Trendlyne Analysis

Nifty 50 lost over 250 points amid selling pressure towards the end of the trading session and closed below the 17,000 mark. Indian indices closed in the red with the volatility index, India VIX, at around 20.5%. European stocks followed the global trend and traded lower than Monday’s close as the Bank of England warned of a "material risk to U.K. financial stability" due to crisis in the country's pension fund sector.

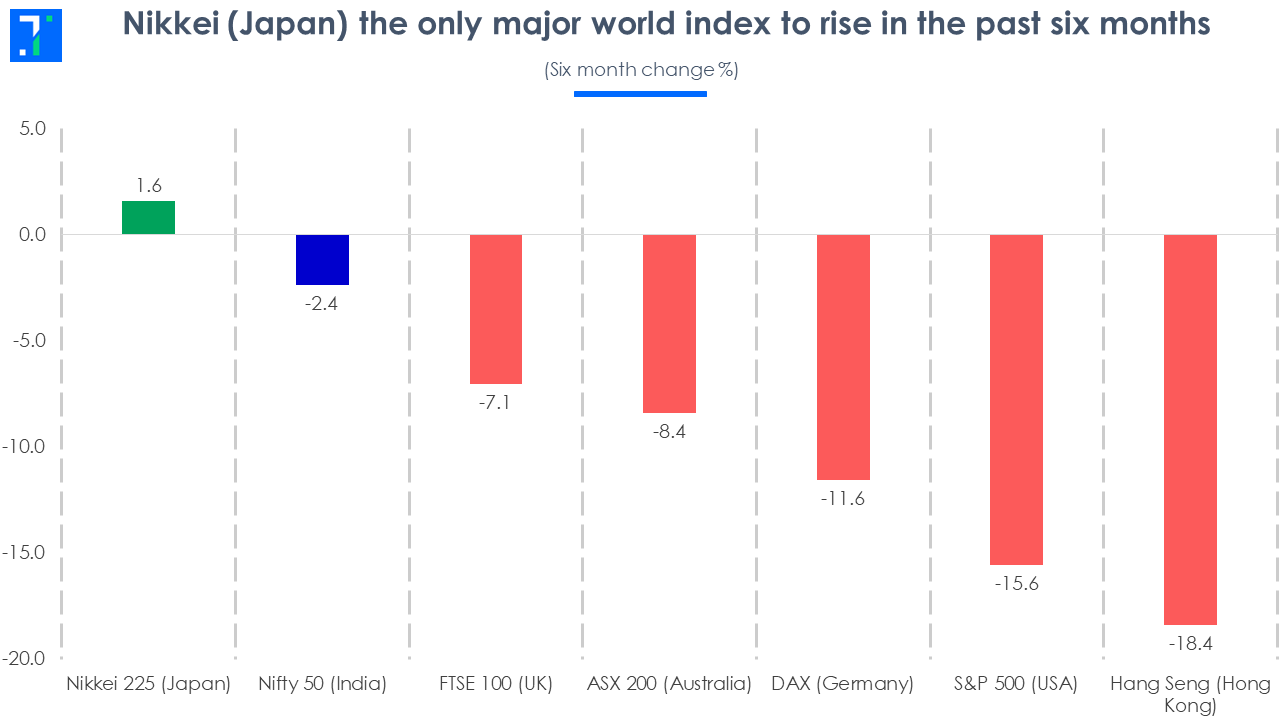

Major Asian indices closed in the red, in line with the US indices, which also closed lower on Monday. The tech-heavy index NASDAQ 100 lost over 1% and settled at its lowest level since July 2020. Investors look ahead to the Federal Open Market Committee meeting minutes and US inflation print to be released later this week. Brent crude oil futures traded sharply after losing 2.4% on Monday. However, crude oil is still up over 9% in the last six days amid supply concerns.

Nifty Smallcap 100 and Nifty Midcap 100 closed in the red, following the benchmark index. Nifty Energy and Nifty Pharma closed lower than Monday’s levels. Nifty IT closed in the red as investors assessed TCS’ Q2FY23 results announced on Monday.

Nifty 50 closed at 16,964.15 (-276.9, -1.6%) , BSE Sensex closed at 57,147.32 (-843.8, -1.5%) while the broader Nifty 500 closed at 14,700.90 (-250.8, -1.7%)

Market breadth is highly negative. Of the 1,937 stocks traded today, 419 showed gains, and 1,476 showed losses.

Stocks like Cochin Shipyard, Rites, Mazagon Dock Shipbuilders, and Tejas Networks are in the overbought zone, according to the relative strength index or RSI.

Brigade Enterprises' Chairman and Managing Director M R Jaishankar steps down as the company’s MD. He will continue to remain the Executive Chairman.

ITD CementationIndia wins orders worth Rs 1,755 crore for construction projects like container terminal in the port of Colombo in Sri Lanka, berth and yard facilities at Dhamra port in Odisha, and piling and civil work for coke oven project at Hazira plant in Gujarat.

Traxcn Technologies Rs 309.3-crore IPO gets bids for 54% of the available 2.1 crore shares on offer on the second day of bidding. The retail investor quota gets bids for 2.6X of the available 38.6 lakh shares on offer.

Mastek and Medplus Health Services hit their 52-week lows of Rs 596.5 and Rs 1,663, respectively. Both stocks fall for three-consecutive sessions.

Larsen & Toubro’s arm L&T Construction wins repeat orders worth Rs 1,000-2,500 crore from the state government of Odisha. The order pertains to the execution of lift irrigation projects to enable the irrigation of almost 30,000 hectares in the districts of Keonjhar, Jajpur, and Kendrapada in Odisha.

HDFC Securities initiates coverage on Endurance Technologies with a ‘Reduce’ rating and a target price of Rs 1,340. The brokerage expects the company’s profitability to be impacted by the slowdown in demand for two-wheelers, a fall in demand for passenger vehicles in Europe, and a sharp rise in energy costs in Europe. The brokerage also believes the company is currently trading at an expensive valuation

Commerial Services & Supplies, Hardware Technology & Equipment and Hotels, Restaurants & Tourismsectors rise more than 25% in the past 90 days.

- Rajesh Ravi of HDFC Securities expects the cement industry’s volume to grow 8% YoY. He also expects the industry’s margin to expand during H2FY23 however fluctuations in fuel prices remain a concern.

#OnCNBCTV18 | Expect #volume growth of 8% #YoY for cement industries. India cement’s valuation for 1 mt capacity in #Rajasthan could be ?600 cr, says Rajesh Ravi of HDFC Securities pic.twitter.com/syihb7VKVO

— CNBC-TV18 (@CNBCTV18Live) October 11, 2022 Sobha is rising as its total sales value rises 13% YoY to Rs 1,164.2 crore as demand for residential and office spaces increases in Q2FY23. Its average price realization is up 14% YoY. It shows up on a screener which lists stocks with strong cash-generating ability from core business.

Sugar stocks like Shree Renuka Sugars, EID Parry (India), Balrampur Chini Mills, and Dalmia Bharat Sugar and Industries are rising in trade. The sugar industry is up 2.5% in trade today.

Automotive Axles is rising as Cummins Inc places an open offer to acquire 26% stake (or 39.3 lakh shares) in the company. The open offer comes after Cummins' subsidiary, Rose Inc entered a merger agreement with Meritor Inc. Meritor is a promoter entity of Automotive Axles and holds 35.52% stake in the company.

Realtystocks like Brigade Enterprises, Oberoi Realty, Sobha, and Phoenix Mills are falling in trade. The broader sectoral index Nifty Realty is also trading in red.

IndusInd Bank falls over 3% as 1.2 crore shares (1.6% equity) amounting to Rs 1,442 crore change hands in a large trade, according to reports.

IndusInd Bank Large Trade | 1.23 cr shares (1.6% equity) worth ?1,442 cr change hands at ?1,176/sh#IndusIndBank#BlockDealpic.twitter.com/hewu7mWTfn

— CNBC-TV18 (@CNBCTV18Live) October 11, 2022Infosys announces that its board of directors will consider a proposal to buyback equity shares at its upcoming board meeting on Thursday.

Adani Ports & Special Economic Zone (APSEZ) receives approvals from the national company law tribunals of Ahmedabad and Hyderabad to acquire the remaining 58.1% stake in Gangavaram Port (GPL). The company had already bought a 41.9% stake in GPL during FY22. The remaining stake will be purchased through a share swap deal, with 4.77 crore shares of APSEZ being issued to the promoters of GPL. The acquisition is valued at Rs 6,200 crore.

- Morgan Stanley expects Delhivery’s express parcel volumes to go up during the festive season. It also expects the company's gross margin to improve to 21% in Q2FY23, compared to 16.8% in Q1.

#BrokerageRadar | @MorganStanley on @delhivery: Expect strong improvement in gross margin to 21% Vs 16.8% in Q1#StockMarket#StocksToWatchpic.twitter.com/4CTPLfCNaF

— ET NOW (@ETNOWlive) October 11, 2022 RateGain Travel Technologies, a SaaS company, is rising in trade as Royal Orchid Hotels selects the company to help the hotel chain in providing competitive pricing and connect online travel agents globally.

Mohnish Pabrai buys a 0.4% stake in Rain Industriesin Q2FY23, he now holds an 8.8% stake in the company.

India Cements sells its entire shareholding in Springway Mining to JSW Cement for a cash consideration of Rs 476.9 crore. Springway Mining is no longer a wholly owned subsidiary of India Cements.

Tata Consultancy Services’ Q2FY23 net profit rises 10% QoQ to Rs 10,431 crore led by strong deal wins. Revenue increases by 4.8% QoQ driven by growth across all its business verticals led by the communication, media & technology and life sciences & healthcare segments. The stock shows up on the screener which lists companies with revenue increasing sequentially for the past eight quarters.

Riding High:

Largecap and midcap gainers today include Bata India Ltd. (1,810.30, 1.64%), Gland Pharma Ltd. (2,083.60, 1.58%) and Axis Bank Ltd. (785.55, 1.12%).

Downers:

Largecap and midcap losers today include JSW Energy Ltd. (326.85, -5.33%), Divi's Laboratories Ltd. (3,502.20, -5.00%) and Havells India Ltd. (1,279.40, -4.91%).

Movers and Shakers

15 stocks in BSE 500 are trading on high volumes today.

Top high volume gainers on BSE included Kalpataru Power Transmissions Ltd. (447.90, 4.71%), Rajesh Exports Ltd. (625.90, 3.98%) and Star Cement Ltd. (110.05, 3.58%).

Top high volume losers on BSE were Divi's Laboratories Ltd. (3,502.20, -5.00%), IndusInd Bank Ltd. (1,164.60, -3.78%) and Intellect Design Arena Ltd. (502.65, -3.32%).

Motilal Oswal Financial Services Ltd. (697.80, -0.69%) was trading at 13.2 times of weekly average. Shipping Corporation of India Ltd. (118.85, 2.06%) and Aster DM Healthcare Ltd. (248.30, -2.65%) were trading with volumes 6.8 and 4.3 times weekly average respectively on BSE at the time of posting this article.

BSE 500: highs, lows and moving averages

6 stocks took off, crossing 52 week highs, while 7 stocks were underachievers and hit their 52 week lows.

Stocks touching their year highs included - Kalpataru Power Transmissions Ltd. (447.90, 4.71%), Star Cement Ltd. (110.05, 3.58%) and Tata Chemicals Ltd. (1,164.35, -2.94%).

Stocks making new 52 weeks lows included - Biocon Ltd. (268.75, -3.12%) and Motilal Oswal Financial Services Ltd. (697.80, -0.69%).

8 stocks climbed above their 200 day SMA including Shipping Corporation of India Ltd. (118.85, 2.06%) and Honeywell Automation India Ltd. (38,890.20, 0.64%). 28 stocks slipped below their 200 SMA including United Spirits Ltd. (815.60, -4.94%) and PNB Housing Finance Ltd. (386.20, -4.79%).