The earnings season is crunch time for equity markets, as investors and analysts compare the promises CEOs had made to actual results.

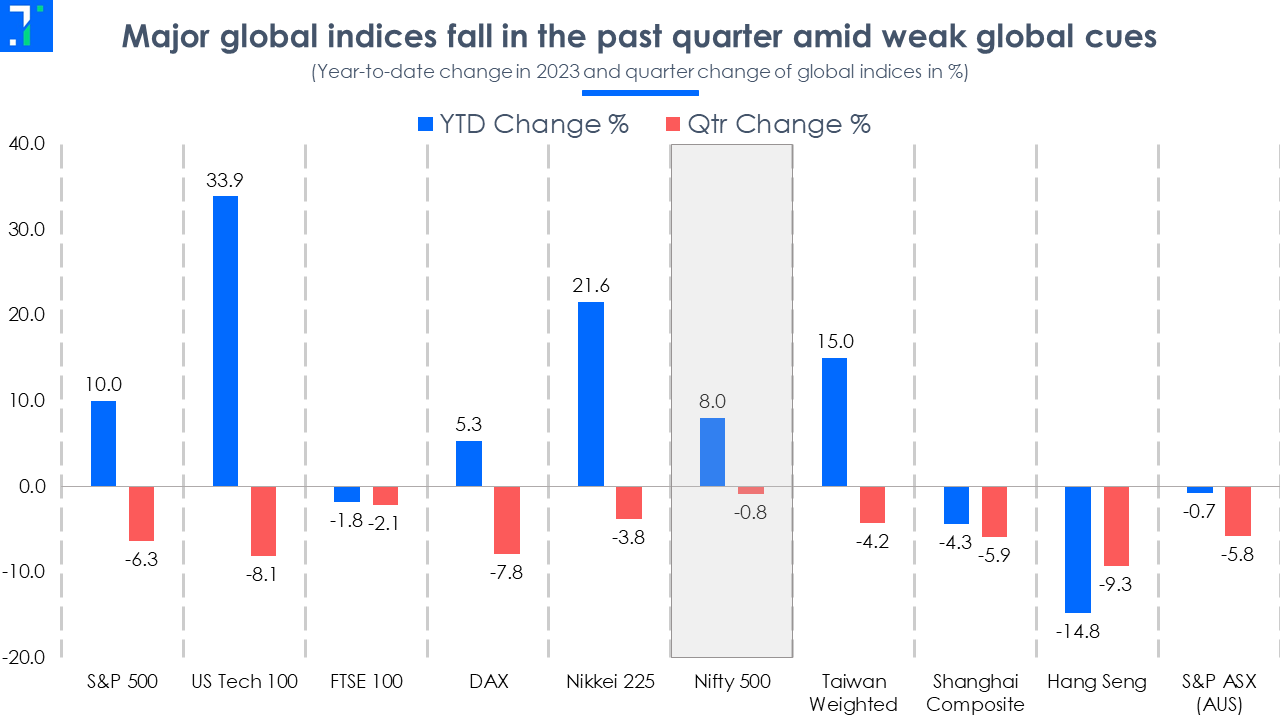

But the Q2 season has been shadowed by concerns beyond balance sheets. Factors like rising oil prices due to the Israel-Hamas conflict, stubborn inflation, and the possibility of high interest rates sticking around for longer, have slowed market momentum.

These concerns have also spooked foreign institutional investors (FIIs), who, after six consecutive months of net buying, sold a net of Rs 18,893.8 crore in September, and Rs 19,982.6 crore in October in Indian stocks. In contrast, domestic institutional investors (DIIs) have been net buyers since April.

But India still remains the most favoured FII destination among emerging markets.

FIIs will now look at corporate earnings for signals on where markets are headed. Currently, the Nifty 500 index shows a revenue growth of 10.3% YoY in Q2FY24, with operating profits rising by 25.8%. Let’s take a look at the sectors and stocks that are driving the Nifty 500’s overall revenue growth.

In this week’s analytics,

- Seven Stars: Seven high-growth stocks from three sectors are beating expectations

- Outperformers Screener:Companies that beat revenue and net profit estimates, and posted strong Q2 results

Banking and finance stocks lead the charge in beating Q2 estimates

The banking and finance sector has taken the lead in driving the Nifty 500’s performance in Q2FY24, with several companies beating Forecaster estimates for both revenue and net profit. The other out-performers are consumer durables and , surprisingly, a few companies in the software and services sector.

Banking and finance companies lead YoY revenue and net profit growth in Q2

Key players driving this momentum include CreditAccess Grameen, Canara Bank, Karur Vysya Bank, Cyient, Tanla Platforms, Dixon Technologies (India) and Polycab India.

Except for Polycab India, all the highlighted companies rose in reaction to results, with CreditAccess Grameen rising 8.5%. Over the past quarter, Dixon Technologies has led the pack overall with a 32.7% increase.

Banking and finance stocks rise post results, and in the past quarter

CreditAccess, Canara Bank and Karur Vysya not only jumped on the day of results but have continued to rise since the result announcements.

Profits roll in: Banking and finance companies build momentum

Companies from the banking and finance (including NBFCs) industries have been resilient in the past few quarters, and posted high revenue and net profit growth in Q2 as well, mirroring positive results from sector front-runners like HDFC Bank and ICICI Bank. Three companies in focus posted a net interest income increase (both YoY and QoQ), helped by strong loan demand:

Net interest income rises YoY and QoQ as loan demand stays strong in Q2

Net interest income rises YoY and QoQ as loan demand stays strong in Q2

CreditAccess Grameen saw a 53.3% YoY jump in net interest income, thanks to an expanding gross loan portfolio. Canara Bank and Karur Vysya Bank also reported net interest income growth, fuelled by a spike in loans in the retail segment. Karur Vysya’s personal loans jumped 2.2 times YoY, while Canara Bank’s retail loans grew by 10.5%.

During Karur Vysya Bank's Q2FY24 earnings call, MD and CEO Ramesh Babu said, “Retail growth has remained steady (+17%) compared to the last quarter, with most of the growth coming from mortgages, both residential and non-residential”.

Karur Vysya and Canara Bank’s deposits also grew at 12.8% and 9% YoY respectively in Q2. However, their deposits grew at a slower pace compared to loans, which can put pressure on margins going forward.

Falling attrition rates help software & services companies’ margins in Q2

Software and services firms have had some tough times recently – this sector is highly dependent on global customers, and the slowdown internationally has hit both deal wins and margins. In Q2, industry leaders TCS and Infosys saw single-digit revenue growth, and TCS marginally missed revenue estimates.

However, mid-cap companies like Cyient and Tanla Platforms posted strong results, beating Trendlyne’s Forecaster estimates for revenue and profit.

Cyient and Tanla showcase rising revenue YoY and QoQ in Q2

Cyient and Tanla showcase rising revenue YoY and QoQ in Q2

Cyient’s digital engineering and technology segment, which saw a 22% YoY increase, has been key to its revenue boost. Meanwhile, Tanla’s enterprise communications segment (SMS and WhatsApp broadcasts) drove its top-line growth.

While talking about new growth verticals, Cyient’s management said that its automotive segment is gaining traction on autonomous and connectivity solutions, and that the demand trend for these services looks very strong.

Both companies have reported YoY rises in operating profit margins due to cost optimization measures and lower employee expenses on the back of falling attrition rates.

Operating profit margin rises sharply YoY but moderates QoQ

Operating profit margin rises sharply YoY but moderates QoQ

Consumer durables companies see margins rise as raw material prices fall

Consumer electronics company Dixon Technologies posted high QoQ and YoY revenue growth in Q2, on the back of a 76.8% YoY rise in its mobile manufacturing segment. Dixon, which operates under various production-linked incentive (PLI) schemes, is set to begin production of Google Pixel 8 phones, according to Bloomberg.

Mobile manufacturing segment drives Dixon Tech’s revenue in Q2FY24

Mobile manufacturing segment drives Dixon Tech’s revenue in Q2FY24

Polycab India, a cable and wire manufacturer, is not far behind in revenue and profit growth, with increases of 26.6% and 58.9% YoY respectively in Q2FY24. In the Q2 earnings call, Chirayu Upadhyaya, Polycab’s Head of Investor Relations, said, “The cables segment grew with rising demand in the defense sector, which accounts for over 21% of revenues in the first half of the year.”

As both companies' top and bottom lines grew, operating profit margins also rose YoY thanks to a fall in raw material prices, and a favourable product mix.

Operating profit margins rise YoY on better product mix

Screener: Companies that beat revenue and net profit estimates, with strong Q2 results

Oberoi Realty tops Forecaster estimates in revenue surprise %

This screener shows stocks from the Nifty 500 that have beaten Trendlyne's revenue and net profit Forecaster estimates for Q2FY24. Stocks from Banking and Finance, Software and Services, Consumer durables, Realty and Retailing feature in the screener.

Major stocks that appear in the screener are Oberoi Realty, ICICI Securities, Nippon Life India Asset Management, PNB Housing Finance, HDFC Asset Management, Central Depository Services (India) and PVR INOX.

Oberoi Realty’s revenue grew by 76.8% YoY to Rs 1,217.4 crore in Q2FY24, aiding it to beat its Forecaster estimates by 28.5%. The realty company’s revenue increased on the back of gains from Oberoi Mall, Commerz and The Westin Mumbai Garden City. Its net profit also expanded by 43.3% YoY, thanks to reduced raw material and operating expenses.

PVR INOX’s revenue grew the most by 191.2% YoY to Rs 1,999.9 crore in Q2FY24. This helped the retailing company outperform Trendlyne’s Forecaster estimates by 7.8%. Its revenue rose on the back of a jump in the average ticket price (ATP) and spend per head (SPH). It posted a net profit of Rs 166.3 crore in Q2FY24 against a net loss of Rs 71.2 crore in Q2FY23.

You can find some popular screenershere.

Signing off this week,

The Trendlyne Team