Prime Minister Modi and US President Trump have something in common: they both like taglines and punchy names. The Big Beautiful Bill, Atmanirbhar, Acche Din, Make America Great Again. So when they got together in February this year, it was inevitable that they would come up with a new catchphrase for the future India US trade relationship - the US-India COMPACT ("Catalysing Opportunities for Military Partnership, Accelerated Commerce & Technology").

Coining the phrase was the easy part. Actually reaching a compact or trade agreement, has turned out to be a bit tricky. From the argument over US exports of "non veg milk" - where American dairy cows are fed meat and blood products - to opening up India's agri sector to genetically modified US crops, there have been many disagreements.

Combine this with Trump having one hammer for many nails, threatening tariffs for nearly every political issue - like 500% tariffs on India for importing Russian oil - and a trade deal becomes even harder.

No surprise then that the US, despite promising "90 deals in 90 days" in April, has only been able to strike deals with the UK and smaller countries like Indonesia and Vietnam.

Trump has complained that India is “the highest tariffed nation anywhere in the world.” And while this is a man with a tendency to exaggerate ("I'm a very stable genius", anyone?), India does charge high tariff rates, averaging around 12% on imports compared to 6% in Thailand, 5% in Vietnam, 3% in China and 2% in Japan.

So these two sides both claim unfair demands from the other, but are working to find common ground. How much does this deal matter to India?

In this week's Analyticks:

- (Maybe) on the brink of a deal: How much does India need a deal with the US?

- Screener: Stocks with the highest merchandise exports to the US

For India, the US is a heavy hitter as a trading partner

Years ago, a study found that Gujaratis had settled in 129 of the world's 190 countries. There were Gujarati families in Nauru, a Pacific Island country of 9,000 people, and Gujaratis working in the diamond mines of Yellowknife, a distant town in northern Canada. But while many millions of Indians are migrants, settling everywhere from the UK to Botswana to Kuwait, India has policy-wise been an inward looking country. Besides software, our country's industries stayed domestically focused while our rival China pushed its exports across the world.

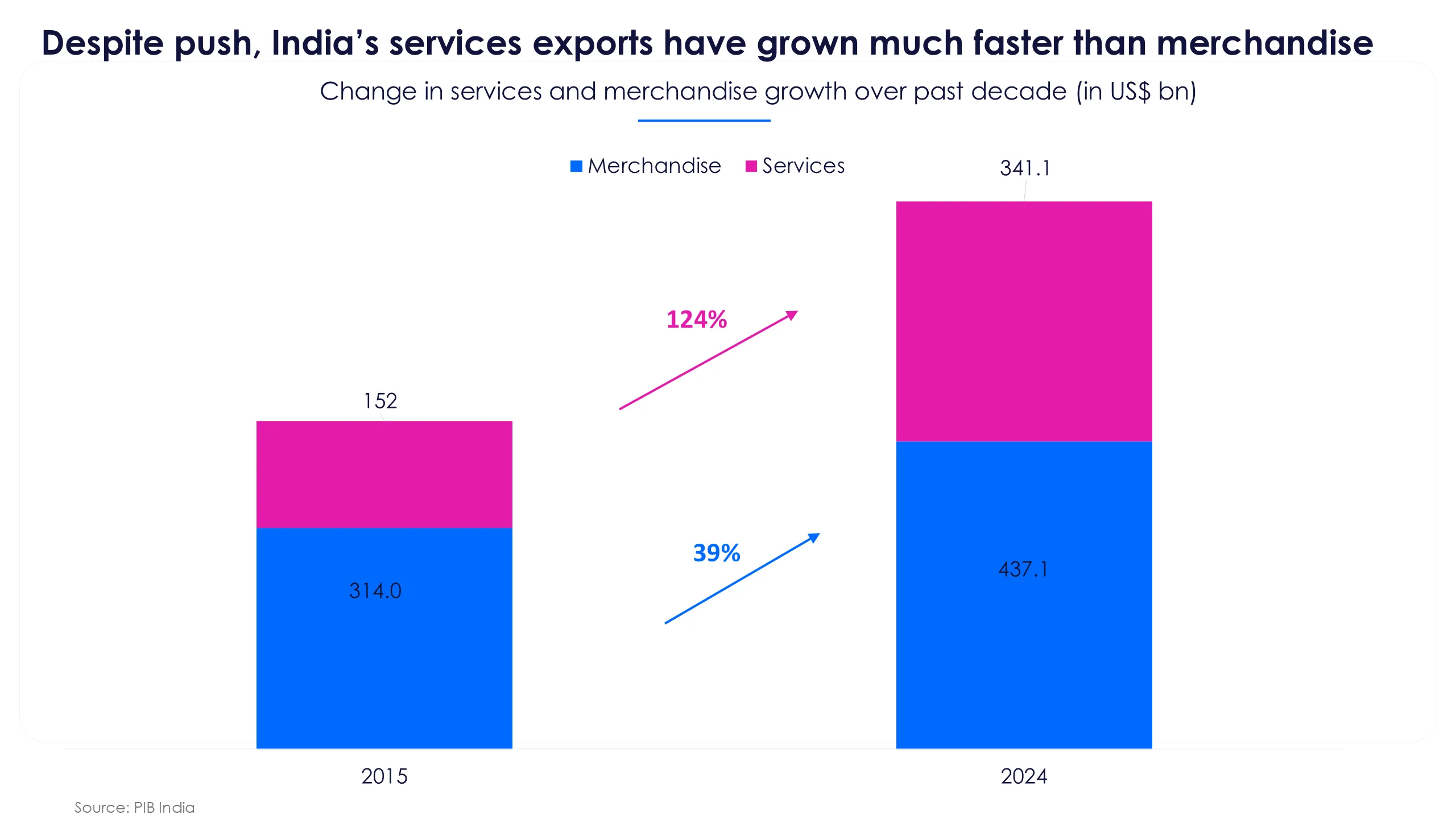

The attitude has changed in recent years, with the government pushing for trade deals with the UK, EU, Australia and other major countries, and providing significant incentives to exporters. Merchandise exports have grown steadily, but services growth, thanks to software exports, have still outperformed overall.

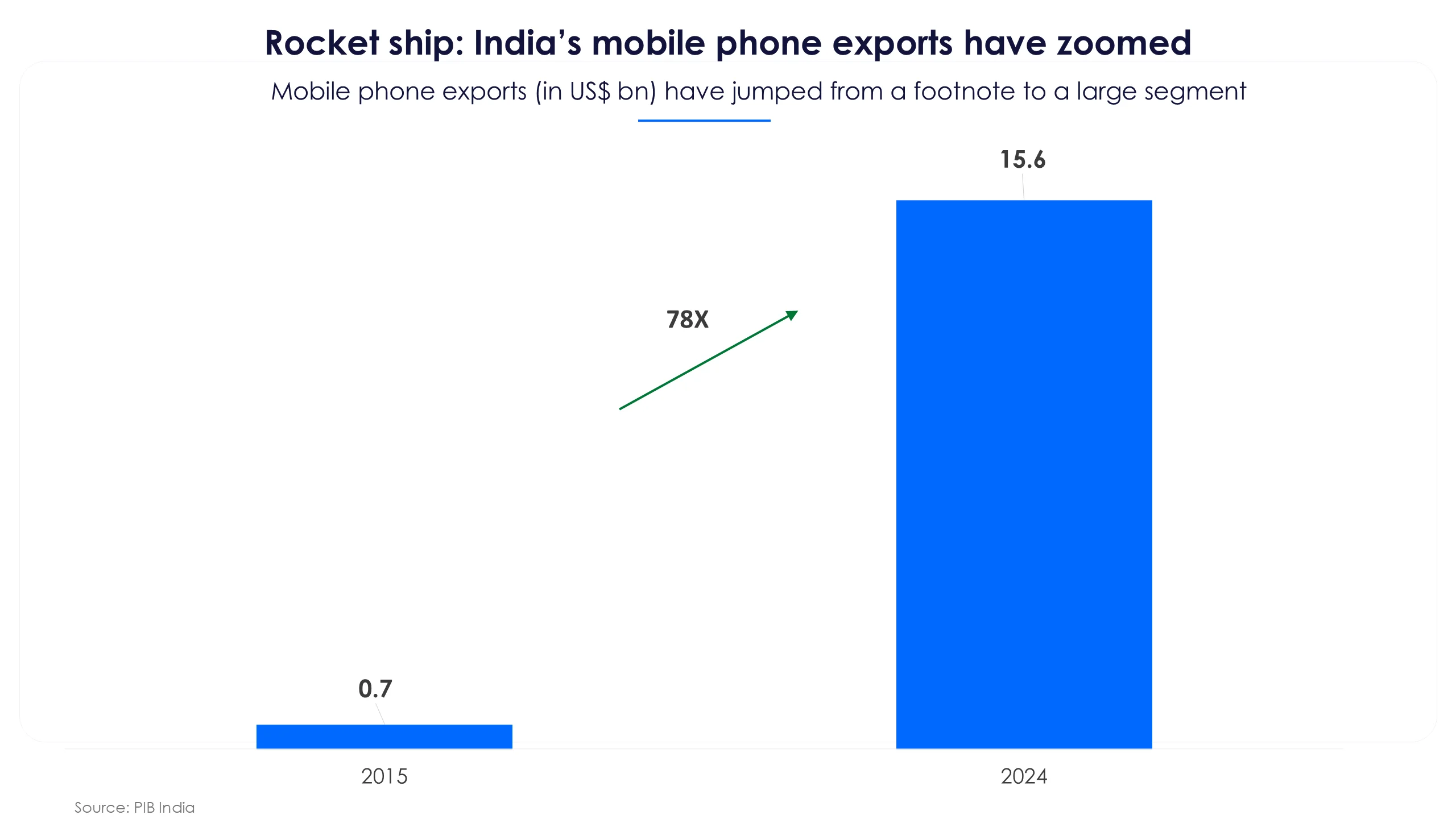

There is little doubt that India got a big export boost after China originated the Covid pandemic, and countries reconsidered their over-dependence on Chinese products. But India has yet to fully take advantage. One notable exception here has been in mobile exports.

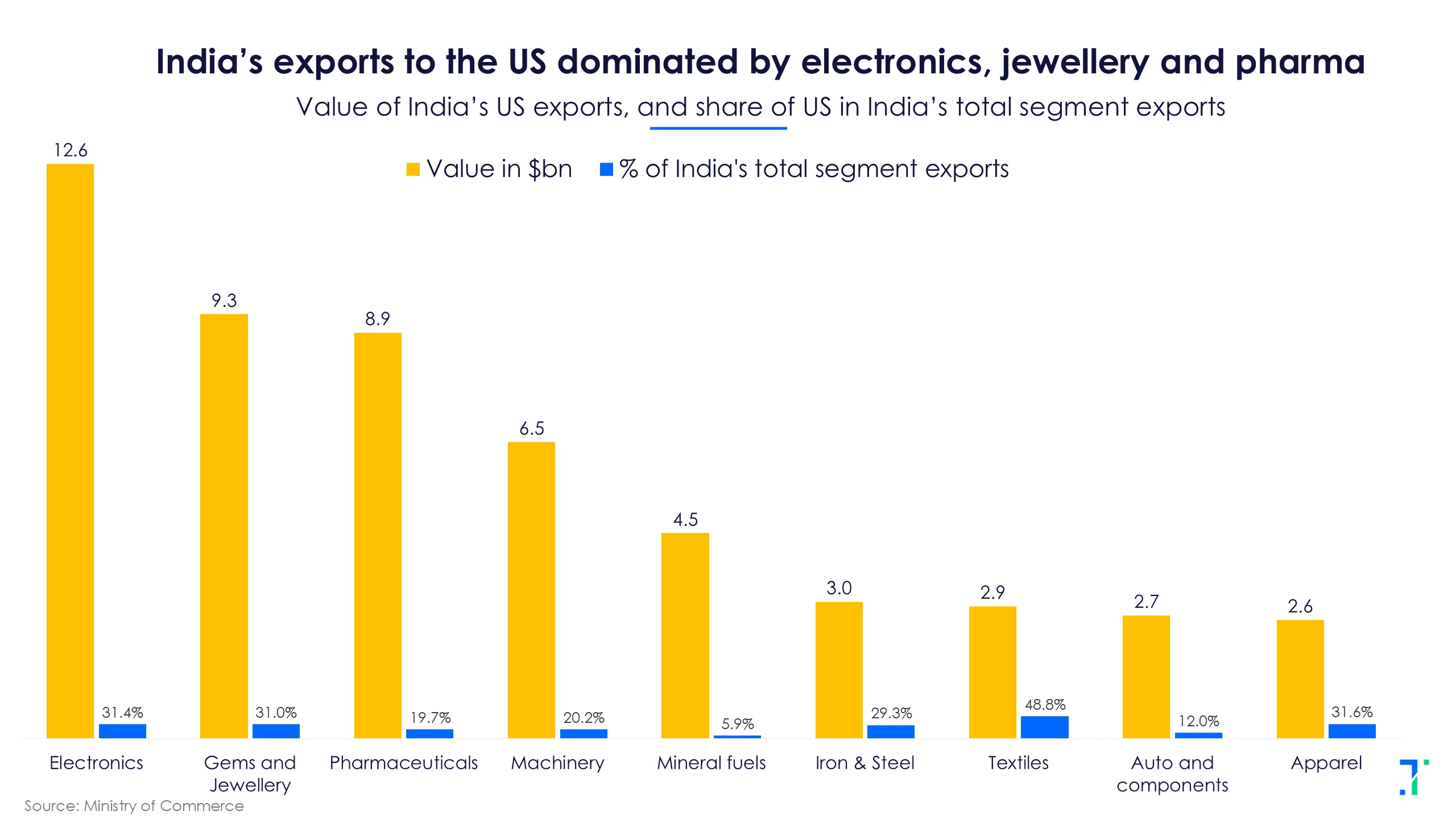

From Apple phones to HP laptops, a lot of electronics are being increasingly assembled in India instead of China. Nearly 18% of India's total merchandise exports go to the US. And electronics, pharma, textiles are big export segments to the US.

The US for example accounts for nearly one third of India's total electronics exports, and nearly 20% in pharma.

For these dominant sectors, having lower tariff rates would make India more competitive and boost an existing advantage. A Niti Aayog report published earlier this month, noted that major exporter economies like Canada and China have been slapped with high US tariffs in the range of 30-35%. This already gives India a relative export advantage in 78 products that make up 52% of India’s exports to the US. These include electronics, mineral fuels, apparel, plastics and furniture, worth in total of $1,265 billion.

The government is eyeing this as a major opportunity, and considering new PLI schemes for these industries, as well as lower setup and electricity costs for manufacturers.

But a US-India trade deal would supercharge this advantage.

The last round of India–US trade talks ran from June 26 to July 2. The Indian team is now again back in the US, trying to hammer out a deal. A favourable deal for Indian sectors like textiles, gems and jewellery, garments, plastics and chemicals, could dramatically increase exports for domestic manufacturers in these segments, and boost job growth.

So while India's ministers like Piyush Goyal have talked tough, saying India won't negotiate on a deadline, everyone is watching a clock that ticks towards August 1, when the tariffs kick in.

Screener: Stocks with the highest merchandise exports to the US

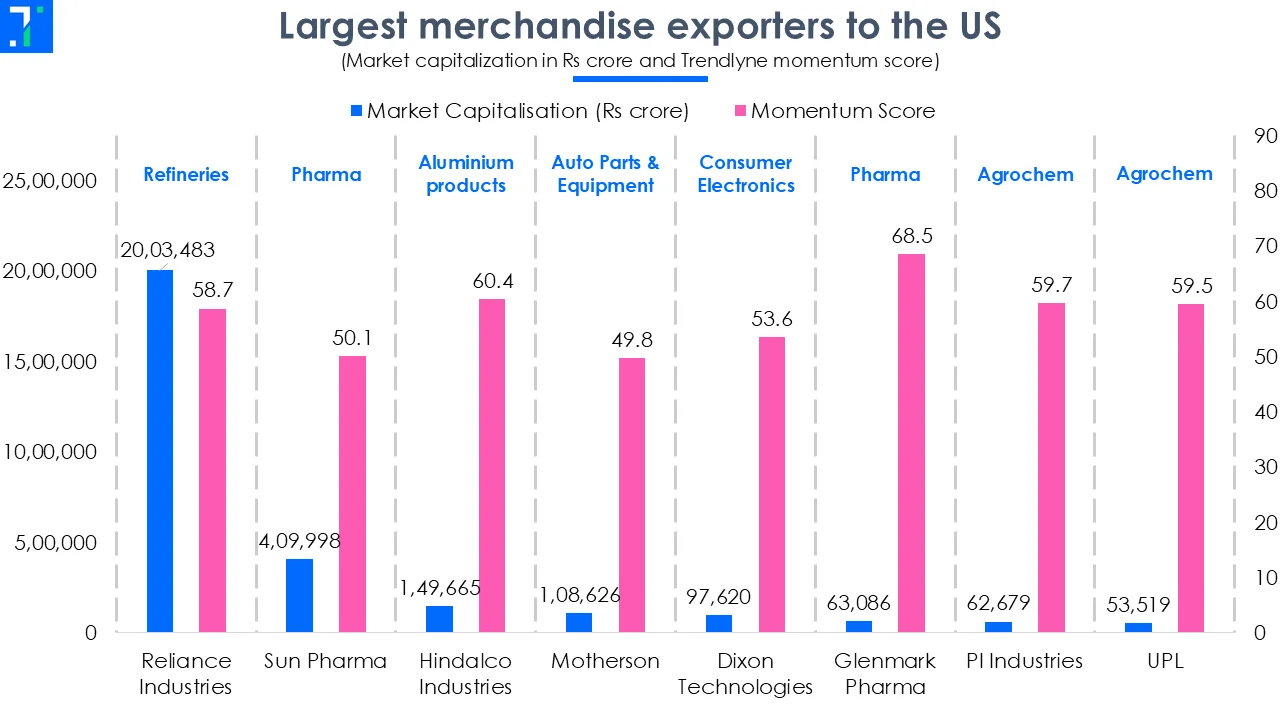

Largest merchandise exporters to the US

As we move closer to the August 1 deadline set by President Trump for import tariffs to take effect, India is reportedly close to finalising a trade deal. The US is India’s largest export market, with a trade surplus of $41.2 billion generated in FY25. In this screener, we look at stocks with the highest merchandise exports to the US.

The screener consists of stocks with significant merchandise exports to the US. These stocks come from the pharmaceuticals, auto parts & equipment, gems & jewellery, consumer electronics, agrochemicals, and textiles industries. Major stocks in the screener are Reliance Industries, Titan, Sun Pharma, Hindalco Industries, Samvardhana Motherson International, Dixon Technologies, Glenmark Pharma, PI Industries, and UPL.

President Trump warned about imposing a 200% import tariff on Indian pharmaceutical companies on July 9, after giving them 12-18 months to set up manufacturing facilities in the US. The Indian pharma industry generated $9 billion (~ Rs 76,831 crore) in sales from the US. Sun Pharmaceutical Industries and Glenmark Pharma were among the largest contributors. Sun Pharma reported a $1.9 billion (~Rs 16,330 crore) revenue from the US in FY25, contributing 30% of the company’s total revenue. Glenmark Pharma generated Rs 3,017.2 crore from the US in the same period, approximately 22.9% of its total revenue.

The agrochemicals industry also faces potential risks from Trump tariffs. In FY25, the industry generated $5.7 billion (~ Rs 48,978 crore) in revenue from sales to the US. UPL and PI Industries are among the largest exporters of chemicals to the US. UPL generated $728 million (~ Rs 6,060 crore) in sales from the US, contributing to 13% of its total revenue. Meanwhile, PI Industries reported $405 million (~ Rs 3,359 crore), contributing to approximately 42% of its total revenue.

You can find some popular screeners here.