Nifty 50 opens lower after falling over 62 points in the pre-opening session. On Friday, Indian indices closed in the green after rising throughout the day. FIIs sold equity worth Rs 4,346.1 crore, while DIIs bought equity worth Rs 3,935.3 crore in Indian markets on the same day.

Nifty Midcap 100 and Nifty Smallcap 100 open lower, tracking the benchmark index. Nifty Pharma and Nifty Realty open lower. Investors await the Q3FY26 results for companies such as Hindustan Zinc, LTIMindtree, Tata Capital and Punjab National Bank.

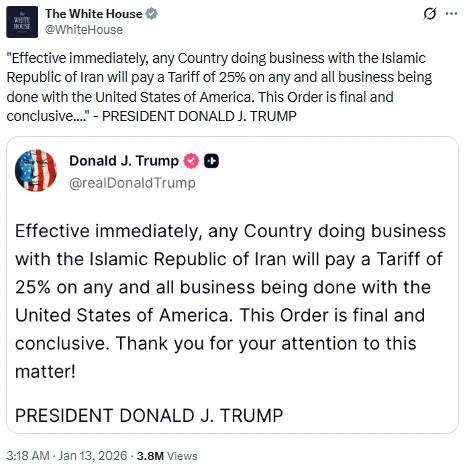

Major US indices closed mixed on Friday. European indices also ended mixed. Asian markets are trading with varied trends. Meanwhile, US President Donald Trump proposed a 10% tariff on goods from eight countries, including Germany and France, effective February 1, in response to their opposition to his plans to acquire Greenland.

Polycab India is rising sharply as its Q3FY26 net profit grows 35.9% YoY to Rs 621.7 crore, helped by lower inventory and sub-contracting expenses. Revenue jumps 46.4% to Rs 7,686.6 crore, led by improvements in the wires & cables, fast-moving electrical goods (FMEG), and engineering, procurement & construction (EPC) segments. It features in a screener of stocks with high trailing twelve-month (TTM) EPS growth.

Advait Energy Transitions is rising sharply as Vijay Kedia adds the company to his portfolio with the purchase of a 1.1% stake in Q3FY26.

Sobha is falling as its Q3FY26 net profit drops 28.9% YoY to Rs 15.4 crore due to higher land, raw materials, sub-contracting, and employee benefits expenses. Revenue declines 21.8% to Rs 983.1 crore, caused by a reduction in the real estate business. It shows up in a screener of stocks with decreasing returns on capital employed (RoCE) over the past two years.

Wipro is falling sharply as its Q3FY26 net profit declines 3.9% QoQ to Rs 3,119 crore due to higher inventory, employee benefits, and subcontracting expenses. However, revenue grows 3.9% to Rs 24,561.1 crore, driven by improvements in the Americas, Europe, and Asia-Pacific, Middle East & Africa (APMEA) markets. It appears in a screener of stocks with declining net profit for the past three quarters.

Warren Kevin Harris, MD and CEO of Tata Technologies, expects margins to improve in the fourth quarter, with the company aiming to return to around 18%, in line with FY25 levels, over the next financial year. He also expects sequential revenue growth of over 10% in Q4, following a $3 million revenue impact from a cyberattack at a major client in the third quarter.

#TataTechnologies confident of double-digit topline growth in #FY27@Reematendulkarhttps://t.co/7iatSaRbXk

— CNBC-TV18 (@CNBCTV18Live) January 19, 2026Bharat Coking Coal's shares debut on the bourses at a 95.7% premium to the issue price of Rs 23. The Rs 1,071.1 crore IPO received bids for 146.9 times the total shares on offer.

Yes Bank is falling as its Q3FY26 revenue declines 1.8% YoY to Rs 9,175.8 crore due to a decrease in the treasury operations and corporate banking segments. However, net profit jumps 55.4% to Rs 951.6 crore owing to lower interest expenses and provisions. The bank's asset quality improves as its gross and net NPAs decline 10 bps and 20 bps, respectively.

Engineers India is rising as it secures a contract worth $350 million (~Rs 3,174.6 crore) from Dangote Group. As per the contract, the company will offer project management consultancy (PMC) and engineering, procurement & construction Management (EPCM) to expand Dongote's polypropylene capacity to 2.4 million metric tonnes per annum (MMTPA) from 830 kilo tonnes per annum (KTPA).

Citi maintains a 'Buy' rating on HDFC Bank with a target price of Rs 1,200. The brokerage says the bank’s net interest margins (NIM) rose 8 bps in Q3 due to lower funding costs. Management remains confident of outperforming system loan growth in FY27. Citi adds that while the loan-to-deposit ratio (LDR) is elevated, it is manageable with a clear glide path as deposits accelerate, and asset quality remains strong with credit costs guided at 50–55 bps.

HDFC Bank share price: Brokerages maintain bullish stance after in-line Q3 numbers; check targets

— ET NOW (@ETNOWlive) January 19, 2026

Read More: https://t.co/PW7k6BDsbbpic.twitter.com/ZZBkfRgElzHDFC Bank's Q3FY26 net profit grows 11.5% YoY to Rs 18,653.8 crore, supported by lower interest expenses and provisions. Revenue jumps 2.9% to Rs 90,005 crore, driven by improvements in treasury operations and retail banking. The bank's asset quality improves as its gross and net NPAs decline 18 bps and 4 bps, respectively.

CG Power and Industrial Solutions surges as it secures an order worth Rs 900 crore from Tallgrass Integrated Logistics Solutions for a large data centre project in the US. The contract includes the supply of power transformers designed to meet the high reliability, efficiency, and uptime requirements.

ICICI Bank is falling as its net profit decreases 4% YoY to Rs 11,317.9 crore in Q3FY26 due to higher provisions. However, revenue rises 1.6% to Rs 41,965.8 crore, driven by improvements in the wholesale and retail banking segments. The bank's asset quality improves as its gross and net NPAs contract by 43 bps and 5 bps, respectively, during the quarter.

Reliance Industries' Q3FY26 net profit grows marginally by 0.6% YoY to Rs 18,645 crore. Revenue jumps 10.5% to Rs 2.7 lakh crore, supported by improvements in the oil-to-chemicals, retail, and digital services segments. It appears in a screener of stocks with improving cash flow over the past two years.

Nifty 50 was trading at 25,596.45 (-97.9, -0.4%), BSE Sensex was trading at 83,494.49 (-75.9, -0.1%), while the broader Nifty 500 was trading at 23,429.30 (-56, -0.2%).

Market breadth is highly negative. Of the 2,187 stocks traded today, 647 were on the uptrend, and 1,456 went down.

Riding High:

Largecap and midcap gainers today include CG Power and Industrial Solutions Ltd. (603.65, 7.5%), Hitachi Energy India Ltd. (16,750, 3.3%) and InterGlobe Aviation Ltd. (4,894, 3.3%).

Downers:

Largecap and midcap losers today include Wipro Ltd. (242.95, -9.2%), IDBI Bank Ltd. (101.12, -3.3%) and Tata Motors Passenger Vehicles Ltd. (343.50, -2.9%).

BSE 500: highs, lows and moving averages

5 stocks overperformed with 52 week highs, while 27 stocks hit their 52 week lows.

Stocks touching their year highs included - Axis Bank Ltd. (1,315.80, 1.7%), Bank of India (159.38, 1.3%) and Canara Bank (158.26, 0.7%).

Stocks making new 52 weeks lows included - Bata India Ltd. (898.45, -0.5%) and ITC Ltd. (330.40, 0.4%).

5 stocks climbed above their 200 day SMA including Kotak Mahindra Bank Ltd. (424, 1.4%) and Angel One Ltd. (2,771.10, 0.7%). 13 stocks slipped below their 200 SMA including Wipro Ltd. (242.95, -9.2%) and Sobha Ltd. (1,489, -2.5%).