The physicist Albert Einstein once said, “In the middle of every difficulty, lies opportunity,” and this sentiment holds true for investors who took a chance on midcap stocks at the beginning of 2023, when market momentum had slowed. Top midcap indices hit their lifetime highs in the past week, as market bulls charged ahead.

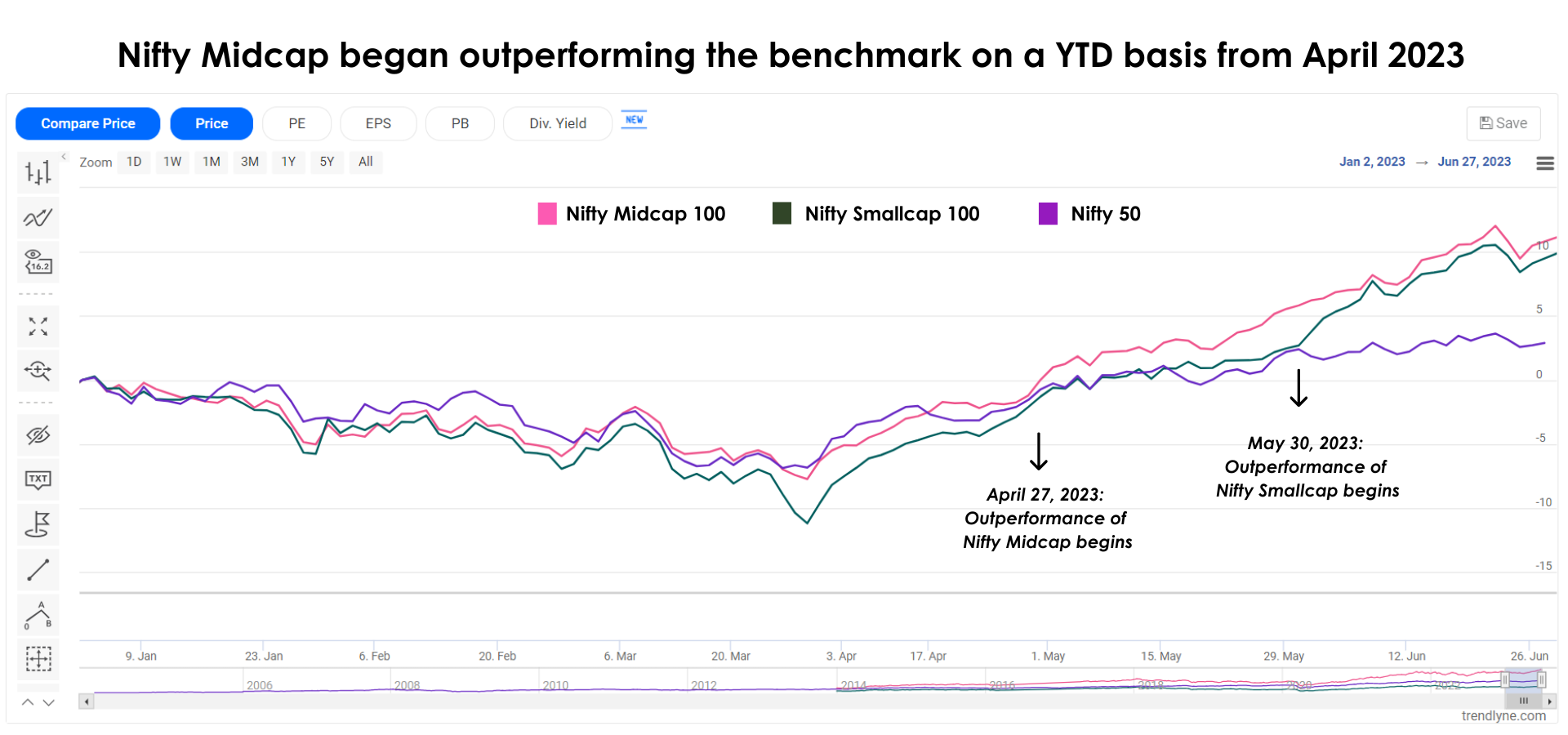

Take the case of the Nifty Midcap 100 index. It has surpassed the year-to-date price returns of the benchmark Nifty 50 and Nifty Smallcap 100 indices. Strong cash inflows from domestic mutual funds and foreign investors propelled this index. But analysts are now divided on its near-term prospects.

Jefferies is optimistic about the outperformance of mid and small caps, given the larger share of India-focused companies in these groups. India’s domestic capex and consumption story is driving investment in this space., There are a few naysayers, however – Kotak Securities believes that midcap stocks may correct on pricey valuations, and underlying weakness in consumption.

Irrespective of the market's direction, there are always opportunities to select the best-performing stocks. We analyze three ‘midcap winners’ that have not only outperformed their respective industries, but also have an encouraging outlook ahead.

Trent, the growth juggernaut, has ambitious expansion plans

Fashion retailer Trent, had a good performance in Q4FY23, surpassing its industry’s revenue growth by over 35 percentage points. Despite a slowdown in discretionary demand, the company has outperformed industry returns by over 12% in the past quarter.

Commenting on the company’s outperformance, Noel Tata, Chairman at Trent, said, “We are a private label business and it means that we design our products, get it manufactured and sell them in our own stores. Hence, the end-to-end margin is greater.”

According to the chairman, retailers who own the brands on their shelves are doing better than multi-brand retailers globally, given the intense competition. Take the case of Zara, a private fashion label. Its operating profits have grown at a healthy CAGR of nearly 8% between 2013 and 2022. In contrast, the American multi-brand retailer, Macy’s, saw its operating profits fall by 13%.

This pattern has also played out back home. Rival retailer Aditya Birla Fashion (ABFRL) has been in losses since FY20, while Trent has been consistently profitable, except in FY21. It’s not just the business model but also the growth strategy which differentiates these two retailers.

Trent’s organic expansion strategy, focusing on its two key brands Westside and Zudio, has yielded results. Notably, the revenue for Zudio has jumped 6X in just three years.

On the other hand, ABFRL has acquired several companies in the ethnic, D2C, and sports segments since 2019, amounting to around Rs 1,100 crore. It continues to make heavy marketing investments to scale up these brands. And with subdued sales growth, profitability is still a far cry.

Coming to Trent’s future plans, the company seeks to double down on store additions in FY24, especially for Zudio. The average capital requirement to set up a Zudio store is Rs 2.5 crore, which is just one-third of the outlay needed for a Westside store.

Backed by these plans, analysts see Trent’s top line growing at a 25% CAGR in the next two years. Profitability is expected to accelerate through margin expansion. However, given the stock’s pricey valuations, investors should ideally wait for an attractive price level before placing their bets.

Outperformer PI Industries: Shining in adversity, future prospects are bright

PI Industries clocked double-digit revenue growth in Q4FY23, comfortably surpassing the agrochemical industry which grew in single digits. The industry has been going through a rough patch due to high channel inventory in markets like India, North and Latin America, and Europe, owing to weak demand. The situation is worse in the generics market.

PI Industries, however, has stayed resilient during this downcycle, thanks to the strength of its custom synthesis business. Through this segment, the company works with international clients to manufacture specialized early-stage molecules based on their orders. Demand visibility is good in this business as contracts are long-term. The inventory risk also reduces substantially.

In comparison, market leader UPL faces challenges as it manufactures and markets its own products in foreign markets. Its portfolio focuses on off-patent molecules. According to its management, there has been a sudden rise in supply of these products from China recently. Higher supply and muted demand have brought down the prices of agrochemicals, impacting realizations.

PI’s CSM business has seen a stellar run in the past few years, aided by its focus on consistently developing new products for its clients. Even in the current environment, the management does not anticipate any adverse impact on the demand in this division.

The management of PI Industries has guided for a top-line growth of 18-20% in FY24. In addition, revenues of Rs 550-600 crore will come from its recently acquired pharma entities. However, the potential development of El-Nino during the monsoon season is a risk factor.

Previous instances of El Nino in 2014-2015, resulted in flat EBITDA growth for the agrochem industry in FY16 as the farm sector struggled. But PI Industries managed to clock decent revenue growth and double-digit EBITDA growth in that year as well.

Analysts expect the company to register a revenue and net profit growth of over 19% in the next two years, powered by its exports business. PI Industries is currently trading at a slight discount to its 5-year average PE.

Over the past decade, PI Industries has compounded investors’ wealth at a 40% rate, making it a reliable investor choice.

Midsize player with outsize performance: L&T Technology delivers sustained growth in a tepid environment

This engineering R&D player has outperformed the IT industry both on sequential and YoY revenue growth in Q4FY23. In fact, L&T Technology’s revenue and EBIT has grown at a compounded rate of nearly 5% since Q4FY22.

While other IT giants experienced a slowdown due to reduced tech spends by American and European clients, LTTS achieved robust growth in Q4. This was driven by a rebound in its medical devices segment and strong performance in plant engineering.

Throughout FY23, the transportation segment was the highlight for L&T Technology. This is the company’s biggest business area, and has delivered consistent growth of over 20% since FY19 (except in FY21).

How does the company provide value to an auto OEM? L&T Technology offers services including software and component design, as well as testing of EV components. For instance, LTTS developed a lightweight integrated inverter and converter for a tier-1 auto player, improving the driving range for their EVs.

Commenting on the demand scenario for this segment, Amit Chadha, Managing Director at LTTS, said, “Electrification is a big area for spending across the US, Europe and Japan for not just auto, but also for trucks and off-highway vehicles as well. This bodes well for the sector.”

Going forward, LTTS is seeing a strong deal pipeline from the connected vehicle domain within the transportation sector. Large opportunities exist across its segments, especially in the development of digital and next-generation products.

The management at L&T Technology has guided for a revenue growth of over 20% in constant currency terms in FY24. This will be driven by both existing business and the acquisition of ‘smart world & communication’ division of L&T. However, the consolidation of this new business may drive down its margins to 17% from the current 18%-19% levels.

Analysts expect the company to clock a top-line growth of 17% in the next two years. Although the pace of growth will moderate compared to the previous two years, it is still promising considering the bleak growth estimates (7-10%) for top-tier IT majors.

LTTS is currently trading at a discount compared to its 5-year average PE, making it an attractive investment opportunity aligned with the clean energy transition and smart electrification mega trend.

This analysis by Trendlyne is meant for investor education - to help understand companies and make informed investment decisions on their own. It should not be considered an investment recommendation