2023 started off on a strong note for global equities, as inflation moderated and investors looked forward to a pause in interest rates globally. Indian indices followed the global trend, and sector indices like the Nifty Auto, Nifty Bank and Nifty PSU Bank hit their all-time highs.

However, the uptrend in global equities quickly turned sour as inflation proved to be pretty sticky. The recent fighting between Israel and Hamas in the Middle East is also spooking markets, as analysts worry that US, Iran and other countries will get pulled into the conflict. Central banks around the world have continued with their hawkish stance, and have suggested holding interest rates higher for a longer period. The Indian indices started falling in the past month as foreign investors began a sell-off in indian equities. This fall came after indices hit record highs in September.

The unpredictable global environment has in recent weeks, triggered a global sell-off across indices as people hunt for less risky options like bonds. This has put world indices under pressure.

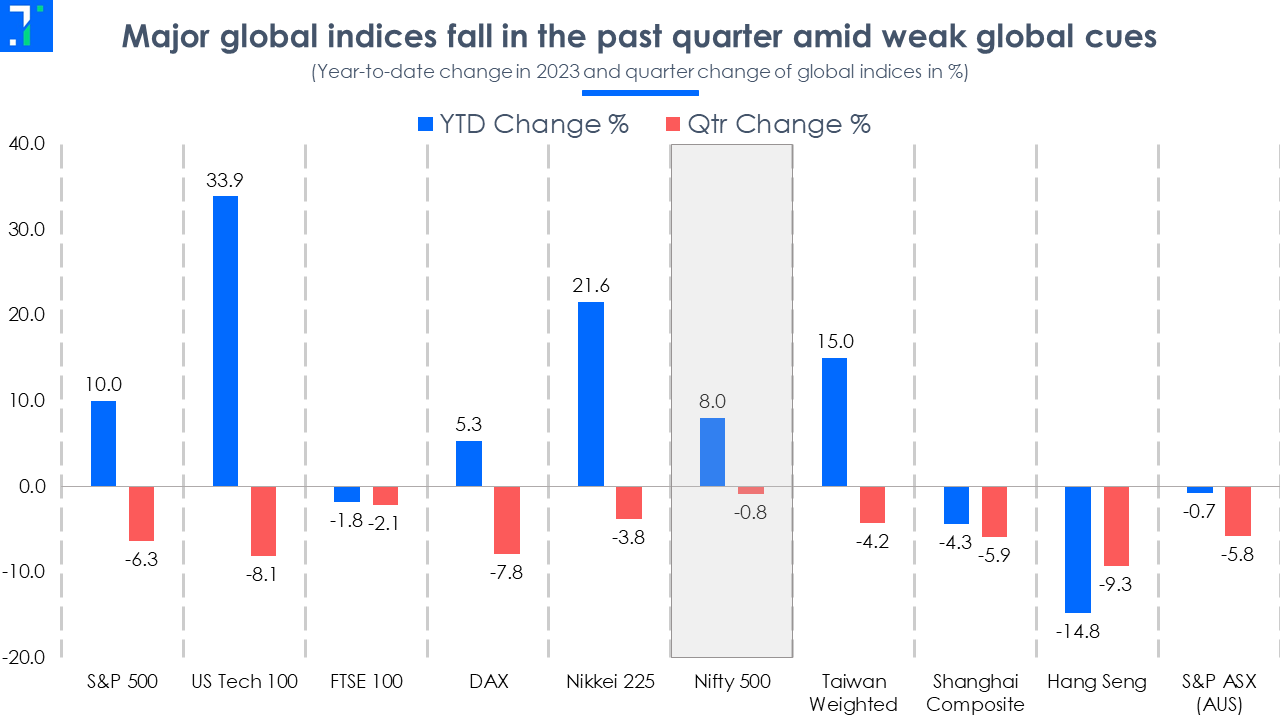

The Nifty 500 index has hung on to some of its early gains - it’s up by 8% in 2023 overall, as of October 25. However, it has lost 0.8% in the past three months. Despite the marginal fall, and journalists announcing that it’s dark days on Dalal Street, the Nifty 500 has still outperformed most global indices over the past quarter. The index also outperformed the US Tech 100 (Nasdaq 100) and S&P 500 in 2022. However, over the past two months, foreign investors have offloaded equities worth Rs 25,960.9 crore, causing Indian indices to fall.

The US’s US Tech 100 and S&P 500 indices have risen the most by 33.9% and 10% respectively in 2023. However, these indices have fallen by 8.1% and 6.3% over the past quarter. It is important to note that US indices fell significantly in 2022. The tech-heavy Nasdaq 100 fell 32.7% while the S&P 500 lost 18.1%.

With inflation remaining sticky, US indices are facing worries of a recession, even as the US economy delivered a strong quarterly performance. The banking crisis and the worsening situation in the Middle East have added to its woes. US Tech 100 suffered its worst month of 2023 in September as it fell 5.1% due to fears of the interest rates rising or staying higher for a longer period of time.

Japan's Nikkie 225 index has the second highest rise of 21.6% in 2023. This rise helped the index to touch its all-time high of 33,772.9 on June 20. However, it has fallen 3.8% in the last three months. This fall can be attributed to the sticky inflation in the country and the Bank of Japan’s refusal to raise interest rates, citing domestic and global uncertainties.

England’s FTSE 100 is down 1.8% and 2.1% in 2023 and the recent quarter, respectively. The country is facing a persistent rise in inflation and weakening consumer sentiment. Its retail sales have fallen in September after a marginal rise in August.

China’s Shanghai Composite index has fallen 4.3% over the last year and 5.9% in the past quarter. The country is facing a property crisis as its largest private sector developer, Country Garden, faces a default on payment of a foreign bond. The realtor has international debts aggregating at $11 billion while it has liabilities worth Rs 200 billion.

The Hang Seng from Hong Kong has fallen the most (both YTD and quarter) among the major global indices. It has fallen by 14.8% in 2023 while it declined by 9.3% over the past quarter. The index is facing a sell-off after foreign investors divest their stakes in the Chinese market.

Other notable indices are the DAX (Germany), Taiwan Weighted (Taiwan) and S&P ASX 200 (Australia). The DAX and Taiwan Weighted rose by 5.3% and 15% respectively in 2023. However, they declined by 7.8% and 4.2% respectively over the last three months.