The markets became more volatile this week. Despite this, inflows from foreign institutional investors continue to rise - in the last week, foreign investors bought over Rs 5,700.5 crore worth of Indian shares.

Consumer confidence is also improving, and Indian households are reporting an increase in spending. 'Outdoor businesses' are in particular, benefiting from this - after too many pandemic months sitting indoors and looking out of the window, Indians want to be outside. Traffic jams are back, shopping malls are packed, and its hard to get a hotel room anywhere.

In this week’s Analyticks,

- Outdoor sectors recover as restrictions disappear in Q1FY23

- Screener: Stocks outperforming their sector in Q1 growth, with high Piotroski score

Outdoor sectors are making a comeback

The Covid-19 pandemic in India hit some sectors harder than others. Some industries like pharma and healthcare services caught investor interest and emerged as stars, due to increased demand for their products and services. But outdoor industries like transport and hotels were impacted by lockdowns and movement restrictions, and the share prices of these companies reacted accordingly.

With the pandemic now in the rearview mirror, outdoor sectors like retailing, transportation, diversified consumer services, and hotels, restaurants, and tourism are seeing a comeback.

After the Q1FY23 results, outdoor sectors are outperforming the benchmark Nifty 50 index in the past month. This is because for the first time in two years, companies in these sectors had a fiscal quarter with no lockdown disruptions. This helped firms post strong YoY revenue and net profit growth. Revenues of these industries in focus at least doubled YoY in Q1FY23.

Leisure facilities industry outperforms Nifty 50 by over 46% in the past month

The overall consumer services sector outperformed the Nifty50 by 4% in the past month. This was helped by the outdoor leisure facilities industry, where share prices rose a staggering 55% on average in the past month (as of August 24). In fact this is the best performing industry in terms of % price change over this period. The companies here include waterpark amusement park chains like Wonderla Holidays andImagicaaworld Entertainment.

As life returned to normal with no disruptions, people began ‘revenge travel’, and many of these companies benefited from it. Their revenues grew exponentially YoY and losses turned into profits in Q1FY23.

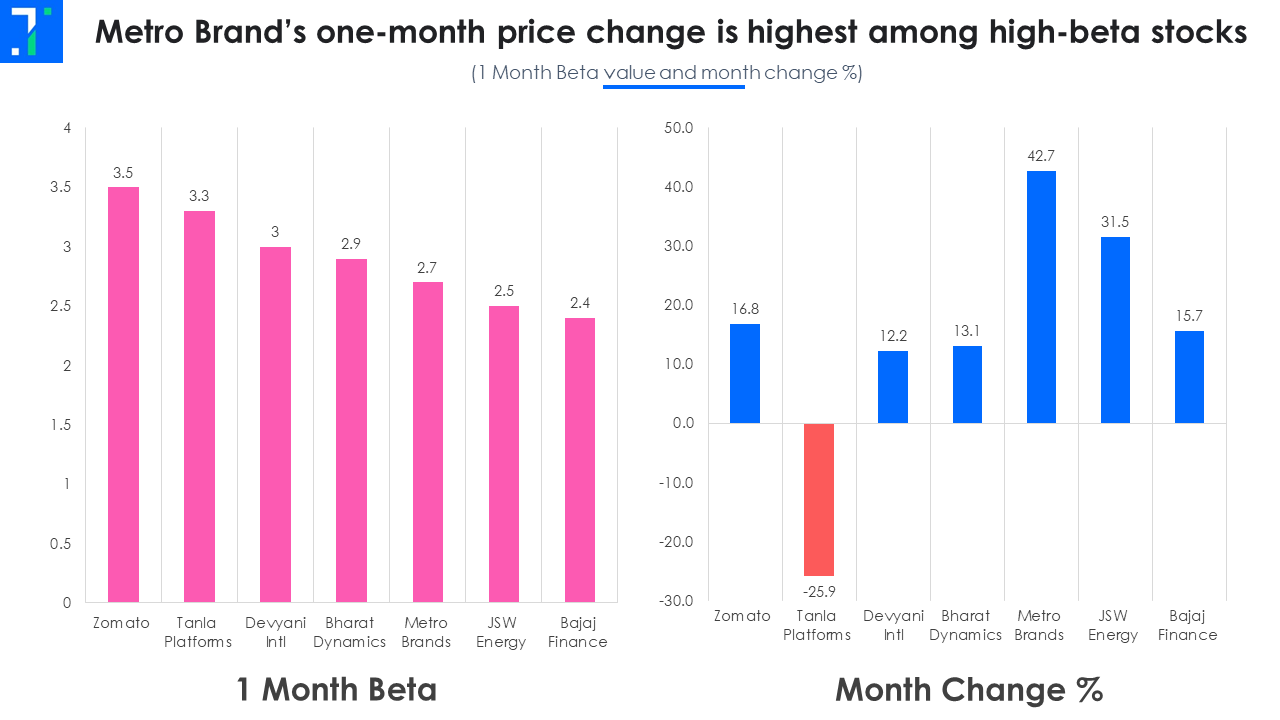

Metro Brands and Campus Activewear jump, outperforming the footwear industry

Another industry affected by lockdowns was footwear. But as the pandemic waned, two big companies got listed on the bourses and are currently among the top four (in market capitalization) in the industry. While the Jhunjhunwala-backed Metro Brands was listed in December 2021, Campus Activewear was listed in April 2022.

Hotel companies back in black in Q1FY23

Among the industries in focus, hotels and airlines are the best performers in YoY revenue growth in Q1FY23. The top four listed hotel companies - Indian Hotels Company, EIH, Chalet Hotels, and Lemon Tree Hotels posted profits in Q1FY23, against losses in the same quarter the previous year.

In the airline industry, InterGlobe Aviation (Indigo) managed to post strong revenue growth of 327.5% in Q1FY23. Jet Airways’ revenue fell 83% YoY in Q1 and SpiceJet is yet to announce the last two quarters’ results, citing a ransomware attack. Spicejet’s Q4FY22 revenue is scheduled to be announced on August 31.

Top performer Indigo’s load factor rose 310 bps to 79.6%, but it is still below pre-Covid levels of 89%. This is due to increased ticket prices on the back of soaring fuel costs. According to its management, Indigo’s international flight operations in Q1FY23 reached pre-Covid levels and it expects to grow in the coming months with the easing of international travel protocols.

Restaurant and department store companies beat Forecaster revenue estimates

The top three listed companies in the restaurants and the department stores industry beat Trendlyne Forecaster’s revenue estimates in Q1FY23.

Trent leads the pack in department stores as it beat Forecaster consensus revenue estimates by over 20%. Its revenue jumped over 3.5 times YoY in Q1 on the back of robust growth in its Westside and Zudio brands, with Westside clocking a like-for-like or LFL growth of 24% in Q1FY23 vs Q1FY20. As a result, Trent outperformed its top peers and rose around 15% in the past month.

With the pandemic at bay, the outdoor sector could continue its growth momentum in Q2FY23 as several industries have surpassed pre-covid levels both in terms of revenue and volumes. However, another Covid wave or a weakening economy remain key risks.

Screener: Stocks with a high Piotroski score, which are outperforming their sector in net profit and revenue growth

Post the June quarter results, we take a look at stocks that delivered a strong performance in the quarter. This screenershows stocks in the Nifty 500 that outperformed their sectors in net profit and revenue growth in Q1FY23 with a high Piotroski score.

Post the June quarter results, we take a look at stocks that delivered a strong performance in the quarter. This screenershows stocks in the Nifty 500 that outperformed their sectors in net profit and revenue growth in Q1FY23 with a high Piotroski score.

These 12 companies are not dominated by any one sector and include stocks from chemicals & petrochemicals, food, beverages & tobacco, and realty. Stocks in the screener include Hindustan Zinc, GAIL (India), United Spirits, and United Breweries.

Hindustan Zinc has the highest Piotroski score (9) among the 12 screener stocks, indicating high financial strength. It also beat the metals & mining sector in YoY net profit and revenue growth in Q1FY23. Its net profit grew 55.9% YoY compared to an average 21.1% fall in net profit for the sector.

Bharat Dynamics also has the highest Piotroski score. It beat the general industrials sector in YoY net profit growth by 147.5 percentage points, and revenue by almost 400 percentage points in Q1FY23.

GAIL (India) has a Piotroski score of 8. The company beat the utilities sector in YoY net profit growth by 29 percentage points and revenue growth by 60.5 percentage points in Q1FY23.

You can find more expert screeners here.