By Swapnil KarkareSingapore, a rich, tiny nation of just 5.8 million people, has long had many Indian connections. It is the only country outside Sri Lanka with Tamil as one of its official languages. The iconic Singaporean fish head curry was invented by a Kerala chef. Our trade links are old: traders on the Singapore island were buying spices, pearls and even elephants from Indian merchants in the 10th century.

In recent years, this chaddi-buddy relationship has intensified. One sign of this: Singapore Airlines now flies to more destinations in India than anywhere else in the world, with eight cities on its route. PM Modi’s visit to Singapore in early September pushed for a closer partnership around industries like semiconductors, healthcare and manufacturing.

Singapore now ranks second only to the US among India's foreign institutional investors (FIIs) - as of August 2024, total Indian assets of Singapore-based FIIs crossed Rs. 7.7 trillion, which includes debt, equity and hybrid instruments.

In this week's Analyticks:

Best friends?: India and Singapore are tying themselves closer together

Screener: Rising stocks with FIIs increasing their stakes in the past eight quarters

India and Singapore find more reasons to work together

In FY 2024, India exported goods worth $14 billion to Singapore, with petroleum and bituminous products accounting for half of it. Changing demand-supply dynamics in Europe, led India to divert its diesel and jet fuel to Singapore and Australia. This turn increased the share of fuel exports from 37% in FY10 to 49% in FY24.

On the imports side, India bought goods worth over $21 billion, with electrical machinery the biggest segment. From FY10-24, exports to Singapore grew 5% annually (CAGR) while imports rose by 9%, leaving India with a trade deficit of $7 billion in FY24. Singapore ranks sixth in India’s total trade (exports + imports) while India ranks twelfth in Singapore’s trade.

Foreign direct investments shift in Singapore's favour

The cumulative FDI into India from Mauritius, the top country, stands at $175 billion. Singapore is at $150 billion and surging fast. The declining attractiveness of Mauritius is clearing the way for Singapore to become the top foreign investor in India in a few years.

Mauritian investments tend to be 'foreign' in name only - many businesses register themselves in Mauritius and operate in India to dodge taxes. Mauritius’ tax haven status has made it a transit point rather than a true source of investment. The infamous 2007 share transfer case of Vodafone, which routed investments through Mauritius, cemented its reputation for tax avoidance. In response, India plugged loopholes in its treaty with Mauritius in April 2017.

In FY17 and FY18, Mauritius invested $15 billion in India each year. But from FY19 onwards, this has plummeted to an average of $8 billion. Singapore, on the other hand, invested $15 billion annually on average during the FY19-24 period, becoming the top investor based on annual inflows.

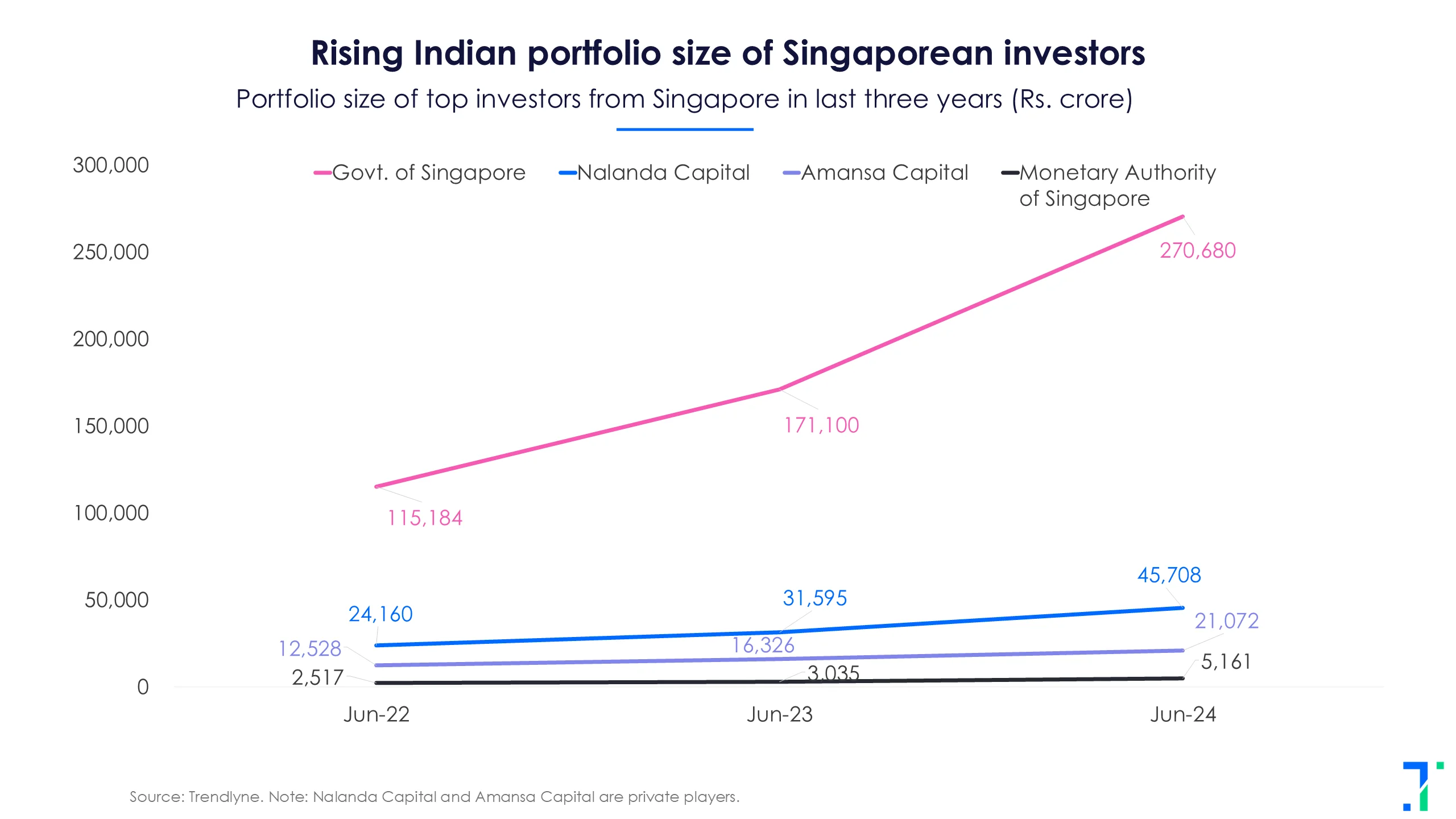

Singapore has become a major FII investor

Singapore isn’t just shining in FDI. It also ranks second only to the US among top foreign institutional investors (FII). Here as well, Mauritius used to dominate a decade ago, holding 27% of total FII assets in India as of March 2012. Today, its share is close to 5%.

Besides the Singapore Government, Nalanda Capital and Amansa Capital are the two major Singapore-based funds investing in India. Nalanda’s portfolio value as on June 2024 was $5 billion (Rs. 45k crore) and that of Amansa’s was $2.5 billion (Rs. 21k crore).

Which stocks are Singaporean investors buying?

Nalanda owns shares in 24 companies, and its top investments by holding value include Havells, AIA Engineering, Thermax, Page Industries, Supreme Industries, Info Edge, Berger Paints, MRF, Ratnamani Metals & Tubes, and Amara Raja Energy & Mobility.

Amansa has invested in 22 companies and top 10 constitutes Trent, SRF, Eicher Motors, Cyient, Bharat Forge, Sundram Fasteners, Intellect Design Arena, V-Mart, Poonawalla Fincorp, and Fortis Healthcare.

But Singapore’s role in India’s financial markets is beyond private wealth management firms or hedge funds. The government’s involvement is significant. It is the largest FII and the eighth-largest institutional investor in India.

The Government of Singapore’s portfolio value was close to $32 billion (Rs. 270k crore) as of June 2024. It has invested in 57 companies. Its top investments include Reliance Industries, HDFC Bank, ICICI Bank, Bajaj Finance, Bharti Airtel, L&T, Infosys, Shriram Finance, M&M and NTPC.

Apart from the government, which invests through GIC, a sovereign fund of Singapore, two other government agencies manage investments. They are the Monetary Authority of Singapore, the central bank, and Temasek Holdings.

The Monetary Authority of Singapore’s portfolio value was over $600 million (Rs. 5k crores). It has invested in 6 companies: Shriram Finance, Max Healthcare, Godrej Properties, Sona BLW Precision Forgings, Affle, and Sapphire Foods.

Temasek Holdings’ net portfolio value as of March 2024 was $20 billion. Its website and news sources suggest that it holds HDFC Bank, ICICI Bank, Manipal Health (unlisted), NSE India (unlisted), Schneider ElectricandZomato, to name a few. Last year, it had announced that it would invest $10 billion over the next three years.

Analysing the Government of Singapore's investments

The Singapore government’s Indian portfolio has favoured the Banking & Finance sector, making up one-third of its total investments. Other prominent sectors include Oil & Gas, Cement & Construction, Software and Auto.

Reliance Industries and HDFC Bank have the lion’s share in its portfolio – accounting for 10% each. However, the actual stakes are 1% in Reliance Industries and 2% in HDFC Bank. The highest stakes were in Samhi Hotels and Sapphire Foods, it holds 8% in these companies.

The Singapore government has increased its shareholding in Sapphire Foods, Max Healthcare, Sona BLW Precision Forgings, Bharti Airtel and M&M in the past year while reducing it in Petronet LNG, Phoenix Mills, Syngene International, Prestige Estates Projects and L&T.

In the last couple of quarters, the government has also added a few new names to its portfolio, like Data Patterns, Entero Healthcare Solutions, Timken, Apollo Hospitals, Indigo, etc. These changes reveal a preference towards healthcare, technology, and capital and intermediary goods.

More investments in the pipeline

Given its historically strong relationship and the recent investment roadshow in Singapore, India is at a sweet spot in receiving investments. A moneycontrol report notes that Singaporean companies have already committed investments over Rs. 5 trillion (~ $60 billion) in the coming years. The Indian High Commission in Singapore has been working on getting more investments in India's infrastructure, renewable energy, and advanced technology sectors.

It will be interesting to see if the sum of all these parts becomes something significant. As Rajat Verma, Head of Institutional Banking at DBS Bank suggests, this partnership could create an international shift, as the industry relationships deepen.

Screener: Rising stocks over the past year with increasing FII holding in the past eight quarters

Banking and IT stocks see the highest rise in FII holdings

As we enter the last couple of weeks of Q2FY25, we take a look at stocks that saw an increase in their foreign institutional investor (FII) holdings during the past two years. This screener shows stocks rising over the past year, where FIIs increased their stake over the past eight quarters.

The screener is dominated by stocks from the software & services, banking & finance, automobiles & auto components and general industrials sectors. Major stocks that appear in the screener are Zomato, 360 One Wam, Max Healthcare, PB Fintech, ITC, Computer Age Management Services, Sona BLW Precision Forgings and Max Financial Services.

Zomato’s FII holding increased the most, by 44.1 percentage points in the past eight quarters, while its stock price also surged by 163.7% over the past year. The Government of Singapore was the largest buyer, acquiring a 2.02% stake in this internet & software services company followed by Camas Investments (bought a 1.9% stake) and Canada Pension Plan Investment Board (bought a 1.3% stake). Public holding dropped significantly to 28.6% in June 2024, down from 84.6% in June 2022, suggesting that public investors are likely the primary sellers due to their reduced stake.

Max Healthcare saw its FII holding rise by 33.7 percentage points in the last two years, the stock has also surged by 62.9% over the past year. The Government of Singapore is the largest buyer in this case as well, acquiring over 6% stake. New World Fund Inc and Monetary Authority of Singapore also bought a 6% and 1.5% stake in this healthcare facilities stock. These shares were sold by public shareholders and DIIs, whose stakes declined from 6.6% to 3.9% and from 19.4% to 15.4%, respectively, between June 2022 and June 2024.

You can find some popular screeners here.