As the Indian equity markets hit record highs in December, over 42 lakh demat accounts were opened in that month alone, marking a 50% increase from November 2023. Markets also started the new year on a positive note, with the Nifty 50 hitting the 22,000 mark on January 15.

In any market, investors seek alpha, aiming to outperform benchmark indices.

One way to achieve this is by using screeners that filter stocks based on multiple performance metrics. The DVM score, for example, looks at management quality, financial health, stock valuation, and several technical indicators to identify high-scoring stocks. Using these scores, investors can shortlist higher-quality stocks for investment.

In this edition of Chart of the Week, we analyse the ‘DVM - High Performing, Highly Durable Companies’ subscriber screener. This screener selects Nifty 500 stocks with strong financial durability, reasonable valuation, and positive momentum scores. It is optimised to select the top five stocks with the highest durability scores, and cycles the stocks quarterly

The screener backtest ran from March 2013 to December 2023, and evaluates the screener’s quarterly performance against the Nifty 500 benchmark. It delivered a cumulative return of 2,300.1%. In comparison, the Nifty 500 was up by 327.8% over the same period, helping the screener outperform the benchmark by 1,972.3 percentage points.

Despite market volatility, the Nifty 500 has grown at a CAGR of 15.7% over the decade. However, Trendlyne’s DVM screener delivered returns at a CAGR of 34%, outperforming the benchmark by 18.3 percentage points during the same timeframe. The screener’s average quarterly return was just over 9.1%.

The heat map compares the performance of the DVM screener stocks with the Nifty 500 over the last decade. A closer look at the period analysis reveals that the screener has outperformed the benchmark in 30 out of 43 quarters.

This strategy saw its maximum drawdown of 30.5% in Q1FY23. Maximum drawdown indicates the biggest observed loss from a portfolio’s peak to its lowest point before reaching a new peak. This automated strategy does not have a stop loss set, so the drawdowns show the maximum loss potential of this approach. Introducing a stop loss could reduce periods of negative returns and lower maximum drawdowns.

Jyothi Labs and Godfrey Phillips achieve the highest returns over the past two years

Jyothy Labs emerges as the best performer in the DVM screener over the past two years

Personal products major Jyothy Labs entered the screener in June 2023 and delivered 67% returns in three months before its exit. Godfrey Phillips remained in the screener for six months, delivering 58.5% returns.

Jewellery maker Kalyan Jewellers and Apar Industries, despite being in the screener for just three months, achieved significant gains. Both stocks had high durability scores (above 75) during the period, with Kalyan gaining 54.7% and Apar Industries 40.1%. Zydus Lifesciences also gained 50.7% returns during its nine-month stay in the screener.

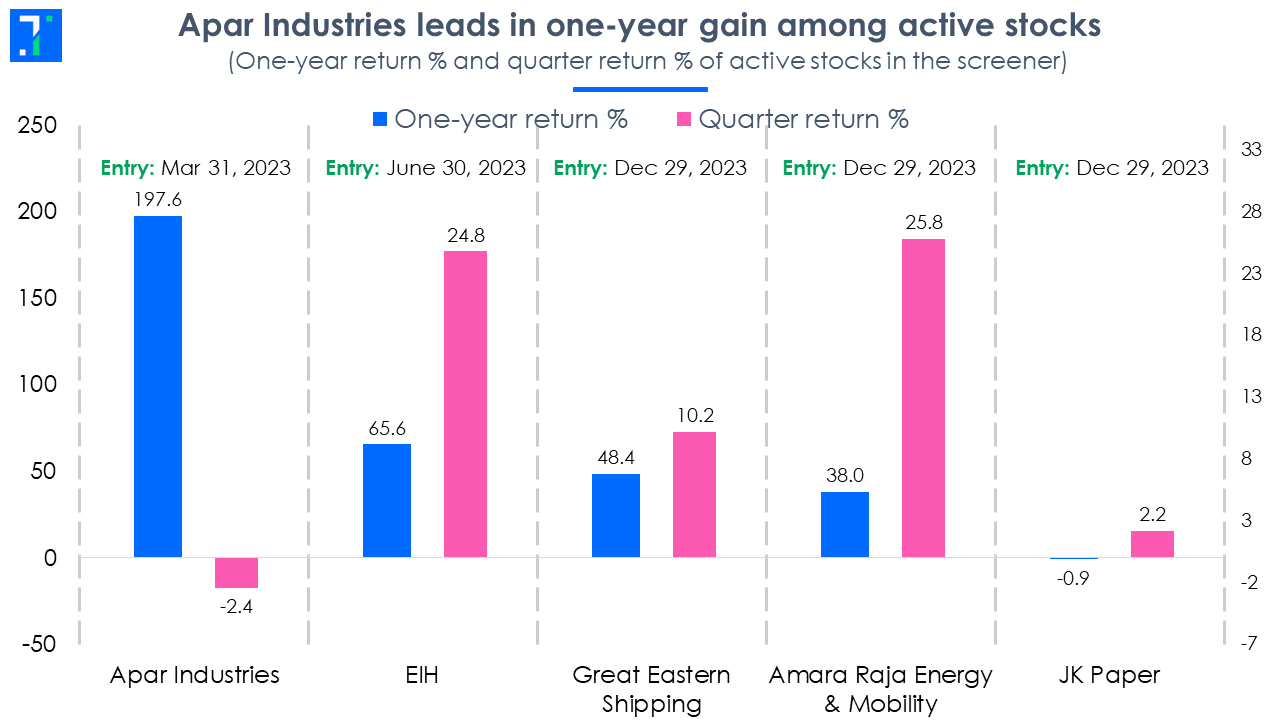

Apar Industries and EIH see the highest one-year rise among the active stocks in the screener

Apar Industries leads in one-year gain among active stocks

Let us now look at the individual performance of active stocks in the screener as of December 2023. Apar Industries entered the screener in March 2023 with a strong durability score of 95. This electrical equipment manufacturer has risen by 197.6% in the last year, making it the top-performer. EIH from the hotels sector follows with a 65.6% rise in the same period, as increased travel post-COVID raised occupancy rates to 74% in 2023 from 65.6% in 2020.

Other active stocks like Great Eastern Shipping and Amara Raja Energy and Mobility have gained 48.4% and 38% respectively in the past year. Paper and paper products company JK Paper has high durability and valuation scores but posted muted price performance over the past year and quarter.

Although the screener strategy has significantly outperformed the benchmark in the past decade, it underperformed in the latest quarter by 540 bps, partly because of the high rise of the Nifty 500 index in Q3FY24. However, the returns were still positive (+6.9%). It is important to note that this comes after the strategy outperformed the Nifty 500 by 27.4 percentage points in Q2FY24.

Investors should regularly review their portfolios and adjust them according to the screener’s stock entries and exits. It is also important to note that past returns don't guarantee future results.