Nifty 50 closed at 25,415.80 (38.3, 0.2%) , BSE Sensex closed at 83,184.80 (236.6, 0.3%) while the broader Nifty 500 closed at 23,853.95 (-44.7, -0.2%). Market breadth is overwhelmingly negative. Of the 2,272 stocks traded today, 568 were gainers and 1,679 were losers.

Nifty 50 closed higher after paring its gains from the morning session. The Indian volatility index, Nifty VIX, fell 6.7% and closed at 12.5 points. NTPC's subsidiary, NTPC Green Energy, files a draft red herring prospectus (DRHP) for an initial public offering (IPO) to raise Rs 10,000 crore. The IPO consists of an entirely fresh issue, with no offer-for-sale component.

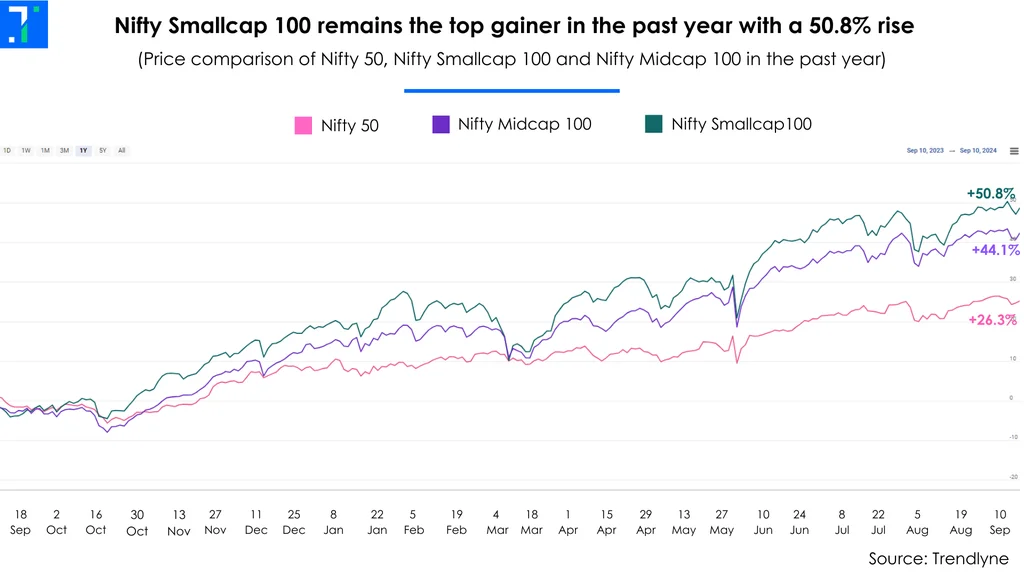

Nifty Smallcap 100 and Nifty Midcap 100 closed in the red. BSE Consumer Durables and S&P BSE Low Volatility Index were among the top index gainers today. According to Trendlyne’s Sector dashboard, Textiles Apparels & Accessories emerged as the best-performing sector of the day, with a rise of 0.9%.

Asian indices closed in the green. European indices are trading in the green, except for Portugal’s PSI, which is trading flat. US index futures are trading in the green, indicating a positive start to the trading session as the Federal Reserve cut rates yesterday by 50 basis points. Brent crude oil futures are trading higher.

Chambal Fertilisers & Chemicals sees a short buildup in its September 26 futures series, with open interest increasing by 24.4% and a put-call ratio of 0.6.

Siemens receives an observation letter from NSE with 'no adverse observations'. The letter approves the board's decision to demerge the company's energy business to Siemens Energy India (SEIL), a wholly owned subsidiary of Siemens.

Gujarat Mineral Development Corp gets the exploration and geological data for the Ambadongar rare earth deposit from the Atomic Minerals Directorate for Exploration & Research (AMD). The company has set a capex of Rs 2,200 crore for the exploration and mining, and Rs 1,300 crore to set up a rare earth elements (REE) processing plant.

Wockhardt rises to its 5% upper circuit as its investigational drug, Zaynich (Zidebactam/Cefepime), successfully treats over 35 critically ill patients with drug-resistant infections, including bacterial meningitis, in India and US.

A JM Financial report suggests that while a US Fed rate cut could benefit IT services, its impact will be complicated and moderated by economic uncertainties. The brokerage notes that any effects on corporate spending are likely to be gradual, making expectations of an immediate boost premature. Its top large-cap picks in the sector include Infosys, Tech Mahindra, and Wipro.

#JMFinancial explains how US #Fed’s 50 bps rate cut will impact the #IT sector

Read here: https://t.co/5rB30H3qsU— Mint (@livemint) September 19, 2024

Power Mech Projects bags an order worth Rs 865 crore from Talwandi Sabo Power to establish, operate and maintain three 660 MW supercritical thermal plants.

DCX Systems rises as it secures a Rs 154.8 crore export order from Israel’s Elta Systems. The contract is to supply RF Electronic Modules, with completion expected within 12 months.

Bharti Airtel surges to an all-time high of Rs 1,711.1 as its B2B division, Airtel Business, partners with Cisco to launch Airtel Software-Defined (SD) Branch. This solution simplifies network management, enhances application performance, and provides greater flexibility and control over branch network infrastructure.

Axis Bank is nearing Yes Bank as the largest payment service provider (PSP) in the UPI ecosystem and may take the top spot by the end of September, according to National Payments Corporation of India (NPCI) data.

#TechWithMC | Axis Bank is closing in on Yes Bank as the largest payment service provider in UPI ecosystem.@AnandJRAnand reports ????https://t.co/477Zt0Qmfk#AxisBank#YesBank#UPIpic.twitter.com/v6QnGlMahM

— Moneycontrol (@moneycontrolcom) September 19, 2024

Zee Entertainment Enterprises falls sharply as Star India files for arbitration in the London Court of International Arbitration (LCIA) against the company after terminating the partnership between the companies. Star India plans to claim damages worth $940 million (approx. Rs 7,860.9 crore) from Zee.

NTPC rises sharply as its subsidiary, NTPC Green Energy, files a draft red herring prospectus (DRHP) for an initial public offering (IPO) to raise Rs 10,000 crore. The IPO consists of an entirely fresh issue, with no offer-for-sale component.

360 One Wam's board of directors approves the issuance equity shares worth Rs 2,250 crore through a qualified institutional placement (QIP).

Brainbees Solutions' shares increase as global brokerages, including Morgan Stanley, initiate an overweight rating on the stock, while BofA assigns a buy rating with target prices of Rs 818 and Rs 770, respectively. They emphasize that the company is well-positioned to take advantage of India's expanding childcare market, with multiple growth and profitability improvement drivers in place. Morgan Stanley also notes potential value through Globalbees Brands.

Shares of Brainbees Solutions, the parent company of FirstCry, rallied 7% after BofA and Morgan Stanley initiated coverage on the stock, signaling upside potential of up to 27%.https://t.co/JofRjrljuH

— ETMarkets (@ETMarkets) September 19, 2024

Indian Renewable Energy Development Agency's board of directors approves a Rs 4,500 crore fundraising in multiple tranches through a qualified institutional placement (QIP), rights issue, preferential issue, or other modes.

GE T&D India falls sharply as its promoters, Grid Equipments and GE Grid Alliance B.V., plan to sell 3 crore shares (11.7% stake) through an offer for sale (OFS) at a floor price of Rs 1,400 per share. The promoters included an oversubscription option to sell an additional 3.9% stake, potentially increasing the total sale to 15.6%, with a total offer size of up to 4 crore shares.

Ion Exchange (India) rises sharply as it secures an order worth Rs 161.2 crore from Adani Power. The contract is for the engineering, procurement, and construction of water and environment management systems for the process and utility needs of two 800 megawatt (MW) units at the Raipur and Raigarh Ultra Super Power Projects.

Aavas Financiers' shares rise after its board approves the issuance of up to 63,000 non-convertible debentures (NCDs) totaling up to Rs 630 crore through private placement. The NCDs will have a tenure of five years from the reference date.

#MarketsWithBS | Shares of housing finance company #AavasFinanciers surged up to 2.93% to hit an intraday high of Rs 1,867.30 per share on Thursday.#markets#sharemarket#StockMarket#buzzingstockshttps://t.co/okROyFWkcc

— Business Standard (@bsindia) September 19, 2024

Aditya Birla Capital is rising as it receives approval from the Reserve Bank of India (RBI) for its proposed merger with Aditya Birla Finance.

Emkay maintains its 'Buy' call on Go Fashion with an upgraded target price of 1,600 per share. This indicates a potential upside of 23.8%. The brokerage believes the company's revenue will grow on the back of improvement in same-store sales growth (SSG) and strong cash flow. It expects the company's revenue to grow at a CAGR of 19.6% over FY25-27.

Lemon Tree Hotels rises as it signs a license agreement for a new hotel in Vijayawada, Andhra Pradesh, set to open in FY26. The property will be managed by Lemon Tree's wholly-owned subsidiary, Carnation Hotels. It will feature 44 well-appointed rooms, a restaurant, a banquet hall and a meeting room.

Telecom stocks like Vodafone Idea, Indus Towers, RailTel Corp of India, and Vindhya Telelinks fall sharply in trade following the Supreme Court ruling in the Adjusted Gross Revenue (AGR) case. The apex court upheld the AGR ruling against the telecom companies and upheld the quantum of the AGR demand. Goldman Sachs highlights that the market seems to be prematurely pricing in potential increases in telecom capex and free cash flow from reduced AGR dues.

#SupremeCourt rejects telcos' plea on re-computation of #AGR dues.

Get all your stock-related queries answered by our technical and fundamental guests with Alex Mathew on @alexandermats. #ndtvprofitlive

https://t.co/zM1733LL9B— NDTV Profit (@NDTVProfitIndia) September 19, 2024

Nazara Technologies touches a new 52-week high of Rs 1,117 per share as its board of directors approves fundraising worth Rs 900 crore through a preferential issue of shares at an issue price of Rs 954.3 per share. The board also approves the acquisition of an additional 19.4% stake in Absolute Sports for Rs 145.5 crore.

BL Kashyap & Sons is rising as it bags an order worth Rs 221 crore from SSS Realty for civil, structural, and allied works in Bangalore. This order win takes the company's order book to Rs 3,546 crore.

Power Grid Corporation of India rises as it secures the bid to build and operate an inter-state transmission system for evacuating power from Rajasthan REZ Phase IV (5.5 GW). The project includes a new substation at Kurawar and transmission lines, along with upgrades to existing substations in Madhya Pradesh.

Macrotech Developers rises as it enters an agreement with Ivanhoe Warehousing India to acquire digital infrastructure platforms, Bellissimo Digital Infrastructure Development Management, Palava Induslogic 4, and Bellissimo In City FC Mumbai 1. Macrotech will acquire a 70%, 66.7%, and 66.7% stake in the companies, respectively, for a total cash consideration of Rs 239.6 crore.

Markets are up today morning. Nifty 50 was trading at 25,549.65 (172.1, 0.7%), BSE Sensex was trading at 83,396.38 (448.2, 0.5%) while the broader Nifty 500 was trading at 24,051.20 (152.6, 0.6%).

Market breadth is surging up. Of the 1,948 stocks traded today, 1,437 were on the uptick, and 467 were down.

Riding High:

Largecap and midcap gainers today include PB Fintech Ltd. (1,877.45, 4.0%), United Breweries Ltd. (2,130.50, 4.0%) and Au Small Finance Bank Ltd. (752.50, 3.9%).

Downers:

Largecap and midcap losers today include Vodafone Idea Ltd. (10.38, -19.5%), Indus Towers Ltd. (389.80, -9.0%) and Torrent Power Ltd. (1,,842.35, -4.7%).

Volume Rockets

27 stocks in BSE 500 are trading on high volumes today.

Top high volume gainers on BSE included KPR Mill Ltd. (934.95, 8.8%), Rainbow Childrens Medicare Ltd. (1386.25, 7.3%) and Garware Technical Fibres Ltd. (3983.40, 6.9%).

Top high volume losers on BSE were Vodafone Idea Ltd. (10.38, -19.5%), Indus Towers Ltd. (389.80, -9.0%) and Chambal Fertilisers & Chemicals Ltd. (478.85, -8.1%).

Sunteck Realty Ltd. (571.65, 0.2%) was trading at 31.2 times of weekly average. Suven Pharmaceuticals Ltd. (1,179.50, 3.0%) and Asahi India Glass Ltd. (708.45, 5.2%) were trading with volumes 9.4 and 8.7 times weekly average respectively on BSE at the time of posting this article.

BSE 500: highs, lows and moving averages

23 stocks took off, crossing 52 week highs, while 1 stock were underachiever and hit their 52 week lows.

Stocks touching their year highs included - Bharti Airtel Ltd. (1,664.85, 0.6%), Britannia Industries Ltd. (6,134.50, 0.2%) and Cholamandalam Investment & Finance Company Ltd. (1,596.30, 0.4%).

Stock making new 52 weeks lows included - Vodafone Idea Ltd. (10.38, -19.5%).

4 stocks climbed above their 200 day SMA including Procter & Gamble Hygiene & Healthcare Ltd. (16,659.85, 0.7%) and IndusInd Bank Ltd. (1,484.75, 0.3%). 22 stocks slipped below their 200 SMA including IIFL Finance Ltd. (495.95, -6.2%) and Data Patterns (India) Ltd. (2,526.90, -4.8%).