Born in Tehran in 1979, Adam Foroughi’s family fled to the US when he was a child. In 2012, he co-founded AppLovin, a gaming and mobile ad business that struggled at first. But in 2024, the company pivoted to AI, and surprised investors with its stellar performance, which pushed up the stock price by more than 700% this year.

The owner of Chinese vaccine maker Zhifei, Jiang Rensheng, was a primary school teacher. Sunil Mittal started out manufacturing bicycle parts. Others like Musk and Ambani, came from business families. What they all have in common: they are now among the 500 richest people in the world.

In 2024, the combined net worth of the top 500 billionaires reached a staggering $9.9 trillion, rising by 19%. But 112 individuals in the top 500 experienced substantial losses. While some billionaires rode a rising wave in sectors like AI, retail, and finance, others faced economic slowdowns and volatile markets.

Europeans struggled, while Asians, Americans prospered

In 2024, the wealth of Filipino billionaires doubled, while Mexican fortunes dipped by about one-sixth. The wealth of American and Chinese billionaires grew 34% and 14%, while Indian billionaires saw a modest 9% growth, beating the French (-14%) and Germans (6%).

One country dominates. More than one-third of the top 500 billionaires in the world live in the US. Together, they have a net worth exceeding $5 trillion. These are familiar names - Elon Musk, the richest person worldwide, Jeff Bezos, Mark Zuckerberg, Bill Gates, Warren Buffett.

China is second with 56 billionaires in the top 500, followed by India and Russia with 26 and 25 billionaires, respectively. Mukesh Ambani and Gautam Adani from India, Zhong Shanshan and Ma Huateng from China, and Russia’s Alexey Mordashov lead their respective countries. Ambani became the richest Asian person in 2024 with a net worth of $91 billion.

The tech boom vs. the consumer slump

The technology sector was a driving force behind wealth creation in 2024. Tech entrepreneurs added more than $900 billion collectively to their wealth -- the rise of AI and the strong US economy fuelling this growth. While tech represents only 82 people (16%) of the top 500 billionaires, it is 32% of the total net worth ($3 trillion).

Not doing so well? The consumer and commodities sectors. Slow growth in China, rising interest rates, and a pause in revenge spending post-pandemic, especially in luxury, resulted in a $21 billion fall in the net worth of consumer-sector billionaires, with French billionaires hit the hardest. Bernard Arnault, the French founder of the world’s largest luxury company LVMH (which owns Louis Vuitton), saw his wealth drop by $31 billion - equivalent to Azim Premji’s entire net worth.

The US is the world's dominant economy, and it takes up a lot of space in the 500 billionaires list.

Who are India’s Richie-Riches?

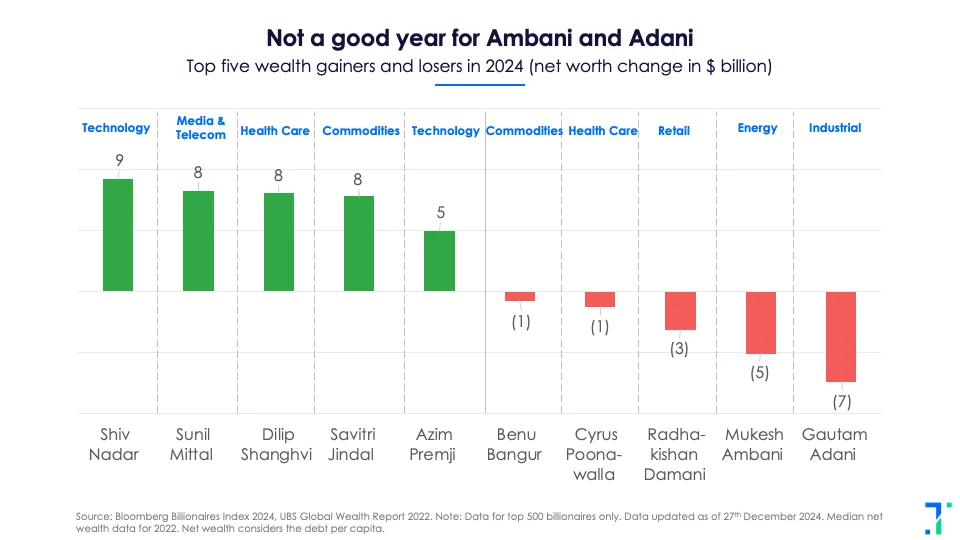

Out of the 500 ultra-rich, Indians take up 26 spots, underscoring the country’s growing influence in the global economy. However, India’s top two wealthiest individuals - Mukesh Ambani and Gautam Adani slipped out of the $100 billion club in the last three months.

18 Indian billionaires saw their wealth increase. Shiv Nadar, the founder of HCL Technologies and the third richest person in India, witnessed the highest jump of $9 billion in his wealth. Others whose net worth spiked include Sunil Mittal, Dilip Shanghvi, Savitri Jindal, Samir & Sudhir Mehta, Murali Divi, Vikas Oberoi and Rahul Bhatia.

Subdued consumer demand has weakened share prices and hit companies like Reliance Retail (Mukesh Ambani), DMart (Radhakrishnan Damani), and Britannia (Nusli Wadia), while a healthy luxury real estate market has boosted the net worth of individuals like KP Singh (DLF) and Vikas Oberoi (Oberoi Realty).

What about the rest of us?

India has witnessed a rise in the number of millionaires and billionaires over the past two decades. However, overall per capita wealth has grown by a mere 6% CAGR, from $2,088 in 2012 to $3,755 in 2022.

The disparity is striking: the average Indian billionaire's net worth is 6 million times India's per capita median wealth, far more than Russia (1.7 million times) and China (0.5 million times). Developed nations, on the other hand, show smaller disparities (0.05 to 0.3 million times).

India stands out as an extreme case compared to both emerging and developed economies. Here, the rise of billionaires is well underway. But the rest of the country has a lot of catching up to do.