in the South China Sea. The group is conducting maritime exercises with smaller nations like the Philippines and Taiwan.

India has also increased defence exports to allies. It dispatched the first batch of its supersonic Brahmos missiles to the Philippines in a $375 million deal. Brahmos missiles are known for their high range and precision with a striking capability range of 500 km, speeds up to 3.5 Mach and are capable of evading radar systems.

India’s defence exports rise 32% in FY24

To beat back the Turkey-Pakistan alliance, India is supplying Akash missiles to Armenia in a Rs 6,000 crore deal. Countries like Singapore, Egypt, Sri Lanka, UAE, Turkmenistan, and Malaysia have shown interest in buying the indigenously developed Light Combat Aircraft (LCA) Tejas.

Defence firms are seeing big opportunities with offset policies

India’s defence budget increased by 4.7% YoY to Rs 6,21,450 crore in FY25. Most of the spending is toward buying foreign-manufactured fighter aircraft. The government's clause in the defence offset policy (foreign firms need to invest a certain percentage of the deal value in India) is a big boost for domestic manufacturers. The offset policy has resulted in $7.9 billion in new orders for domestic firms. Defence stocks have outperformed the broader indices owing to an uptick in new orders.

Defence stocks outperform the Nifty 50 in the past year by huge margins

Zen Technologies Chairman Ashok Atluri expects the firm's revenue to grow by 50% CAGR for the next four years. Zen Technologies has bagged orders for Tank simulators and anti-drone systems. The firm has an order book size of Rs 1,500 crore with an export order book of Rs 437 crore.

PSU defence firms like Hindustan Aeronautics and Bharat Electronics have also been winners of the offset scheme. HAL has delivered two Hindustan-228 aircraft to Guyana Defence Forces and has made tie-ups with General Electricals USA for the manufacturing of aircraft engines. HAL expects to double its revenue in FY25 due to order execution of 83 Tejas aircraft.

PSU defence firms have the largest order books in the industry

Bharat Electronics has reported a 13.7% growth in its revenue for FY24. The firm has benefited from export orders of Akash missile systems, communication systems for naval ships, radars, night vision devices and so on. The firm is expected to win orders of around Rs 50,000 crore in FY25 and FY26, and is expected to grow its revenue by 20% CAGR in the same period.

Mazagaon Dock Shipbuilders supplies ships and submarines to the Indian Navy. It has recently won orders for the supply of patrol vessels (Rs 1,612 crore) and hybrid-powered vessels (Rs 350 crore). Its current order book stands at Rs 35,000 crore. It has formed a JV with Germany’s Thyssenkrupp to bid for Rs 45,000 crore worth six P-75 class submarines for the Indian Navy. The firm is also looking at exports to countries like Sri Lanka, Brazil and South America.

While Indian firms are benefiting from increased global military spending, India still lacks key technology and depends on foreign counterparts. Defence tech has been seeing rapid innovations in unmanned systems, drone warfare, deep tech and now artificial intelligence. We need to step up our game by investing in R&D and scaling up domestic manufacturing in these areas, to truly gain an edge in both exports and on the battlefield.

Screener: Rising defence stocks with high Forecaster growth estimates for revenue and EPS in FY24

Defence stocks boast double-digit growth forecasts from analysts

As the result season is ongoing, we take a look at the booming sector of defence and stocks which are touted for growth in FY24. This screener shows defence stocks that have risen over the past year with high durability and Forecaster growth estimates for revenue and EPS in FY24.

Major stocks that appear in the screener are Data Patterns, Bharat Dynamics, Mazagon Dock Shipbuilders, Bharat Electronics and Astra Microwave Products.

Data Patterns has the highest Trendlyne Forecaster estimates for YoY revenue growth at 26.7% in FY24, Forecaster also expects the company’s EPS to grow 32.7% YoY. The company rose by 78.6% over the past year. Nirmal Bang is positive on the stock on the back of high demand from the armed forces for defence electronic systems, and the company’s diversified ability to design and develop in multiple domains – space, air, land and marine.

Bharat Dynamics also features in the screener with Trendlyne Forecaster estimates for revenue and EPS YoY growth at 16.3% and 49.5% for FY24. The company has risen 94.3% over the past year. Analysts believe that the company’s large order book will provide headroom for growth over the next 3-4 years with order execution picking up in H2FY24 and FY25. Analysts also expect the company to receive an influx of orders as it is the primary provider of guided missiles and torpedoes to the Indian Armed Forces.

You can find more screeners here.