By Deeksha JanianiThe Indian stock market has been very upbeat, thanks to a surge in foreign fund investment. The Sensex briefly touched a record high today, at 63588.3.

But one major part of the primary markets has stalled: so far this year, not a single tech startup has come out with an IPO. This is quite a contrast to the nine major startup IPOs during the bull run of 2021.

Technology startups have delayed their IPOs, reduced their planned offer size or dropped their plans altogether. Take the case of Ixigo, a travel company whose DRHP expired in March, with no plans for a resubmission in the near future. Similarly, OYO reduced its offer size by nearly half to $400-600 million in its latest filing.

What is holding back these companies? One factor is the underperformance of startup stocks that recently listed. And, the increase in interest rates significantly hit the excitement around startups in public markets and private capital.

Startups were being funded at mind-boggling valuations as investors were afraid of missing out on the 'next big thing', and seemingly unconcerned with business models or profitability. Capital was cheap, as the Fed cut its interest rate to near zero in March 2020 and kept it there till March 2022. The mood was exuberant. For instance, Groww's valuation tripled to $3 billion post its series E funding in October 2021.

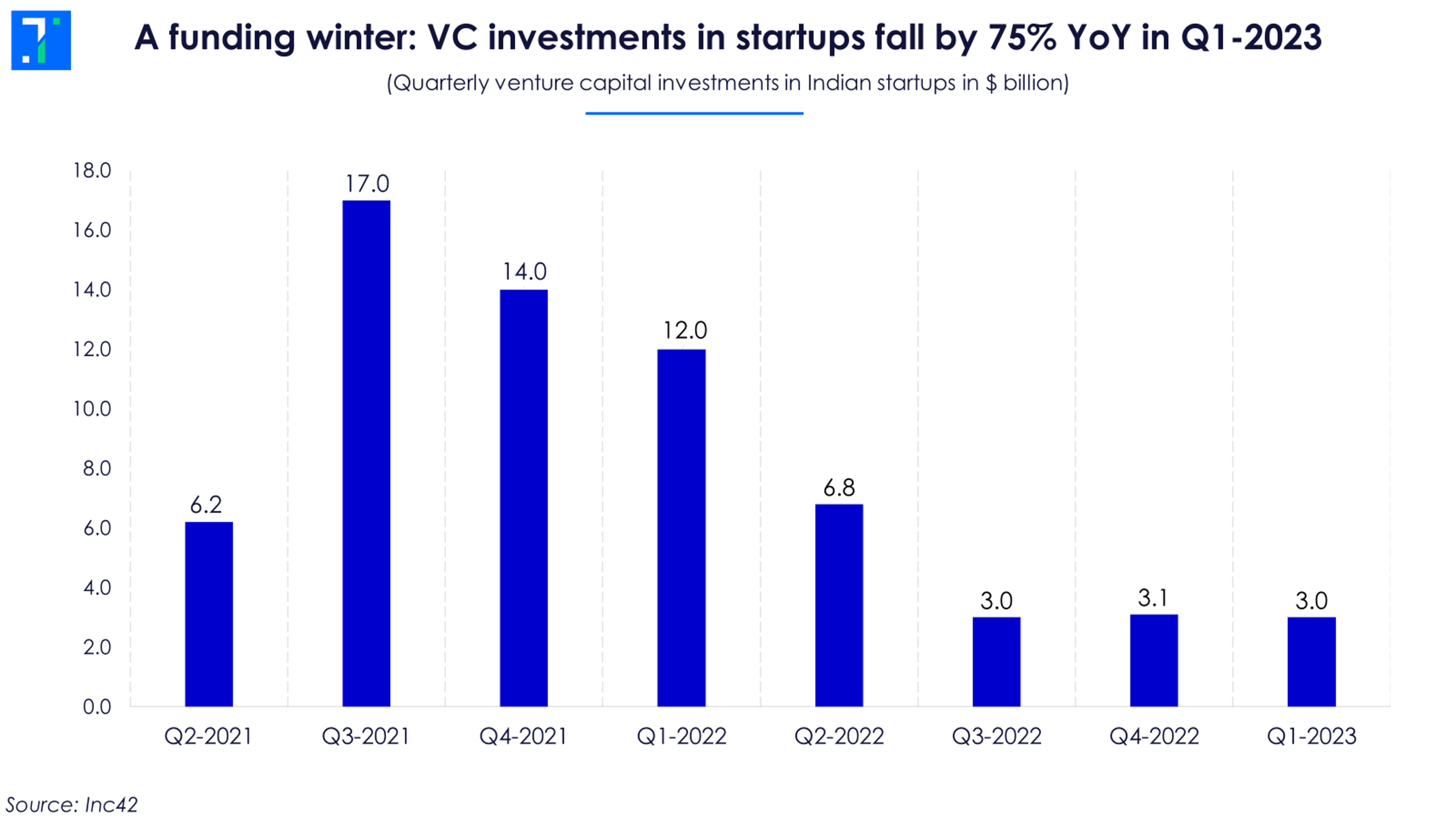

Now, the funding taps are drying up, and venture capital for Indian startups has declined in recent quarters. The recent rise in interest rates is only partly to blame here.

Scott Shleifer, partner at Tiger Global, a key backer of Indian startups, noted his disappointment during an investor call in February, “Returns on capital in India have sucked historically. If you look at internet market-leaders like Google, Facebook, or Tencent, revenue for them got bigger than costs a decade ago. But that did not happen in India”.

So are startup investors right to worry?

In this week’s Analyticks:

- Are startups overestimating the Indian market opportunity?

- Screener: New-age startups that may clock high revenue growth in FY24

Let’s get into it.

Market size questions: Did tech startups see the cake as bigger than it actually is?

Several Indian unicorns (startups valued at over $1 billion) have witnessed big markdowns in their valuations since the second half of 2022. American investment company Blackrock wrote off over 60% of Byju’s valuation in its recent quarterly filing.

A company’s valuation is decided by two key factors: the estimated future growth rate and the discounting rate. With the rise in interest rates, the discounting rate increases, reducing the present value. But since most startups are burning cash, the future growth rate is much more relevant here.

The future growth of a startup depends on the market size, and its ability to capture a piece of it. And after years of pouring billions of dollars into the Indian market, it looks like startups and venture capitalists may have overestimated its true size.

A relatively small user base is powering online spending

At a conference in 2022, Narayana Murthy, former chairman of Infosys, said, “New-age startups have by habit, overestimated the Indian market. In the mid-90s, many foreign companies set shop in India, estimating that there are 200 million middle-class Indians who are willing to buy. And they found that they weren’t there. The same story has repeated today.”

Blume Ventures estimates that the real target market for tech startups consists of 30 million high-income households, with a total headcount of 120 million. The average per capita income of these households is $12,000 per annum (nearly Rs 10 lakh).

Nithin Kamath, co-founder of Zerodha, suggests that the addressable market for B2C tech startups is a maximum of 150 million users. A Ken report estimates this market to be even smaller, at 70 million. Within this, just 10 million users are India’s ‘California users’ - the digitally savvy customers who account for 40% of India's online spends.

Let’s consider another estimate of the number of users driving online spending. According to Redseer and TRAI, out of India’s 850 million internet subscribers, only 45 million are considered mature users who contribute significantly to online transactions.

In the case of Zomato, only 5% of users drive 33% of its orders. Similarly, payment platforms like Paytm, PhonePe, Google Pay and UPI rely on 6.5% of users who are responsible for 44% of the total transactions.

Flat growth in internet subscribers a concern for online business

Internet subscribers in India, the main driver for online businesses, grew at a CAGR of 20% between FY15-FY20. The broadband user base rose even faster, due to events like demonetization and the launch of cheap or free plans from Reliance Jio.

But this user base growth has fallen to single digits post FY21. This isn’t a good sign for tech startups that are banking on high future growth. Ideally, as more people get connected to the internet, startups have a larger pool of users, some of which become their customers.

If we go by Inc42 estimates, the internet user base in India may rise to over 130 crore by 2030, translating to a CAGR of roughly 6%. This is a rosy number, since the current growth rate has already fallen below that.

Growth in e-commerce market slowed in FY23

The e-commerce sector contributes the largest share of 44% to the Indian internet economy, according to the ‘India eConomy Report’. This segment grew at an impressive CAGR of 40% between FY20 and FY22 due to intermittent shutdowns of physical stores during the pandemic.

However, the growth in e-commerce GMV slowed to 22% in FY23 as the economy reopened. Accordingly, the e-commerce sector’s demand for warehousing also declined by 71%.

The impact of the slowing e-commerce market was also visible in the performance of Delhivery. The logistics tech player saw its revenues fall by double-digits in Q4FY23.

Commenting on this, Falguni Nayar, CEO of Nykaa, said in the recent earnings call, “On the fashion front, the physical store network of domestic brands was very large, and as these domestic stores opened, there was some adversity in growth.”

Growth pace slows for listed tech startups

The overall slowdown in discretionary demand from November 2022 has trickled down to consumer-facing tech startups as well.

Zomato, for instance, saw a decline in user growth for its food delivery business. The company attributes this decline to its decision to shut operations in 225 cities, to focus on achieving profitability. The gross order value has remained within the Rs 6,400-6,700 crore range since Q1FY23.

Nykaa also experienced slower order growth in its flagship beauty division post-Covid, while the average order value was more or less flat. Order trajectory in the emerging fashion segment has been steady between 1.3 million and 1.5 million since Q2FY22.

As for Paytm, the growth in its merchant payments or B2B segment was much faster than its B2C growth.

Foreign analysts expect India's internet economy to touch almost $1 trillion by 2030, with e-commerce contributing 50% to this number. Essentially, they are factoring in a 25% growth CAGR. But tech startups, including e-tailers, food tech, and edtech, are once again competing with brick-and-mortar establishments, while battling the seemingly stubborn preference among Indians to shop offline.

Achieving high growth will be difficult without an increase in customer wallet spends and higher per capita incomes. Indians need to get rich quick, for tech startup dreams to come true.

Screener: New-age tech startups with strong Forecaster estimates for FY24 revenue growth

As FY24 unfolds, the growth prospects of new-age tech startups are under scrutiny. This screener shows startups that are likely to clock robust revenue growth in FY24, according to Trendlyne’s Forecaster.

Among the companies listed, RateGain Travel has the highest revenue growth estimates for FY24, followed by Easy Trip Planners, CE Info Systems, Zomato, Paytm and Nykaa. Notably, PB Fintech, Zomato and Paytm are projected to continue making losses in FY24, although at a lower rate compared to previous years.

According to analysts, RateGain Travel is expected to clock a revenue growth of 56% in FY24. The company posted a 70% YoY rise in Q4 revenue, while its net profit improved by 2.9x. This was driven by improvements in revenue from the distribution, marketing technology, and desktop as a service segments. Analysts expect its profits to double in FY24.

Consensus estimates of analysts see Easy Trip’s revenue rising by 39% in FY24, with a 32% growth in net profit. The company witnessed a YoY revenue rise of over 90% in Q4, backed by improvement in gross booking revenue.

CE Info Systems comes in next with a Trendlyne Forecaster revenue growth estimate of 35.1% in FY24 and a net profit growth estimate of nearly 25%. The company’s revenue rose by 28.1% YoY in Q4FY23, which was aided by a rise in customer base and order book.

You can find some popular screenershere.