For many Indians, the Tata, Bajaj, Adani, and Birla companies have a presence across their daily lives—from the cars and clothes they wear, to the credit cards they carry. Many of these businesses have also been wealth creators for investors.

The Nifty 50 index has tripled in the past ten years, rising from 7,600 in 2016 to 24,754.3 in 2025. Strong corporate earnings and stable macro conditions supported a 213% gain in the Nifty 50 from 2016 to 2025 YTD. Several blue-chip stocks —including Tata Motors, Bajaj Finance, Adani Enterprises, and Hindalco — outperformed the index over the same period.

Still, the road had its fair share of bumps. Economic headwinds—demonetization, the pandemic, inflation, rate hikes, and tariffs—led the Nifty 50 to correct by 10% or more almost ten times, roughly once every year.

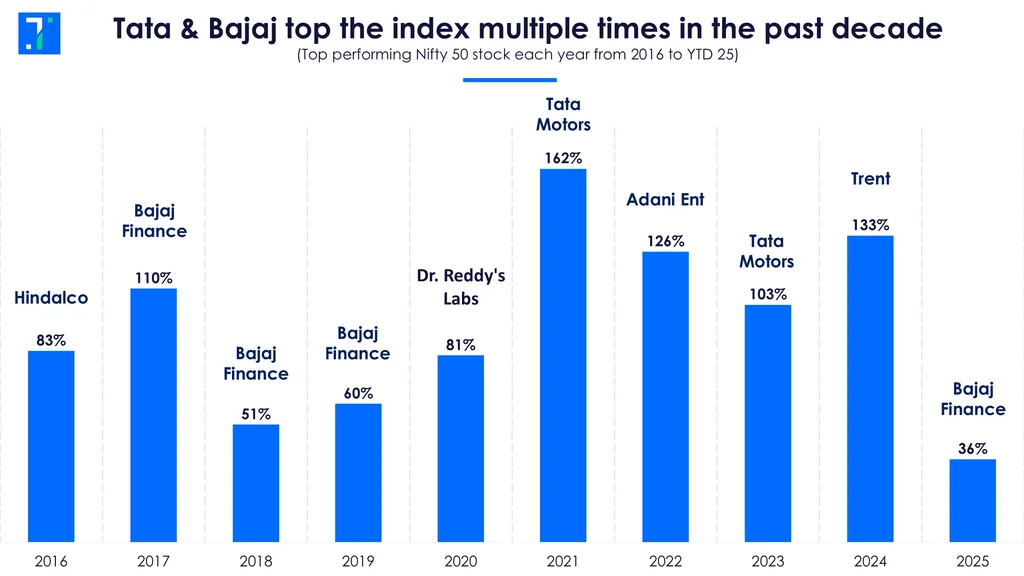

In this edition of Chart of the Week, we analyze the top Nifty 50 gainers from 2016 to 2025 YTD and the key drivers of their share price gains.

Bajaj Finance unlocked high returns with digital lending and rural push

Investors look for stocks that can multiply their wealth, but such opportunities are rare. Bajaj Finance is the only Nifty 50 stock that has ranked as a top performer four times over the past 10 years. After its inclusion in the Nifty 50 in 2017, it delivered a hat-trick performance, leading the Nifty 50 with over 110% return in 2017 and more than 50% in 2018 and 2019.

This strong run established Bajaj Finance as one of the biggest wealth creators, with its stock rising 15x over the past decade. The growth came from consistent double-digit earnings and net interest income.

These were also the years that almost everyone in India got a phone call from Bajaj Finance offering them a loan.

The company began diversifying its loan portfolio from FY14 by adding small and medium-sized enterprises (SMEs), commercial, and rural consumer loans, and two-wheeler and consumer financing to reduce risk and tap multiple revenue streams. In FY15, it expanded into rural markets via digital platforms for loan disbursement and offered customized products for customers in tier 2 and 3 cities.

This diversification drove a 32.3% CAGR in assets under management (AUM), reaching Rs 1.1 lakh crore between FY17 and FY19. The company kept its non-performing asset (NPA) ratio between 0.19% and 0.65% due to lower exposure to unsecured loans.

After six years, Bajaj Finance remains a favourite among investors in 2025. The stock gained 33% YTD and touched a 52-week high of Rs 9,709.7 in April 2025, outperforming the benchmark and its peers.The AUM grew 26% YoY to Rs 4.1 lakh crore in FY25, driven by rural and gold loan markets.

Tata Group fuelled growth with new launches, as consumption rises

Tata Group companies have emerged as major wealth creators in the Nifty 50 for shareholders, with Tata Motors and Trent doubling shareholders’ wealth over three years.

Among auto stocks, Tata Motors delivered multi-bagger gains in 2021 and 2023. In 2021, its passenger vehicle business recorded its highest annual sales in eight years despite challenges from Covid-19 and a global semiconductor shortage. Strong recovery in passenger vehicle demand, especially SUVs, pushed Tata Motors’ shares up 162% in 2021.

Building on this momentum, the company launched key models like the Punch, Safari (2nd generation), Nexon EV, and Tigor EV. This drove its SUV market share up to 22%, while overall passenger vehicle share increased from 4.6% in FY20 to 10.9%.

These launches helped Tata Motors strengthen its lead in the EV market, reaching a 94% share by the end of 2021—an increase of 23 percentage points YoY. Its early EV push and government incentives like FAME-II supported this growth.

Investor confidence grew in October 2021 as TPG Rise Climate and Abu Dhabi’s ADQ invested Rs 7,500 crore in Tata Motors’ EV arm, TML EVCo, to develop 10 electric models. At the same time, news of a partnership with Tesla boosted optimism and lifted the stock further.

One year later, in 2023, Tata Motors regained investor attention by reporting a Rs 2,957.7 crore profit in Q3FY23, ending four years of losses. Higher sales in the JLR and passenger vehicle segments, combined with the company’s India business becoming debt-free in the second half of the year, lifted the share price by 103%. However, over the past six months, the stock has declined 7.5% due to weak JLR sales and concerns about US import tariffs.

Another Tata Group’s retail company, Trent, doubled its stock price in 2024, gaining 133%. Its strong financial performance, aggressive expansion, and growing digital presence made it a market favourite.

The company’s inclusion in the Nifty 50 index in September 2024 was the cherry on top, attracting Rs 3,901 crore in investments and making it the top Nifty performer within three months.

Trent increased its focus on private-label brands to improve margins and boost sales by integrating offline and online channels. This strategy helped the company beat earnings estimates in every quarter of 2024.

Pharma, metals, infra giants surged on demand and expansion tailwinds

Stocks rally when demand coincides with a favourable business environment. At the forefront of this trend were companies like Dr. Reddy's Laboratories, Hindalco, and Adani Enterprises.

During the Covid-19 lockdown, investor interest shifted to the pharmaceutical sector, boosting Dr.Reddy's Laboratories. The stock surged 81% in 2020 as global demand for the Sputnik V vaccine surged.

The company also launched Remdesivir in India through a licensing deal with Gilead Sciences. It also partnered with the Russian Direct Investment Fund to conduct clinical trials and distribute the Sputnik V vaccine in India.

Hindalco Industries, an aluminium products manufacturer, gained 83% in 2016, driven by a 36% YoY rise in aluminium production to 1.1 million tonnes. Lower production costs helped the company absorb weak global commodity prices and outperform its peers in a sluggish metals market.

Between FY15 and FY17, Hindalco’s net profit grew at a CAGR of 49%. Its EBITDA margin increased by 385 basis points to 13.3%, driven by higher volumes, lower energy costs, and a shift to high-margin products such as extrusions and rolled goods. China’s aluminium supply cuts and rising global demand in 2016 improved Hindalco’s export opportunities. At home, anti-dumping duties on imports supported the stock’s sharp rally.

Adani Enterprises' stock rose 126% in 2022, driven by its inclusion in the Nifty 50 index in September and its plan to invest over Rs 12.4 lakh crore across data centers, green energy, airports, and healthcare businesses to become a global conglomerate with a valuation of $1 trillion.

Between FY21 and FY23, revenue grew at a CAGR of 85.1% and profit at 63.7%, driven by strong growth in its mining, airport, and energy businesses. These developments made Adani Enterprises the top-performing Nifty 50 stock in 2022. Over the past six months, the stock has seen a modest gain of 3.3%.