- Hindustan Unilever: Axis Securities maintains its ‘Buy’ rating on this FMCG company with a target price of 2,810. This indicates an upside of 7.1%. In Q1FY23, the company’s net profit increased 13.5% YoY to Rs 2,381 crore and revenue rose 19.9% YoY to Rs 14,624 crore.

Analysts Preeyam Tolia and Dhananjay Choudhury say “Hindustan Unilever delivered a resilient performance ahead of our and street expectations on key performance metrics”. Sales growth was driven by price hikes, market share gains and strong double-digit growth in home care and beauty & personal care segments, according to Tolia and Choudhury.

However, its EBITDA margin fell 110 bps YoY to 23.2% on the back of high raw material cost inflation, they point out.

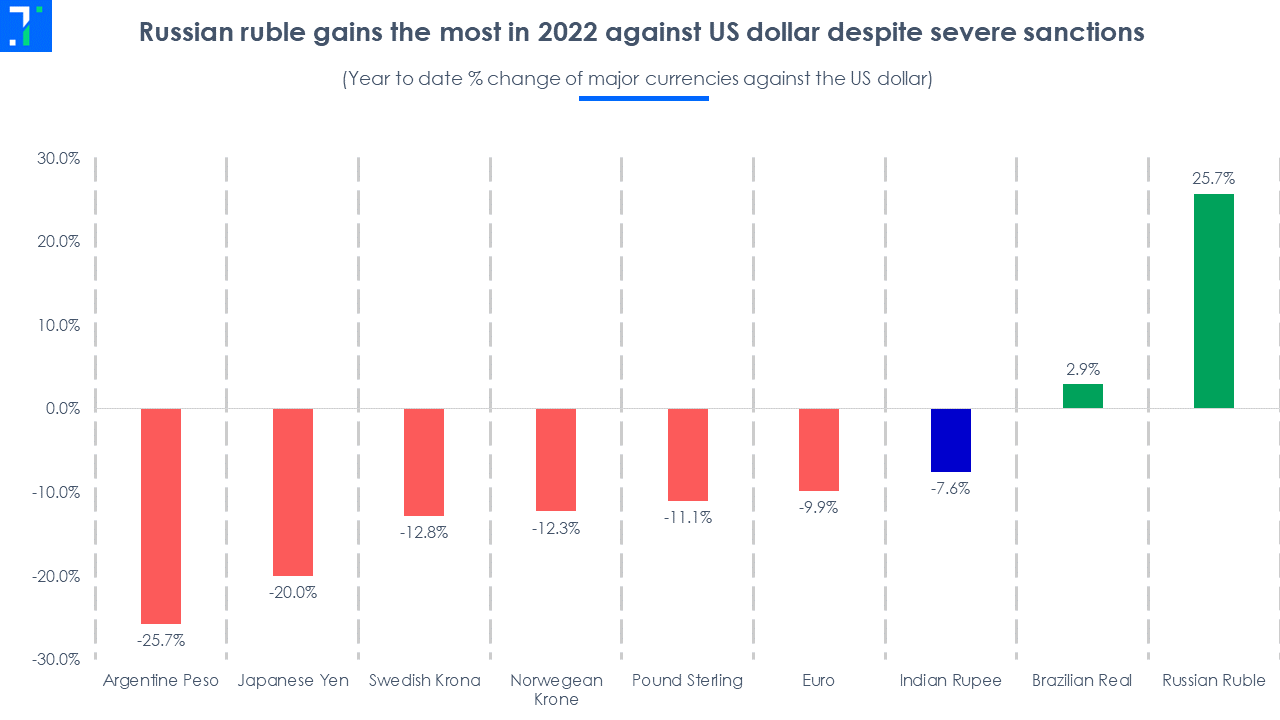

Tolia and Choudhury anticipate margins to remain under pressure until Q3 this year on high raw material costs and the weakening rupee. They believe the company’s mid- and long-term prospects are bright given its diverse product portfolio, market share gains, cost-saving initiatives, and strong execution capabilities. The analysts expect the company’s net profit to grow at a CAGR of 15.6% over FY22-24.

- Oberoi Realty: Motilal Oswal maintains its ‘Buy’ rating on this realty company with a target price of Rs 1,100. This indicates an upside of 25%. In Q1FY23, this company’s net profit grew nearly 5X YoY to Rs 403.08 crore and revenue jumped 3.2X YoY to Rs 913.1 crore.

Analysts Pritesh Sheth and Sourabh Gilda expect Oberoi Realty’s pre-sales to “increase by 22% YoY to Rs 4,800 crore in FY23”. The strong launch pipeline will drive growth in FY23, say Sheth and Gilda. In Q1, the realty developer got steady bookings amounting to Rs 760 crore, which fell 18% QoQ but rose nearly 4.5X times YoY.

The company’s retail and hospitality segments’ occupancy rates in Q1 have reached their highest levels since covid-19, say Sheth and Gilda. The occupancy rates of its retail mall and hospitality assets stood at 96% and 91%, respectively. “Renewed focus on business development is a positive sign and will continue to provide further growth visibility for Oberoi Realty,” say the analysts. They expect the company’s profit to grow at a CAGR of 32.7% over FY22-24.

- HDFC Bank: LKP Securities maintains a ‘Buy’ call on this bank with a target price of Rs 1,709, indicating an upside of 22.4%. In Q1FY23, the bank reported a profit growth of 21.9% YoY to Rs 9,654.2 crore and 13.53% YoY revenue growth to Rs 44,202.3 crore. “HDFC Bank reported moderate operating performance in Q1FY23,” says analyst Ajit Kumar Kabi.

Kabi says the bank’s “superior underwriting practices, higher liquidity, adequate coverage, and strong capital position makes it well placed.” The analyst further adds that the bank maintained its growth as the net advances during Q1 increased 21.6% YoY to Rs 14 lakh crore and deposits grew 19% YoY to Rs 16 lakh crore.

The bank’s net interest income stood at Rs 19,480 crore (up 14.5% YoY) and its net interest margin stood at 4.2%, up 10 basis points YoY. The analyst expects the bank to outperform the sector in the long run on the back of a healthy balance sheet growth, higher provision than the regulatory requirement in the balance sheet, and best-in-class underwriting and risk management practices.

- Jindal Steel & Power: BOB Capital maintains its ‘Buy’ rating on this steel company’s stock but reduces the target price to Rs 460 from Rs 555. This indicates an upside of 24.3%. In Q1FY23, the company’s revenue increased by 22.8% to Rs 13,069.2 crore and net profit increased by 4,727.9% to Rs 1,992.9 crore.

An exceptional loss of Rs 1,240.12 crore in Q1FY22 and a reversal of deferred tax of Rs 1,276.22 crore in Q1FY23 have led to the elevated profit number during the quarter.

Analyst Kirtan Mehta says that the “Q1 results were ahead of consensus (estimates).” But despite a healthy EBITDA of Rs 3,000 crore and inflow of Rs 3,000 crore as consideration for the stake sale (in the company), the net debt reduction was muted at Rs 1,100 crore QoQ in Q1.

The analyst thinks the rise in coking coal prices will likely extend margin pressure on the company during Q2 this year. He adds that the company plans to continue with its Rs 18,000 crore capex plan to enhance margins and expand pellet, hot strip mill, and crude steel capacity even in the current environment. He is cautiously positive on the stock despite uncertainties, due to the company’s healthy growth.

- Angel One: ICICI Securities maintains a ‘Buy’ call on this stock broking company but revises its target price downwards to Rs 1,830 from Rs 2,230. This indicates an upside of 29.4%. In Q1FY23, the company reported a 49.6% YoY increase in net profit to Rs 181.5 with revenues rising 44.7% to Rs 686.5 crore.

Analysts Ansuman Deb and Ravin Kurwa feel that despite the positive results, “Angel One reported a decline in the number of orders and margin trading facility book, in line with weak market sentiment in Q1 and especially June 2022”. The analysts expect the Indian stock market to decline further, causing a decline in key operating parameters for the company’s business.

“We expect orders per day to remain resilient although it may dip in the near term, in line with market sentiment,” say Deb and Kurwa. They expect employee costs and other expenses to remain elevated due to new hiring and investments towards marketing costs in order to increase market share. Accordingly, the analysts forecast the profit to be at Rs 700 crore and Rs 780 crore in FY23 and FY24, respectively.

Note: These recommendations are from various analysts and are not recommendations by Trendlyne