Indian benchmark equities look flat over the past year. But the calm surface hides a turbulent story.

Investors have been on a wild ride, dodging trade fights, tariff announcements, and worries about corporate earnings. The action wasn’t just in the market – political tensions are rising, and the news headlines recently exploded with Trump advisor Navarro’s bizarre claim that the Russia-Ukraine war was “Modi’s war”.

The drama is far from over. Now Modi is holding hands with a smiling Putin, and Russia, India, and China huddling together at the SCO summit. Modi has clearly been forced to look for economic concessions – partnerships with Chinese companies, and cheaper crude oil from Russia – to cushion the blow of US tariffs.

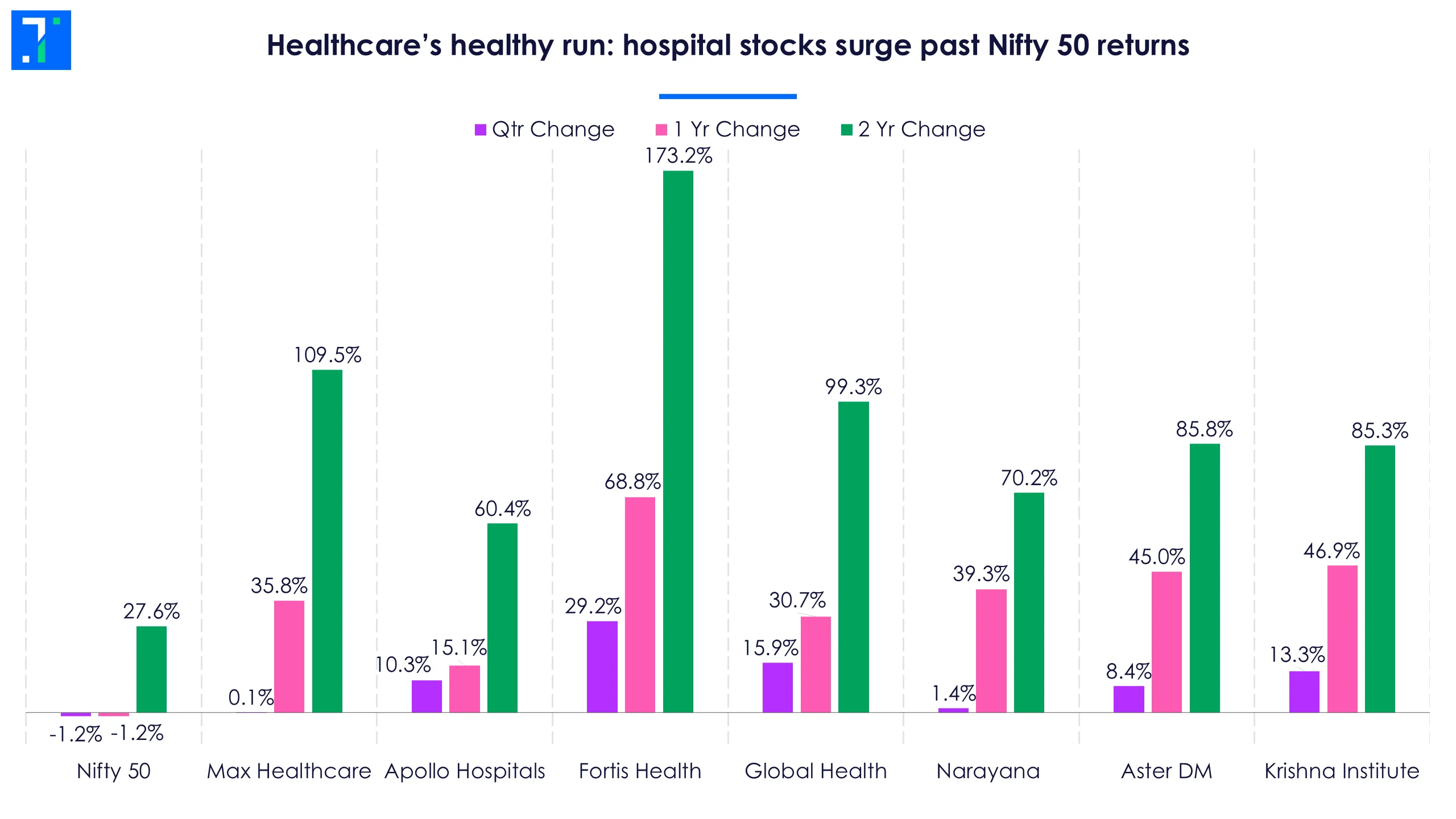

While the Nifty 50 and Sensex appear range-bound, one sector has stood out in this upheaval — the hospital industry.

Let’s dive in.

A bull run in healthcare: Indian hospital stocks are defying the market

Traditionally a defensive play, hospital chains are behaving like growth stocks, and leaving the Nifty50 in the dust.

The top seven hospital chains by market cap have all outperformed the benchmark. Over the last two years, Fortis Healthcare has surged 2.7x. Even Apollo Hospitals, the “laggard” of the group, beat the Nifty 50 by more than 30 percentage points in the past year.

Healthcare’s healthy run: hospital stocks surge past Nifty 50 returns

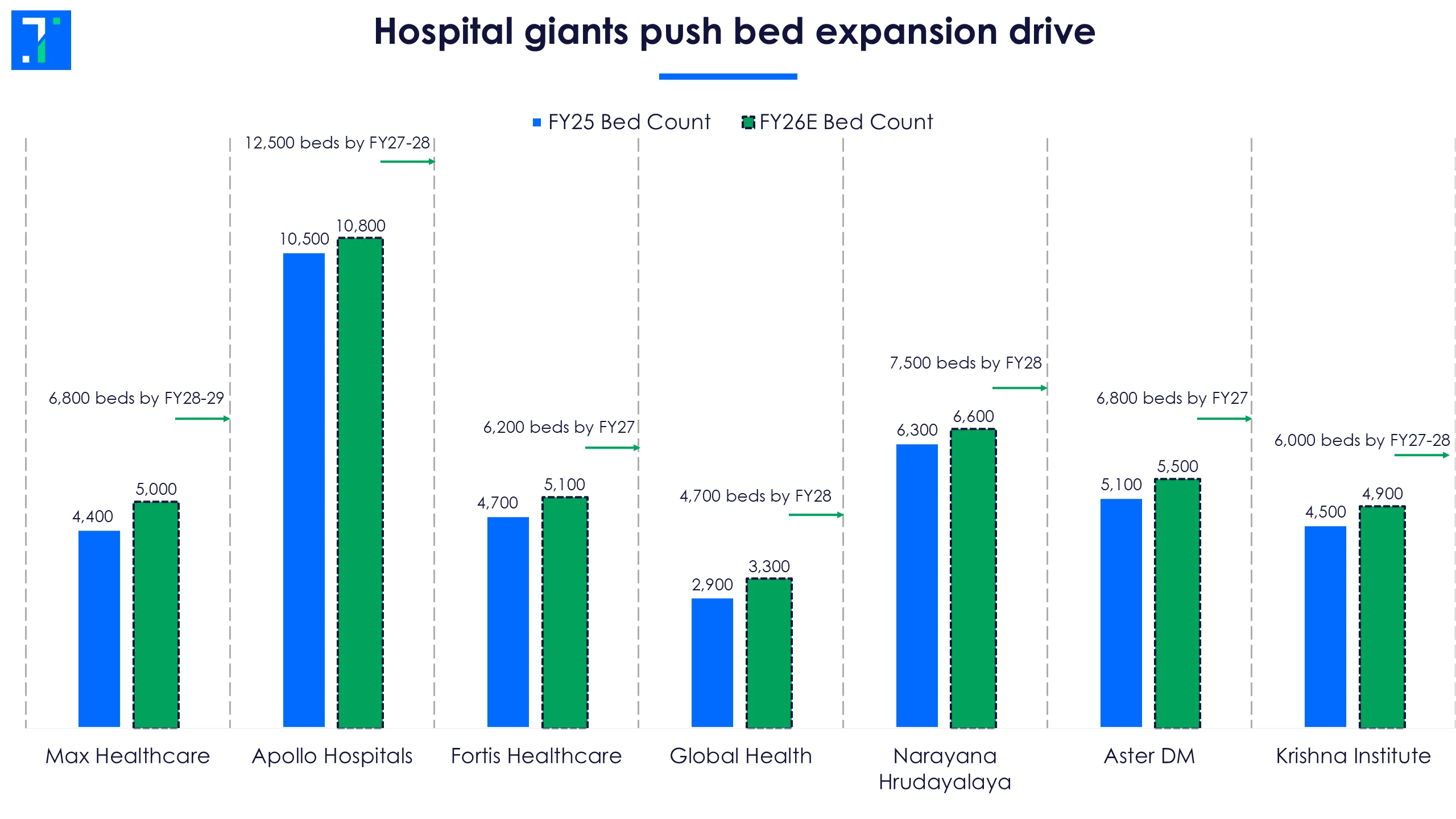

Post-Covid, there has been rising health awareness among Indians, but the health market is still massively underserved. India has just 0.5 hospital beds per 1,000 people, (compared to a global average of 3). Closing this gap means adding over 2 million beds, and hospital chains are racing each other to do that.

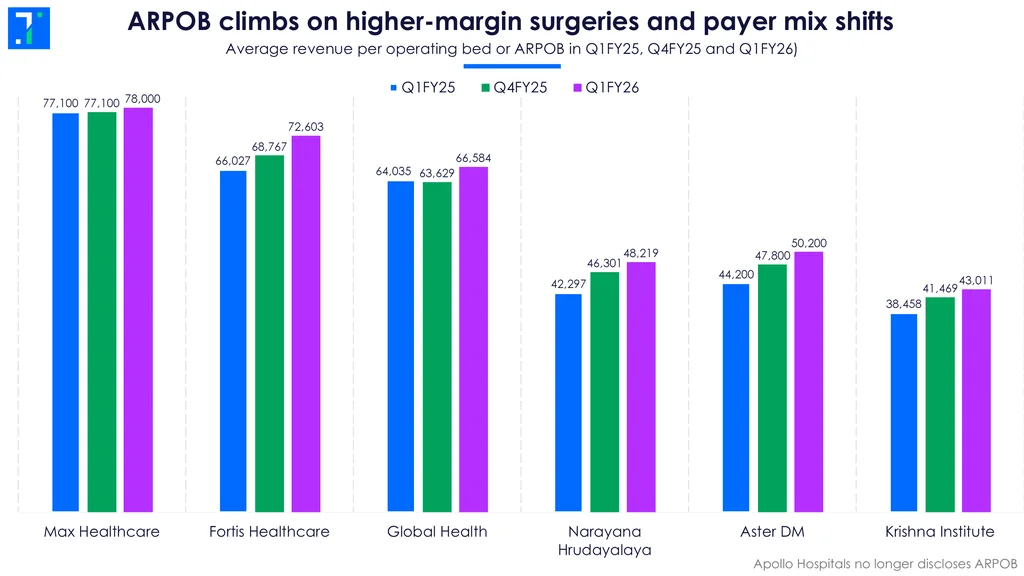

So bed additions have surged, and the key metric – average revenue per occupied bed (ARPOB) is climbing across companies. Price hikes, higher-margin elective surgeries, and more insurance coverage have all boosted this number.

Occupancy has stayed stable even as prices and availability rise. There's just a lot of pent-up demand. The revenue and net profit of these hospital chains have jumped.

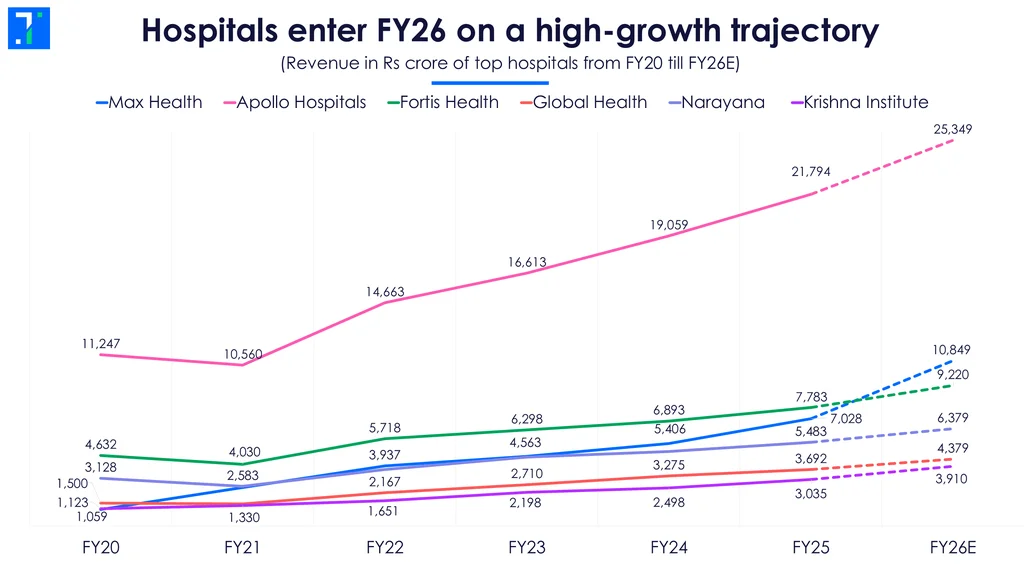

Hospitals enter FY26 on a high-growth trajectory

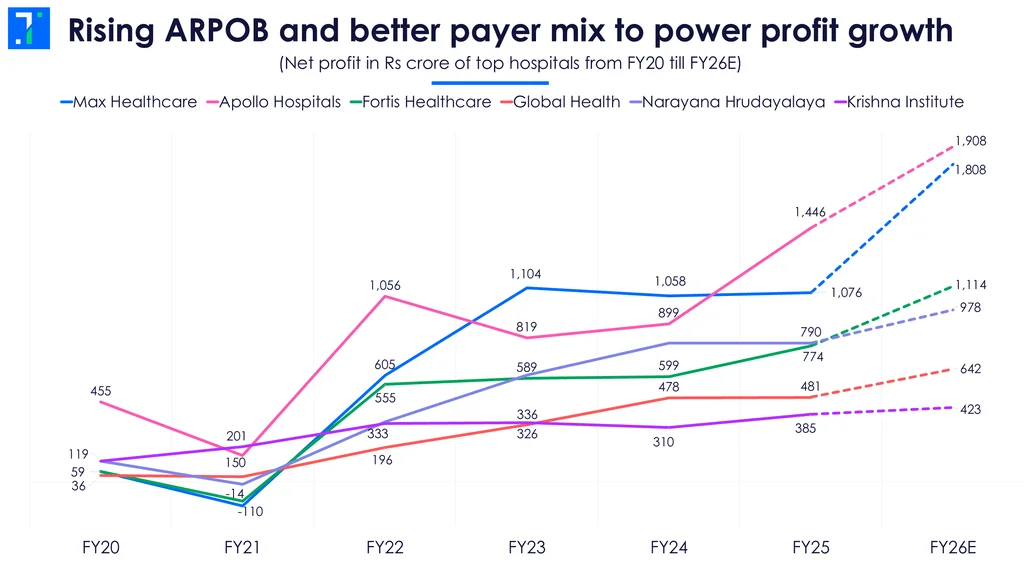

Profits have gone up across hospital chains, except for the Covid year, which saw low occupancies and postponed surgeries.

Rising ARPOB and better payer mix to power profit growth

The great hospital rush: build, build, build

Max Healthcare’s Managing Director, Abhay Soi, says, “We have per capita income increasing right now, aspirations are increasing, and the desire for proper hospitals is also increasing. I don't see us catching this curve for the next 20-30 years. We need to build, build, build.”

Hospital chains are racing to increase their bed counts and have set aggressive targets for fiscal year 2026 and beyond. They are doing this in two ways: capex and acquisitions.

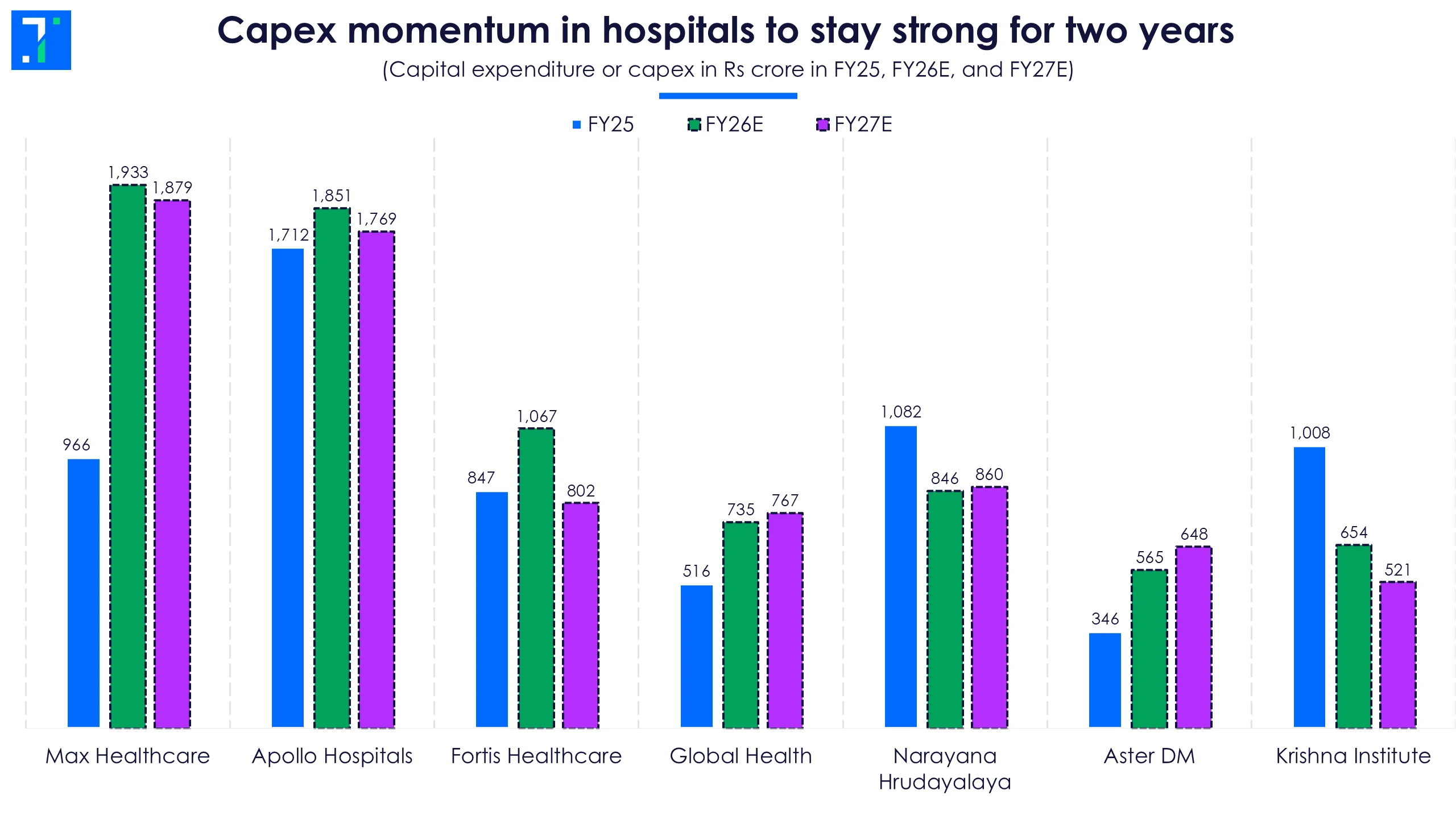

Capex momentum in hospitals to stay strong for two years

Capex for all hospitals are up, with Max Healthcare leading the pack. Hospitals are funding expansions through cash flows, equity, and debt.

Hospital giants push bed expansion drive

Hospital chains are also doubling down on acquisitions to grow faster. Max Healthcare snapped up Lucknow’s Sahara Hospital in December 2023 for Rs 940 crore, and also bought a 63.65% stake in Jaypee Healthcare for Rs 398 crore. gaining control of a 500-bed hospital in Noida and a 200-bed unit in Bulandshahr. Others like Aster DM Healthcare are also expanding their footprint.

An insurance stand-off even as ARPOB rises

Ashutosh Raghuvanshi, MD and CEO of Fortis, says, “ARPOB growth is getting a boost from a rising share of complex cases, as reflected by a 75% increase in robotic surgeries. We are also seeing an improved payer mix via insurance payouts.”

ARPOB climbs on higher-margin surgeries and payer mix shifts

But the path to better numbers isn’t entirely smooth. While hospitals prefer patients who pay through insurance, friction is rising, with more disputes between insurers and hospitals.

Hospitals accuse insurers of delays in claim settlements and unfair pricing pressures. Insurers have fired back, saying that hospitals have been inflating their bills.

These tensions have flared to the point that over 15,000 hospitals — including Max Healthcare and Medanta—say they have stopped accepting cashless claims from Bajaj Allianz General Insurance from September this year.

In a workaround, Narayana Hrudayalaya has launched its own insurance arm, bringing the insurer and health provider under one roof to prevent patient overcharging.

The final diagnosis: hospital stocks trading at premium valuations as growth looks rosy

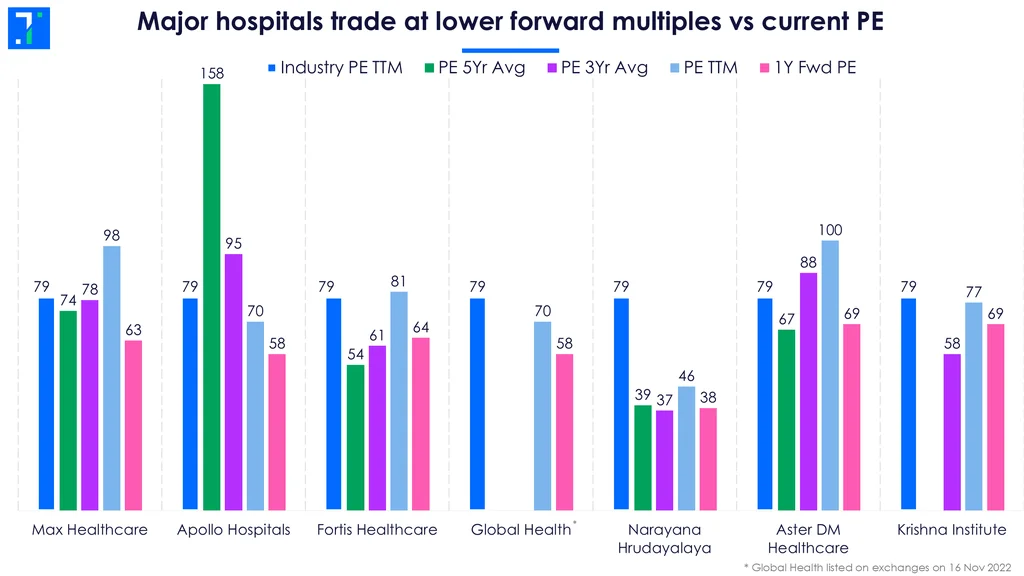

It’s no surprise that hospital stocks are trading at premium valuations: the market is betting on a bright future. All major hospital companies have forward P/E ratios lower than their current P/E levels, a sign that investors are expecting strong profit growth to continue.

Major hospitals trade at lower forward multiples vs current PE

Apollo Hospitals, Global Health, and Narayana Hrudayalaya are all trading below their historical and forward PEs. Narayana Hrudayalaya also appears attractive on an EV/EBITDA basis, at 26, compared to the sector average of 31.

The sector is in a sweet spot, with strong revenue and profit growth, and a massive IPO coming up in the $1 billion Temasek-backed Manipal Hospitals offering set for FY26 (targeting a valuation of around $13 billion).

But investors will be keeping an eye on whether capacity expansion continues to translate to profitable growth. Right now, occupancy rates are stable even as beds are being added. But any drops in efficiency would raise red flags—especially for chains like Narayana Hrudayalaya and KIMS, which are seeing lower occupancy levels.

You can deep dive into the Healthcare Facilities industry here.