Finding the right investment opportunities can feel like a race against time for stock market investors. By the time a good stock is widely covered, much of its potential upside may already be gone. The challenge is identifying the right stocks at a good valuation, while sifting through a lot of data.

Screeners make it easier to find stocks that outperform on not one or two but multiple metrics. For example, Trendlyne’s durability and momentum scores look at metrics across management quality, financial health, and several dozen technicals to identify high-scoring stocks. These scores help investors shortlist quality stocks more easily.

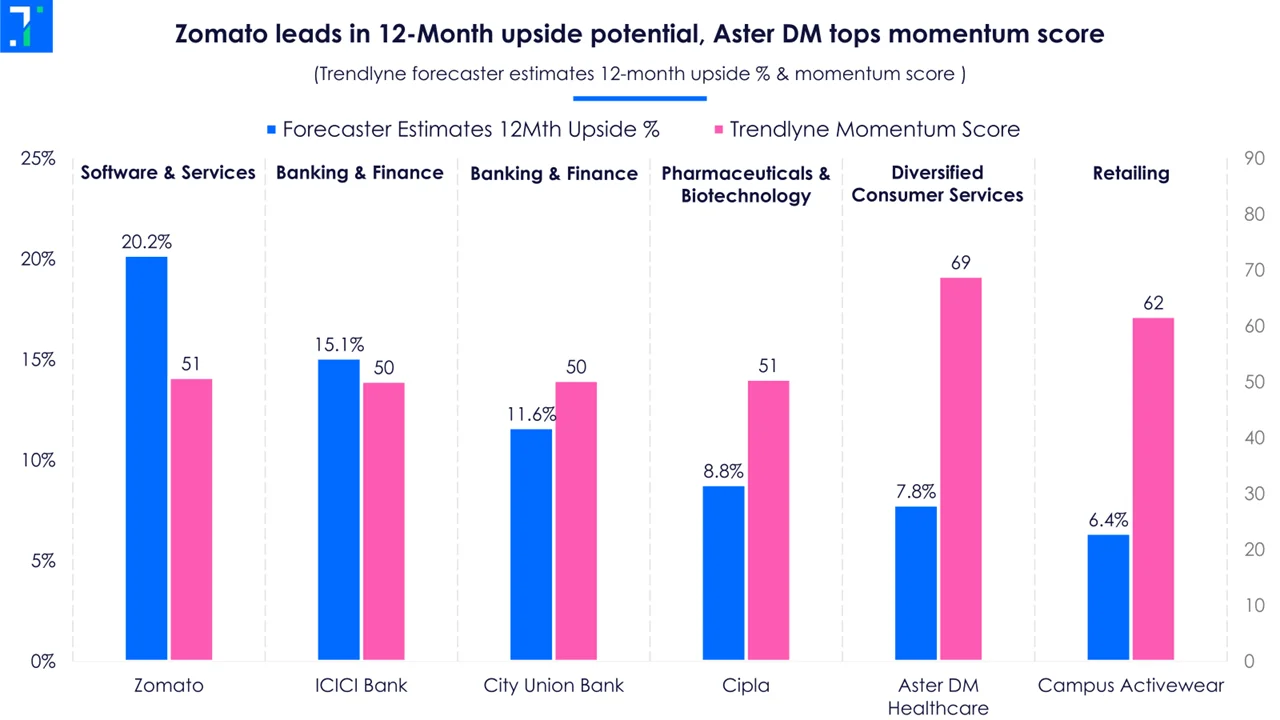

In this week's Chart of the Week, we look at this screener of stocks with high durability and momentum scores, that fall within the PE buy zone with at least a 5% target price upside, according to the Forecaster. A stock in PE Buy zones indicates that it is undervalued compared to its historical averages.

These stocks are from various sectors, including software & services, banking & finance, pharmaceuticals & biotechnology, retailing and diversified consumer services.

Zomato leads in 12-month upside from analysts

The internet platform company, Zomato, boasts a 12-month upside forecast of 20.2%. It has an impressive durability score of 80 and a momentum score of over 50. The company has risen 93.7% over the past year. In Q2FY25, the company reported a 64% YoY revenue increase, driven by strong performance in key segments including hyperpure, quick commerce, and the food ordering and delivery business. Net profit rose 388.9%, driven by platform fees and higher ad revenue.

Geojit Paribas maintains its ‘BUY’ rating on the stock with a revised target price of Rs 284. Analysts noted, “We believe that growth in all key areas - orders, AOV, and new user acquisition should enhance profitability going forward.”

However, on Tuesday, Jefferies downgraded Zomato to a ‘HOLD’ rating, citing increasing competition in the quick commerce space.

Healthcare sector companies exhibit strong momentum

Cipla, a pharmaceutical company, has a 12-month upside potential of 8.8%, backed by solid durability and momentum scores of 85 and 51, respectively. In Q2FY25, Cipla's revenue increased by 5.7% YoY, driven by growth in South Africa, emerging markets, and Europe. Revenue from Indian operations saw a 4.7% YoY increase, fueled by strong sales in chronic therapy and consumer health.

PL Capital has upgraded Cipla to ‘BUY’ with a target price of Rs 1,730. Analysts at the brokerage stated, “We believe the recent classification of its Goa facility as VAI (Voluntary Action Indicated) by the US Food and Drug Administration has paved the way for the gAbraxane launch.” This clears regulatory hurdles, enabling Cipla to proceed with production and launch of gAbraxane, a generic version of the chemotherapy drug Abraxane, in the US market. Cipla’s $1 billion net cash position also provides room for strategic M&A opportunities.

Healthcare facilities player Aster DM has a 12-month upside potential of 7.8%. It has the highest momentum score of 69 among all the stocks in the screener, signalling strong buying interest. The company’s net profit increased to Rs 96.8 crore, a turnaround from a net loss of Rs 30.8 crore in Q2FY24. Steady growth in its core business segments and effective cost-optimization strategies drove this performance. On November 29, 2024, Aster DM board approved a merger with Quality Care, which made them the third largest healthcare chain in terms of revenue and bed capacity in India.

After the Q2FY25 result announcement, Alisha Moopen, Deputy Managing Director, stated, “We expect synergies to deliver a near-term EBITDA upside potential of 10-15%, driven by optimizing material and manpower costs and improving ARPOB (average revenue per occupied bed) through a better clinical mix. Over the next 3-4 years, we aim to further enhance margins to 24-25%.”

Banking and finance companies show strong growth potential and high momentum

ICICI Bank has a 12-month upside forecast of 15% and is categorized as a 'Strong performer, under radar', in Trendlyne’s DVM score classification. The bank holds a durability score of 60 and a momentum score of 50, consistently delivering strong financial results. In Q2FY25, it recorded a 27.3% YoY revenue growth and an 18.8% YoY increase in net profit.

Brokerages like Motilal Oswal and Sharekhan have maintained their ‘Buy’ ratings, citing the bank’s robust performance driven by healthy loan growth, strong asset quality, and industry-leading return ratios. Sharekhan highlights, “ICICI Bank remains our top pick in the private banks and is well positioned to deliver superior performance despite cyclical headwinds. NIMs (net interest margin) are expected to be stable in H2 vs. H1 FY25 until the rate cut cycle starts.”

City Union Bank (CUB) offers a 12-month upside potential forecast of 11.6%, with a durability score of 65 and a momentum score of 50. The bank posted positive results for Q2FY25, with net profit and revenue increasing by 1.6% YoY and 11.7% YoY, respectively, driven by improved asset and earnings quality.

Axis Securities says, “CUB appears to have re-started its growth journey, with demand-driven growth evident in its core segments. As revamped processes show results and the bank expands into the non-core retail segment, we expect further improvement. Steady NIMs, better operating expense ratios, and stable credit costs are likely to help CUB achieve RoA (return on asset) and RoE (return on equity) of 1.6% and 13-14%, respectively, over FY25-27.” The brokerage upgraded its rating from HOLD to BUY on the valuation front. They revised the target price to Rs 185, a 8.7% upside potential from the current market price of Rs 170.3.

Retail sector company Campus Activewear shows strong momentum

Campus Activewear, a footwear company, has a 12-month upside potential of 6.4%, with durability and momentum scores around 60. In Q2FY25, the company reported a 30% YoY revenue increase and net profit grew to Rs 14.3 crore from a loss of Rs 0.3 crore in Q2FY24, driven by 35% volume growth.

Motilal Oswal maintains a ‘BUY’ rating with a target price of Rs 360, based on 55x Dec’26 P/E. It stated, “Campus’ innovative designs, color combinations, and attractive price points make it a market leader in the Sports and Athleisure category. We expect the revival of the demand environment in 2H and stabilization in the D2C online channel to aid Campus’ growth recovery."