2024 looks to be a nail-biter of a year, with India's general election coming up. In fact, more than 50 nations are holding elections in 2024, with 4 billion people - half the world's population - voting. The results of elections in the US, India, the Eurozone and Russia will be closely watched.

Vladimir Putin is of course, likely to be re-elected in the Russian election. One would argue that Putin should be worried about the impact of 315,000 Russians dying in the Ukraine war, and a weak economy. But since people opposing Putin usually end up with jail terms or "fall" out of windows, he doesn't have much real competition.

In the US, opinion polls this early in the election cycle are usually inaccurate. But right now Donald Trump has the lead over Biden, despite the many legal cases he faces this year. In India, surveys suggest that PM Modi will be the voters’ choice.

Strategists at Goldman Sachs expect higher foreign inflows into India post elections:

The Modi-led government is using the Ayodhya temple inauguration to woo Hindu voters, and may also announce new benefits for rural votebanks in the upcoming budget. Rural voters could see a hike in minimum support prices (MSPs), or a boost in employment programs.

In India, the average return of the Nifty 50 one year before the elections is 29.1%, and one year after is 12% (averaged over the past five general elections).

Nifty50 has risen 20% on average in the six months before elections, over the past five general elections

But India’s runaway stock market needs to face up to slowing consumption. Lower capex by India Inc. compared to government spending, and slowing foreign direct investment have also increased uncertainty over market reaction in an election year.

In this week’s Analyticks:

- The election impact: How will the Indian market perform in an election year?

- Screener: Rising stocks that have announced result dates, with strong Forecaster estimates for revenue and EPS in Q3FY24

Let’s get into it.

Populist giveaways may not have a big impact on the stock market

Recent state elections have seen a range of populist moves, from free travel for women to interest waivers for agricultural loans. To lock in the rural vote, the Modi-led government may announce something additional this year, similar to the 2019 direct benefit transfer of Rs 6,000 per farmer per year.

Speculation is that the announcement could include free electricity for rural voters, or an increase in the size of subsidized agricultural loans (currently agricultural loans up to Rs 3 lakh have an interest subsidy of up to 4% per annum if promptly repaid).

The one thing common across pre-election budgets has been an increase in the minimum support price (MSP) of crops. The government typically increases MSPs for Rabi and Kharif crop just before the election. The National Rural Employment Guarantee Act (NREGA) has also increased its budgetary estimate pre-election in the past ten years.

One would expect these populist moves to push up the budgetary deficit for the economy, but this has not been true in the last decade. India has exceeded its budgetary estimates only four times in the past ten years (FY09, FY12, FY20 and FY21).

India’s actual revenue expenditure is less likely to shoot budgetary estimate in 2024

One reason is that any MSP increase puts more money in the hands of rural folks, boosting rural consumption. Food inflation might see a spike as a result. But if the inflation impact is not major, the overall benefits overshadow the downside.

Since government spending in rural areas has declined by 3% (April 23-November 23), the government may announce additional incentives for rural voters in the FY25 budget. The market could see a knee-jerk negative reaction to these populist moves. But in the long run, these announcements don't break the bank and usually deliver positive returns.

Cuts are coming: US Fed expected to cut rates in April, RBI in May

Interest rate cuts are expected across the globe this year. But the timing of interest rate cuts in India is still unclear.

According to Bloomberg and HSBC, the first round of interest rate cuts by the US Fed is expected to be around April-May, and big cuts are likely only after June. The interest rate cuts will be absorbed by the consumer just before the US presidential election in November. This will be followed by rate cuts by the European Central Bank as the European Parliament heads into elections in November.

The RBI usually cuts Indian interest rates after rate cuts by the US Fed. With India’s general election planned for May 2024, it will be interesting to see if RBI jumps the gun and cuts interest rates pre-election and before the Fed. But Morgan Stanley expects RBI to cut interest rates only in May or June.

Interest rate cuts just before elections are considered a populist move. Will this government risk pushing the RBI to do this, opening the door to higher inflation? Investors will be watching this closely.

India's market valuations don’t match reality

The revenue and profit growth of Nifty 50 companies have seen a mismatch in the past couple of quarters. Revenue growth has been moderate, while profits have been strong. A report by Sharekhan expects Nifty 50 firms' revenue to increase by 6% YoY in Q3FY24, while profits are expected to surge 11% YoY.

The tepid growth in revenues indicates slowing consumption and the impact of the global slowdown on India's economy. Companies have battled this with premiumization of products, along with a cut-down in capex spending, which has helped profits grow.

The growth in profits has pushed the Nifty 50 to new highs, with investors ignoring the underlying problem of weaker revenues. Indian indices are trading at expensive valuations compared to historical averages.

India’s Sensex is trading at a 27% premium compared to its historical average

India’s stock market valuations are among the highest in the world right now. The Sensex is currently trading at 24 PE, a premium of 27% from its 10-year average. Most other emerging economies' benchmark indices are trading below their historical averages (except for Taiwan and Hong Kong).

The recent runup in Indian indices could limit the positive reaction from the stock market, if a single party gets a clear win. The optimism with a single party mandate could also be subdued with a Modi win, as the Modi led government has now been in power for the past 10 years. However, a hung assembly could definitely spook markets.

According to Chris Wood, the global head of equity strategy at Jefferies LLC, Nifty 50 is expected to see a 25% correction if the Modi-led government fails to get a clear mandate. Markets are mostly pricing in a Modi or Modi-coalition victory, so there is not much remaining upside for that outcome. A more confusing election result would be a different story.

Screener: Rising stocks have announced their result dates with strong Forecaster estimates for revenue and EPS in Q3FY24

Craftsman Auto leads in Forecaster estimates for revenue YoY growth in Q3

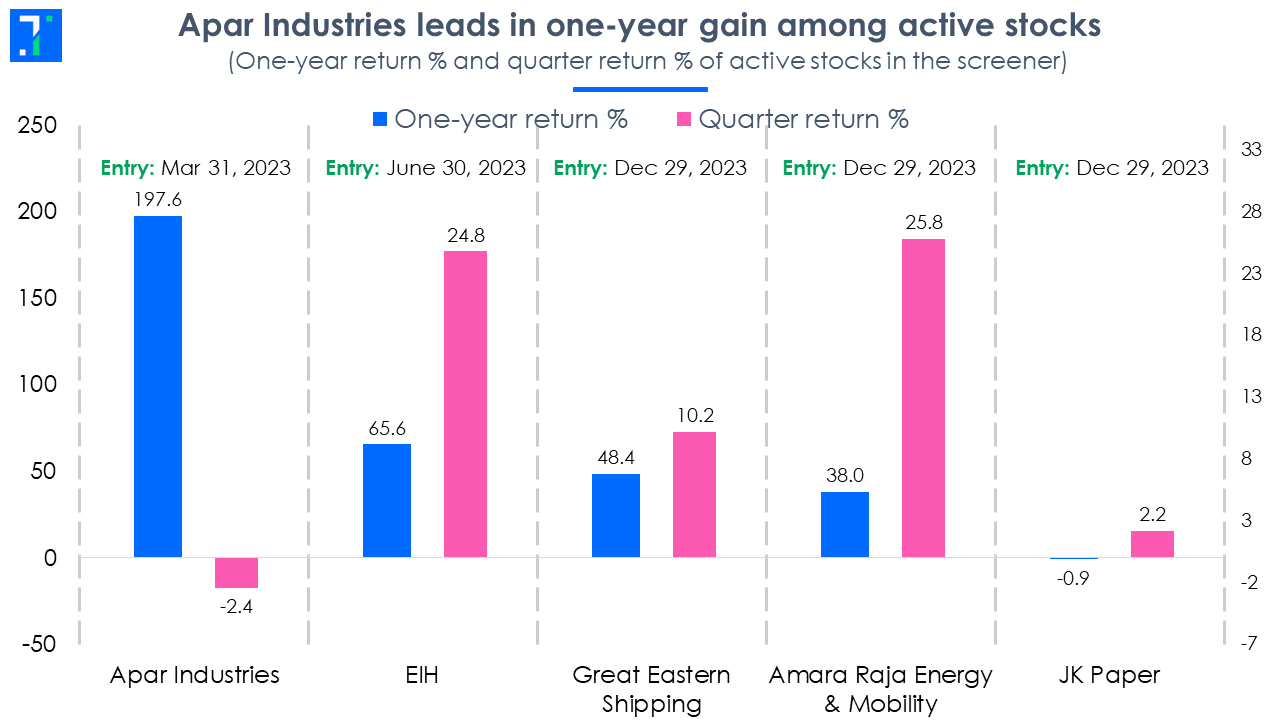

As the result season begins, we take a look at stocks that have risen the most over the past year and quarter, with high Forecaster estimates for growth in Q3FY24. This screener shows rising stocks over the past quarter and year which have announced their result dates. These stocks also have high Forecaster growth in revenue and EPS in Q3FY24, and 'Strong Buy' or 'Buy' broker consensus rating.

The screener is dominated by stocks from the automobiles & auto components, banking & finance and software & services sectors. Major stocks that appear in the screener are Craftsman Automation, CreditAccess Grameen, Nippon Life India Asset Management, Endurance Technologies, Tata Motors, Equitas Small Finance Bank, Intellect Design Arena and Motherson Sumi Wiring India.

Craftsman Automation has the highest Forecaster estimates for YoY revenue growth at 55.7% in Q3FY24. The stock has risen by 11.2% over the past quarter and 45.8% in the past year. According to Motilal Oswal Financial Services, growth in the aluminium products segment and in the passenger vehicles’ original equipment manufacturing segment will drive revenue growth for this auto equipment manufacturer.

For CreditAccess Grameen, Trendlyne’s Forecaster expects its revenue to grow 42.5% YoY in Q3FY24. The stock rose by 22.3% over the past quarter, while it gained 92.9% in the past year. HDFC Securities believes that the NBFC is delivering strong profitability and revenue growth in a volatile asset class which will help in improving its cost of funds in the medium term.

You can find more screeners here.

Signing off,

The Trendlyne Team