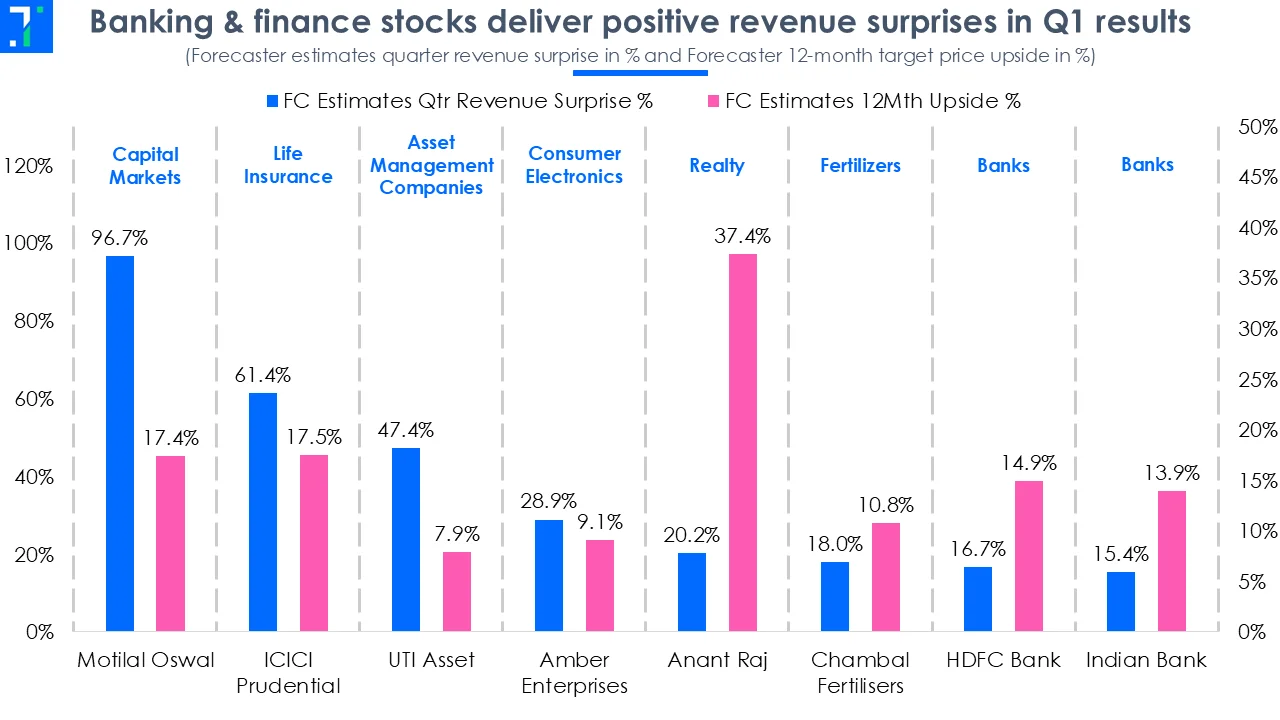

1. GE Vernova T&D India:

The stock of this industrial machinery company rose 2.9% over the past week following the announcement of its Q1FY26 results. It reported a 38.3% YoY increase in revenue, driven by a 78% jump in export sales. Net profit more than doubled to Rs 291.2 crore from Rs 134.5 crore in the same period last year, a result of better price realization and rising volumes. Its operating revenue exceeded Forecaster estimates by 6.9%, supported by strong order inflows, 85% of which came from the domestic market. The stock features on a screener of companies with no debt.

The company’s orderbook for the quarter rose 57% to Rs 1,620 crore driven by a rise in domestic orders. Commenting on the current orderbook, CEO and MD, Sandeep Zanzaria said, “New orders outpaced revenue, expanding the order backlog to Rs 12,960 crore as of June 2025. Most of these orders are for transmission equipment like transformers and reactors. We are also regularly receiving orders from data centers, with current offtake at around the 220 kV level. We expect this to grow to 400 kV as more data centers are built.”

Mr. Zanzaria highlighted that the global shift toward energy transition has spurred robust demand from regions including Europe, Australia, the Middle East, Latin America, and Southeast Asia. He added, 'We have set a long-term target for exports to comprise 30% of our order backlog and are confident of maintaining this target based on our current pipeline.”

ICICI Securities notes that India is upgrading its power grid to handle about 900 GW of capacity and plans to source 43% of its electricity from renewables by 2030. As a result, transmission capex is expected to rise following a muted investment cycle during FY20–24. The brokerage estimates a capex of Rs 3.4 lakh crore for inter-state transmission over the next 4–5 years and believes the company is well-positioned to benefit from India’s focus on grid strengthening. ICICI Securities maintains a ‘Buy’ rating on the stock with a higher target price to Rs 3,000 per share.

2. JSW Steel:

Thisiron and steel products manufacturer rose 3% on August 4 afterannouncing a Rs 5,845 crore investment with Japanese partner JFE Steel to expand electrical steel production capacity. Once complete, the joint venture’s capacity will increase seven-fold to 3.5 lakh tonnes per annum. Electrical steel, also called grain-oriented steel, is a specialised high-grade steel used in transformers and power equipment.

Joint MD & CEO Jayant Acharyasaid, “India imports almost 100% of its electrical steel. So, this investment will enable India to become self-reliant and replace imports.” While exports currently contribute just 10% of JSW Steel’s revenue, he sees long-term potential to tap international markets in South Asia, the Middle East, and Africa, where demand for power infrastructure is rising.

This expansion forms part of JSW Steel’s Rs 20,000 crore capital expenditureplan for FY26. The company has already spent 20% of this in Q1, mainly toward the ongoing capacity expansion at Vijayanagar, upgrades at Bhushan Power & Steel, other facilities, and mines.

InQ1FY26, crude steel output rose 14% YoY, while sales volumes grew 9%. Despite this, revenue stood flat and marginally belowForecaster estimates, as softer steel prices and muted exports offset volume gains. The company maintains its full-year sales volume guidance of 28 million tonnes, with Q1 output accounting for just under a quarter of this target.

Net profit came in ahead of estimates after rising 159% YoY in Q1, driven by a favourable product mix and lower coking coal costs. EBITDA margin improved to 17.5%. Value-added high-margin products contributed to over half of total sales, supporting margins even in a weaker pricing environment.

Motilal Oswalmaintains a ‘Buy’ rating on JSW Steel, with a target price of Rs 1,200. The brokerage highlights domestic demand, an increasing share of premium products, and growth from capacity additions. However, it flags downside risks, including volatility in global steel prices, rising low-cost imports, and execution delays in mining projects.

3. Emami:

This personal products maker’s share price increased 6.3% on July 31 following the announcement of its Q1FY26 results. The company’s net profit increased 7.6% YoY to Rs 164.3 crore, driven by lower advertising and inventory-related expenses, and beat Trendlyne’s Forecaster estimates by 15.3%. Emami features in a screener of companies where mutual funds increased their shareholding in the past month.

During the quarter, revenue declined marginally by 0.2% YoY to Rs 904.1 crore due to weaker domestic sales. The management highlighted that rural demand held up, due to the early arrival of monsoon and a strong harvest, while urban demand was muted. However, FMCG players are now seeing some green shoots in urban areas after months of slump. Good macro-economic conditions, lower food inflation, and monetary and fiscal policy measures have helped – and the trend is expected to continue through the rest of the fiscal year.

For Emami, the pain management portfolio, home to brands like Zandu and Mentho Plus, was a key growth driver, up by 17%, due to the early monsoon. It's no surprise that the summer-centric portfolio underperformed, since the premature onset of rains negatively impacted consumption across staples like prickly heat powders. Commenting on this, Mohan Goenka, the Whole-Time Director and Vice Chairman, said, “We expect weakness in our summer portfolio to persist going into Q2FY26, with favourable monsoon conditions likely to reduce seasonal demand.”

Emami has been focusing on niche, high-margin, and underpenetrated segments, building a strong presence with flagship brands like Boroplus, Navratna, and Zandu, particularly in areas where competitors have yet to see meaningful traction. Looking ahead, the company plans an entry into the nutraceuticals space, betting big on emerging categories such as health foods, nutrition, pet care, aloe-vera-based beverages, and science-backed skincare.

Dolat Capital has a ‘Reduce’ call on Emami with a lower target price of Rs 610 amid challenges in select categories. However, the brokerage remains optimistic about the company’s long-term growth, noting significant headroom for expansion in rural markets across categories.

4. Hitachi Energy India:

Thispower transmission & distribution company fell 3.5% on July 31 following the announcement of itsQ1FY26 results, as the company missedForecaster estimates on revenue and net profit by 22% and 4.6%, respectively. The performance fell shortdue to slower execution in its Rs 29,125 crore order pipeline. However, its revenue grew 11.4% YoY to Rs 1,479 crore and net profit rose nearly eleven-fold to Rs 131.6 crore, driven by higher other income.

A key highlight of the quarter was the company booking its highest-ever quarterly order inflow, whichsurged 365% YoY to Rs 11,339 crore, led by the Bhadla-Fatehpur High Voltage Direct Current (HVDC) linkproject from Adani Energy. Transmission remained the dominant segment in the order inflow, accounting for over 80% of total orders, while the rail, metro, and data center segments accounted for the rest.

Commenting on the order execution, N Venu, MD & CEO of the company,said, “HVDC projects are pretty long, multi-year projects. Our completion period is 48-54 months. So, execution will take time and in the first year, revenues are not much. We expect some amount of revenue starting from the next financial year.”

Hitachi Energy Indiaplans to invest Rs 2,000 crore over the next few years to expand capacity across transformers, high-voltage equipment, grid automation, and HVDC systems. The management expects at least two, and potentially up to three, HVDC projects per year to be finalized in the Indian market for bidding over the next three to four years.

Post results, Motilal Oswalreiterated its ‘Sell’ rating on the stock, citing rich valuations and weaker-than-expected execution despite strong order inflows. It remains positive on Hitachi Energy’s long-term potential, supported by strong demand in transmission and exports, along with capacity expansion plans. But to justify current valuations, the company must deliver consistent execution and margin improvement, especially in large HVDC orders.

5. ABB India:

This heavy electrical equipment manufacturer fell 6% on August 4 following the announcement of its Q2CY25 results. Net profit fell 20.7% YoY due to higher raw material costs and currency fluctuations. Revenue increased 12.3% from strong demand in the electrification and robotics segments.

The company’s revenue and net profit missed Forecaster estimates. New orders in Q2 declined 12% due to delays in customer decision-making and weak domestic demand in the chemicals and oil & gas sectors.

The company also faced operational challenges in regulatory compliance due to higher imports of electrical components. This increase in costs led to a 3.9 percentage point decline in profit margins to 11.1%.

Sanjeev Sharma, Managing Director, notes, “We earn 90% of revenue from the domestic market. Forex volatility related to the import of electrical components impacted profitability during the quarter. Over the second half, we expect the domestic demand to improve in infrastructure, real estate, and the data centre business, with easing inflation and a pickup in government and private capex.”

Commenting on the outlook, T.K. Sridhar, CFO, said, “We remain optimistic about medium-term growth, supported by domestic market demand and a few mid- to large-sized opportunities in the railways and metro segments.” He highlighted that capacity ramp-up in the electrification and robotics segments will meet growing demand and also help the company to sustain the profit margin of 12–15% in CY25.

Post results, ICICI Securities maintained a ‘Hold’ rating, citing electrification and data centre projects as growth drivers in the medium term. The brokerage highlights that despite weak order inflow in Q2, ABB's order book has remained healthy at Rs 10,060 crore and expects revenue visibility over the next 18 months. The brokerage projects revenue to grow at a CAGR of 12% over FY26-27.

Trendlyne's analysts identify stocks that are seeing interesting price movements, analyst calls, or new developments. These are not buy recommendations.