Nifty 50 closed at 23,213.20 (37.2, 0.2%), BSE Sensex closed at 76,724.08 (224.5, 0.3%) while the broader Nifty 500 closed at 21,551.20 (70.2, 0.3%). Market breadth is balanced. Of the 2,392 stocks traded today, 1,220 were on the uptick, and 1,128 were down.

Indian indices closed in the green, with the benchmark Nifty 50 index closing at 23,213.2 points. The Indian volatility index, Nifty VIX, declined 1.1% and closed at 15.3 points. HDFC AMC’s Q3FY25 net profit grew by 31% YoY to Rs 641.5 crore, while revenue increased by 26.2% YoY, helped by higher assets under management (AUM).

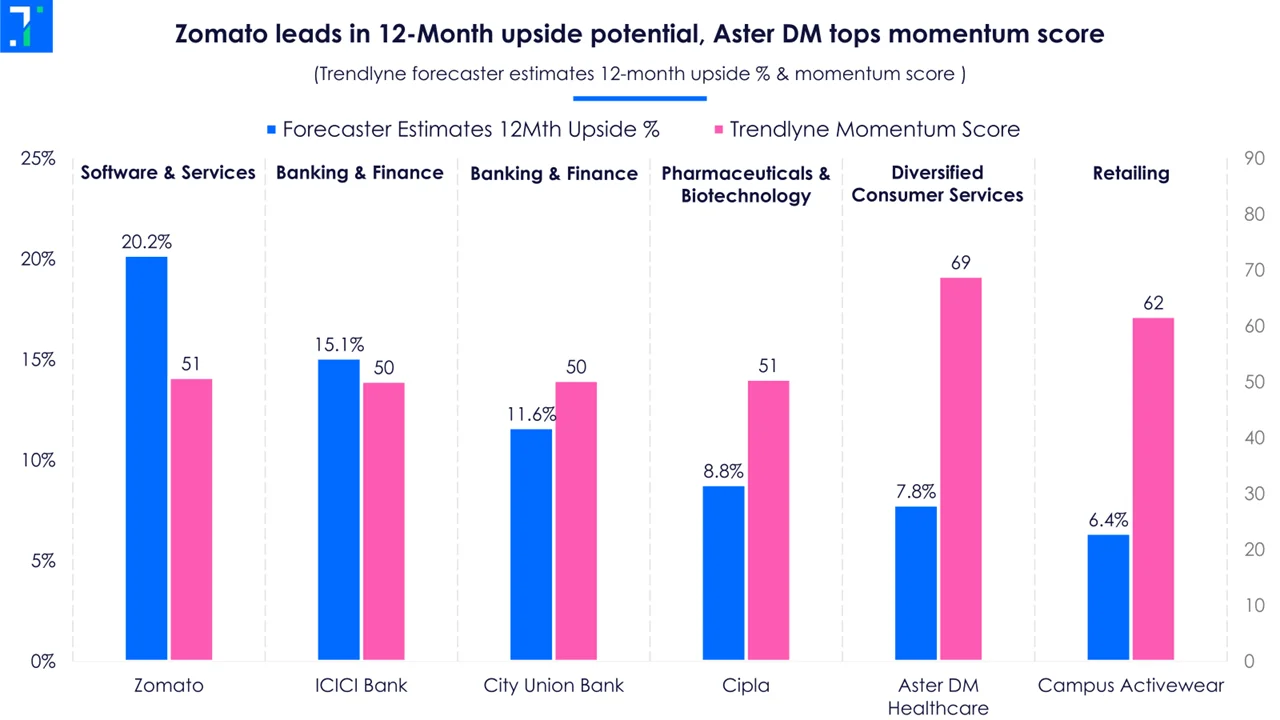

Nifty Smallcap 100 and Nifty Midcap 100 closed in the green, following the benchmark index. S&P BSE Utilities and BSE Power were among the top index gainers today. According to Trendlyne’s Sector dashboard, Retailing emerged as the best-performing sector of the day, with a rise of 2.1%.

Asian indices closed mixed, while European indices are trading in the green, with an exception of Russia’s MOEX & RTSI index. US index futures traded in the green, indicating a positive start to the trading session. Brent crude oil futures are trading in the green. Barclays notes that the S&P 500’s growth in Q4 earnings season depends on technology stocks. It observes that downward revisions for sectors outside tech are 300bps higher than average, signaling bearish sentiment ahead of the reporting season.

Relative strength index (RSI) indicates that PTC Industries is in the overbought zone.

NESCO rises as it wins a contract from National Highways Logistics Management to develop, operate, and maintain wayside amenities on the Raipur-Visakhapatnam Expressway. The project is expected to cost Rs 200 crore, with an estimated annual revenue of Rs 300 crore from year four of operations.

Alembic Pharmaceutical receives final approval from the US FDA for its abbreviated new drug application (ANDA) for Brexpiprazole tablets. The drug is a therapeutic equivalent to Otsuka Pharmaceutical's reference listed drug (RLD), Rexulti tablets, used to treat major depressive disorder (MDD) and schizophrenia. It has an estimated market size of $2 billion for the year ending September 2024.

Maharashtra Scooters is rising as its net profit surges 3.3X YoY to Rs 3.3 crore in Q3FY25, helped by lower raw material and employee benefit expenses. However, revenue falls by 9.1% YoY to Rs 5.8 crore due to a reduction in the manufacturing segment. The company appears in a screener of stocks where mutual funds increased their holding in the past quarter.

January crude oil futures reach Rs 6,729 on Multi Commodity Exchange (MCX) during the initial hour of trading after a weekly report by the industry body American Petroleum Institute (API) indicated a decline in inventories by 2.6 million barrels in the US for the week ending January 10.

#CrudeOil#futures traded higher on Wednesday morning after a weekly report by the industry body American Petroleum Institute (API) indicated a decline in inventories in the US for the week ending January 10.https://t.co/YdaEk2G66y

— businessline (@businessline) January 15, 2025

Network18 Media & Investments plunges to its 52-week low of Rs 58.2 per share as its Q3FY25 net loss expands to Rs 1,435.5 crore compared to Rs 58.8 crore in Q3FY24 due to higher finance costs. Revenue declines by 25.3% YoY to Rs 1,442.6 crore, led by lower demand during the festive period and reduced advertising volumes. It shows up in a screener of stocks with high interest payments compared to earnings.

Premier Energies rises sharply as three subsidiaries secure orders worth Rs 1,460 crore for solar PV cells and modules. These include Rs 1,041 crore to supply modules and Rs 419 crore for cells, starting May 2025.

NBCC rises sharply as it secures orders worth Rs 405 crore, including projects for Delhi University's Hindu College, Fakir Mohan University in Odisha, and Maharaja Sriram Chandra University in Mayurbhanj.

BofA Securities upgrades Maruti Suzuki India to a 'Buy' rating with a target price of Rs 14,000. The brokerage highlights that the company started its EV journey with the launch of the 'e-Vitara,' and the Toyota alliance has fueled growth, with combined exports now at 20% of volume. It expects a 7.5% volume CAGR and over 10% revenue CAGR for FY25-27.

#BrokerageRadar | @BofA_News upgrades Maruti to Buy with a Target Price of ?14,000. pic.twitter.com/tpKE2cKH4n

— ET NOW (@ETNOWlive) January 15, 2025

J Kumar Infraprojects is rising as it bags an order worth Rs 1,073.4 crore from NBCC (India) to develop Silicon City Phase-IV Group housing in Sector 76, Noida. The project will be undertaken on an engineering, procurement & construction (EPC) basis, with operations and maintenance for two years.

HDFC Asset Management rises sharply as its Q3FY25 net profit grows by 31% YoY to Rs 641.5 crore, beating Forecaster estimates by 7.3%. Revenue increases by 26.2% YoY, helped by higher assets under management (AUM). It features in a screener of stocks with rising net cash flow and cash from operating activities.

Quadrant Future Tek surges to its all-time high of Rs 532.8 per share as it appoints Mohit Vohra and Amit Kumar Jain as its Managing Director (MD) and Chief Executive Officer (CEO), respectively.

Reports suggest that the Adani Group is in advanced talks with Dubai-based Emaar Properties to acquire a majority stake in its Indian subsidiary, Emaar India, for an estimated Rs 4,000-5,000 crore. The deal will likely involve the acquisition of 70-100% ownership in Emaar India, primarily through Adani Realty, an unlisted entity within the Adani Group.

Adani Group in advanced talks to acquire majority stake in Emaar India for Rs 5,000 cr: Report

More details here????https://t.co/2B0CA0wgKD#AdaniGroup— Moneycontrol (@moneycontrolcom) January 15, 2025

Indian Railway Finance Corp is rising as it emerges as the lowest bidder to finance Rs 3,167 crore for the Banhardih Coal Block development in Jharkhand. The project will be undertaken by Patratu Vidyut Utpadan Nigam, a joint venture (JV) between NTPC and Jharkhand Bijli Vitran Nigam.

Sula Vineyards' revenue declines marginally by 0.7% YoY to Rs 217.3 crore in Q3FY25. However, wine tourism revenue grows 11.5% YoY. It features in a screener of stocks with rising net cash flow and cash from operating activities.

Aether Industries rises as it amends its supply agreement with Baker Hughes. The deal finalizes volume and pricing for two products exclusively manufactured by its subsidiary, Aether Specialty Chemicals.

-

According to Trendlyne’s shareholding data, mutual funds substantially raised their stake in One 97 Communications (Paytm) during Q3FY25, reaching an all-time high. By the end of December 2024, 27 mutual funds held an 11.2% stake in Paytm, amounting to 7.1 crore shares. This represents a significant increase from the 7.9% stake held in Q2FY25.

#MutualFunds significantly increased their stake in #One97Communications, the parent company of #Paytm, during the third quarter of the current fiscal year (Q3FY25) to an all-time high level.https://t.co/XJE99wE085

— Mint (@livemint) January 15, 2025

Delta Corp's revenue rises marginally by 0.4% YoY to Rs 235.3 crore in Q3FY25. Net profit grows 3.6% YoY to Rs 35.7 crore, helped by lower raw material and depreciation & amortization expenses. The company appears in a screener of stocks with net profit increasing over the past two quarters.

Welspun Corp rises sharply as it signs a memorandum of understanding (MoU) with Saudi Aramco to set up a 3.5 lakh MT per annum longitudinal submerged arc welding (LSAW) pipe manufacturing unit in Saudi Arabia.

Shoppers Stop rises sharply as its revenue rises 11.5% YoY to Rs 1,379.5 crore in Q3FY25. Net profit surges 41.7% YoY to Rs 52.2 crore, helped by inventory destocking. The company features in a screener of stocks with increasing net profit and profit margin (QoQ).

Nuvama Research expects FTSE to raise Adani Wilmar's weight in the index during its rebalancing today, following the offer for sale by its promoter. This could result in passive inflows of $25 million (approximately Rs 206 crore), equivalent to 7.8 million shares or 1.7 days of trading impact. The research highlights that trading volume mainly drives such events, not just price movements.

Following Adani Wilmar’s offer for sale by its promoter, FTSE is expected to increase its weight in the index in its rejig today, that could lead to $25 million of passive inflows, Nuvama Research stated.https://t.co/fz6FKE6uaJ

— businessline (@businessline) January 15, 2025

Aditya Birla Fashion and Retail's board of directors approves raising Rs 2,400 crore through a qualified institutional placement (QIP) and a preferential issue of 8.1 crore shares. The board sets the issue price at Rs 272.4 for the QIP and Rs 317.5 for the preferential issue.

Adani Green Energy rises sharply as it expands its operational renewable capacity to 11,666.1 MW. This follows the commissioning of a 57.2 MW wind power project in Gujarat under its wind-solar hybrid initiative, operational from January 15.

Angel One is rising as its net profit grows 8.1% YoY to Rs 281.5 crore in Q3FY25, driven by a reduction in fees & commission expenses. Revenue increases 19.1% YoY to Rs 1,263.8 crore, led by improvements in the active client base, number of orders, and average daily turnover (ADTO). It appears in a screener of stocks with a decrease in provisions in recent results.

HCL Technologies is rising as its Q3FY25 net profit grows 8.4% QoQ to Rs 4,591 crore, beating Forecaster estimates by 0.3%. Revenue increases 3.6% QoQ to Rs 30,367 crore, helped by improvements in the IT & business services, engineering & R&D services, and HCL Software segments. It features in a screener of stocks near their 52-week highs with significant volumes.

Markets are up today morning. Nifty 50 was trading at 23,225.45 (49.4, 0.2%), BSE Sensex was trading at 76,882.06 (382.4, 0.5%) while the broader Nifty 500 was trading at 21,536.80 (55.8, 0.3%).

Market breadth is highly positive. Of the 1,918 stocks traded today, 1,426 were gainers and 449 were losers.

Riding High:

Largecap and midcap gainers today include Thermax Ltd. (4,014.90, 7.5%), Phoenix Mills Ltd. (1,656.90, 5.5%) and FSN E-Commerce Ventures Ltd. (172.77, 4.8%).

Downers:

Largecap and midcap losers today include Central Bank of India (51.32, -7.3%), Indian Overseas Bank (49.91, -7.2%) and UCO Bank (42.41, -6.3%).

Crowd Puller Stocks

23 stocks in BSE 500 are trading on high volumes today.

Top high volume gainers on BSE included Newgen Software Technologies Ltd. (1,755.90, 11.5%), Devyani International Ltd. (193.29, 8.4%) and Alok Industries Ltd. (20.88, 8.1%).

Top high volume losers on BSE were Central Bank of India (51.32, -7.3%), Cello World Ltd. (669, -2.3%) and Birla Corporation Ltd. (1,155.20, -1.8%).

Vardhman Textiles Ltd. (474.80, 3.0%) was trading at 51.5 times of weekly average. Shoppers Stop Ltd. (625.10, 0.8%) and Welspun Living Ltd. (150.99, 2.7%) were trading with volumes 17.3 and 13.9 times weekly average respectively on BSE at the time of posting this article.

BSE 500: highs, lows and moving averages

1 stock took off, crossing 52 week highs, while 9 stocks hit their 52 week lows.

Stock touching their year highs included - Newgen Software Technologies Ltd. (1,755.90, 11.5%).

Stocks making new 52 weeks lows included - Asian Paints Ltd. (2,229.70, -0.5%) and Kansai Nerolac Paints Ltd. (243, -0.2%).

25 stocks climbed above their 200 day SMA including Phoenix Mills Ltd. (1,656.90, 5.5%) and Zomato Ltd. (243.90, 4.4%). 10 stocks slipped below their 200 SMA including Kalyan Jewellers India Ltd. (555.10, -6.9%) and Bajaj Finserv Ltd. (1,671.65, -2.4%).