On September 3, the Nifty 50 recorded its longest winning streak (14 days) since its inception in 1996. There have been other, shorter rallies like this before, and an analysis of the past six such events reveals a pattern: the index usually fell by 3% on average in the 30 days after a rally, according to Trendlyne's share price history and Samco. Whether this pattern will repeat this time around, is still an open question.

Nifty 50 has delivered negative returns historically after a long gaining streak

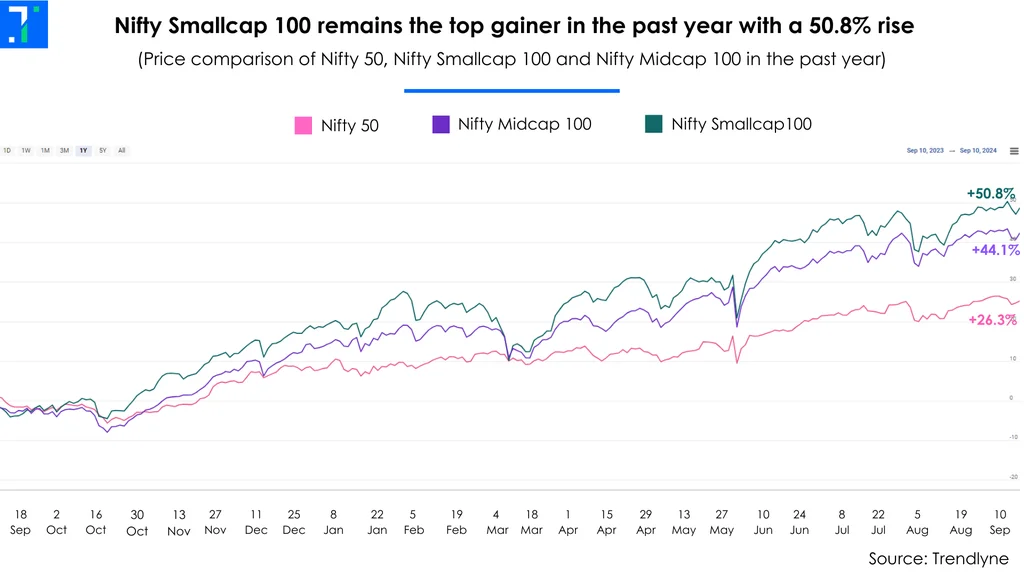

Indian indices have surged over the past year, driven by robust economic growth and lower inflation. While India’s growth story looks strong, current market valuations are beginning to worry both investors and analysts.

The Nifty 50 soared 26.3% over the past year. But the star performer has been the Nifty Smallcap 100, which posted a remarkable 50.8% gain in the same period.

Nifty Smallcap 100 remains the top gainer in the past year with a 50.8% rise

With such a rise across all three indices, is the stock market valuation a balloon about to burst?

In this week’s Analyticks,

- Valuation check: We look into the Nifty Smallcap, Midcap and Nifty50

- Screener: Stocks which have risen over the past quarter, with PE TTM lower than 3-year, 5-year, and 10-year averages

The winner in the middle: Nifty Midcap beats Smallcap and Nifty 50 indices

While the smallcap index has outperformed its peers over the past year, the longer-term view tells us a different story. When looking at 3, 5, and 10-year time frames, the Nifty Midcap 100 is the stronger performer by far, outshining both the Nifty Smallcap 100 and Nifty 50.

Nifty Midcap 100 outperforms peers in 10, 5 and 3 year gains

The Nifty Midcap 100 has historically commanded a higher price-to-earnings (PE) ratio due to its stronger growth potential. Currently, it has the highest PE among the three major indices, at 44.2. This elevated PE is also a result of a sharp drop in its earnings per share (EPS) following the Q4FY24 results.

Nifty Midcap 100's EPS falls in the past year, Nifty 50 on top in EPS growth

Q1FY25 results did not help the Nifty Midcap’s EPS to recover to March 2024 levels. This was due to companies like HPCL (Oil & Gas), Bharat Dynamics (Defence), Tata Chemicals (Commodity Chemicals) and BSE (Exchange) reporting a significant fall in their EPS. As a result, the Nifty Midcap continues to trade at a high PE.

Bhaskar Laxminarayan, chief investment officer for Asia at Julius Baer says, “Every investor understands India's growth story, but valuation is a worry. Valuation of largecaps is not as much of a worry as with small and midcaps.”

Nifty 50 is analysts’ top pick, backed by historical data

When examining the valuations of the three indices, the Nifty Smallcap 100 stands out with a current PE of 30.3, well above its historical average. But this elevated valuation is somewhat supported by its strong performance in Q1FY25, where it posted the highest year-on-year (YoY) net profit growth among the three indices.

1 Yr Forward PE of indices below current PE

According to Trendlyne’s results dashboard, the revenue and net profit of the Nifty Smallcap 100 rose 11.9% and 50.9% YoY in Q1FY25 respectively.

The big jump in net profit was mainly due to Raymond’s net profit rising 591% YoY due to income from discontinued operations. After excluding this, net profit growth for Nifty Smallcap comes to 15%. Nifty 50 and Nifty Midcap’s net profit increased by 6.8% and 9.2% respectively.

The strong growth in smallcaps is expected to continue, boosted by India's GDP growth. This is reflected in the smallcap index's much lower forward PE of 21, compared to its current PE of 30.3. The lower forward PE suggests that high profit growth is expected to continue for these smallcap companies, potentially justifying the current valuation. But a major earnings miss could trigger a sharp correction in the index.

In comparison, the Nifty 50 appears more reasonably valued. Its current PE is below its 5 and 10-year historical averages. It has a forward PE of a very modest 20.5, which makes it even more appealing valuation wise. Goldman Sachs’ Asia-Pacific strategist Sunil Koul said, “One of the key views we have is that you should see a rotation in the Indian market. It was the year of mid and small-caps, but that seems to be changing already over the past month.”

PSUs, auto and banking & finance sectors dominate the top gainer lists

Public sector units (PSUs) have had a great year, and it is not surprising to see some of these becoming star stocks in the Nifty 50, Nifty Midcap 100 and Nifty Smallcap 100 indices. Sectors that stand out are Banking and Finance and Auto.

Banking and finance stocks are in focus with interest rate cuts on the horizon. The US Federal Reserve is expected to lower rates this month, and India’s RBI Monetary Policy Committee (MPC) will meet on October 9 to decide on its rate action.

Lower interest rates drive loan demand, benefiting banks. However, the top banks will face the challenge of keeping margins up as rates decline. Despite this, the banking and finance sector is attractively valued, with a relatively low PE ratio of 20.1, and the sector is up 10.1% over the past quarter.

Of the top five highest gainers in the Nifty 50, two are from the auto sector – Bajaj Auto and Hero Motocorp. The auto sector has been on the rise with strong demand in the rural segment driving sales in the past quarter. The sector is also up 59.4% in the past year, according to Trendlyne’s sector dashboard, and has a PE ratio of 36.4 as opposed to Nifty 50’s 23.5.

Banking and auto stocks outperform in the past year

The other three top gainers in the list include Bharat Petroleum Corp, Coal India and Adani Ports & Special Economic Zone.

Among the Nifty Smallcap 100, Banking and Finance sector stocks appear twice. Housing and Urban Development Corp (HUDCO) and Multi Commodity Exchange of India (MCX) are from this sector.

Other top-performing stocks include Rail Vikas Nigam (RVNL), Oil India, Suzlon Energy, Cochin Shipyard, NBCC, Prestige Estates Projects, Oracle Financial Services and Tata Investment Corp.

Screener: Low PE stocks which have risen over the past quarter with PE TTM lower than 3-year, 5-year, and 10-year averages

Auto stocks’ TTM PE is lower than their 3yr average PE

PE ratio shows the stock price of the company relative to its earnings per share (EPS). It is widely used by investors and analysts reviewing a stock's relative valuation. This screener shows stocks with trailing twelve months (TTM) PE values less than average three-year, five-year and ten-year PE values.

The screener is dominated by stocks from the automobiles & auto components, and pharmaceuticals & biotechnology sectors. Major stocks that feature in the screener are Great Eastern Shipping, JK Paper, Bharat Petroleum Corp, Tata Motors, Welspun Corp, Natco Pharma, Bombay Burmah Trading and Ceat.

Great Eastern Shipping’s TTM PE stands at 6.4 compared to its 3-year and 5-year PE at 7.3 and 8.4, respectively. The TTM PE ratio reflects the most recent earnings. The shipping company’s revenue and net profit increased by 18.1% YoY and 18% YoY, respectively in Q1FY25. This rise in earnings has led to a lower TTM PE ratio compared to the 3-year and 5-year average P/E ratios.

JK Paper also features in the screener with its TTM PE falling to 8 from its 3-year average of 10.3 and 5-year average of 8.2. This paper & paper products company’s TTM PE declined on the back of its stock price falling by 7.4% over the past month due to a disappointing Q1FY25 due to margin pressures. Despite a 16% rise in sales volume, net sales growth was offset by higher raw material costs, which rose 23% YoY. Other expenses increased 40% YoY due to an acquisition. Consequently, EBITDA margin fell by 1376 bps YoY to 16.4%, and net profit dropped 55% YoY to Rs 1.4 billion.

However, IDBI Capital expects the company’s margins to improve in Q2FY25 on account of price hikes across its product portfolio.

You can find some popular screeners here.