Does the tariff policy coming out of the US mean anything anymore? It seems pointless for markets to react to new announcements, since Trump could withdraw some tariffs in the morning and add new ones in the evening.

Still, global equities got some breathing room after Trump hit pause on the latest round of tariffs. But don’t get too comfortable. US policy has become volatile, and dangers lurk around every corner.

Fear gauges like the Nifty VIX and S&P 500 VIX have surged since Trump’s "liberation day." And now, with the Q4FY25 earnings season kicking off, there’s potential for more stock market turbulence. Morgan Stanley projects just 3% revenue growth for Nifty 50 companies—a 19-quarter low.

The real question is: which companies will beat that trend?

We have identified five stocks with the potential to beat both the overall index, and their industries. One company in the list has a fast-growing vertical that is defying the slowdown. Another has massive new international orders coming in, while a third has a reliable client that keeps on spending. They all have something unique about them.

In this week’s Analyticks:

- Five stocks to watch this results season: Five companies that could deliver high growth

- Screener: Stocks rising in the past quarter, with high durability scores and at least 20% target price upsides

The big winners: Five stocks expected to stand out in upcoming results

Heading into the Q4FY25 results, we shortlisted five stocks from the Nifty 500 that are predicted to post high revenue and net profit growth YoY and QoQ in Q4FY25, according to Trendlyne’s Forecaster. These companies have already set the bar high with strong results in the previous quarter.

Five stocks across industries have strong revenue and profit forecasts

All five stocks in the list—KEC International, Mastek, Larsen & Toubro, Endurance Tech, and Hindalco Industries—are from different sectors. While these stocks weakened in the past year due to the market downturn, they’ve outperformed the benchmark index over two years.

Short-term laggards, long-term winners vs Nifty 50

Due to the fall, Trendlyne’s Momentum scores for these companies range from neutral to weak. But high Durability and Valuation scores signal that these may be strong, undervalued picks.

All stocks in focus have good Durability scores with strong fundamentals

T&D all the way: One segment becomes the star for KEC International

Industrials player KEC has got a boost from the Centre's capex push. The big revenue driver here is the company’s transmission and distribution (T&D) segment. In Q3FY25, the T&D business grew 17% YoY, with new orders surging an impressive 119% to Rs 16,000 crore. This momentum is expected to continue in Q4FY25.

T&D and civil segment expected to improve KEC’s profitability

Analysts expect T&D margins to improve in the coming quarters due to a higher mix of T&D orders (54%) in the order book, and strong T&D traction in both domestic and international markets.

Golden goose: Mastek eyes 50% growth in UK healthcare in FY26

This software and services company generates 56% of its revenue from the UK, with a significant portion coming from government contracts, especially with the NHS (National Health Service).

This is Mastek's golden goose, and has long been a growth driver for the GovTech-focused firm. In Q3FY25, UK revenue rose 13% YoY, helped by a rebound in UK’s overall healthcare spending.

Mastek’s revenue to rise YoY for the tenth straight quarter

Expectations for Q4 are positive, with revenue and net profit projected to grow YoY and QoQ. There is however, a word of caution. Recent news about cuts to NHS England’s administration, due to its merger with the Department of Health and Social Care (DHSC), led to high volatility in Mastek's share price.

However, the management is optimistic and is projecting 40-50% revenue growth in UK healthcare next year due to the government’s modernisation commitment, including increased funding and a 10-year health plan.

Going vroom: Endurance Tech rides EV momentum, with strong order wins and German expansion

Automotive component manufacturer Endurance Technologies has operations in India, Italy and Germany. It supplies aluminum castings, suspensions, transmissions, braking, and battery management systems.

Endurance Tech has been on a good streak. Strong order wins and good execution have led to rising revenue and net profit for the past nine quarters. This trend is expected to continue in Q4FY25.

Endurance Tech’s strong order execution to continue in Q4FY25

As of Dec'24, the company secured Rs 3,341 crore in new orders from India and €244 million from Europe. 84% of the latter is linked to EVs or hybrids. In India, the EV order backlog stands at Rs 960 crore, including orders from Bajaj Auto.

The company is expanding its presence in Europe, which contributes to around 23% of the total revenue. In December 2024, Endurance Tech acquired a 60% stake in Stoferle, a German company, for € 37.7 million to strengthen its presence in Germany. However, Trump’s new tariffs have led several European automakers to cut forecasts, which could weigh on demand for Endurance Tech.

Super-sized orders. But can it deliver?: QatarEnergy deal powers L&T

On March 26, this Nifty 50 giant won its largest-ever project—an eye-popping $4 billion order from QatarEnergy LNG. The company’s order book is on the rise. As of Q3FY25, it reached Rs 5.64 trillion, with 58% from domestic projects and the remaining 42% from international markets.

The infrastructure projects segment continues to anchor growth, posting a 14.7% YoY revenue in Q3 and accounting for nearly half (49.5%) of total revenue in the quarter.

Analysts expect revenue and profit to grow YoY and QoQ in Q4FY25, driven by strong execution, especially in the international order book.

Strong order execution in the international segment to drive L&T's revenue

Despite the surge in new orders, investors are concerned about the company’s ability to execute such a massive order backlog while maintaining profitability. While these large order wins sound impressive, they can sometimes be margin-dilutive.

Growth amid uncertainty: Capex-fueled growth for Hindalco, but tariffs cause jitters

On April 1, this metals and mining company announced a $10 billion capex plan through FY29 to scale production at Hindalco and its US subsidiary Novelis significantly.

The investment will fund capacity expansions across India's aluminium and copper operations, while Novelis aims to add approximately 800,000 tonnes of aluminium capacity globally by FY27. Following the investor day, brokerages including ICICI Securities, Anand Rathi, and Axis Direct reiterated their ‘Buy’ ratings, citing long-term growth potential.

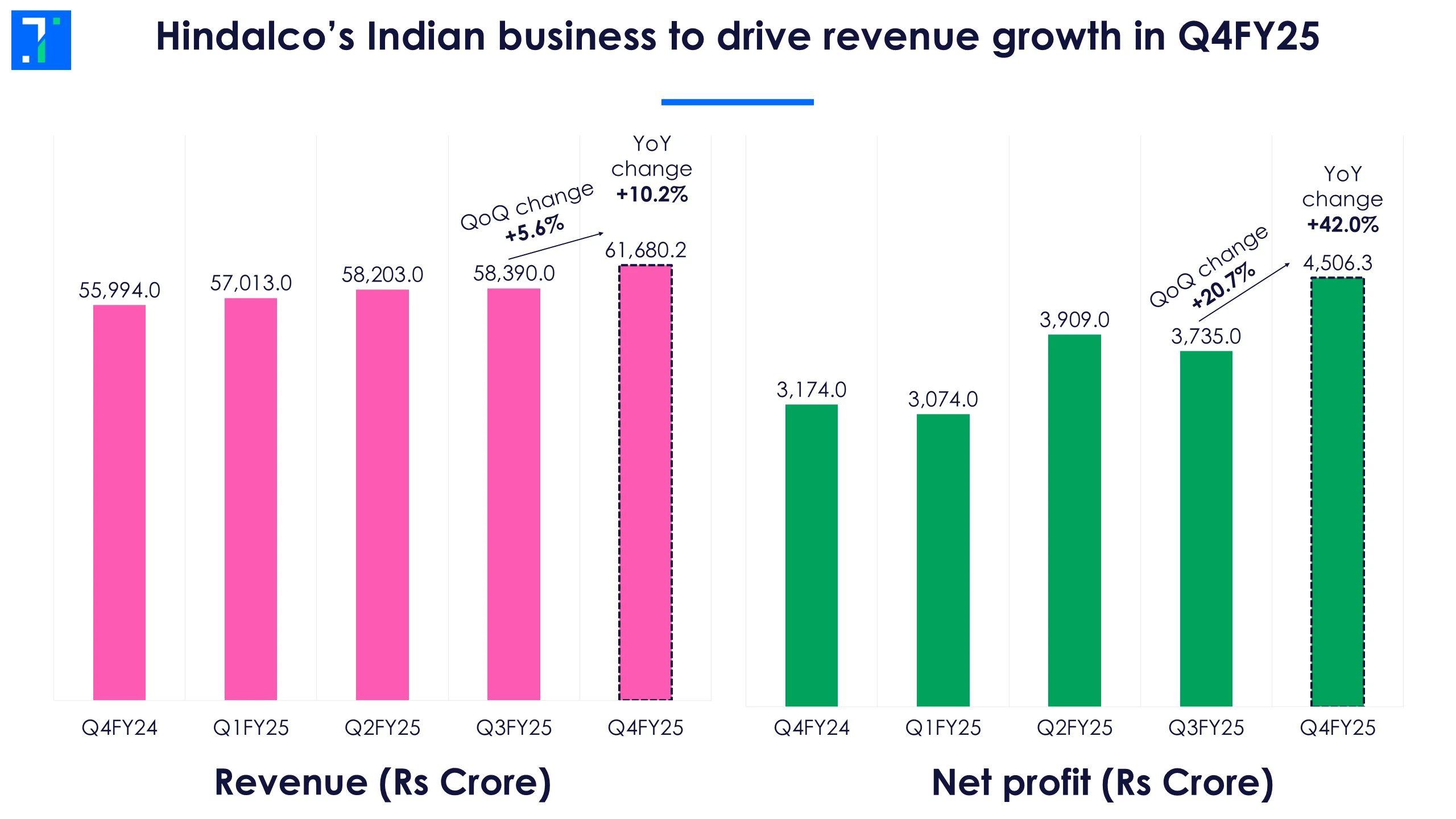

Hindalco’s Indian business to drive revenue growth in Q4FY25

In Q3, the company’s aluminium upstream revenue rose 25% YoY, driven by higher average aluminium prices. Downstream aluminium revenue also increased 25% on the back of higher volumes. Analysts anticipate strong performance in Q4, led by strong growth in Indian operations.

However, shares are down 9.4% in April, impacted by recent tariff-related announcements.

Novelis, Hindalco’s US subsidiary, is largely insulated from tariffs due to its reliance on aluminium scrap, which isn’t tariffed. However, Hindalco's direct aluminium exports to the US are expected to decline due to the tariffs, which could affect profitability.

Screener: Stocks rising in the past quarter with high durability scores and 20%+ Forecaster target price upsides

Forecaster expects banking stocks to rise the most in the next year

As the Q4 results season kicks off, we look at stocks with the highest upside potential over the next 12 months, according to Trendlyne’s Forecaster. This screener shows stocks rising more than 5% in the past quarter with strong durability scores, and where Forecaster sees at least a 20% target price upside.

The screener consists of stocks from the banking, housing finance, aerospace & defence, construction & engineering, and heavy electrical equipment industries. Major stocks that feature in the screener are NBCC (India), Adani Ports & SEZ, Transformers & Rectifiers (India), Balrampur Chini Mills, Indian Bank, Aadhar Housing, PNB Housing Finance, and Union Bank of India.

NBCC (India) appears in the screener with the highest Forecaster target price upside of 31.4%. The stock has risen 7.1% over the last quarter, helped by multiple order wins and project sales. Analysts believe the construction and engineering company's consistent growth in infrastructure and residential real estate projects positions it well for long-term growth. They expect NBCC’s order book to expand on the back of continued public sector projects and increasing demand for urban development.

Transformers & Rectifiers (India) also appears in the screener with a Forecaster target price upside of 25.8%. This heavy electrical equipment company’s stock price increased by 11% over the past quarter, driven by strong Q4FY25 results. Its revenue and net profit grew 33% YoY to Rs 683.4 crore and 135.8% YoY to Rs 94.2 crore during the quarter. Analysts at ICICI Direct are positive about the company due to a strong order book of Rs 5,132 crore and further bid prospects of Rs 22,000 crore.

You can find more screeners here.