Welcome to 2025 - which Defence Minister Rajnath Singh calls the "Year of Reforms" for India’s defence sector. Singh wants to modernise the sector, and increase local production.

The government has been arguing that our defence processes are frozen in time. But reforms face many blocks, including outdated command structures, internal resistance to change ("we have always done it this way"), and tight budgets.

Still there has been progress: India’s defence exports have jumped 30X in the last decade, with help from the private sector.

The growth is happening just in time. The world is becoming increasingly violent, with the Israel-Hamas conflict, the Ukraine-Russia war, and China-Taiwan all simmering. The US has elected a President that puzzlingly, wants to annex Canada and Greenland. India’s defence needs will grow in a more aggressive world, and will need heavy investments.

One can argue that people being the way they are, the market for bullets will never die. A defence investor may see this as an optimistic statement, and these stocks have become quite popular. The message from Motilal Oswal’s Defense Fund ad — "India is investing in defence, are you?" — captures the shift over the last ten years.

In this week's Analyticks:

- Defence stocks boom, as private companies make their mark

- Screener: Defence stocks with high durability scores and revenue growth forecasts for Q3

India moves towards the West, and away from Russia

The French Rafale deal controversy marked an early shift in India's defence strategy. India hugged Russia close for decades for its military needs - the country accounted for 76% of our arms imports between 2009 and 2013.

That has drastically reduced, and is below 50had % for the first time since the 1960s. While Russia is still the largest supplier with36% of our imports, Western countries - France (33%) and the US (13%) - are getting the larger share. This is part of a strategy to reduce our reliance from any single nation.

India is the world’s largest arms importer, accounting for 9.8% of global arms imports. However, the country is now focusing more on manufacturing defence products here and reducing dependency on foreign suppliers.

India's defence makeover: government push boosts production and exports

Our defence transformation took off with 2014’s ‘Make in India’ initiative. The government identified over 36,000 defence items that could be produced locally, ranging from complex systems, sensors, weapons, and ammunition. Since then, public sector companies have placed orders worth over Rs. 7,500 crore with domestic defence vendors

India's diplomats have also turned into brand ambassadors for Indian-made defence products. India’s defence exports touched Rs. 21,000 crore in FY24, growing by 40% CAGR over the last decade. Defence production has soared 8% CAGR, from around Rs. 74,000 crores in FY17 to Rs. 1.3 trillion in FY24. The government hopes to hit Rs. 3 trillion in production and Rs. 50,000 crore in exports by 2030.

Enter the entrepreneurs: open doors for the private sector

The public sector has long dominated India's defence production, but the private sector has made recent gains, with a 20% share in production and 60% in exports. The increase in private sector participation has led to interest from a wide range of investors, including retail, mutual funds, and foreign institutions.

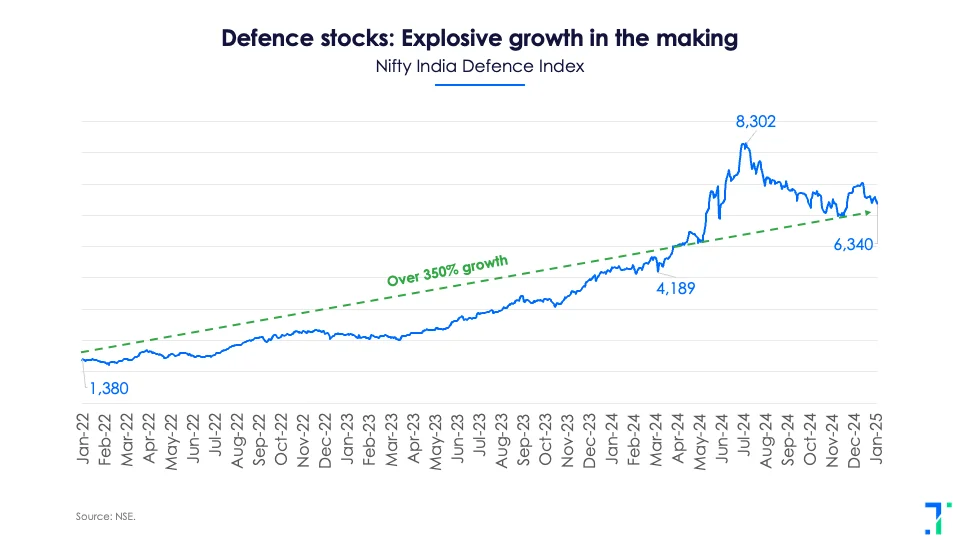

In 2022, the NSE launched the Nifty India Defence Index, which has seen an impressive 4.5-fold rise since its inception, further fueling investor interest in the sector. As a result of this growing interest, fund houses like HDFC, Motilal Oswal, Aditya Birla Sun Life, and Groww have launched defence-specific schemes, with three of them debuting in 2024.

A Balasubramanian, CEO of Aditya Birla Sun Life, highlighted the large order books of top defence companies as attractive for investors. However, he noted that state-owned firms still dominate the sector, with the government holding majority stakes in many companies. Limited free float also makes these stocks vulnerable to price swings.

High valuations is another worry. The HDFC scheme, for example, had to stop accepting fresh investments due to worries about peak valuations. But over the last six months, the defence sector index corrected by 20%, driven by slower order inflows, supply chain disruptions, and other execution challenges.

Valuations are a high wall to climb for defence

The sector is promising, but stocks are at pretty high valuations. Surjitt Singh Arora of PGIM India AMC warns that “valuations have run ahead of fundamentals”. Shiv Chanani of Baroda BNP Paribas Mutual Fund agrees, pointing out that while order books provide revenue visibility, execution hurdles and rich pricing are worries.

Despite this, Binod Modi of Mirae Asset Sharekhan, is among the optimists, arguing that the sector’s growth potential justifies its current valuations. He also says that the sector will see premium valuations for the next 3-5 years. Brokerages like Antique and Elara Securities share this bullish outlook, and point to the recent correction as a good entry point for long-term investors.

Diamonds in the mix?: Looking for good fundamentals amid high valuations

Among the key players in the industry, Solar Industries, Astra Microwave, Hindustan Aeronautics (HAL) and Bharat Electronics (BEL) have grown steadily in revenue, net profit, order books and return ratios.

ICICI Securities expects Solar Industries to increase its share of defence revenue over the next five years, particularly with the global shortage of ammunition creating new opportunity. Astra Microwave’s healthy order book and robust pipeline have also kept its revenue and profitability healthy, especially with a focus on higher-margin domestic contracts.

ICICI Direct forecasts that HAL’s revenue growth will rise significantly from FY26, due to better execution. And Mirae Asset Sharekhan expects BEL to be the biggest beneficiary of recent proposals from the Defence Acquisition Council, including maritime surveillance, and other capability upgrades.

Challenges like high valuations or FII sell-offs could dampen the sentiment in the near term. But the long-term potential of the sector has made analysts upbeat.

Since FY23, the government has cleared Rs. 8.3 trillion worth of Acceptance of Necessities (AoNs) for defence projects — a 53% jump from the past decade. Government procurement begins after an AoN, and this signals a massive pipeline of upcoming projects for defence companies. According to Elara Securities analysts, there are substantial growth opportunities for the sector in the coming years, driven by the government’s focus on indigenisation and exports.

The government is also looking to increase the role of startups, SMEs, and corporates in various segments such as research and AI. Antique Research is particularly excited about the untapped potential in this space, noting that several defence companies with unique technologies and capabilities are still not publicly listed - including Tata Advanced Systems, Reliance Naval and Engineering, Mahindra Aerospace, Kalyani Strategic Systems, DRDO, Munitions India, and BrahMos Aerospace. A long established sector is seeing fresh excitement, with young players rising alongside promising, listed companies.

Screener: Defence stocks with the highest Durability scores and revenue growth estimates for Q3FY25

Defence stocks have high durability and revenue growth estimates in Q3

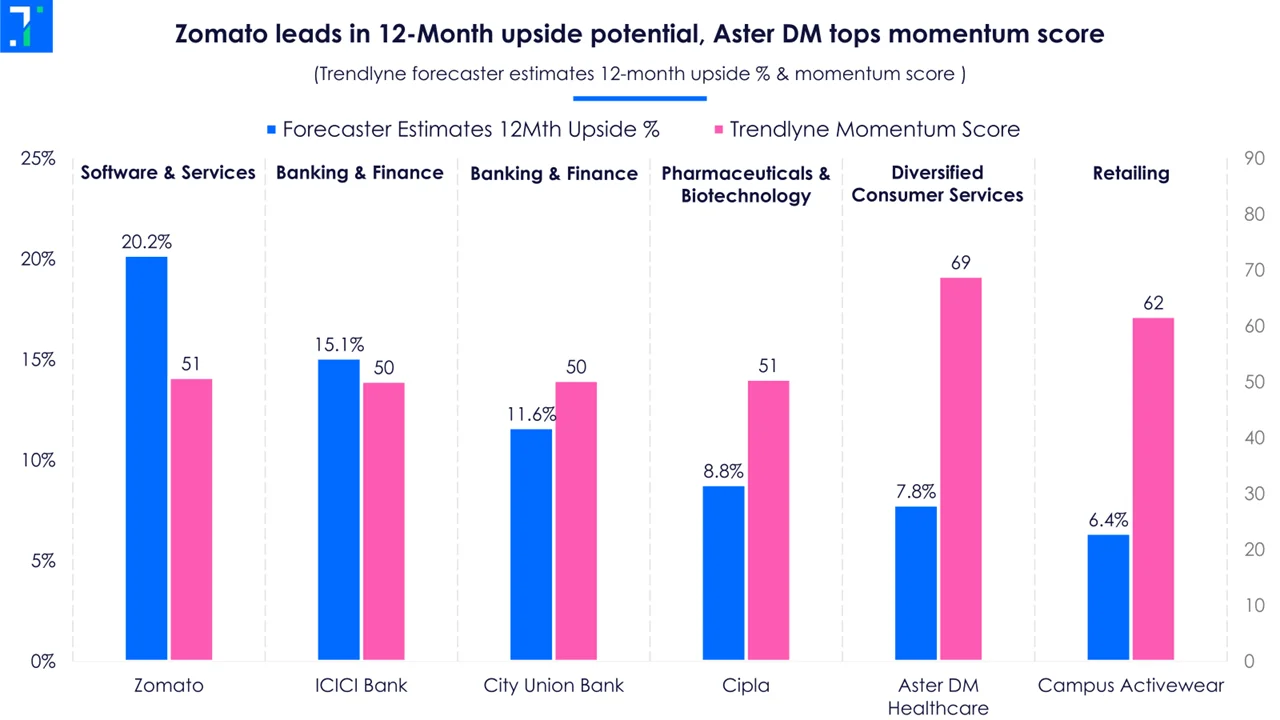

As we wait for the Q3 result season, we look at defence stocks with the highest Forecaster estimates for revenue YoY growth and a good Trendlyne durability score. Stocks with high durability scores are companies rated with good management, that have consistently demonstrated good growth and cash flow, stable revenues and profits, and low debt. This screener shows such defence stocks, which are expected to show high revenue growth in upcoming results

The most notable stocks in the screener are Bharat Dynamics, Data Patterns (India), ideaForge Technology, Bharat Dynamics, Hindustan Aeronautics, Mazagon Dock Shipbuilders, and Garden Reach Shipbuilders & Engineers.

Bharat Dynamics shows up in the screener with a Trendlyne Durability score of 70 and Forecaster estimates revenue growth of 102.8% YoY in Q3FY25. This debt-free defence stock’s high score can be partly attributed to its net profit increasing YoY in five out of the past eight quarters. Analysts at Phillip Capital and Elara Capital expect the company’s revenue to grow due to a strong order backlog and its inclusion in defence modernisation programs.

Bharat Electronics also features in the screener with the highest Trendlyne Durability score of 85 among defence stocks. Its good durability can be attributed to consistent revenue growth YoY for the past nine consecutive quarters and net profit increasing YoY for the past eight quarters. The company also has low interest expenses and a strong return on equity (RoE) of 16.8% in FY24. Its trailing twelve-month (TTM) PE stands at 45.4, higher than its three-year and five-year average PE. Trendlyne’s Forecaster estimates this company’s revenue to grow by 28.6% YoY in Q3FY25. Analysts at Sharekhan expect its revenue to grow due to increasing defence spending in India, the structural trend of indigenisation, and export opportunities.

You can find some popular screeners here.

Signing off this week,

The Trendlyne Team