Nifty 50 closed at 25,377.55 (-41, -0.2%) , BSE Sensex closed at 82,948.23 (-131.4, -0.2%) while the broader Nifty 500 closed at 23,898.65 (-71.3, -0.3%). Market breadth is overwhelmingly negative. Of the 2,274 stocks traded today, 724 were in the positive territory and 1,536 were negative.

Nifty 50 touched a new all-time high of Rs 25,482.2 before paring its gains in the afternoon session to close lower. The Indian volatility index, Nifty VIX, surged 6.2% and closed at 13.4 points. Hindalco Industries reportedly plans a capex of Rs 2,450 crore to set up a copper and e-waste recycling plant in Dahej and a copper tube manufacturing plant in Vadodara.

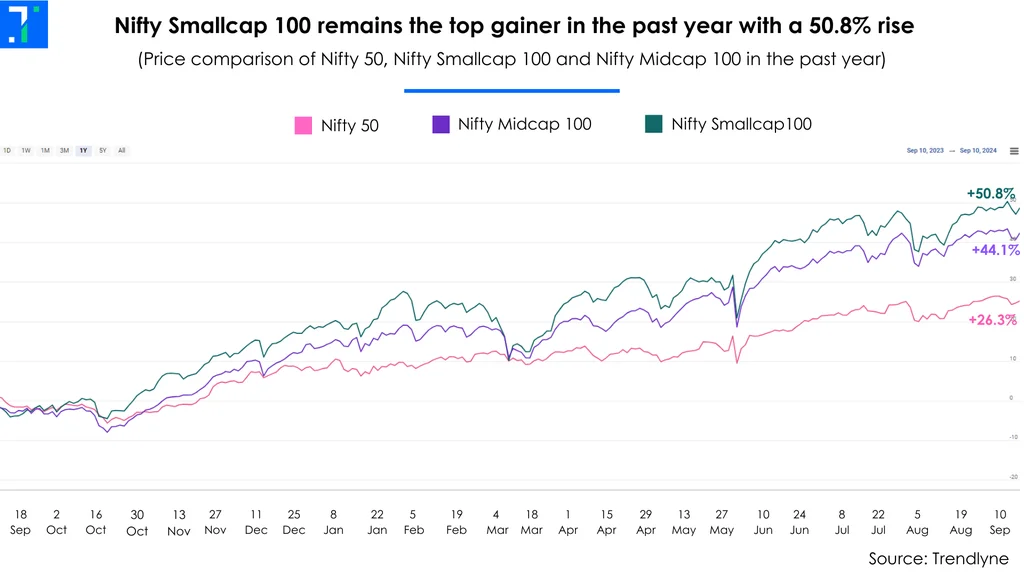

Nifty Smallcap 100 and Nifty Midcap 100 closed in the red. Nifty Financial Services and Nifty Bank were among the top index gainers today. According to Trendlyne’s Sector dashboard, Healthcare Equipment & Supplies emerged as the best-performing sector of the day, with a rise of 1.8%.

Asian indices closed mixed. European indices are trading lower, except for Germany’s DAX which is trading flat. US index futures are trading in the green, indicating an optimistic start to the trading session as analysts are expecting the Federal Reserve to cut interest rates by a more aggressive 50 bps today.

Relative strength index (RSI) indicates that stocks like Jubilant Pharmova, Himadari Specialty Chemicals, Godrej Industries, and Radico Khaitan are in the overbought zone.

Siemens receives an observation letter from BSE with 'no adverse observations'. The letter approves the board's decision to demerge the company's energy business to Siemens Energy India (SEIL), a wholly owned subsidiary of Siemens

Heritage Foods' board of directors approves setting up a new ice cream manufacturing facility in Telangana with an estimated capex of Rs 204 crore.

Awfis Space Solutions launches a new centre in Gujarat International Finance Tec-City (GIFT City), Gandhinagar. The centre offers 30,221 sq ft and is located on the 26th floor in Gift One Tower.

Nifty IT drops over 3% as Morgan Stanley points out that macroeconomic risks, including a potential U.S. recession, could impact the sector. However, the brokerage also stated that while valuations are not inexpensive, they are not in the 'sell zone' either.

#MarketsWithMC | IT stocks see profit booking ahead of FOMC decision ????, Nifty IT dips 3% ????

Here's more on it ??https://t.co/rq5s4Qx4aW#Trading#StockMarket— Moneycontrol (@moneycontrolcom) September 18, 2024

Indian Hume Pipe Company announces plans to double the production capacity at its Walwa and Dhule factories in Maharashtra. The expansion in Walwa is expected to be completed by October 2024, and in Dhule by January 2025, requiring an investment of Rs 37.6 crore.

REC is rising as it signs a memorandum of understanding (MoU) with renewable energy (RE) developers for funding worth Rs 1.1 lakh crore for the next five years to develop solar and hybrid power projects.

Lupin signs a non-exclusive patent license agreement with Takeda Pharmaceutical to commercialize Vonoprazan Tablets in the Indian market. Lupin will market the drug as Lupivon in two strengths: 10 mg and 20 mg.

Zee Entertainment Enterprises denies Star India's claims regarding the termination of their cricket broadcasting agreement. Star India is pursuing $940 million (Rs 7,952.7 crore) in damages from the company in the London Court of International Arbitration.

India's Zee refutes Disney-owned Star's claims for termination of cricket broadcasting deal https://t.co/i2U3In4wjapic.twitter.com/1KcCrDjAll

— Reuters (@Reuters) September 18, 2024

Tata Power Renewable Energy (TPREL), a subsidiary of Tata Power, secures a letter of award (LoA) for a 400 MW Wind-Solar Hybrid project from Maharashtra State Electricity Distribution Company (MSEDCL). The project includes an initial 200 MW capacity, with an additional 200 MW under the Greenshoe option, making it the largest renewable energy project in Maharashtra for TPREL.

Tata Consultancy Services signs a two-year partnership deal with Golden Arches Development Corporation (GADC), the master franchise holder of McDonald's in the Philippines. This partnership aims to standardize and digitize the IT operations for over 760 McDonald’s restaurants in the Philippines.

NTPC's joint venture (JV) with Nuclear Power Corp of India (NPCIL) receives the Indian government's approval to set up four 700 MW nuclear power plants in Rajasthan.

Morgan Stanley maintains its 'Overweight' rating on Bajaj Finance with a target price of Rs 9,000. The brokerage anticipates gradual improvement in the company’s standalone financials. They also view the valuations as attractive in relation to return on equity (RoE) and earnings per share (EPS) growth, projecting a 19% upside from current levels.

#MarketsWithMC | ???? Bajaj Twins surge nearly 3% post Bajaj Housing stellar debut, Morgan Stanley's bullish call.

Here's more ??https://t.co/g4OkWChcZ1#BajajHousing#MorganStanley— Moneycontrol (@moneycontrolcom) September 18, 2024

Restaurant Brands Asia rises sharply after 1.1 crore share (2.1% stake), worth Rs 113 crore, reportedly change hands in a block deal at an average price of Rs 105 per share.

Indo National announces the divestment of its entire 51% stake in Kineco for Rs 220 crore. The company plans to invest the funds in new-age enterprises, aerospace, defence industries, and the FMCG sector.

Reliance Power surges to its 5% upper circuit as it fully settles its obligations as a guarantor for Vidarbha Industries Power (VIPL). This results in the release and discharge of the corporate guarantee, undertakings, and all related claims tied to VIPL's outstanding debt of Rs 3,872 crore.

In FY24, proceeds from dividends and share buyback for individual promoters and prominent business families in India surpassed the Government of India’s earnings from listed central public-sector undertakings (CPSUs) and multinationals' earnings from their Indian subsidiaries. Collectively, these promoters earned approximately Rs 1.1 trillion, a slight increase of 0.2% from the previous year.

In 2023-24, dividends and share buybacks by Indian promoters and business families surpassed the Govt of #India’s earnings from listed #CPSUs and multinationals' earnings from their listed Indian subsidiaries.#Finance#IndianEconomy#CorporateEarningshttps://t.co/mwP0vQnr55pic.twitter.com/UmxxVCichJ

— Business Standard (@bsindia) September 18, 2024

Hindalco Industries reportedly plans a capex of Rs 2,450 crore to set up a copper and e-waste recycling plant in Dahej and a copper tube manufacturing plant in Vadodara. The company expects a capex of Rs 2,000 crore for the Dahej plant with a capacity of 300-350 kilotonnes (KT) per annum, while the Vadodara plant has an estimated capex of Rs 450 crore with a capacity of 25,000 tonnes.

Dodona Holdings sells nearly 11 lakh shares (0.3% stake) in Trent, worth approximately Rs 803.2 crore, at average price of Rs 7,330 per share in a block deal. Siddharth Yog is the buyer in the transaction.

ICICI Securities retains its 'Buy' call on Gravita India with an upgraded target price of Rs 3,265 per share. This indicates a potential upside of 26.1%. The brokerage believes that the company is poised for medium-term growth owing to regulatory changes helping with the availability of scrap in the domestic market and its planned expansion in Europe. It expects the company's revenue to grow at a CAGR of 23.5% over FY25-26.

CRISIL notes that recent developments in Bangladesh have had a limited impact on India's trade, and future effects will depend on specific industry and sector nuances. However, prolonged disruptions could influence the revenue profiles and working capital cycles of certain export-oriented industries that rely on Bangladesh as a demand center or production hub.

Limited Impact of #Bangladesh's developments on #India's #FMCG, footwear & soft luggage sector: #CRISILhttps://t.co/4QWY5lgLmr

— Economic Times (@EconomicTimes) September 18, 2024

Suraj Estate Developers rises sharply as LIC Mutual Fund - Flexi Cap Fund buys 2.8 lakh shares (or a 0.6% stake) in the company, for Rs 21.5 crore at an average price of Rs 758.9 per share, in a block deal on Tuesday.

Honasa Consumer enters a partnership with the Ministry of Defence to distribute its products to the Canteen Stores Department (CSD) across India.

Ceigall India rises sharply as it bags an order worth Rs 1,299.2 crore after emerging as the lowest bidder at an auction held by the National Highway Authority of India (NHAI). The order is to construct a 4 to 6 lane Southern Ayodhya Bypass.

Inox Wind rises sharply as it receives a letter of intent (LoI) from IGREL Renewables to execute a 550 megawatt (MW) wind project. Inox Wind will supply, install, and commission the Wind Turbine Generators (WTGs) and provide multi-year operations and maintenance (O&M) services after commissioning.

Nifty 50 was trading at 25,394.20 (-24.4, -0.1%) , BSE Sensex was trading at 82,964.56 (-115.1, -0.1%) while the broader Nifty 500 was trading at 23,962.15 (-7.8, 0.0%)

Market breadth is in the green. Of the 1,945 stocks traded today, 1,055 were gainers and 835 were losers.

Riding High:

Largecap and midcap gainers today include Torrent Power Ltd. (1,932.90, 8.6%), Samvardhana Motherson International Ltd. (204.16, 4.7%) and Shriram Finance Ltd. (3,574.70, 4.4%).

Downers:

Largecap and midcap losers today include Oracle Financial Services Software Ltd. (11,259.50, -8.3%), MphasiS Ltd. (3,004.40, -5.5%) and Sona BLW Precision Forgings Ltd. (717.55, -3.7%).

Crowd Puller Stocks

20 stocks in BSE 500 are trading on high volumes today.

Top high volume gainers on BSE included Graphite India Ltd. (586.35, 9.3%), HEG Ltd. (2,290.50, 8.6%) and Torrent Power Ltd. (1,932.90, 8.6%).

Top high volume losers on BSE were MphasiS Ltd. (3,004.40, -5.5%) and Abbott India Ltd. (27,783.05, -3.7%).

Alkyl Amines Chemicals Ltd. (2,367.05, 6.7%) was trading at 33.6 times of weekly average. Fine Organic Industries Ltd. (5,435.95, 4.5%) and Balaji Amines Ltd. (2,345.35, 1.9%) were trading with volumes 16.2 and 10.8 times weekly average respectively on BSE at the time of posting this article.

BSE 500: highs, lows and moving averages

27 stocks made 52 week highs,

Stocks touching their year highs included - Bajaj Auto Ltd. (11,764.65, -1.6%), Bharti Airtel Ltd. (1,654.90, -0.4%) and Cholamandalam Investment & Finance Company Ltd. (1,590.15, 1.0%).

6 stocks climbed above their 200 day SMA including Graphite India Ltd. (586.35, 9.3%) and Varroc Engineering Ltd. (564.45, 4.2%). 9 stocks slipped below their 200 SMA including Indian Bank (505.05, -2.8%) and TV18 Broadcast Ltd. (47.56, -2.4%).