When mutual funds (MFs) and foreign institutional investors (FIIs) raise their stake in a company, it often signals firm conviction in its long-term growth story. These institutional players typically invest only after deep research into the company and its peers, so their buying rarely goes unnoticed. This screener highlights stocks that saw a QoQ increase of over 2% in both MF and FII holdings in Q1FY26—a potential sign of rising institutional confidence.

The Economic Times noted, “While FIIs have pared back broadly in 2025, they have sharply increased investments in sectors such as financials, telecom, and services—signalling selective confidence in high-growth segments.”

In Q1FY26, eleven Nifty 500 companies saw a rare show of confidence—both mutual funds and FIIs increased their stake by over 2% each. Such parallel buying is often a strong signal of conviction in a company’s growth potential.

Notably, several of these names come from the financial services space—RBL Bank, KFIN Technologies, and PNB Housing among them. In many cases, promoter exits and a strong earnings outlook opened the door to fresh institutional interest.

A driver of rising institutional buying in Q1 has been promoter stake sales through block deals, creating liquidity windows that mutual funds (MFs) and foreign institutional investors (FIIs) were quick to seize.

In this week’s Chart of the Week, we spotlight eleven companies—ranging from Vishal Mega Mart, Swiggy, Sagility India, and Sai Life Sciences to InterGlobe Aviation, and PG Electroplast—that have caught the eye of both MFs and FIIs. We break down what’s driving this institutional buying spree.

Promoter stake sales unlock institutional buying

Vishal Mega Mart and PG Electroplast’s mutual fund and FII holdings increased after their promoters sold stakes through a block deal. At Vishal Mega Mart, the promoter entity Samayat Services LLP sold a 20% stake worth ?10,488 crore via a block deal in June, following the expiry of the pre-IPO lock-in period. The move triggered a surge of institutional buying, with FIIs raising their stake by 14.3% and mutual funds by 5.8%.

Among the major domestic investors were HDFC Business Cycle Fund, SBI Equity Hybrid Fund, and Kotak Pioneer Fund, each picking up meaningful stakes. What attracted these investors was the company's strong FY25 performance: revenue rose 20.5%, and net profit grew 36.8%, both ahead of analyst expectations.

The company’s business model, anchored in a strong presence in tier-2 cities, a diverse and affordable private label portfolio (contributing 73% of revenue), and a lean cost structure, enhanced its appeal. Growth across apparel, general merchandise, and FMCG segments, along with improved inventory efficiency, also boosted investor confidence.

A similar pattern played out at PG Electroplast. In May, the company’s promoters sold a 5.6% stake for Rs 1,177 crore through a block deal. Institutional interest quickly followed, with FIIs increasing their holding by 2.1% and MFs by 2.6%.

Key institutional investors included ICICI Prudential Smallcap Index Fund, Government Pension Fund Global, and the Government of Singapore.

Backed by standout financials in FY25, the company delivered a 77.7% increase in revenue and a 113.3% jump in net profit, far exceeding expectations. Strong demand for its core products—room air conditioners, washing machines, and air coolers—drove top-line growth, while its emphasis on backward integration improved margins and profitability.

These gains positioned PG Electroplast as a compelling pick in the consumer electronics manufacturing space.

IndiGo, operated by InterGlobe Aviation, also saw a rise in institutional holdings in Q1FY26, with mutual funds increasing their stake by 3% and FIIs by 2.2%. Among the major participants were ICICI Prudential S&P BSE 500 ETF and SBI Resurgent India Opportunities Scheme .

The airline’s appeal lies in its dominant 64% share of the domestic aviation market during Q1FY26 and its forward-looking expansion strategy. IndiGo has over 900 aircraft on order and plans to expand its international capacity share from 28% to 40% by FY30, factors that have strengthened its long-term investment case among institutions.

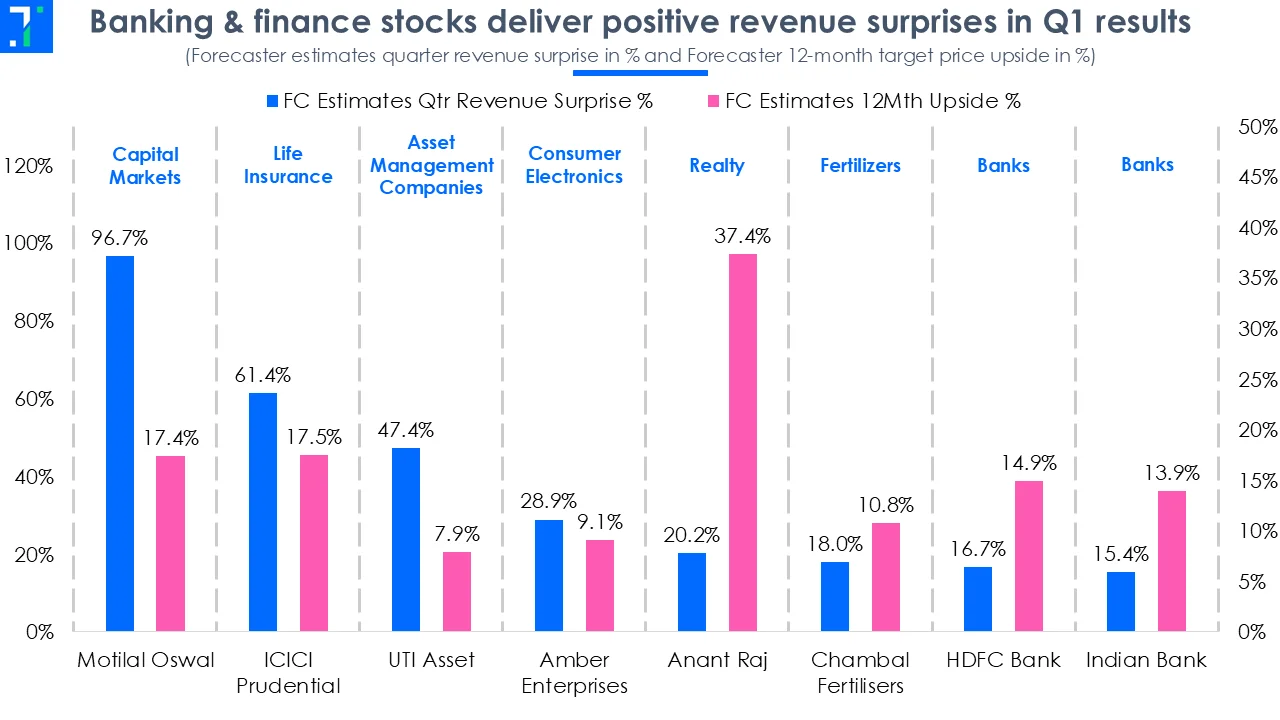

Smart money flows into financial stocks on a bullish outlook

Institutional investors ramped up their stakes in several financial companies during Q1FY26, driven by strong FY25 earnings, fresh capital raises, and promoter stake exits. The shift reflects growing confidence in the sector’s outlook, particularly in housing finance, asset management, and mid-sized banks.

KFIN Technologies saw FII holdings rise 5.3% and mutual fund holdings increase 3.3%, following a 10% stake sale by promoter General Atlantic via a block deal in May 2025. The company’s acquisition of Singapore-based Ascent Fund Services in Q4FY25 and plans to grow international revenue have added to investor optimism, despite slightly missing FY25 earnings estimates.

PNB Housing and Aptus Value Housing also attracted significant institutional interest after large private equity exits. Carlyle sold its entire 10.4% stake in PNB Housing, while Westbridge offloaded a 12.6% stake in Aptus, both through open market deals. In response,

FIIs raised their stakes in both companies by 2.7%, while mutual funds increased holdings by 6.7% in PNB Housing and 5.7% in Aptus. Strong FY25 earnings and renewed demand in the retail housing segment have brought these names into the spotlight.

RBL Bank saw a jump in institutional interest following exits by British International Investment and Unity Associates in April. FIIs increased their stake by 3.1%, while mutual funds added a significant 13.9%. The bank’s better-than-expected FY25 results and a 29% stock rally during the quarter reinforced confidence. Broader trends in the banking sector—such as lower slippages, better asset quality, and steady credit growth—are drawing institutional money back to mid-tier banks.

Capri Global Capitalraised Rs 2,000 crore in May 2025 through its first qualified institutional placement (QIP) in a decade. Post-issue, FIIs raised their stake by 3.7% and mutual funds by 4.5%. The company’s robust FY25 performance added to the momentum.

Of the five financial firms, four beat FY25 earnings estimates, with only KFIN Technologies falling slightly short. A mix of earnings strength, large stake sales and capital raises created fresh entry points for long-term investors.

Post-IPO surge: Institutions load up on Swiggy, Sagility India, Sai Life

Recently listed companies—Sai Life Science, Swiggy and Sagility India—drew strong institutional interest in Q1FY26 following robust FY25 earnings. All three companies listed in late 2024 have seen FIIs and MFs increase their holdings meaningfully since then.

Sai Life Sciences, listed in December 2024, saw mutual fund holdings rise 7.2% and FII holdings rise 2.2%. Major MF investors included Nippon India Pharma, Inevsco India Smallcap Fund, and Axis Mutual Fund. The company reported a 15.9% increase in revenue and a 105.5% jump in net profit, beating Forecaster estimates in FY25. Growth was driven by strong performance in the CDMO and CRO segments, along with lower finance and inventory costs.

Swiggy, which was listed in November 2024, also saw increased institutional interest. MFs raised their stake by 4.3% and FIIs by 2.5% in Q1FY26. Mirae Asset Large & Midcap Fund and Invesco India Flexi Cap Fund each picked up a 1% stake, while the Government Pension Fund Global bought 1.3%.

Revenue rose 34.3% in FY25, led by strong growth in food delivery and quick commerce. The company plans to shift its quick commerce segment to an inventory-led model, which could improve margins. CFO Rahul Bothra noted that Swiggy has increased its domestic ownership above 40%, moving closer to the 51% threshold required under FDI rules to operate inventory-led e-commerce businesses.

Sagility India, also listed in November 2024, reported a 17.7% increase in revenue and a 136.2% jump in net profit for FY25. MFs raised their stake by 4%, and FIIs by 2.6%. ICICI Prudential Technology Fund and Mirae Asset Aggressive Hybrid Fund were among the largest mutual fund investors.