By Swapnil Karkare"Momentum". "Narrative". "Buzz".

When you ask analysts why certain Indian stocks are climbing in gravity-defying fashion, that’s what they say. Kotak analysts call the current market environment ‘All Dressed Up and Nowhere to Go’, with valuations in several sectors higher than what fundamentals justify.

But not everyone agrees. A counter view comes from ICICISec analysts, who argue that current valuations are "reasonable" given strong returns and the growth forecast.

India's risk premium has hit a 20-year low of 175 basis points. That’s the smallest gap between Indian and US 10-year yields in two decades. Simply put, this means that the Indian market looks much less risky now, and returns have held up — the average RoE (Return on Equity) is at 15% in India compared to 19% for the US.

So are we in a bubble waiting to pop, or not? Let's find out.

In this week's Analyticks,

Up, up and away: Are stock valuations out of control?

Screener: Rising stocks whose PE is below long-term averages

Calm down everyone, large-cap valuations are ok

Many analysts have different opinions about India’s valuations. Jefferies notes that MSCI India is trading at 23x forward PE, 17% above the 10-year average.

But Anand Rathi economist Sujan Hajra says that Indian stocks haven’t fully reflected the benefits of falling bond yields and improving business fundamentals. His approach looks true at least for the large-caps (Nifty 50), whose valuations have stayed within the long-term averages.

Searching for bubbles in India's equity market

In some Indian sectors however, valuations remain elevated.

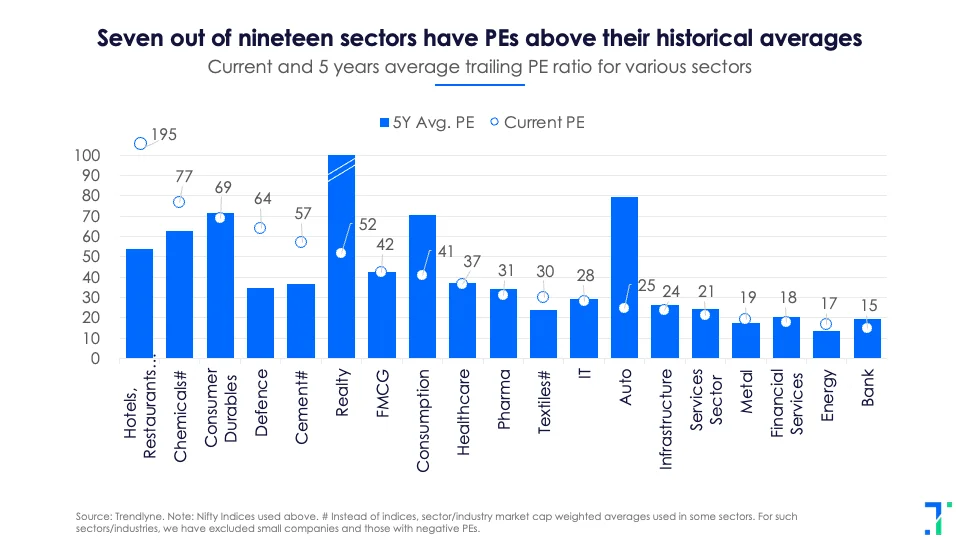

We did an analysis of trailing PE ratios across Nifty sectoral indices and industries (based on market cap averages), and found some striking numbers. Hotels, Restaurants, and Tourism (195x), Chemicals (77x), Consumer Durables (69x), Defence (64x), and Cement (57x) are all trading at exceptionally high PE multiples.

Additionally, current PE ratios for Textiles, Metals and Energy have exceeded their historical averages by 10-27%, suggesting that investors need to be careful.

Double trouble: Potentially high-risk stocks inside high risk sectors

As a next step, we used Trendlyne's PE Buy Sell Zone to find sell zone companies in the eight expensive sectors mentioned above. The PE sell zone is calculated based on how many days a stock has historically traded below its current PE level.

The list of stocks below have PE sell zone values close to 100%. This means that these stocks trade below their current PE nearly 100% of the time.

We look at cement in a separate section, where we analyse EV/EBITDA ratios instead of PE multiples.

Some hot chemical stocks are seeing volume and profit declines

Axis Securities downgradedArchean Chemical from ‘Buy’ to ‘Hold’ due to execution risks over several quarters and a sequential decline in bromine volumes. While Sudarshan Chemical’s Q4 results aren't out yet, the trailing 12-month performance tells a troubling story. Declining profits have pushed its PEG ratio (price to earnings growth) into negative territory, making it one of the most overvalued names in the dyes and pigment space.

The harshest assessment comes for Anupam Rasayan, where Jefferies maintained an 'Underperform' rating with a brutal target price of Rs. 520 — roughly half the current trading level. The concerns are mounting: negative operating cash flow, rising net debt, and a stock price that's 3-standard deviations above its historical forward PE average.

The chemicals sector appears to be struggling with operational headwinds. Such high valuation disconnects suggest more pain ahead.

Consumer Durables stocks see a mix of good and bad news

It's a mixed picture here — while jewellery continues to shine, building materials face demand pressures.

Kalyan Jewellersposted a 36.5% rise in net profits in Q4FY25. Its debt reduction efforts, plans to open 170 new showrooms in FY26, and strong demand outlook have made it attractive. Motilal Oswal is positive on the overall jewellery sector.

But building materials has faced difficulties due to a sluggish demand environment. Century Plyboards posted a 34% decline in net profits in Q4. Last year’s 11% market returns and demand headwinds have prompted Elara Securities to cut the target price and downgrade from ‘Buy’ to ‘Accumulate’. Similarly, Kajaria Ceramics experienced a 20% YoY fall in FY25 EPS, leading to a downgrade from IDBI Capital, citing valuation concerns.

Defence: Everyone's talking about it. But order books are not that pretty

India’s defence sector is booming. While the sector’s long-term prospects look strong, the valuations are pretty eye-watering.

Kotak notes that prices of buzzy stocks like Bharat Dynamics and Solar Industries already have an optimistic future baked in, and Value Research warns that "much of the past performance is driven by valuation re-rating rather than earnings, order books remain patchy and dependence on a single client (the government) adds structural vulnerability."

Energy stocks see earnings take a hit

The energy sector is struggling with weak earnings and lower volumes. NHPC’s inoperative Teesta-V plant continues to drag its finances. The stock’s recent rally leaves little room for upside. ICICI Securities downgraded the stock to ‘Sell’.

SJVN’s numbers have looked rough as it swung from profit in Q4FY24 to a loss in Q4FY25. Despite a 20% decline in the stock over the past year, valuations remain steep — its current PE and EV/EBITDA are still double their historical averages, implying a potential downside of over 30% from current levels.

GSPL has faced operational challenges. Cheaper liquid fuels and shutdowns at fertiliser plants have pulled GSPL’s transmission volume down, which is expected to recover only in FY26–27.

Hotels and restaurants: Indians are travelling but not eating out

While hotels are doing well, restaurant stocks are grappling with demand challenges and valuation concerns.

ITC Hotels reported a healthy quarter, with a 41% rise in consolidated net profit, riding on higher room demand than supply. Elara is bullish on its outlook as it expects a 15% CAGR in revenue growth over the next 3-4 years. The analyst sees it as attractive even at current valuations, given the sectoral tailwinds.

Restaurant operators face a tougher environment. Analysts are waiting for the consumption to take off. In Q4FY25, Devyani International, which runs KFC, Pizza Hut and Costa Coffee, saw losses nearly double from Q4FY24 levels. Citi believes it is well-positioned to benefit when consumer sentiment improves.

Jubilant Foodworks, which runs Domino’s and Dunkin’, on the other hand, is aggressively driving volumes through innovations, value meals, and promotional offers in the weak demand environment. At current valuations, PL Capital projects limited upside, while UBS recommended selling it and booking profits.

Metals and textiles: Valuations are outpacing results

The metals sector is showcasing solid operational performance, but valuation gaps persist.

APL Apollo reported a strong 25% YoY growth in sales volumes. Its management is confident of a 20% CAGR growth over the next 3–4 years, driven by rising infrastructure demand, capacity expansion, and a shift from scrap-based to HRC-based pipes. However, its valuations are way up there, compared to peers.

JSW Steel posted a 13.5% YoY rise in Q4 profit, despite weak steel prices. Analysts are optimistic about growth due to rising domestic demand and cost efficiencies.But Elara hit it with a ‘Reduce’ rating, pointing to oversupply concerns and the legal overhang from the Bhushan Steel case.

Textile stocks have been swinging up on hopes that global politics could work in India's favour, including the China+1 strategy and improving global demand. But valuations from every angle, are steep.

Cement sees a big disconnect

The cement sector is a classic example of elevated valuations that are disconnected from the fundamentals. Despite low asset efficiency, large earnings downgrades and modest ROE, Kotak calls cement companies’ valuations ‘ridiculous’.

Looking at two highly valued names (Dalmia Bharat and Star Cement) based on EV/EBITDA ratios reveals the stark contrasts within the sector.

Dalmia Bharat struggled in Q4FY25 with its revenue falling 5% YoY due to muted volumes and realisations. BOB Capital hit it with a ‘Sell’ rating, citing pricing pressure, rising debt and supply overhang despite ongoing expansion plans.

Star Cement, a leader in the North-Eastern region, however, presents a more compelling story. Thanks to the rising share of renewable energy, government incentives, and firm prices in the region, Emkay expects an improvement in EBITDA margins from 18% in FY25 to 22-23% by FY27. Most brokers maintain ‘Buy’ ratings, though the stock trades at 5x its historical average valuation.

Overall, the numbers don’t lie. The Indian market looks healthy overall, and reflecting the fundamentals. But some sectors and stocks are running too hot.

Screener: Stocks with PE TTM lower than 3-year, 5-year and 10-year PE averages, with good financial results

Lupin, Bharti Airtel’s TTM PE is below 3-year average PE

With the Indian markets getting some relief with the RBI rate cut and growth recovery in Q4, we look at undervalued stocks with strong financials. This screener shows rising stocks with trailing twelve-month (TTM) PE lower than the 3-year, 5-year and 10-year average PE, alongside profit and revenue growth.

The screener contains stocks from the automobiles & auto components, pharmaceuticals & biotechnology, banking & finance, and telecom services sectors. Major stocks featured in the screener are Bharat Airtel, Eicher Motors, Lupin, Engineers India, Cipla, Jubilant Pharmova, HDFC Bank, and Bombay Burmah Trading.

Bharti Airtel’s TTM PE of 32.1 is lower than its 3-year, 5-year, and 10-year average PEs of 87.5, 82.3, and 303.7, respectively. This telecom services company’s net profit surged by 4.5x YoY to Rs 33,556.1 crore in FY25, helping to lower the TTM PE. Strong margin growth in the enterprise business, tariff hike in the India wireless business, full quarter integration of Indus Towers, and exit from low-margin businesses, led to the increase in net profit.

Lupin also shows up in the screener with a TTM PE of 27.9, lower than its 3-year, 5-year, and 10-year average PEs of 79.3, 56.4, and 61.4, respectively. This pharma company’s net profit grew by 71.4% YoY to its highest level of Rs 3,281.6 crore in FY25, driving its PE lower. Improving product mix and products with higher margins, niche launches in the US, clearance from the US FDA for facilities, domestic formulations regaining momentum and cost optimisation measures led to higher profits.

You can find some popular screeners here.