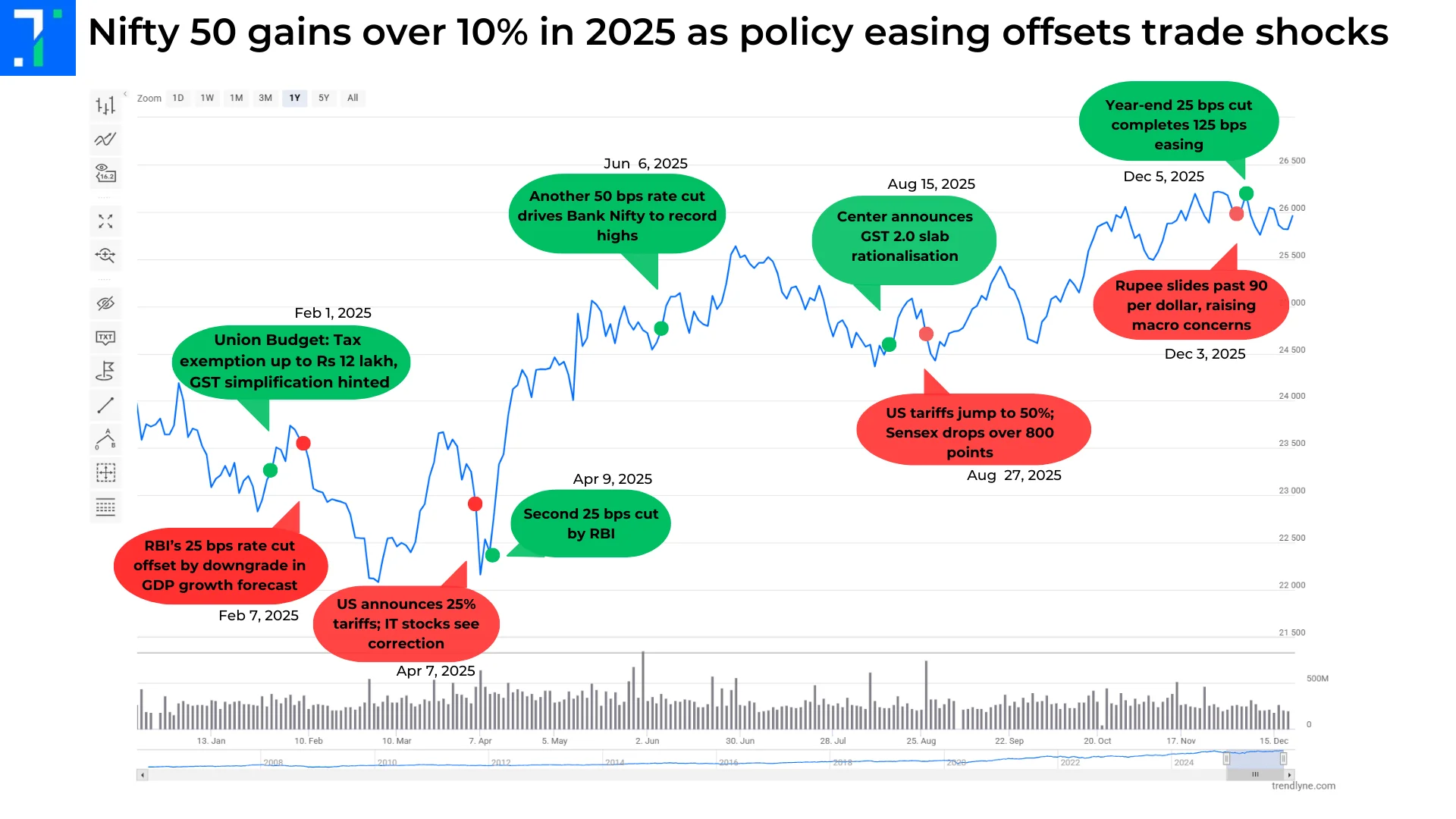

The Nifty 50 closed 2025 as one of the most unpredictable years in recent history. What began with optimism around steady growth turned over the months into a stop-start market, that struggled to find direction. By year-end, India lagged global peers, with the index delivering a modest 10.1% return.

That number doesn’t provide the full picture. There were long stretches this year where the market went nowhere, interrupted by sudden, sharp swings that tested investor patience. Unlike the smoother rallies of the past two years, 2025 felt like a constant tug-of-war between hope and fear.

Market stress was visible across earnings, valuations, and sentiment. Rajiv Batra of JPMorgan summed it up: “Indian equities were under pressure due to weak earnings, soft consumption, high valuations, trade headwinds and a weaker rupee,” noting that “policymakers are now clearly focused on reviving domestic growth.”

In this edition of Chart of the Week, we track how policy actions, global trade shocks, currency pressure, and earnings trends shaped the Nifty’s volatile journey through 2025—and why the year looks like a reset before a potential recovery.

An odd marriage: A resilient economy, a hesitant market

One of the biggest contradictions of 2025 was the gap between the economy and the stock market. While equities struggled, the broader economy held up better than expected. India’s services sector, which now contributes about 55% of total economic activity, played a stabilising role. Even as global trade slowed and manufacturing exports came under pressure, demand for services continued to grow.

The stock market, however, focused more on what could go wrong than right, given already high valuations. In H1CY25, analysts cut Nifty 50 EPS forecasts due to weak urban spending, banks seeing slower growth due to a high base, and soft global IT demand.

Valuations added another challenge. Stocks were not cheap enough to attract aggressive buying, but not expensive enough to justify extreme optimism. The result was a market stuck between strong long-term fundamentals and uncomfortable short-term realities.

RBI rate cuts: support came, but slowly

Policy support became the market’s main anchor in 2025, especially as global conditions worsened. The Reserve Bank of India took a clear pro-growth stance, cutting interest rates aggressively to support liquidity and confidence. Over the year, the RBI reduced the repo rate by a cumulative 125 basis points, taking it from 6.5% to 5.25% by December.

The first 25 bps cut in February, the RBI’s first rate reduction in five years, was met with caution. Alongside the rate cut, the central bank also lowered its GDP growth forecast by 20 bps to 6.4%, reinforcing concerns around slowing momentum. As investors focused on tariff-related risks and weaker growth signals, the Nifty slipped instead of rallying.

A second 25 bps cut in April came amid rising trade tensions, leading to an initial dip before a modest recovery led by banks and real estate stocks. June then marked a turning point. A larger 50 bps cut, along with a clear shift in the RBI’s stance, lifted sentiment. Banking stocks surged to record highs as expectations around credit growth and consumption improved.

By the time the final 25 bps cut arrived in December, the move was largely priced in. The Nifty barely reacted, ending the year in a cautious phase. Meanwhile, RBI Governor Sanjay Malhotra said India is in a rare “goldilocks” phase, with steady growth and controlled inflation. He added that rates are likely to stay low for longer, and any progress in trade talks—especially with the US—could lift growth by around half a percentage point.

Global trade shocks tested confidence, and exporters adapted

Global events remained a constant source of stress for Indian markets in 2025, with trade tensions—especially with the US—frequently unsettling investor confidence. In early April, the US imposed 25% tariffs on Indian goods, triggering a sharp fall in the Nifty. Export-heavy sectors were hit the hardest as investors quickly priced in weaker overseas demand.

The situation worsened in late August when tariffs were raised to 50% after India continued importing Russian oil. The market reacted sharply, with textiles, gems and jewellery stocks seeing heavy selling. These repeated trade shocks have deepened concerns about India’s export outlook and added to the market’s overall nervousness.

Currency pressure amplified the impact. The Indian Rupee weakened past Rs 90 to the dollar, making it one of the weakest-performing Asian currencies during this period. While a softer rupee can help exporters, it raises costs for energy imports and foreign debt repayments. Dilip Parmar of HDFC Securities noted that the rupee significantly underperformed regional peers, further weighing on sentiment.

Yet exporters did not stand still. Companies began shifting focus to alternative markets, and the data reflected this adjustment. Exports to China jumped 31% YoY in September–October, while shipments to Saudi Arabia and parts of Europe also increased. These moves helped cushion some of the damage from US tariffs.

By December, sentiment improved as talk of a potential US–India trade deal gained traction. The possibility of easing tariffs in exchange for higher Indian purchases of US energy helped calm markets and offered hope that the worst of the trade pressure may be nearing an end.

Tax relief gives consumption a boost

Alongside monetary support, fiscal measures played an important role. The Union Budget 2025 raised the personal income tax exemption limit to Rs 12 lakh, putting more money directly into household hands. While broader market reaction was muted on budget day, consumer-focused stocks responded positively in the weeks that followed.

JP Morgan estimated that the tax relief could add around 0.6% to GDP over time, gradually lifting consumption. The impact became more visible after the rollout of GST 2.0 in September. The tax structure was simplified into two main slabs—5% and 18%—replacing a complex system that businesses had long criticised.

The immediate effect was seen in consumer durables. Products like air conditioners and large televisions moved from the 28% bracket to the 18% bracket, leading to price cuts of 8–9%. Retailers reported a noticeable jump in footfalls and sales. To offset revenue loss, the government retained a steep 40% tax on luxury items such as premium SUVs.

Earnings bring a turning point

After months of uncertainty, October saw a change in the market's tone. The Nifty rose 4.5%, its strongest monthly gain of 2025, not due to policy announcements, but because earnings were better than feared. The steady stream of downgrades slowed, suggesting profits may have finally bottomed out.

Banks and auto companies led the recovery, reporting stable demand and improved cost control. The results were not spectacular, but they were “less bad” than expected—and that was enough. Motilal Oswal and other brokerages noted that the worst phase of earnings pressure appeared to be behind.

The October rally did not erase the damage of the year, but it shifted the investor mindset. As 2025 ended, the focus moved away from constant downside risks toward the possibility of a gradual recovery in 2026, making the year look less like a downturn and more like an overdue reset.