This week marks one year of the Ukraine war, with millions of displaced people, and massive economic losses. The sound of Russian tanks rolling into Ukraine was heard across the globe, driving energy prices up, and upending supply chains.

But the conflict may have benefited one particular industry–agrochemicals. The supply-chain bottlenecks caused by the conflict sent the prices of essential commodities soaring. The industry rode high on remunerative crop prices and resilient demand.

However, cracks have now begun to show.

At the beginning of 2023, Kotak Securities and Prabhudas Liladher identified the key challenges vexing the agrochemical industry. Dealers have been left with high inventory levels owing to muted demand during the kharif season.

Monsoons overstayed their welcome and led to crop damage, which in turn, lowered the instances of pest infestation. Overall, as climate patterns become more unpredictable, hot summers alternating with erratic monsoons may complicate the industry’s forecasts.

Agrochemical majors like UPL, PI Industries and Sumitomo Chemical confirmed these trends in their post-earnings call and presentations for Q3FY23.

Another concern is the risk of higher sales returns. According to Kotak Securities, some products have been lying unsold with channel partners for two years now, owing to lacklustre kharif seasons. The products are near their expiry date and may have to be returned to the manufacturers, impacting their top-line growth.

The latest budget failed to lift the spirits of the industry as well. The Agro Chem Federation of India had asked the government to ease customs duty and GST on crop protection chemicals, but the Finance Ministry made no such moves.

As of now, there is a glaring gap between the GST charged for crop protection chemicals (18%) and all other farm inputs (0% to 12%). This makes buying agrochemicals a costly deal for farmers. Parity in taxes could have gone a long way in revving up domestic demand.

Despite these challenges on the domestic front, agrochemical players posted healthy results in Q3 on the back of a buoyant pricing environment and the strength of export markets.

Star performers: PI Industries and UPL stand out in terms of topline growth

Agrochemical major UPL registered the highest revenue growth among the larger players in Q3. Higher sales realisations and favourable foreign exchange movement drove revenue growth. International prices of commodities like rice, corn, wheat and soybean are still trending higher on a YoY basis, aiding the pricing growth for agrochemical players.

UPL’s revenue growth over the past four quarters has been price-led and sales volumes barely saw a rise in FY23 so far. Volumes in the domestic market were particularly impacted in Q3, owing to channel inventory concerns.

Of the two smaller players, Anupam Rasayan posted robust top-line growth despite one of its manufacturing plants being shut in Q3. This rise is mainly due to the consolidation of Tanfac Industries’ financials from Q2.

It was PI Industries that stole the show in terms of profit growth. The company’s stock price zoomed 11% within two days of the result date. While most players saw their margins contract, PI Industries’ EBITDA margins expanded by almost four percentage points in Q3. Robust revenue growth, controlled fixed costs and improved product mix aided its margins.

To the rescue: American market propels the growth of agrochemical players

Commenting on the performance of the domestic market, Mayank Singhal, Managing Director at PI Industries, said, “Growth came from newer products, while generic products suffered. That is why overall growth was subdued.”

While the Indian market disappointed investors, the export division of most players saw double-digit revenue growth in Q3. Players with higher exposure to foreign markets got a boost in Q3, unlike Bayer Cropscience and Sumitomo Chemicals.

For UPL, Latin American and North American markets sustained over 20% YoY revenue growth in Q3, similar to Q2. Both the markets gained close to 3% share combined in the company’s revenue pie for 9MFY23.

Within the Latin American market, growth in Brazil has been especially impressive, driven by insecticides and fungicides. UPL saw robust growth in the Indian market as well in Q3, mainly due to its seeds business.

In its recent earnings call, UPL’s management highlighted that the issue of high channel inventory was not limited to India. Dealers across the globe had stocked up more than required, anticipating supply-chain concerns. Sumitomo Chemical witnessed early signs of slowdown in its Latin American market due to the inventory build-up.

However, Sumitomo Chemical saw its export division grow faster in Q3FY23 and 9MFY23. Now, this segment occupies more than 20% of the revenue pie, owing to strong traction in North American and African markets.

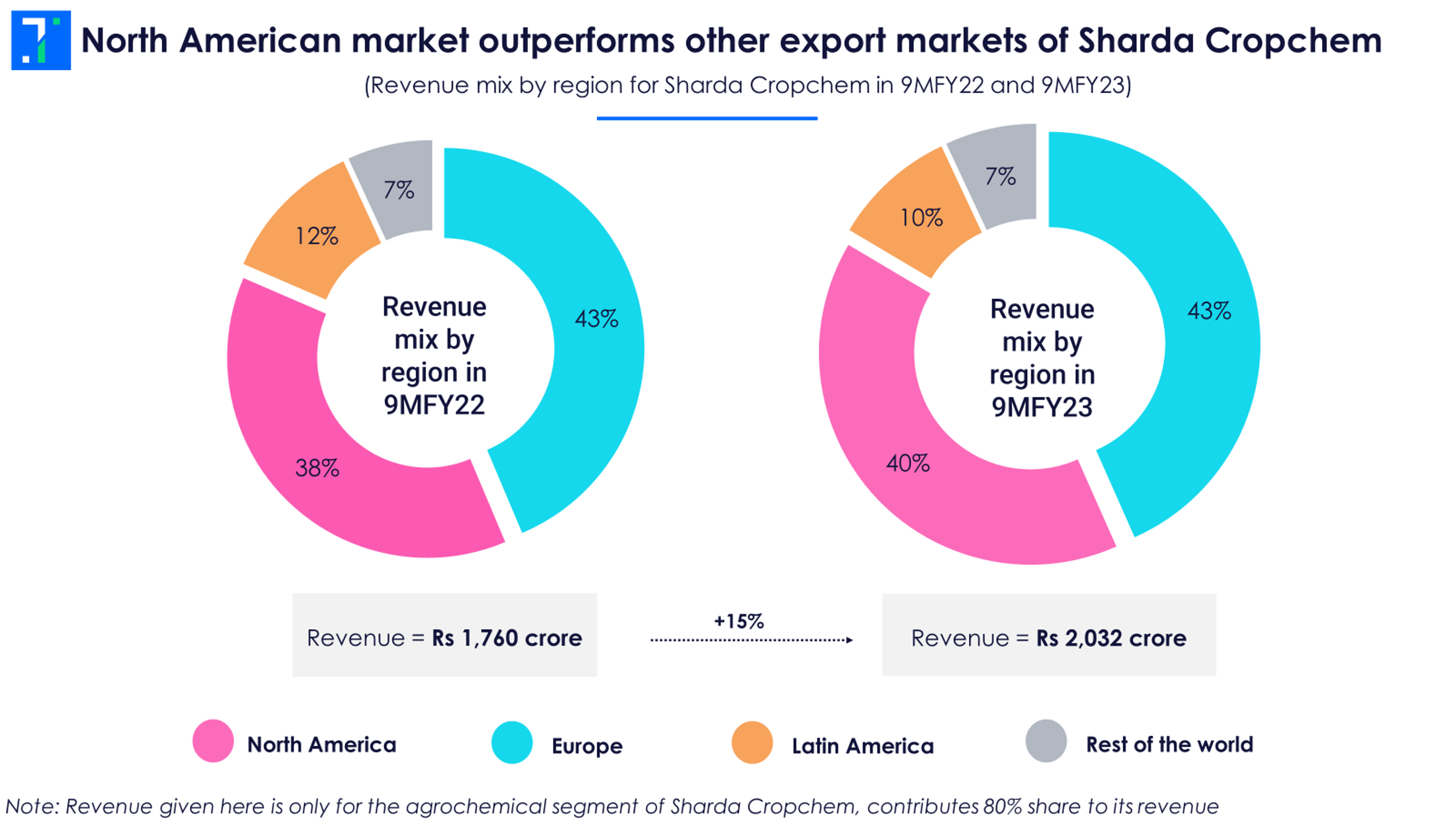

The strength of the North American market has been visible in the results of a small player like Sharda Cropchem as well. The company’s sales grew faster in this market than in its European market in 9MFY23. The European market sales were affected by the depreciation of euro against dollar.

The risk of destocking looms large in the near-term

Summing up the near-term outlook of the agrochemical industry, Michael Frank, Global CEO at UPL, said, “I would not expect to see such strong growth across the industry next year. I think it's going to be a tighter mark and there will be some de-inventory.” The key takeaway here is a likely de-stocking trend.

Dealers/distributors will focus on clearing the existing stock of agrochemicals before ordering more from manufacturers. According to PI Industries’ management, Q4 is not a major consumption period either. Hence, inventory clearance may take a few more quarters. This will impact the top-line growth of agrochemical players.

Poor sales growth along with higher cost of inventory may also hit the margins of agrochemical makers. Hence, the challenging domestic situation may continue till channel stock levels stabilize.

However, the picture is not that bleak overall.

Growth to moderate even as export markets stay buoyant

Market leader UPL is still positive on the domestic demand, driven by the strong rabi season in Q4FY23. Additionally, it also expects volume growth to be strong, supported by its recently launched products in Brazil, North America and India.

Most players don’t see a slowdown in export markets and haven’t heard a word of caution from their foreign clients. In fact, UPL and PI Industries have retained their original growth guidance. The demand situation continues to be strong in the American region. Accordingly, product launch and capex plans of major players are intact.

PI Industries commercialised 10 new products in its CSM and domestic business combined in 9MFY23 and has over 55 new molecules under development. The company has also set a capex outlay of Rs 800-850 crore for FY24, to be spent on two multi-product plants.

Anupam Rasayan is another player with a healthy pipeline and looks to launch 14 new molecules in the next 12-18 months. The company aims to raise its capex spends by over 70% to Rs 300 crore in FY24. This also includes its spends on fluorination chemistry.

While things are looking up on the export front, subdued domestic markets will hinder the growth of agrochemical players in FY24. CRISIL sees the growth rate of the agrochemical industry tapering off to 10-12% in FY24 from 18-20% in FY23. Analysts also see a similar trend for top agrochemical companies in accordance with Trendlyne’s Forecaster.

An industry that turned a geopolitical crisis into an opportunity in 2022, especially on the export front, now appears to be at the fag end of its solid growth cycle.

This analysis by Trendlyne is meant for investor education - to help understand companies and make informed investment decisions on their own. It should not be considered an investment recommendation.