Despite Trump's near-daily threats -- to fire Powell, to increase tariffs -- the US markets have continued to rise in puzzling fashion, making new highs over the past quarter. There is one powerful force at play here: American firms are pouring billions into buying back their own shares, providing a critical support to share prices at a time of high volatility.

Share buybacks have become one of Corporate America’s favourite cashback schemes to shareholders, a quick way of returning capital to them. Unlike dividends, buybacks offer flexibility, reduce outstanding shares to boost earnings per share, and allow management to signal confidence in the company’s valuation. They also carry tax advantages for many investors and help offset dilution from employee stock compensation.

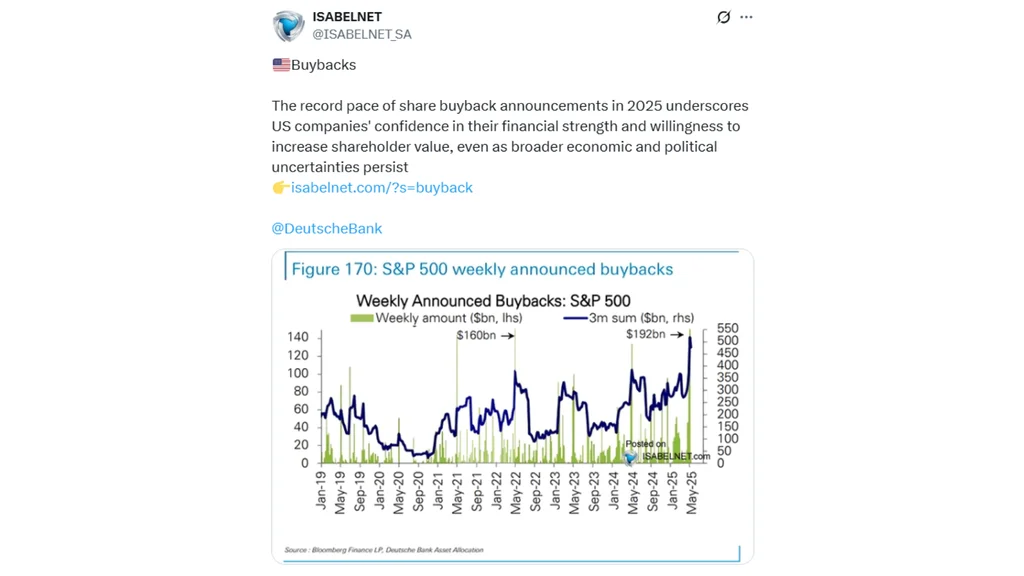

While institutional investors pulled back during recent market swings, retail investors and companies kept buying stocks. Companies have sped up repurchase activity to a near-record pace, making 2025 the strongest year-to-date for corporate stock buybacks.

“We have raised the year-end S&P 500 target to 6,550,” says Binky Chadha, Chief US Equity & Global Strategist at Deutsche Bank. “We expect robust corporate demand to reduce stock supply, forecasting $1.1 trillion in buybacks this year, supported by resilient earnings.”

Beyond returning cash to shareholders, companies view buybacks as a practical way to navigate market swings and manage their share price. Michael, Chief Market Strategist at Jones Trading, said, “The benefit to having an approved buyback program in this environment is that should volatility emerge, the company opportunistically retires shares while supporting the share price.”

Buyback authorizations reach record high

Trump’s, er, unconventional trade moves have, in many cases, made planning for the future more difficult. Buybacks have become increasingly popular since Trump’s corporate tax cuts in 2017 left companies with more cash, boosting repurchases by S&P 500 companies to an annual record of $943 billion last year, according to S&P Global.

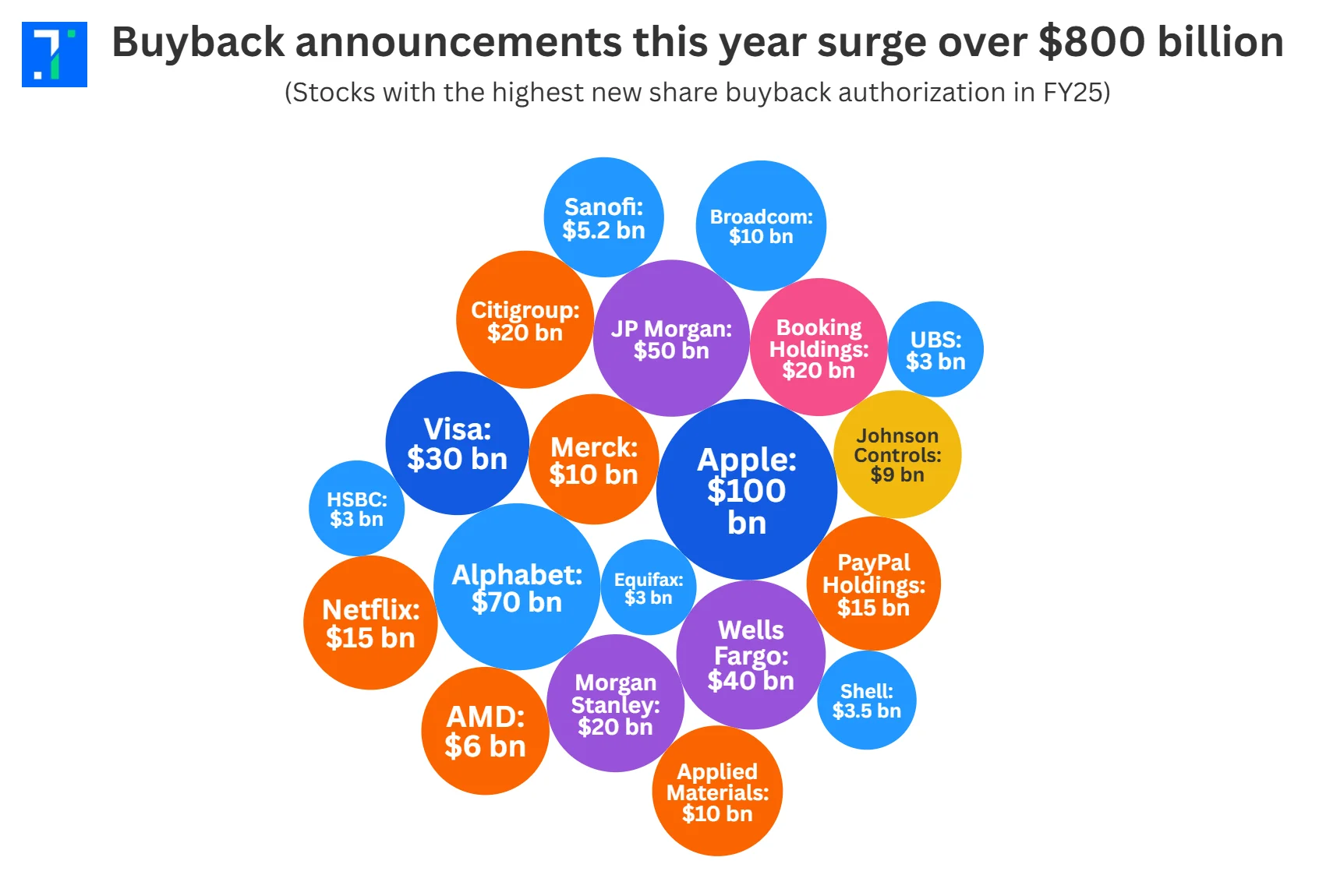

So far in FY25, US companies have announced over $800 billion in share buybacks, putting the market on track to easily cross the $1 trillion mark for the year.

Buyback announcements this year surge over $800 billion

This year’s surge stands out not just for its size but also for its breadth. Tech giants lead the way, with Apple authorizing $100 billion in repurchases and Alphabet approving $70 billion. Other companies joining the wave include Meta, Visa, PayPal, Nvidia, and Netflix.

Even financial institutions are not far behind, with banks announcing a total of $130 billion in buybacks.

JP Morgan recently announced a share repurchase program worth $50 billion. “Our capital levels are strong,” said Jamie Dimon, CEO of JPMorgan Chase. “Having passed the Fed’s stress test, we believe share repurchases are a responsible way to return excess capital while continuing to invest in the business.”

Several large banks, including Wells Fargo, Citigroup and Morgan Stanley, ramped up buybacks after clearing the Fed’s annual stress tests. This suggests that these banks are well-capitalized and can withstand severe economic downturns.

Buybacks: A corporate power play

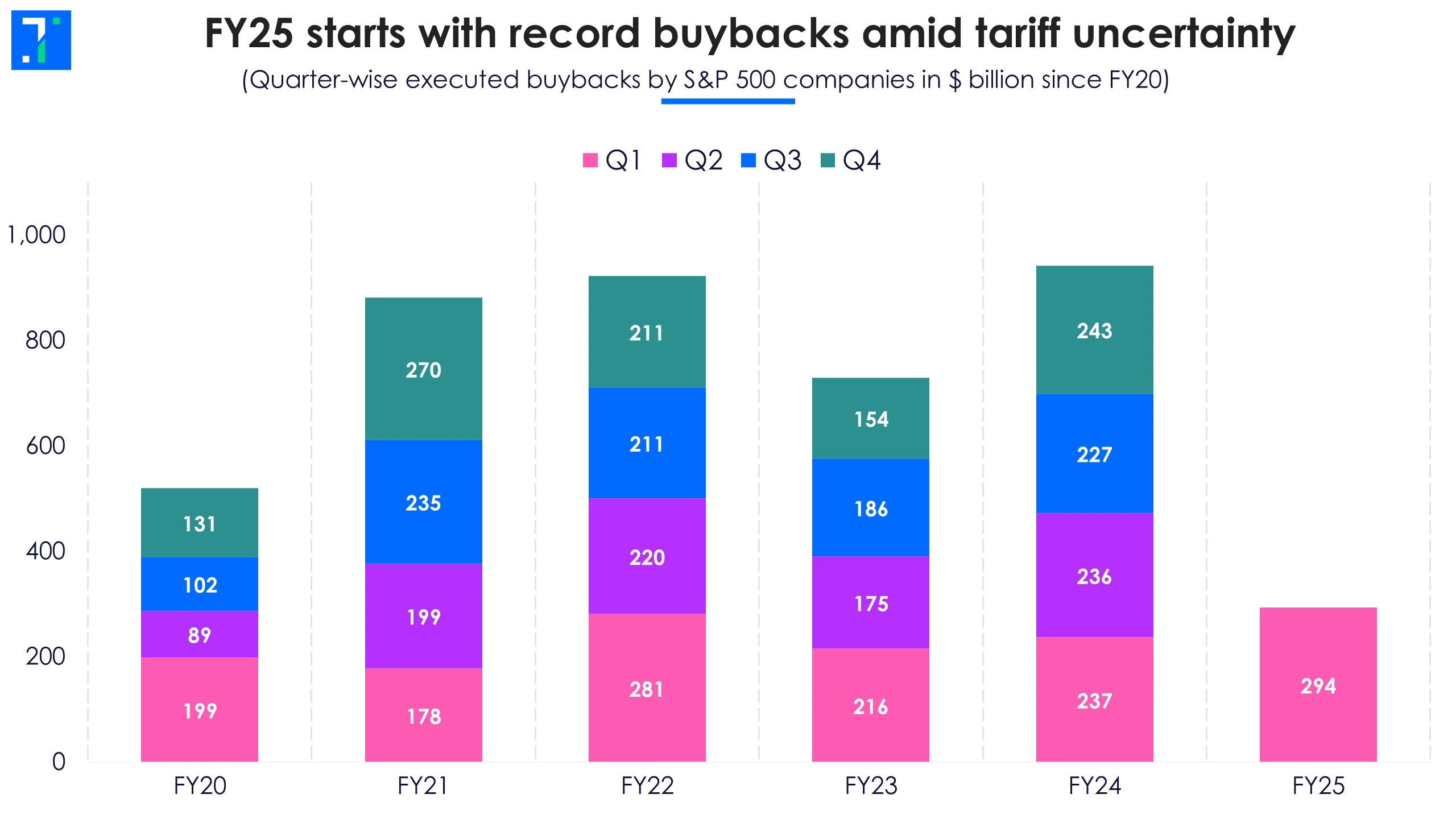

The pace of executed share repurchases has picked up sharply. In Q1 FY25, S&P 500 companies executed $294 billion worth of buybacks, marking the highest quarterly total on record, surpassing even the Q1 2022 peak of $281 billion.

That’s a 21% jump compared to the previous quarter and 24% higher year on year.

However, in terms of dollars spent on buybacks, the activity is highly concentrated, with the top 20 companies collectively accounting for half of all the repurchases in Q1.

FY25 starts with record buybacks amid tariff uncertainty

“Corporations are hedging against volatility by locking in shareholder support, buybacks to give them control over valuation and earnings optics,” said Savita Subramanian, US equity strategist at Bank of America.

This timing also coincides with receding recession fears and a growing belief that the Fed is done hiking rates, and this has pushed firms with healthy balance sheets to act on previously authorized repurchase programs. For many, this was the perfect opportunity to buy shares at lower valuations as the stock market plunged in Q1 after President Trump announced reciprocal tariffs on April 2.

“When growth visibility gets murky, companies tend to favor levers that offer immediate impact, and buybacks do just that,” said Mark Zandi, Chief Economist at Moody’s Analytics.

Asset-light companies spending more on buybacks

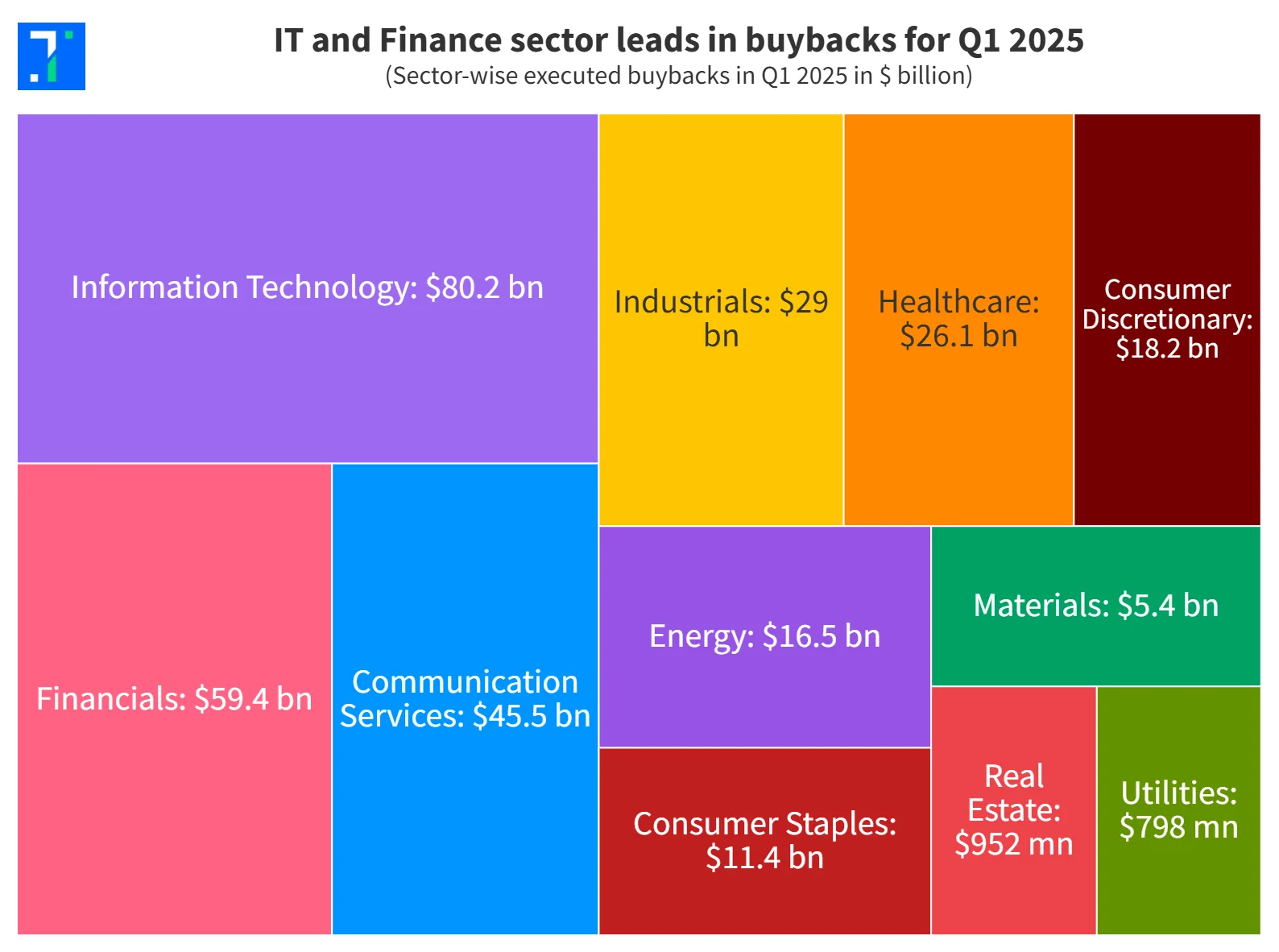

Information technology and financials dominated buybacks executed in Q1 FY25, accounting for almost 40% of all S&P 500 repurchases. Tech companies bought back $80.2 billion in shares, while finance firms followed with $59 billion in repurchases.

In contrast, capital-heavy sectors like utilities spent far less. This shows that utilities, real estate and other capital-intensive sectors tend to spend less on buybacks in contrast to asset-light sectors such as tech and financials.

IT and Finance sector leads in buybacks for Q1 2025

“Tech companies, especially the cash-rich giants, continue to see buybacks as a way to send a confidence signal without committing to risky M&A or expansion,” said Dan Ives, Managing Director at Wedbush Securities.

This concentration in buyback activity by high-margin, asset-light sectors reveals which parts of the market are best positioned to navigate the current economic crosswinds, taking a more cautious approach.

Buybacks vs. Capex

While tech firms remain leaders in buybacks, they face growing trade-offs. Companies like Microsoft, Amazon, Alphabet, and Meta plan to invest over $300 billion in AI infrastructure and other capital expenditures in 2025, representing a 35% increase from 2024.

Amazon's board approved a $10 billion buyback program in 2022, but the company used only half of it by Q2 FY22 and hasn’t repurchased shares since. Meanwhile, Amazon’s capital spending surged from $63 billion to an estimated $104 billion.

This contrast highlights a critical point: while buybacks remain a key part of capital return strategies, major firms are increasingly prioritizing long-term investments, especially in areas like AI. That shift may gradually reshape how companies allocate excess cash, with a growing share moving from shareholder returns to strategic growth initiatives.

Still, buybacks aren’t without critics. Warren Buffett has warned that companies risk destroying value if they repurchase shares at a price above their intrinsic worth.

“It would be value-destroying if we overpaid..while buying Berkshire,” Buffett famously wrote in a shareholder letter. The takeaway: Buybacks only make sense when companies purchase shares at a price below their intrinsic value. Else, companies caught up in the buyback fever can erode long-term shareholder wealth.