1. Titan Company:

This gems and jewellery major has risen by 1.5% over the past week, outperforming its industry by 4.1%. This comes after Titan reported a 24% YoY growth in revenue in its Q3FY25 business update.

The jewellery segment (which contributes over 87% of the total revenue) grew by 25% YoY, driven by strong festive demand. Plain gold jewellery sales jumped 24% YoY due to robust festive and wedding purchases over October-December despite higher gold prices, while gold coin sales surged 48% YoY.

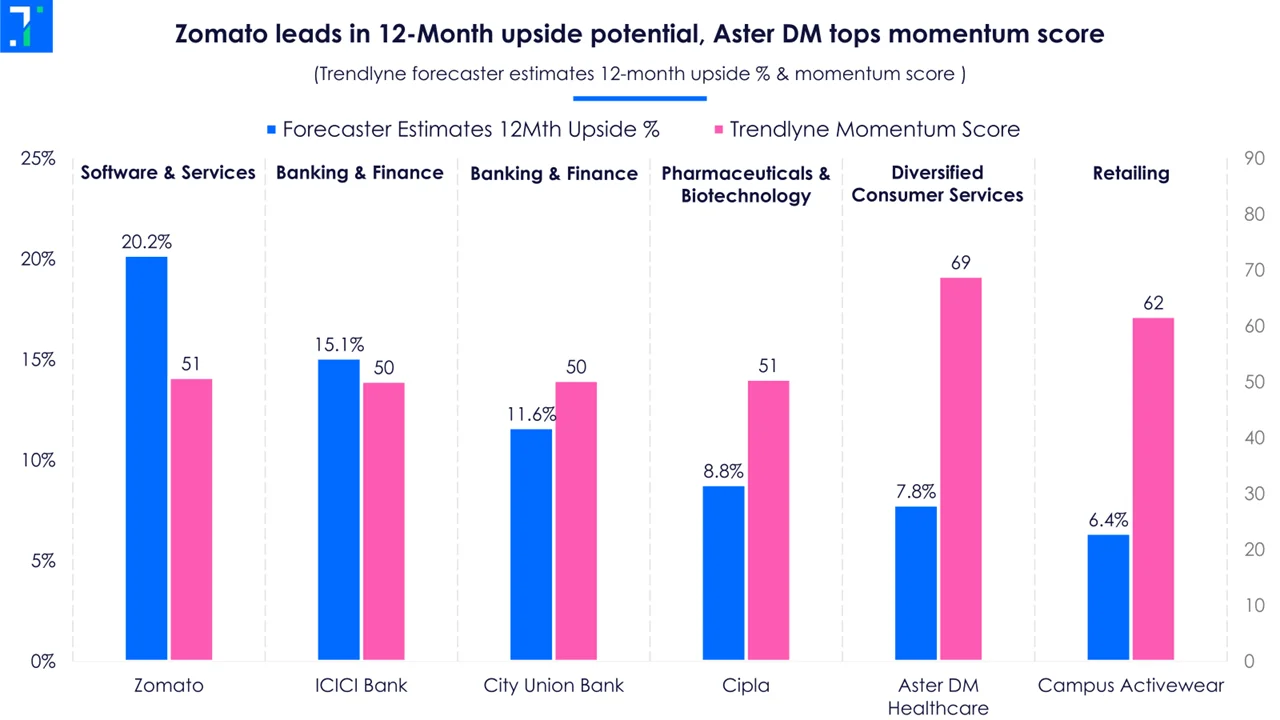

Analysts believe that jewellery consumption remained strong due to rising gold prices, more auspicious days, and a shift from unorganised to organised trade after a 900 bps gold import duty cut to 6% (during the FY25 Union Budget). The company’s peer Kalyan Jewellers has also reported healthy revenue growth in Q3FY25, with a 39% YoY rise. According to Trendlyne’s Forecaster, Titan’s revenue is expected to grow by 16.1% YoY in Q3FY25.

Meanwhile, the company added 69 stores on a net basis during the quarter, taking its retail store count to 3,240. Titan has a market share of 8% in the Indian jewellery market and has been working on expanding its retail footprint. It also aims to triple volumes in emerging segments like wearables, women’s bags and ethnic wear by FY27. It opened an exclusive store for its bags and accessories brand, IRTH, in Chennai, as part of its expansion plans in South India. Commenting on this, Manish Gupta, CEO of the Fragrances and Fashion Accessories Division, said, “We aim to achieve Rs 1,000 crore in revenue by FY26-27 from our IRTH and Fastrack bags divisions”.

InCred Equities gives an ‘Add’ rating on Titan Co with a target price of Rs 3,600. The brokerage remains positive on the company but expects margin pressures from higher gold prices and diamond price volatility. It expects EBITDA margins to contract by 105 bps YoY to 10% in Q3FY25.

2. Manappuram Finance:

This gold loan company’s share price jumped over 6% before paring its gains amid profit booking by investors. This surge followed the company’s announcement that the RBI had lifted its ban on new loans and disbursements by its subsidiary, Asirvad Micro Finance. The RBI had slapped this ban on Asirvad over two months ago on October 22, after it found “material supervisory concerns and non-compliance issues”.

Manappuram’s stock fell by over 13% after the ban was imposed and made a 52-week low in the days that followed. The removal of this ban is a significant development for the company, as its micro-finance business contributes around 30% to its total revenue. The other 70% of the company’s revenue comes from gold loans.

The company's consolidated AUM (assets under management) jumped by 17.4% on a YoY basis in Q2. The gold loan segment has experienced remarkable growth over the past year, driven by higher-than-normal interest rates on unsecured loans. Bloomberg columnist Andy Mukherjee, writes that loans against gold jewellery have risen in India by 56.2% annually. In Q3, Forecaster expects revenue growth for Manappuram of 14.2%, with net profit growth of 8% on a YoY basis.

V P Nandakumar, MD and CEO, said, “The micro-finance sector is facing (collection-related) challenges in certain geographies.” Due to this, the company added around 5,000 new loan officers in Q2. He also said that he expects net interest margins to fall as operating expenses rise.

Motilal Oswal retains a 'Hold' rating on the stock with an upgraded target price of Rs 205. The brokerage anticipates a gradual recovery in Asirvad’s microfinance (MFI) and gold loan segments. However, it predicts that credit costs will remain high over the next two to three quarters due to industry-wide pressures. Currently, the stock is in the PE Buy Zone, trading at a relatively cheaper valuation than its historical PE.

3. Dabur India:

ThisFMCG producer declined 3.8% on January 6 following theannouncement of its Q3FY25 business update. Dabur India expects low single-digit (~1-5%) revenue growth due to weak demand in segments like Health Care, impacted by a delayed winter, and in Beverages, as consumersshift from non-carbonated to carbonated drinks. Higher-priced juices are seeing the biggest impact.

Management noted that rural demand for FMCG outpaced urban demand, contributing around 4-8% growth in the home & personal care (HPC) segment. Dabur expects its culinary brands to deliver double-digit growth, supported by brands like 'Homemade Cooking Pastes & Purees' and 'Badshah Spices.'

InQ2FY25, the company reported a revenue decline of 5.5% YoY to Rs 3,028.6 crore, with net profit falling 17.5% YoY to Rs 425 crore. This underperformance was due to heavy rainfall, floods, and high food inflation, which slowed down consumption. Dabur Indiareduced the inventory days of its general trade partners from 30 days to 21 days in Q2, to tackle challenges from alternative channels like modern trade, e-commerce, and quick commerce. The company aimed to reduce this by 19 days by the end of December ‘24. According toTrendlyne’s Forecaster estimates, the company’s revenue is expected to grow by 5.8% YoY in Q3FY25.

Mohit Malhotra, CEO of Dabur India,said, “We expect the Home Care portfolio to grow in double digits going forward in the future, taking up the portfolio from Rs 700 crore to around Rs 1,000 crore in 2 to 3 years.” To achieve this, Dabur is premiumizing and expanding its home care range, introducing Odonil (room air freshener) in gel pockets, diffusers, and premium air fresheners, and launching Odomos (mosquito repellent) in a liquid vaporizer format. The recentacquisition of hair oil brand Sesa marks Dabur’s entry into the premium Ayurvedic hair oil market, in line with its strategy to diversify and expand.

Still, analysts are pessimistic. Following the business update, Citimaintained its ‘sell’ rating on Dabur India and lowered its target price to Rs 510. The brokerage expects a 2.5% YoY revenue growth in Q3FY25, citing weak performance in healthcare and beverages, rising costs, and shifting consumer preferences as key challenges.

4. Zydus Lifesciences:

This pharma company's stock rose by 1.4% over the past week after it signed an agreement with CVS Caremark, a US healthcare solutions provider, on January 7. The agreement also adds the ZituvioTM range - Sitagliptin and combination tablets - to CVS' list of medicines for type 2 diabetes treatment.

On the same day, the US FDA accepted the New Drug Application (NDA) for CUTX-101, a potential treatment for Menkes disease, and assigned it priority review. The application was filed by Sentynl Therapeutics, the US subsidiary of Zydus. Menkes disease is a rare pediatric condition with no FDA-approved treatment, and often leads to death in infants. The CUTX-101 clinical trials showed promising results, with early-treated patients having an 80% lower death risk. The Menkes disease market, valued at approximately $8 million at the end of 2023, is expected to grow 5.9% annually through 2034.

Following the news, Nomura upgraded Zydus Life to ‘Buy’ from ‘Hold’ and raised its price target to Rs 1,140, indicating an upside of 13.5%. The brokerage also increased earnings estimates due to higher contributions from the Sitagliptin drug, used to regulate high blood sugar. They believe the drug’s market opportunity, estimated between $300-500 million, could provide Zydus with an annual revenue boost of $100-150 million. However, they anticipate a 5% decline in US revenues in FY26.

In Q2FY25, the company’s revenue increased 19.9% YoY to Rs 5,237 crore, driven by improvements in the US formulation (up 30%) and Indian formulation (up 9%). Its net profit rose 20.5% YoY to Rs 865.8 crore during the quarter. For Q3FY25, Trendlyne’s Forecaster estimates profit to surge 14.9% YoY, with a revenue growth of 17.8%.

Managing Director Sharvil Patel mentioned that Zydus is focusing on expanding its portfolio in the US by targeting high-value products that offer better returns and margins. This involves launching limited-competition products and exploring in-licensing opportunities for niche, high-value products. He added, “We anticipate topline growth in the high teens (15-17%) and maintain our FY25 margin guidance of 27%, with an expected improvement of 100-150 basis points over last year.”

5. Reliance Industries:

This refineries & petro-products company has declined by over 4% in the past month. The company has reportedly raised $3 billion (approximately Rs 24,900 crore) from a consortium of 11 banks, marking its largest borrowing deal in nearly two years. The five-year loan, finalized last month, was set at 120 bps above the three-month Secured Overnight Financing Rate (SOFR), with $450 million (around Rs 3,700 crore) denominated in Japanese yen. It is also reported that the company is gearing up for substantial loan repayments in 2025.

The company posted a nominal 0.3% YoY increase in revenue for Q2FY25. However, its net profit declined by 4.8% to Rs 16,563 crore due to a decline in EBIT of the Oil-to-Chemical(O2C) segment. The Trendlyne Forecaster estimates the company’s revenue to rise by 2.9% and the net profit to rise by 4.8% Q3FY25. Morgan Stanley expects the company's refining segment to grow on the back of increasing global demand. It appears in a screener of stocks where mutual funds have increased holdings in the past month.

Mukesh Ambani, chairman & MD of the company, said, “Jio and Retail are expected to double their revenues and EBITDA in the next 3-4 years. I see immense growth potential in our media business. I foresee our New Energy business becoming as big and profitable over the next 5-7 years, as our O2C business which we had built over the past 40 years.”

Global brokerage firm Jefferies points out that while Reliance lagged behind the Nifty 50 index by 15% in 2024, primarily due to concerns about its retail business's medium-term growth and weak earnings growth for the year, the company’s retail segment is expected to see mid-teen growth going forward. Additionally, improved profitability is anticipated in the Oil-to-Chemicals (O2C) segment by FY26. Jefferies also notes the potential initial public offering (IPO) of Reliance Jio, the company’s telecom arm in FY26.

Geojit has maintained Reliance Industries at a ‘Buy’ rating as it expects the recent tariff hikes and ongoing technology advancements to strengthen Jio's customer base, supporting its growth momentum. The brokerage also says that although the recent tariff hikes led to some SIM consolidation and a higher churn rate, the management expects the full impact of the hikes to be reflected in the earnings over the next 2-3 quarters. With a target price of Rs 1,516, the stock has a potential upside of over 22%.

Trendlyne's analysts identify stocks that are seeing interesting price movements, analyst calls, or new developments. These are not buy recommendations.