Finance Minister Nirmala Sitharaman is probably not very happy with Tariff ManDonald Trump, considering how his tariff announcements stomped all over her Budget buzz.

The Budget this year was a careful balancing act, with big income tax cuts for consumers as well as lower import duties to boost manufacturing. All this got eclipsed by Trump's tariff threats, and market chaos peaked on Sunday, as Nasdaq futures crashed 2.5%.

Last-minute agreements with Mexico and Canada have now delayed tariffs for a month. But Trump is the chaos president. Just yesterday, on February 4 he announced that the US plans to seize the Gaza strip, relocate its two million residents elsewhere, and turn it into a 'riviera'.

Trump said, "Everybody I have spoken to loves the idea of the United States owning that land". Well, everybody except almost every country in the Middle East.

So, how are superstar investors playing this volatile market?

In this week’s Analyticks,

- Superstar investors see their net worth fall from their peak

- Screener: Stocks with positive surprises in Revenue and EPS this quarter

Market correction hits superstar investors' portfolios

India's benchmark indices have fallen 12% from their all-time highs. Relentless FII selling, muted earnings and worries about a trade war are spooking investors.

Superstar investors haven’t been spared either, despite their long experience and in-house research teams.

Major superstar investors see their net worth fall in 2025

With negative market sentiment in Q3FY25, only two major superstar investors—Mukul Agrawal and Vijay Kedia—managed to grow their net worth.

Mukul Agrawal's gains were primarily from his bet on BSE, which surged 22% during the quarter. The stock constitutes 14% of his portfolio, making it the key driver of his overall performance.

Vijay Kedia’s gains came from TAC Infosec, which rose 14% in Q3 and contributes 14% to his total holdings.

Outside of these two, most superstar investors have faced significant declines since the correction began in Q2FY25.

Dolly Khanna’s public portfolio slumped 25.5% in Q3, dragged down by Chennai Petroleum, which fell 17%. That one stock alone makes up 25% of her holdings - an argument for diversification, folks.

Rakesh Jhunjhunwala & Associates saw a rise in overall net worth in January 2025, but that was mainly due to a Rs 14,953 crore fund infusion into a newly listed company (Inventurus Knowledge) on December 19, 2024. Without this capital injection, the portfolio actually declined 4.6% in January.

Ace investors’ net worth fall from their Q1FY25 peak

As expert investors saw their net worth fall, most decided to either hold or trim their stakes. Buys were few. But Mukul Agrawal has followed a different strategy - he shuffled his portfolio significantly, both decreasing his stakes in 12 companies and buying shares in eight new companies.

Mukul Agrawal breaks the trend, buys several stocks even as he sells

We will have to wait and see if these new buys turn out to be smart bets.

Expert investors buy new stakes in financially strong and recently listed companies

The group of top investors we analyzed acquired in total, new stakes in 15 companies in Q3, mainly in the small-cap space. Mukul Agrawal contributed eight of these new additions.

Two clear patterns emerge from this list. First, six of these new buys were recently listed on the exchanges and outperformed the benchmark index over the past quarter. Second, these stocks have strong financials, as reflected in Trendlyne’s Durability scores.

Two sectors stand out among these investments—commercial services & supplies and textiles, apparel & accessories, both appearing frequently in the portfolio updates.

Superstar investors are buying stocks with good financial health

Note that newly listed companies don’t yet have some Trendlyne scores.

The quarter's best performer was KRN Heat Exchanger (listed on exchanges on October 3) picked up by Mukul Agrawal. In fact, five of the six recently listed stocks have delivered better returns than the Nifty50 in the last three months.

Superstar investors pick up stakes in recently listed companies

Superstar investors sell stakes in underperforming companies

Nine stocks exited superstar portfolios in the past quarter. Barring Jagsonpal Pharma, all other companies have underperformed the Nifty50 in the past quarter.

Superstar investors sell underperforming stocks in Q3FY25

The list includes stocks from pharma to banking and finance. The top loser on the list is the software and services company E2E Networks, which was sold by Ashish Kacholia.

Rare Enterprises and Dolly Khanna reduced their stake to below 1% in Sun Pharma Advanced Research Company and Pondy Oxides Chem, respectively, in Q3.

Top performers: Mukul Agrawal's 2017 bet Neuland Labs delivers growth

When we look at long-term bets by these superstars, Mukul Agrawal's Neuland Labs and Kacholia’s Shaily Engineering Plastics come out on top. Neuland Labs and Shaily Engg contribute around 13.5% of their portfolios.

Best performing long-term holdings: Mukul Agrawal's Neuland Labs tops the list

Bhanshali’s Gujarat Fluorochemicals (30% of total holding value) and Khanna’s Chennai Petroleum Corp (22% of total holding value), on the other hand, have relatively lagged since they bought the stock. However, Bhanshali's net worth has almost tripled in the past two years due to high performance in their other holdings and fresh buys in new stocks.

Screener: Stocks with positive surprises in Revenue and EPS in Q3FY25

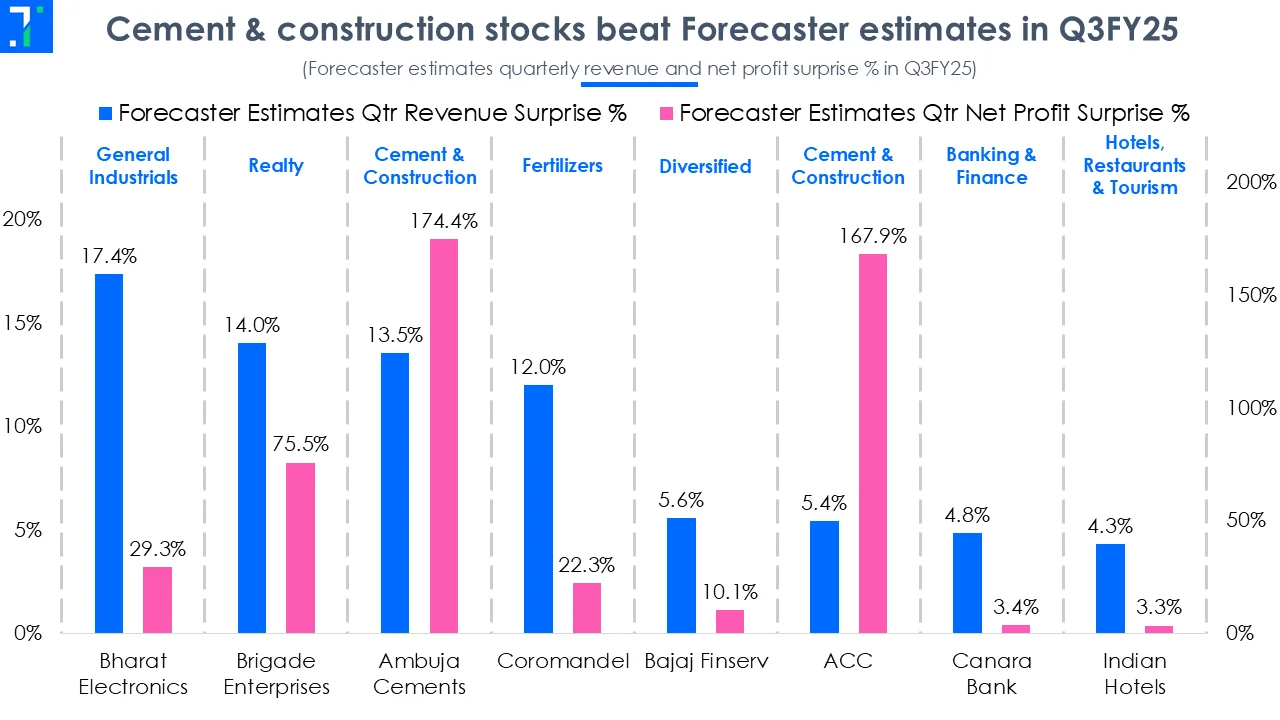

Cement & construction stocks beat Forecaster estimates in Q3FY25

As we are past the halfway point of the Q3FY25 results season, we look at stocks that have outperformed estimates with the highest margin. This screener shows stocks where quarterly revenue and EPS in Q3FY25 beat Forecaster estimates.

The screener is dominated by stocks from the realty, general industrials, pharmaceuticals & biotechnology, metals & mining, and banking & finance sectors. Major stocks that show up in the screener are Bharat Electronics, Brigade Enterprises, Ambuja Cements, Coromandel International, Bajaj Finserv, ACC, Canara Bank, and Indian Hotels.

Bharat Electronics features in the screener with the highest Forecaster revenue surprise of 17.4% in Q3FY25. Meanwhile, its net profit beat Forecaster estimates by 29.3% during the quarter. This aerospace & defence company’s revenue and net profit grew by 37.6% YoY to Rs 5,957.1 crore and 52.5% YoY to Rs 1,311 crore, respectively. Its revenue increased on the back of its order book rising by Rs 11,000 crore to Rs 71,100 crore so far in FY25. Net profit rose due to a reduction in inventory costs.

Ambuja Cements’ revenue and net profit beat Forecaster estimates by 14% and 75.5%, respectively in Q3FY25. This cement & cement products firm’s revenue grew by 26.6% YoY to Rs 1,529.7 crore, driven by an improvement in sales of cement and ready-mix concrete. Its net profit surged 157% YoY to Rs 2,115.3 crore owing to a tax return of Rs 805 crore and lower finance costs.

You can find some popular screeners here.