1. Multi Commodity Exchange of India:

This capital markets company has risen 6.5% over the past week after receiving approval from SEBI to launch electricity derivatives. Multi Commodity Exchange (MCX) offers online trading in commodity futures such as gold, crude oil, base metals, and options, along with data services.

The electricity derivatives contracts will allow power generators, distribution companies and large consumers to hedge against power price fluctuations and manage risks more effectively. The new revenue stream and increasing trading volumes will benefit MCX.

In FY25, the average daily turnover (ADT) of futures and options on MCX doubled to Rs 2.2 lakh crore. The ADT for commodity futures alone rose 38%. Net profit surged 574% to Rs 560 crore, while revenue grew 59.3%. Gold prices have climbed 33% since April 2024, prompting greater investor and institutional participation in gold futures, which boosted MCX’s fee-based revenue. Trading in silver, energy, and agri-commodities also picked up due to sharp price movements.

Praveena Rai, CEO & MD,noted that MCX is ready with index options (contracts based on commodity indices) and is awaiting regulatory approvals. She mentioned that since the launch of gold options as monthly contracts, there has been a strong uptick in turnover. Rai added, “Between our indices and new products such as electricity, we see significant growth in the coming time,” noting that options are generally easier for retail participants to understand than futures and may gradually shift trading volumes toward options due to lower margin requirements.

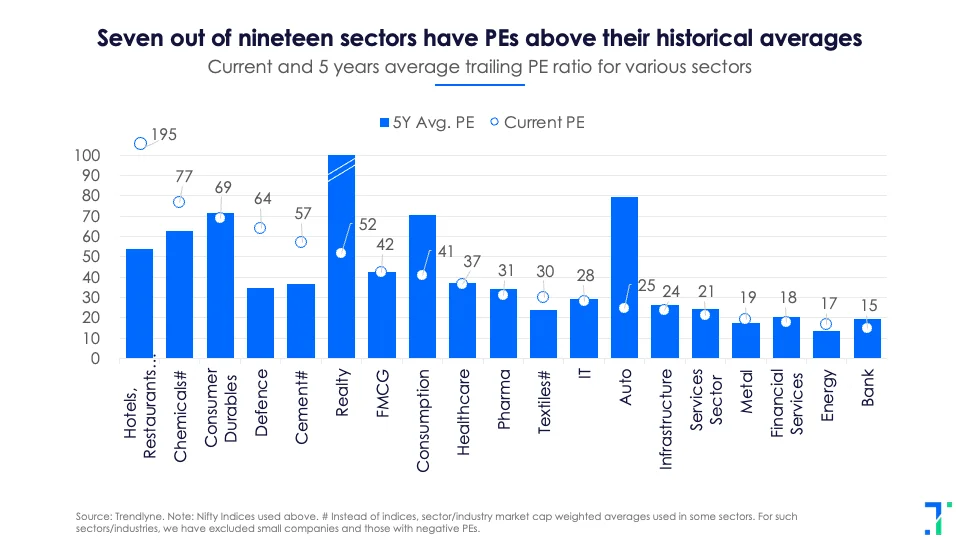

MCX is currently undervalued based on both its current PE and future earnings estimates. However, it appears in a screener of stocks with PE higher than the industry average. The stock has surged 99.2% over the past year.

2. Welspun Living:

This textiles player rose by 5% on June 5 after Jefferies initiated coverage with a ‘Buy’ rating and target price of Rs 185. The brokerage sees Welspun as a key beneficiary of India’s potential FTAs (Free Trade Agreements) with the US and EU, similar to the one with the UK. This is the highest target in the consensus – the average target from analysts on Welspun Living, according to Trendlyne’s Forecaster, is Rs 176.

For Welspun Living, the US is its largest market, contributing over 60% of its revenue. Its key clients include Costco and Walmart. While near-term volatility from US reciprocal tariffs is a concern, the company seems unperturbed – it has reduced its export share to the US, bringing it down from 80% to 60–65%. It has also been expanding its footprint in the UK, EU, GCC (Gulf Cooperation Council) countries, Japan, Australia, and New Zealand.

In FY25, the textile company’s revenue grew around 9% to Rs 10,545.1 crore. EBITDA margins stood at 13.6%. Commenting on the outlook, Dipali Goenka, the MD & CEO, said, “While we’ve held back our guidance for FY26 due to ongoing macro and tariff-related headwinds, we remain confident of achieving our revenue target of Rs 15,000 crore and EBITDA margins at 15–16% by FY27. Our core business remains strong, and we expect continued momentum in emerging segments”. During the year, Welspun’s emerging businesses (including domestic consumer, branded products, advanced textiles, and flooring) contributed approx 30% of total revenue.

Jefferies flags near-term risks due to tariff uncertainty in the US. However, it remains optimistic and notes that Welspun has diversified into new product categories and is building a branded business. It believes Welspun is well-positioned to manage tariff-related pressures. The company ranks high on Trendlyne’s Checklist, scoring 56.5.

3. Jindal Saw:

This steel pipe manufacturer surged 11% over the past week after its board approved $118 million (~Rs 1,009 crore) expansion plans in the Middle East. The investment includes a new manufacturing facility in the United Arab Emirates with a steel pipe capacity of over 3 lakh tonnes per annum, along with two joint ventures in Saudi Arabia, also focused on steel pipe production.

With this expansion, Jindal Saw aims to strengthen its presence in the GCC (Arab states of the Gulf), focusing on the oil and gas value chain. Management stated that establishing a facility within the region allows the company to leverage local “in-country value” incentives, an advantage that helps it become a preferred supplier.

The announcement comes amid plateauing performance in FY25. Revenue growth remained flat in FY25 and missed Forecaster estimates by 1.6%. Management attributed this to “not enough budgetary allocation” to the Jal Jeevan Mission, as it was an election year, which slowed down order inflows. “It’s an anomaly,” said Neeraj Kumar, Group CEO and Director, referring to the decline in sales in Q4. Net profit was slightly higher but fell 12% short of estimates due to a deferred tax expense of over Rs 250 crore.

Despite 25% of sales coming from exports, the company has minimal direct exposure to US tariffs. “The indirect impact is stability in commodity prices, because China will have to make its adjustments,” Kumar added. Management highlights that while new capacity in the Middle East may temporarily dent export volumes, growing domestic demand will likely absorb the shortfall.

Three analysts' consensus recommendation on Jindal Saw is ‘Strong Buy.’ Based on analyst estimates, Trendlyne’s Forecaster projects an upside of 65%. The P/E buy-sell zone suggests that the stock is trading in the Neutral Zone.

4. Hyundai Motor India (HMIL):

This cars & utility vehicles company rose by 5.8% over the past week. It reported a 1.7% decline in revenue with net profit falling 6.9% in FY25 due to weak demand and high competitive pressures. It marginally surpassed the Forecaster net profit estimate by 3.7% led by an improved mix in both domestic & exports and price hikes in 2025. The company appears in a screener of companies with zero promoter pledges.

On June 2nd, the company announced total May sales of 58,701 units. This included 43,861 domestic sales (down 11% MoM) and 14,840 export units. Commenting on monthly sales, Tarun Garg, Whole-time Director and COO of HMIL, said, “May is a month of our routine week-long biannual maintenance shutdown at our Chennai manufacturing facility, which affected a few critical models.”

Society of Indian Automobile Manufacturers (SIAM) projects a 2% growth for passenger vehicles in FY26 and the company’s MD, Unsoo Kim aims to be in line with the industry. He highlighted the company’s target to launch 26 products (combination of new and refreshes) by FY30, of which 20 would be Internal Combustion Engine (ICE) and six would be EVs.

KS Hariharan, Head-Investor Relations of HMIL, said, “ We're targeting 7-8% export growth and a Rs 7,000 crore capital expenditure in FY26. Of that capex, 40% is allocated to the new Pune plant and 25% to new product development.”

To address concerns about potential rare earth magnet supply restrictions by China, the company reportedly has planned to tap into its parent, Hyundai Motor Co.'s global supply network. It remains cautious but believes its current inventory is sufficient to prevent production disruptions through year-end.

Motilal Oswal maintains a ‘Buy’ rating on HMIL, with a higher target price of Rs 2,137. The brokerage believes that the company will deliver 7% volume CAGR over FY26-27. However it also believes that start-up costs of the new Pune plant will impact earnings in the near term and normalize in FY27. The brokerage has raised its FY26 EPS estimate by 1%, while it has increased FY27 EPS by 7%.

5. Dr. Reddy's Laboratories:

Thispharma company has surged 5.6% over the past week after announcing itscollaboration with Iceland-based biotech company Alvotech to develop a biosimilar of Keytruda (pembrolizumab) for global markets. Keytruda, one of the world’s top-selling cancer drugs, is used to treat various cancers including lung and skin, and recorded global sales of $29.5 billion in 2024.

This collaborationsupports Dr. Reddy’s entry into immuno-oncology and strengthens its oncology pipeline as it tries to reduce reliance on generic Revlimid (gRevlimid).

InQ4FY25, revenue rose 19.9% YoY to Rs 8,528 crore, with North America generics contributing Rs 3,570 crore and revenue in Europe nearly doubled YoY due to the Nicotine Replacement Therapy (NRT) acquisition, which added smoking cessation products like patches and gums to its portfolio. Its net profit increased 21.6% YoY to Rs 1,593.3 crore, beating Forecaster estimates by 10% during the quarter.

ForFY25 the company’s revenue grew 16.7% to 33,741.2 crore, driven by the NRT acquisition and strong growth in the generics business across major markets such as North America, India, and Russia. Commenting on FY26, CEO Erez Israelisaid, “You are going to see similar growth overall in next year. This year, we grew ~16%. That kind of range of growth you are going to see also in FY26.”

The company isfacing pressure in its US business, with gRevlimid set to lose market exclusivity in January 2026. The drug contributed around 35-40% of US revenue in FY25. Analysts at Nuvama and Citi havewarned that this could lead to a drop in US revenue if not offset. To manage this risk, the company is focusing on semaglutide, a diabetes and weight-loss drug with strong global demand. Israelisaid, “We are gearing up to launch Semaglutide during the calendar '26”. Initial launches are planned in Canada, Brazil, and India, with a US launch likely around 2031-32.

However, the Delhi High Court hasbarred the company from selling semaglutide in India following a patent dispute withNovo Nordisk. While Dr. Reddy’s has started manufacturing the drug, currently it is allowed to export to markets where Novo Nordisk lacks patent protection. The company canbegin selling in India after the patent expires in January 2026.

HSBCupgrades its rating to "Buy" from "Hold" and also raises target price to Rs1,445, citing strong upside from Semaglutide. The brokerage expects semaglutide sales to reach $280 million by FY27, led by Canada, with a best-case potential of $500 million.

Trendlyne's analysts identify stocks that are seeing interesting price movements, analyst calls, or new developments. These are not buy recommendations