Nifty 50 closed at 24,619.35 (132.0, 0.5%), BSE Sensex closed at 80,539.91 (304.3, 0.4%) while the broader Nifty 500 closed at 22,698.10 (129.5, 0.6%). Market breadth is in the green. Of the 2,502 stocks traded today, 1,333 were on the uptick, and 1,121 were down.

Indian indices closed higher after rising in the afternoon session. The Indian volatility index, Nifty VIX, fell 0.8% and closed at 12.1 points. One97 Communications (Paytm) closed 3.1% higher after its unit, Paytm Payments Services, received RBI’s approval to operate as an online payment aggregator.

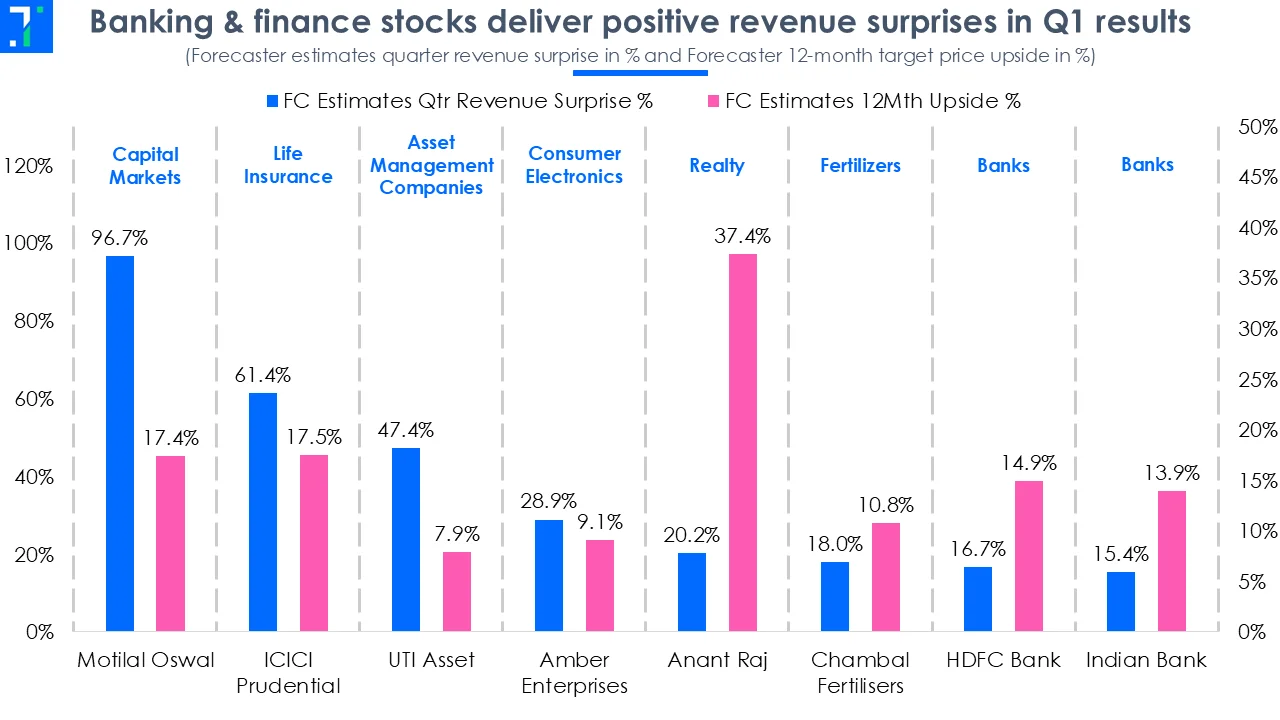

Nifty Smallcap 100 and Nifty Midcap 100 closed higher. Nifty Capital Markets and Nifty Healthcare Index were among the top index gainers today. According to Trendlyne’s sector dashboard, Hotels, Restaurants & Tourism emerged as the best-performing sector of the day, with a rise of 2.5%.

Asian indices closed higher, except for Australia’s S&P/ASX 200, which closed lower. European indices are trading in the green, except for Russia’s MOEX and RTSI. US index futures are trading higher as investors expect the Fed to cut rates after July inflation data matched expectations. Meanwhile, Perplexity AI, valued at $18 billion, has made a $34.5 billion bid to buy Google’s Chrome browser, aiming to tap its billions of users to train its AI model.

Relative strength index (RSI) indicates that stocks like Fortis Healthcare, HBL Power Systems, and eClerx Services are in the overbought zone.

Godrej Industries surges as its net profit rises 8.3% YoY to Rs 349.2 crore in Q1FY26, helped by higher inventory destocking. Revenue grows 5% YoY to Rs 4,459.8 crore, driven by improvements in the chemicals, vegetable oils, estate & property development, finance & investments, and crop protection segments. It features in a screener of stocks with decreasing promoter pledge.

Honasa Consumer is rising sharply as its Q1FY26 net profit grows 2.6% YoY to Rs 41.3 crore, helped by lower inventory costs. Revenue increases 8.1% YoY to Rs 619.1 crore, driven by improvements in its focus categories in the e-commerce and modern trade channels. It features in a screener of stocks with PEG lower than industry PEG.

PI Industries' Q1 FY26 revenue falls 7.2% YoY to Rs 1,986.4 crore due to lower agrochemical exports and reduced sales of biological products. Net profit declines 10.9% YoY to Rs 400 crore. The firm appears in a screener of stocks where foreign institutional investors (FIIs) have increased their shareholding.

Capital markets stocks like BSE, Motilal Oswal and Angel One are rising sharply as the Securities and Exchange Board of India (SEBI) reportedly plans a rule overhaul for stock brokers. SEBI reportedly proposes to allow stock brokers to access the Negotiated Dealing System – Order Matching (NDS-OM) platform, used for trading in government securities.

Angel One, Motilal Oswal, BSE shares in focus on buzz about SEBI planning big rule overhaul for stock brokers https://t.co/4C0IOkM2Ts

— Financial Express (@FinancialXpress) August 13, 2025

Archean Chemical Industries rises sharply as its subsidiary, SiCSem, receives approval from the Central Government to set up a silicon carbide (SiC) based compound semiconductor fab under the India Semiconductor Mission (ISM). The fab will have a total annual capacity of 60,000 wafers and 96 million packaged units.

Indoco Remedies receives US FDA approval for its abbreviated new drug application (ANDA) for Rivaroxaban tablets, used to treat blood clots. According to IQVIA, the drug had a market size of $8 billion in March 2025.

Premier Explosives rises sharply as its Q1FY26 net profit surges 109.7% YoY to Rs 15.3 crore. Revenue grows 76.2% YoY to Rs 148 crore, driven by strong order execution for the order book in the defence and explosives segments. It shows up in a screener of stocks with a QoQ increasing profit margin.

ITC Hotels' Chairman, Sanjiv Puri, expects demand for hotel rooms to outpace supply on the back of increasing international tourist count, which is expected to surpass pre-COVID levels. Puri also notes that the company will exceed its target of 200 hotels by 2030, with more than 220 hotels.

ITC Hotels to cross 220 properties by 2030 as room demand outpaces supply, says Sanjiv Puri https://t.co/R3X2bA2ti1

— Economic Times (@EconomicTimes) August 13, 2025

Aurionpro Solutions rises sharply as it secures an order worth Rs 250 crore from the Mumbai Metropolitan Region Development Authority (MMRDA) to design, supply, implement, and maintain the Automatic Fare Collection (AFC) system for Mumbai Metro Lines 4 and 4A.

Transrail Lighting rises sharply to its all-time high of Rs 855.8 as it secures orders worth Rs 701 crore. These include power transmission, civil construction, and pole & lighting projects from domestic and international clients.

Waaree Energies falls as the US Department of Commerce (DOC) initiates anti-dumping and countervailing duty investigations on solar panels imported from India. As of Q1FY26, exports account for 41% of Waaree Energies' order book.

Trump’s import tariffs hit India’s toy industry as US retailers like Walmart, Amazon, and Target pause orders from Indian manufacturers. The US contributes to 40% of toy exports from India, amounting to Rs 6,00 crore. India's toy industry has a market size of $1.7-2 billion (~Rs 14,905-17,535 crore) and is expected to grow to $4.4 billion (~Rs 38,578 crore) by 2032.

#UStariffs hit #India’s ?6,000-cr toy exports as Walmart, Amazon, Target pause orders; 40% of Indian toy exports go to US, which still sources 80% from China.@shinejachttps://t.co/HOQr6cAFUcpic.twitter.com/wC5aPlUjyc

— Business Standard (@bsindia) August 13, 2025

One97 Communications (Paytm) rises sharply to hit a new 52-week high of Rs 1,187 after the RBI grants its unit Paytm Payments Services in-principle approval to operate as an online payment aggregator. The central bank also lifts the merchant onboarding curbs imposed in November 2022.

NMDC is rising as its Q1FY26 net profit beats Forecaster estimates by 15.1% despite falling marginally YoY to Rs 1,967.7 crore. Revenue increases 24.5% YoY to Rs 6,738.9 crore, driven by higher sales in the iron ore and pellet segments during the quarter. The company appears in a screener of stocks outperforming their industry price change over the past quarter.

Jupiter Wagons' Q1FY26 revenue falls 46.4% YoY to Rs 476.2 crore due to lower railway wagon deliveries. Net profit declines 64.4% YoY to Rs 32.7 crore on higher finance and employee expenses. The company appears in a screener of stocks where mutual funds increased their shareholding during the past quarter.

Larsen & Toubro rises as its subsidiary, L&T Energy Greentech, enters an agreement with Japan's ITOCHU Corp to jointly develop and commercialise a 300 KTPA green ammonia project in Gujarat.

#JustIn | L&T’s arm, L&T Energy GreenTech enters into a Joint Development Agreement with #ITOCHU Corporation of Japan to develop and commercialise a 300 KTPA green ammonia project at #Kandla in #Gujaratpic.twitter.com/5GORccStmF

— CNBC-TV18 (@CNBCTV18Live) August 13, 2025

Nazara Technologies' Q1FY26 net profit grows 2.4 times QoQ to Rs 53.4 crore. Revenue rises 6.9% QoQ to Rs 575.8 crore, driven by growth in the gaming and e-sports segments. The company’s board approves a bonus issue in the ratio of 1:1.

Va Tech Wabag's Q1FY26 revenue rises 16.9% YoY to Rs 745.3 crore on strong order execution. Net profit increases 19.6% YoY to Rs 65.8 crore. The firm appears in a screener of stocks with zero promoter pledge.

FSN E-Commerce (Nykaa) is rising sharply as its Q1FY26 net profit surges 141.9% YoY to Rs 23.3 crore. Revenue grows 23.4% YoY to Rs 2,164.3 crore, driven by improvements in the beauty and fashion segments. It appears in a screener of stocks with improving net cash flow over the past two years.

Krishna Prasad Chigurupati, Managing Director of Granules India, expects its revenue to grow 13-15% in FY26. He notes that supply issues resulted in subdued performance in Q1FY26. Chigurupati adds that the US FDA's clearance for a new facility will help improve supply.

#CNBCTV18Market | Capacity constraint was the reason for subdued performance in #Q1FY26, expect an uptick in margin with an increase in revenue.

Supply issues expected to get better after clearance by #FDA for new facility. Revenue Is expected to improve QoQ, with 13-15% YoY… pic.twitter.com/U339tAbTiU— CNBC-TV18 (@CNBCTV18Live) August 13, 2025

Karnataka Bank is falling as its net profit drops 27% YoY to Rs 292.4 crore in Q1FY26 due to higher provisions and contingencies. However, revenue increases 2.5% YoY to Rs 2,619.6 crore, driven by improvements in the treasury and retail banking segments during the quarter. The bank's asset quality improves as its gross and net NPAs decline by 8 bps and 22 bps YoY, respectively.

Suzlon Energy is falling as its Q1FY26 net profit misses Forecaster estimates by 23.5% despite growing 7.3% YoY to Rs 324.3 crore, helped by inventory destocking. Revenue jumps 54.8% YoY to Rs 3,165.2 crore, driven by improvements in the wind turbine generator, foundry & forging, and operation & maintenance segments. It shows up in a screener of stocks with expensive valuations according to Trendlyne valuation scores.

Apollo Hospitals rises to its all-time high of Rs 7,646.5 as its net profit surges 41.8% YoY to Rs 432.8 crore in Q1FY26, helped by inventory destocking. Revenue increases 14.9% YoY to Rs 5,842.1 crore, driven by higher sales in the healthcare and digital health segments during the quarter. The company appears in a screener of stocks with improving cash flow from operations over the past two years.

Jindal Steel & Power is rising as its Q1FY26 net profit grows 11.5% YoY to Rs 1,494 crore, owing to lower raw materials, inventory, and finance costs. However, revenue declines 9.7% YoY to Rs 12,324.9 crore during the quarter. It features in a screener of high DVM stocks among mid and largecaps.

Nifty 50 was trading at 24,554.05 (66.7, 0.3%), BSE Sensex was trading at 80,546.63 (311.0, 0.4%) while the broader Nifty 500 was trading at 22,660.90 (92.3, 0.4%).

Market breadth is highly positive. Of the 2,048 stocks traded today, 1,477 were on the uptick, and 527 were down.

Riding High:

Largecap and midcap gainers today include Apollo Hospitals Enterprise Ltd. (7,808.50, 7.9%), GlaxoSmithKline Pharmaceuticals Ltd. (2,772.60, 7.1%) and FSN E-Commerce Ventures Ltd. (215.04, 5.1%).

Downers:

Largecap and midcap losers today include Coromandel International Ltd. (2,257.70, -5.8%), Waaree Energies Ltd. (2,941.90, -4.6%) and Suzlon Energy Ltd. (60.38, -4.4%).

Movers and Shakers

26 stocks in BSE 500 are trading on high volumes today.

Top high volume gainers on BSE included NMDC Steel Ltd. (43.02, 20%), JM Financial Ltd. (187.07, 15.0%) and EIH Ltd. (418.45, 14.8%).

Top high volume losers on BSE were Coromandel International Ltd. (2,257.70, -5.8%), Oil India Ltd. (407, -4.3%) and Jupiter Wagons Ltd. (316.75, -3.9%).

Honasa Consumer Ltd. (285.15, 5.9%) was trading at 61.4 times of weekly average. FSN E-Commerce Ventures Ltd. (215.04, 5.1%) and Godrej Industries Ltd. (1,169.80, 6.8%) were trading with volumes 17.3 and 15.6 times weekly average respectively on BSE at the time of posting this article.

BSE 500: highs, lows and moving averages

11 stocks hit their 52 week highs, while 6 stocks tanked below their 52 week lows.

Stocks touching their year highs included - Apollo Hospitals Enterprise Ltd. (7,808.50, 7.9%), Fortis Healthcare Ltd. (945.80, 1.5%) and JM Financial Ltd. (187.07, 15.0%).

Stocks making new 52 weeks lows included - Bata India Ltd. (1,096.90, -3.4%) and Colgate-Palmolive (India) Ltd. (2,171.70, -1.4%).

18 stocks climbed above their 200 day SMA including NMDC Steel Ltd. (43.02, 20%) and EIH Ltd. (418.45, 14.8%). 13 stocks slipped below their 200 SMA including Suzlon Energy Ltd. (60.38, -4.4%) and Balrampur Chini Mills Ltd. (547.10, -2.5%).