Nifty 50 closed at 24,768.35 (-86.7, -0.4%), BSE Sensex closed at 81,185.58 (-296.3, -0.4%) while the broader Nifty 500 closed at 22,914.95 (-118.6, -0.5%). Market breadth is in the red. Of the 2,472 stocks traded today, 847 were in the positive territory and 1,583 were negative.

Indian indices closed in the red following US President Donald Trump’s announcement of a 25% tariff on Indian exports, along with an unspecified additional tariff for importing from Russia. The Indian volatility index, Nifty VIX, rose 3% and closed at 11.5 points. Hindustan Unilever closed 3.4% higher as its Q1FY26 net profit grew 5.6% YoY to Rs 2,756 crore, helped by lower advertising & promotion expenses and inventory destocking.

Nifty Midcap 100 & Nifty Smallcap 100 closed in the red, following the benchmark index. Nifty FMCG and BSE FMCG Sector were among the top index gainers today. According to Trendlyne’s Sector dashboard, FMCG emerged as the best-performing sector of the day, with a rise of 1.4%.

Asian indices closed in the red, while European indices are trading mixed. US index futures traded in the green indicating a positive start to the trading session. South Korea became the latest nation to finalize a trade deal with the US. Under the agreement, it will pay a 15% tariff, invest $350 billion in the US, and buy $100 billion worth of LNG or other energy products. In return, South Korea will impose zero tariffs on US goods.

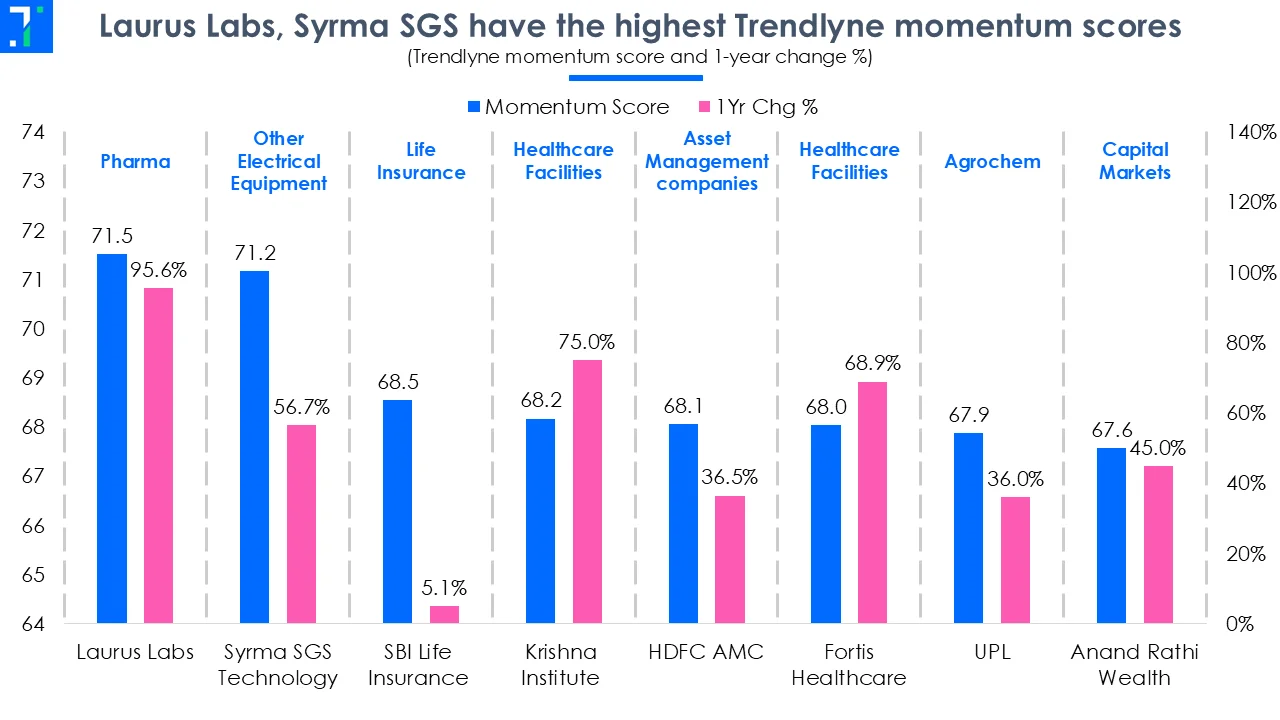

Money flow index (MFI) indicates that stocks like Anand Rathi Wealth, Craftsman Automation, EID Parry, and Syrma SGS Technology are in the overbought zone.

Dr Lal PathLabs' Q1 FY26 net profit rises 24.3% YoY to Rs 134 crore. Revenue grows 11.3% YoY to Rs 670 crore, driven by a higher number of medical tests and supported by expansion across metro, Tier-I, and Tier-III markets. The stock appears in a screener of companies with no debt.

Emami is rising as its net profit grows 7.6% YoY to Rs 164.3 crore in Q1FY26, driven by lower inventory-related expenses. However, revenue falls marginally by 0.2% YoY to Rs 904.1 crore due to weaker domestic sales during the quarter. The company appears in a screener of stocks with improving RoCE over the past two years.

Jubilant Ingrevia rises sharply as its Q1FY26 net profit jumps 54.1% YoY to Rs 75.1 crore, driven by lower raw materials, finance, and power & fuel expenses. Revenue grows 14.8% YoY to Rs 1,049.2 crore, helped by improvements in the speciality chemicals segment. It appears in a screener of stocks where promoters are decreasing their pledged shares.

Textile and apparel stocks decline following the Trump's 25% tariff announcement on Indian exports. The US is India's largest market for textile and apparel products, accounting for nearly 42% of the country's total textile exports. According to the Commerce Ministry, India exported $34.4 billion worth of textiles in FY24, underscoring the sector's importance to the nation’s manufacturing and export economy.

Textile stocks sink 9% after Trump’s tariff shock—buy the dip or hold off?#TrumpTariff#TextileCrash#StockMarkethttps://t.co/YlKHBsYgHI

— Zee Business (@ZeeBusiness) July 31, 2025TVS Motor's revenue rises 18.4% YoY to Rs 12,210 crore in Q1FY26, driven by improvements in the automobiles, vehicles & parts and financial services segments. Net profit surges 32.3% YoY to Rs 610 crore during the quarter. It features in a screener of stocks with improving book value per share over the past two years.

DCB Bank's Q1FY26 net profit rises 19.7% YoY to Rs 157.3 crore. Revenue increases 21.8% YoY to Rs 1,813.6 crore, driven by improvements in the treasury and retail banking segments during the quarter. The bank's asset quality improves as its gross and net NPAs declines by 35 bps and 4 bps YoY, respectively.

Hitachi Energy India is falling sharply as its Q1FY26 net profit misses Forecaster estimates by 5.9% despite surging 12.6x YoY to Rs 132 crore. Revenue grows 15.3% YoY to Rs 1,530 crore, driven by improvements in operational efficiency and order execution. It shows up in a screener of stocks with high market capitalisation and low public shareholding.

The Securities and Exchange Board of India (SEBI) issues a confirmatory order against Gensol Engineering and its promoter-directors, Anmol Singh Jaggi and Puneet Singh Jaggi, upholding its April order that had prima facie found them involved in fund diversion and document falsification. SEBI rejected the brothers’ arguments challenging the order, stating that the challenge was unwarranted.

Sebi confirms Gensol fraud, finds promoters diverted funds, falsified recordshttps://t.co/GuRKtjWVEs

— ETMarkets (@ETMarkets) July 30, 2025GMR Power & Urban Infra is falling sharply as it posts a Q1FY26 net loss of Rs 7.8 crore compared to a net profit of Rs 1,225.2 crore due to higher raw materials, inventory, and employee benefits expenses. However, revenue rises 1.9% YoY to Rs 1,768.1 crore, helped by improvements in the power and smart meter infrastructure segments. It shows up in a screener of stocks with high interest payments compared to earnings.

Tata Steel's Q1FY26 net profit surges 116.5% YoY to Rs 2,077.7 crore, helped by lower raw materials and inventory expenses. However, revenue declines 2.8% YoY to Rs 53,466.8 crore, caused by reductions in the Indian and Rest of the World markets. The company's board approves acquiring a 27% stake in Italy-based commercial vehicle manufacturer, Iveco SPA, at a valuation of Euro 3.8 billion (~ Rs 33,360 crore).

HEG's Q1 FY26 net profit grows 355% YoY to Rs 104.8 crore. Revenue rises 15.5% YoY to Rs 683.8 crore, driven by strong demand for graphite electrodes and lower finance costs. The board approves a capacity expansion plan to add 15,000 tonnes per annum (TPA) to its current 100,000 TPA, with an investment of Rs 650 crore.

The US imposes sanctions on six India-based companies over their alleged involvement in the trade of Iranian petroleum, petroleum products, or petrochemicals. The sanctioned firms are Kanchan Polymers, Alchemical Solutions, Ramniklal S Gosalia and Company, Jupiter Dye Chem, Global Industrial Chemicals, and Persistent Petrochem. Additionally, any entity that is 50% or more owned by these companies is also sanctioned.

The Trump administration has sanctioned six Indian companies for their "significant" sales and purchases of Iranian-origin petrochemical products.

— businessline (@businessline) July 31, 2025

Click here to read more: https://t.co/daxzxPTuqjAurobindo Pharma's US subsidiary signs an agreement to acquire a 100% stake in Lannett Co, a US-based complex generic drugs maker. The deal is valued at $250 million (approx Rs 2,185 crore).

Navin Fluorine's Q1 FY26 net profit grows 128.8% YoY to Rs 117.1 crore. Revenue rises 38.5% YoY to Rs 739.3 crore, driven by strong growth in the contract development and manufacturing organisation (CDMO) and the specialty chemicals segments. The firm appears in a screener of stocks where foreign institutional investors (FIIs) are increasing their shareholding.

Brigade Hotel Ventures' shares debut on the bourses at a 9.9% discount to the issue price of Rs 90. The Rs 759.6 crore IPO received bids for 4.5 times the total shares on offer.

Shares of domestic shrimp feed exporters such as Apex Frozen Foods, Avanti Feeds and Coastal Corporation decline after US President Donald Trump imposed a 25% tariff and additional penalties on Indian exports. Indian shrimp exports to the US currently face a combined duty of 17.7%, including a 5.7% countervailing duty and a 1.8% anti-dumping duty, which is now expected to increase to 25%.

#MarketsWithMC | Trump tariff hits Indian shrimp exporters as Apex Frozen, Avanti Feeds shares fall 6%#TrumpTariffs#Export#StockMarket

Details below ????https://t.co/70OPJ0ZsKx— Moneycontrol (@moneycontrolcom) July 31, 2025

Kaynes Technology is rising as its net profit grows 46.9% YoY to Rs 74.6 crore in Q1FY26. Revenue increases 33.6% YoY to Rs 673.5 crore, driven by improvements in the electronics manufacturing businesses during the quarter. The company appears in a screener of stocks where mutual funds have increased their shareholding in the past two months.

ITD Cementation's Q1 FY26 net profit grows 37% YoY to Rs 137.2 crore. Revenue rises 6.7% YoY to Rs 2,556.8 crore, driven by strong order execution and lower finance costs. The firm appears in a screener of stocks where mutual funds have increased their shareholding in the past month.

Indus Towers is falling as its net profit declines 9.8% YoY to Rs 1,736.8 crore in Q1FY26 due to higher power and fuel costs, employee benefit expenses, and maintenance costs. However, revenue rises 9% YoY to Rs 8,057.6 crore, driven by higher tower deployments during the quarter. The company appears in a screener of stocks with improving ROE over the past two years.

Crude oil prices hit six-week highs, with Brent at $72.6 and WTI at $69.2 per barrel. The surge follows US President Trump's 25% tariff on Indian exports, penalties over India’s Russian oil trade, and the toughest sanctions on Iran since 2018. These sanctions target over 115 entities allegedly linked to Mohammad Hossein Shamkhani, the son of a senior adviser to Iran’s Supreme Leader.

#CommodityCorner | #Crude prices surge to 6-week highs after US announces #tariffs on India #exports & penalty for #Russia#oil imports. US also introduces the most extensive sanctions in #Iran. #petroleum & #petrochem @Manisha_3005

WATCH: https://t.co/bwl6e1QCci— CNBC-TV18 (@CNBCTV18News) July 31, 2025

Hindustan Unilever's Q1FY26 net profit grows 5.6% YoY to Rs 2,756 crore, helped by lower advertising & promotion expenses and inventory destocking. Revenue increases 0.5% YoY to Rs 16,715 crore, led by improvements in the home care, beauty & wellbeing, personal care, and food segments. It features in a screener of stocks with improving net cash flow over the past two years.

InterGlobe Aviation (Indigo) rises as its Q1FY26 revenue grows 6.4% YoY to Rs 21,542.6 crore during the quarter. However, net profit declines 20.2% YoY to Rs 2,176.3 crore due to higher aircraft maintenance, airport fees, inventory, employee benefits, and finance costs. It appears in a screener of affordable stocks with high returns on equity (RoE) and Trendlyne momentum scores.

CESC's Q1FY26 net profit grows 2.4% YoY to Rs 387 crore, helped by lower energy and fuel costs. Revenue rises 7% YoY to Rs 5,202 crore due to power demand across its distribution circles, especially in Kolkata, and improved electricity sales volumes. The company appears in a screener of stocks outperforming their industry price change over the quarter.

Mahindra & Mahindra rises as its Q1FY26 net profit jumps 24.4% YoY to Rs 4,083.3 crore owing to inventory destocking and higher tax returns. Revenue grows 23.4% YoY to Rs 46,446.1 crore, driven by improvements in the automotive, farm equipment, financial services, and industrial businesses & consumer services segments. It features in a screener of stocks with increasing revenue for the past eight quarters.

Markets fell in early trading. Nifty 50 was trading at 24,680.30 (-174.8, -0.7%), BSE Sensex was trading at 80,695.50 (-786.4, -1.0%) while the broader Nifty 500 was trading at 22,861.60 (-172.0, -0.8%).

Market breadth is highly negative. Of the 2,003 stocks traded today, 294 were in the positive territory and 1,651 were negative.

Riding High:

Largecap and midcap gainers today include Godrej Consumer Products Ltd. (1,259, 3.5%), Hindustan Unilever Ltd. (2,521.20, 3.4%) and Aditya Birla Capital Ltd. (256.65, 3.2%).

Downers:

Largecap and midcap losers today include Indus Towers Ltd. (363, -5.4%), Waaree Energies Ltd. (2,992.40, -4.8%) and Ambuja Cements Ltd. (592.70, -4.1%).

Crowd Puller Stocks

28 stocks in BSE 500 are trading on high volumes today.

Top high volume gainers on BSE included Sagility India Ltd. (46.62, 10.0%), Kaynes Technology India Ltd. (6,172, 9.5%) and HEG Ltd. (573.10, 7.3%).

Top high volume losers on BSE were Aarti Industries Ltd. (420.05, -5.7%), Indus Towers Ltd. (363, -5.4%) and Sonata Software Ltd. (391.95, -5.3%).

Emami Ltd. (600.65, 6.3%) was trading at 17.5 times of weekly average. Zen Technologies Ltd. (1,464.10, -4.1%) and Graphite India Ltd. (572.75, 3.3%) were trading with volumes 15.0 and 12.7 times weekly average respectively on BSE at the time of posting this article.

BSE 500: highs, lows and moving averages

11 stocks took off, crossing 52 week highs, while 2 stocks were underachievers and hit their 52 week lows.

Stocks touching their year highs included - Bosch Ltd. (40,385, 0.8%), Coromandel International Ltd. (2,670, 0.7%) and EID Parry (India) Ltd. (1,228, -0.7%).

Stocks making new 52 weeks lows included - Tata Consultancy Services Ltd. (3,036.80, -0.6%) and Five-Star Business Finance Ltd. (593.80, -2.7%).

11 stocks climbed above their 200 day SMA including Emami Ltd. (600.65, 6.3%) and Thermax Ltd. (3,940.40, 2.7%). 31 stocks slipped below their 200 SMA including Hindustan Copper Ltd. (243.35, -5.8%) and Aarti Industries Ltd. (420.05, -5.7%).