Nifty 50 closed at 19,393.60 (83.5, 0.4%), BSE Sensex closed at 65,216.09 (267.4, 0.4%) while the broader Nifty 500 closed at 16,852.05 (94.4, 0.6%). Market breadth is in the green. Of the 1,973 stocks traded today, 1,135 were on the uptrend, and 776 went down.

Indian indices maintained their gains from the afternoon session and closed in the green, with the Nifty 50 closing at 19,394. The volatility index, Nifty VIX, dropped by 1.5% and closed at 12 points. According to data released by the Telecom Regulatory Authority of India, the telecom industry’s adjusted gross revenue increased by 2.5% to Rs 64,494 crore in the March 2023 quarter.

Nifty Midcap 100 and Nifty Smallcap 100 closed in the green, following the benchmark. Nifty IT and Nifty Bank closed higher, compared to Friday’s closing levels. According to Trendlyne’s sector dashboard, healthcare equipment & supplies emerged as the top-performing sector of the day, with a rise of over 3.8%.

Most European indices trade in the green. US indices futures trade lower, indicating a negative start. German producer price index declines by 1.1%, against the contraction estimates of 0.2%. The numbers indicate cooling inflation in the Eurozone’s dominant manufacturing economy.

Reliance Industries sees a short buildup in its August 31 future series as its open interest rises 7.3% with a put-call ratio of 0.38.

The Central Bureau of Investigation (CBI) reportedly closes a case against Adani Enterprises and a former Chairman of the National Cooperative Consumer Federation. The case relates to alleged irregularities in awarding a contract for supplying imported coal to the Andhra Pradesh Power Generation Corp.

Aeroflex Industries, a diversified flexible flow solutions provider, opens for IPO subscription tomorrow. The price band for the issue is Rs 102-108 per share. The size of the issue is Rs 351 crore, comprising a fresh issue of Rs 162 crore and an offer for sale for Rs 189 crore.

PB Fintech, RattanIndia Enterprises and Swan Energy witness their operating profit margins improve by 34.8, 30.3 and 27.4 percentage points QoQ respectively in Q1FY24.

ABB India rises in trade today as it receives an order from Reliance Life Sciences to deploy automation and control solutions for its new biosimilars and plasma proteins manufacturing facilities in Nashik, Maharashtra. It appears in a screener of stocks with strong annual EPS growth.

Knowledge Marine & Engineering Works is rising as its arm bags four orders from various sand buyers from Bahrain. The orders are worth Rs 342.1 crore in total and involve the supply and sale of dredged marine sand.

Larsen & Toubro is rising as its hydrocarbon energy business bags an order worth Rs 1,000-2,500 crore from Saipem & Clough JV for the fabrication and supply of process and piperack modules for a 2.3 MMTPA urea plant for Perdaman Chemicals and Fertilisers. The company's heavy engineering business also secures multiple orders for the complete package of Urea Equipment for the same project.

Antique Broking downgrades its rating on Dr Reddy’s Laboratories to a 'Sell' with an unchanged target price of Rs 4,658. The brokerage cites competition in the company’s base business from H2FY24 and the lack of a launch pipeline with large-value products as reasons for the downgrade. It also adds that the current stock price already accounts for the upcoming opportunities in the US.

#AntiqueStockBroking downgrades #DrReddys Laboratories to 'sell' rating from 'hold'.

Here is why.@SanghviMonal reports.https://t.co/KaJ1w4CH1S— BQ Prime (@bqprime) August 21, 2023

EIHand Praj Industries touch their all-time highs of Rs 236.9 and Rs 504.8 respectively. The former has risen by 10.6% over the past month, while the latter increased by 18.6%.

Pyramid Technoplast's Rs 153.1 crore IPO gets bids for 5.84X the available 75.6 lakh shares on offer on the second day of bidding. The retail investor quota gets bids for 6.52X of the available 46.1 lakh shares on offer.

Khurshed Yazdi Daruvala, promoter of Sterling and Wilson Renewable Energy, sells a 1% stake in the company in a bulk deal on Friday.

IT stocks like Persistent Systems, Mphasis, L&T Technology Services, Coforge and Wipro are rising in trade. All the constituents of the broader sectoral index, Nifty IT, are trading in the green.

Robert Sockin, Global Economist at Citi, anticipates higher interest rates to persist for a longer duration in the US. He also highlights the possibility of one more rate hike from the US Federal Reserve.

#OnCNBCTV18 | #US eco resilience is convincing markets that rate cut hopes need to be pushed out. Expect one more rate hike from the US Fed. Most of the #inflation in #China is being driven by services, says Robert Sockin of Citi pic.twitter.com/ljhsqv061K

— CNBC-TV18 (@CNBCTV18Live) August 21, 2023

Geojit BNP Paribas upgrades rating on CIE Automotive India to ‘Buy’ from ‘Reduce’ and raises the target price to Rs 576 from Rs 376. This implies an upside of 15.7%. The brokerage turns positive about the company’s prospects given its focus on expanding its EV portfolio, increasing business with existing customers and healthy order book.

Utilities stocks like Adani Power, Adani Transmission and KPI Green Energy rise more than 2% in trade. The broader S&P BSE Utilities index also trades more than 2% higher.

PNB Housing Finance rises more than 5% in trade as it resolves and fully recovers a large corporate non-performing account of Rs 784 crore (~1.3% of loan asset) through an ARC sale under the Swiss Challenge method. This is in line with the Reserve Bank of India (Transfer of Loan Exposures) Directions, 2021. It appears in ascreener of stocks with strong momentum.

Amish Shah, Head of India Research at BofA Securities, lists increased earnings growth expectations, a busy political calendar, and erratic monsoons as major risks for the domestic stock markets. He estimates the Nifty 50 to touch 20,500 in 2023. Shah is bullish on sectors like financials, industrials and staples and bearish on IT, utilities and metals sectors.

Amish Shah, Head of India Research, BofA Securities is bullish on domestic cyclical sectors like financials, industrials, and stapleshttps://t.co/nEkfDH1Hpu

— Business Today (@business_today) August 21, 2023

Bharat Forge hits a new all-time high of Rs 987.8 as its arm, Kalyani Strategic Systems, wins two export orders worth 93.9 million euros. The order is for the supply of components and armoured vehicle chassis over 18 months, subject to necessary government approvals.

Cholamandalam Investment & Finance Company rises in today's trade following the resolution of the dispute between the family branch of the late MV Murugappan and other members of the Murugappa family. The company appears in a screener of stocks with consistently high returns over 5 years.

Metal stocks like Hindalco Industries, NMDC, Jindal Steel & Power, National Aluminium Co and JSW Steel are rising in trade. Barring APL Apollo Tubes, all the other constituents of the broader sectoral index, BSE Metal, are trading in the green.

Jio Financial Services lists at Rs 265 on BSE and 262 on NSE today. The stock price has fallen since the listing and is currently trading in the lower circuit.

CLSA maintains its ‘Outperform’ rating on Titan Co with a target price of Rs 3,270, citing the company's aim to improve its reach through its subsidiary's acquisition. The brokerage adds that the firm is committed to building CaratLane as an integral part of its jewellery business. Titan acquired an additional 27.18% stake in CaratLane for Rs 4,621 crore on August 19, taking its holding to 98.28%.

Brokerage Radar | CLSA on Titan: Maintain Outperform; Looking to enhance reach through CaratLane#Titan#CaratLane#StockMarketpic.twitter.com/YoIEkbTyjU

— ET NOW (@ETNOWlive) August 21, 2023

Malav Ajitbhai Mehta, promoter of Infibeam Avenues, sells a 1.3% stake in the company via market sale.

Bharat Heavy Electricals wins an order worth approx Rs 4,000 crore from Mahan Energen (an arm of Adani Power) to supply equipment (boiler, turbine, generator) and supervise the erection and commissioning of 2x800 MW power project based on supercritical technology at Bandhaura, Madhya Pradesh.

Ashish Kacholia sells a 0.6% stake in SJS Enterprises for approx Rs 11.6 crore in a bulk deal on Friday.

KEC International surges more than 5% as it bags three orders worth Rs 1,007 crore in the Indian and overseas markets. The first order is for designing, engineering, procuring and constructing a multispecialty hospital in India. The second order is for a 380 kV Overhead Transmission line project in the Middle East, and the third involves supplying various types of cables in India and overseas.

Riding High:

Largecap and midcap gainers today include Adani Power Ltd. (324.85, 6.65%), Adani Transmission Ltd. (923.55, 5.92%) and Sona BLW Precision Forgings Ltd. (590.90, 4.24%).

Downers:

Largecap and midcap losers today include Delhivery Ltd. (407.40, -2.98%), Union Bank of India (91.80, -2.86%) and One97 Communications Ltd. (837.95, -2.55%).

Volume Shockers

25 stocks in BSE 500 are trading on high volumes today.

Top high volume gainers on BSE included Tamilnad Mercantile Bank Ltd. (572.30, 18.19%), Trident Ltd. (35.70, 10.19%) and Data Patterns (India) Ltd. (2,364.60, 9.55%).

Top high volume loser on BSE was Jindal Worldwide Ltd. (378.70, -2.17%).

Capri Global Capital Ltd. (760.20, 1.84%) was trading at 10.8 times of weekly average. Nuvoco Vistas Corporation Ltd. (340.10, 2.97%) and PNB Housing Finance Ltd. (657.90, 3.55%) were trading with volumes 9.9 and 7.9 times weekly average respectively on BSE at the time of posting this article.

BSE 500: highs, lows and moving averages

32 stocks took off, crossing 52 week highs,

Stocks touching their year highs included - Bharat Forge Ltd. (980.05, 0.96%), Cera Sanitaryware Ltd. (8,570.00, 1.48%) and Emami Ltd. (535.00, 1.21%).

14 stocks climbed above their 200 day SMA including Trident Ltd. (35.70, 10.19%) and KNR Constructions Ltd. (255.50, 4.91%). 9 stocks slipped below their 200 SMA including Elgi Equipments Ltd. (475.10, -2.08%) and Aptus Value Housing Finance India Ltd. (266.60, -1.70%).

China has been a naval power longer than some countries have existed - the Song Dynasty, dating back to the 12th century, had a permanent standing navy, with squadrons and fighting vessels. For China, aggression via sea is an old tactic, and its growing maritime presence around India in recent years has raised eyebrows.

China's naval strategy around India involves an expanding network of ports across the Indian Ocean, essentially encircling India and forming what experts have called the "String of Pearls".

This not only positions China as a key regional player in the Indian Ocean but has also made any potential response from India more complicated.

The strategic significance of these Chinese or China-funded ports cannot be overstated, as they serve as crucial hubs for international trade, connectivity, and regional influence. It's important to note that the civilian ports China has invested in, must provide logistical support to the Chinese navy if required. The Chinese investments thus come with military commitments to China.

This edition of Chart of the Week explores the key Chinese-operated ports in the Indian Ocean region, examining their growth, investments, and the broader implications for India and its neighbours.

China encircles India, by investing in eight ports in the Indian Ocean

India’s neighbours are, Pakistan, Sri Lanka and Bangladesh. All three countries have received port investments from China.

Under the China-Pakistan Economic Corridor (CPEC), China has invested in two Pakistani ports: the Gwadar port ($248 million investment) and the Karachi deep-water terminal ($550 million investment).

China's engagement with the Gwadar Port has unfolded in two phases. The first phase took place from 2002 to 2006, involving a financial infusion of $248 million through foreign aid grants from the Chinese government and loans from the Export-Import (Exim) Bank of China. The second phase, initiated in 2013, remains undisclosed in terms of the invested amount. Under this agreement, China will be providing financial investment in exchange for a concession agreement to conduct operations at the port.

The second port, the Karachi Deep Water Container Terminal, commenced its operations at Karachi Port in December 2016. The port was established through a public-private collaboration between Karachi Port Trust (KPT) and Hong Kong's Hutchison Ports. Its significance lies in providing optimal access to ships entering Karachi, which is strategically positioned in the CPEC under China's Belt and Road Initiative (BRI).

In addition, there is a direct investment pledge of $3.5 billion from the Chinese government in the Karachi Coastal Comprehensive Development Zone (KCCDZ) from 2021, according to reports. Unlike a conventional loan, this investment aims to transform the underutilised land of the Karachi Port Trust into a multi-purpose residential, commercial, and seaport infrastructure.

Debt-ridden Sri Lanka has, thanks to its highly strategic location, two ports under Chinese influence: Hambantota Port and CICT Terminal Colombo. China has invested around $1.3 billion in the former and $500 million in the latter. State-owned China Merchants Port Holding (CMPH) is the contractor for both these ports. Hambantota Port received funding from China’s Exim Bank in two phases: an initial $508 million from 2007 to 2014, and a subsequent $808 million from 2014 onwards. Under the agreement, CMPH will get a 99-year concession agreement of $1.12 billion and 85% ownership of the port.

Bangladesh also has two ports with major Chinese investments. The Chittagong Port and the Payra Port have investments of $400 million and $600 million respectively. Mongla Port is contracted out to China National Complete Engineering, another state-owned entity. It is one of the main seaports of Bangladesh, handling about 80% of the nation's export-import trade.

As for the Payra Port, the construction and development of its core infrastructure started in 2016. The project was executed by two Chinese companies, China Harbour Engineering Company (CHEC) and China State Construction Engineering Corporation (CSCEC). CHEC was responsible for building the core infrastructure, which amounted to $150 million, while CSCEC undertook tasks such as fortifying riparian areas, reducing flood risks, and establishing housing, education, and health facilities, involving an investment of $60 million.

Much like Pakistan, Myanmar is also involved in China's BRI through the China-Myanmar Economic Corridor (CMEC). China earmarked an investment of $1.3 billion for the Kyaukphyu Port, starting from 2020. The total project cost was $7 billion. However, Myanmar’s National League of Democracy (NLD) regime reduced the project's scope in 2020, due to fears of falling into a debt trap. The China International Trust and Investment Corporation Group (CITIC) leads the project, which also involves creating an industrial zone. Situated on the western coast of Rakhine state, , the Kyaukphyu Port occupies a strategic location on the Bay of Bengal. This geographical positioning follows the trajectory of the 21st-century Maritime Silk Road, a modern-day maritime route that interlinks Asia, Europe, and Africa.

China looks to expand far east with ports in Cambodia and Malacca

China has increased its presence in Cambodia through a $1.5 billion investment in the Ream Naval base. This initiative, led by state-owned Shanghai Construction Company and China Bridge and Road Company, is set to be operational by 2025. The initial project phase has a $200 million investment to establish container operation zones, commencing with a yearly capacity of 300,000 TEU (twenty-foot equivalent unit). Plans include highway connections, including one to the nearby capital, Phnom Penh. Recent reports indicate swift progress, with the pier development underway in the first half of 2023.

Adjacent to the Cambodian naval base is Malaysia's Malacca Port, a crucial link between the Indian Ocean and the South China Sea. The project was awarded in 2016 to Malaysian developer KAJ Development. Collaborating with Chinese companies like PowerChina International Group, a subsidiary of China's State Power Investment, along with Shenzhen Yantian Port Group and Rizhao Port Group, KAJ envisioned a 246-hectare project featuring economic zones, upscale housing, hotels, and diverse tourist attractions. However, the project was left incomplete after the Malacca government cancelled the agreement with KAJ Development owing to three years of inactivity in November 2020.In December 2022, the countries made new plans for the redevelopment of the port into a new deep sea port with an investment of $7.2 billion from China. The redevelopment deal also includes a commitment of imports of $2 trillion from Malaysia over the next five years.

China continues to make new investments in African nations

We now shift our focus to the African continent, where China stands as one of the top four investors with investments reaching $3.4 billion in 2022 and another $1.3 billion by April 2023.

Among African countries, Sudan represents one of China's earliest engagements with the continent. Sudan’s Haidob port received a Chinese investment of $141 million, and was inaugurated in December 2020. This facility is dedicated to the transportation of livestock such as cattle, camels and sheep to Asian markets. In the vicinity, Eritrea and Djibouti have two ports with major Chinese investment - the Massawa Port and the Doraleh Multipurpose Port, respectively. Massawa Port’s project was contracted to state-owned China Harbor Engineering Company for $400 million. Doraleh, on the other hand, was financed for $405 million by China’s Exim Bank and was contracted to state-owned China Civil Engineering Construction Corp and Channel Engineering Bureau Group.

Coming to the Southern part of Africa, we encounter Tanzania, home to the Dar Es Salaam and Bagamoyo ports. For the Dar es Salaam Port, a $154 million contract was awarded to China Harbour Engineering Company in 2017. The project involves the expansion of the primary port in the commercial hub, the construction of a roll-on, roll-off terminal, and the enhancement of the depth and resilience of seven berths within the port. On a different note, the Bagamoyo Port is a stalled $10 billion project, which is being renegotiated between the Tanzanian Government and China Merchant Port.

Mirroring Tanzania, Kenya also hosts two ports with Chinese funding - Lamu and Mombasa. The Lamu Port plays a crucial role in the expansive transportation corridor linking Lamu, South Sudan, and Ethiopia. This corridor, known as the Lamu Port South Sudan-Ethiopia Transport (LAPSSET) corridor, is valued at $23 billion. The initial phase of this project, which involves constructing 32 berths, was undertaken by the state-run China Communications Construction Company at $367 million in 2021, focusing on the first three berths. The Mombasa-Nairobi standard gauge railway received a $3.2 billion loan from China’s Exim bank. The initial auditor’s report suggested that the Mombasa port served as collateral, and any default on yearly payment of $705 million could result in a Chinese takeover, akin to the events in Sri Lanka.

China eyes global trade with two ports in the Suez Canal

From eastern and southern Africa, we move to the ports along the Suez Canal, which is a vital route for India’s trade with Europe. Among these, Port Said is situated in the northern part of the canal and Ain Sokhna Port occupies the southern part. China’s COSCO Shipping Ports (CSPL) has purchased a 25% stake in a new container terminal at the Ain Sokhna Port for $375 million. The company already had a 20% stake in the non-controlling container terminal at Port Said.

In Australia, the Darwin Port was leased to China’s Landbridge group for $390 million for a period of 99 years. As Australia’s relations with China deteriorated in recent years, the Australian government decided to build a new port in Darwin for $1.5 billion.

In conclusion, China's "String of Pearls" strategy involves strategic investments in maritime ports along the Indian Ocean, thereby reshaping regional geopolitics. Ports like Gwadar, Hambantota, and Chittagong enhance China's influence through initiatives like BRI and CPEC. The situation in Hambantota, Sri Lanka, is a warning about the risks of falling into debt traps. The impact extends to trade routes like the Suez Canal, reflecting China's global maritime ambitions. These nations are striving to strike a balance between reaping economic benefits and addressing security concerns, thereby reshaping policies in response to China's ever-expanding maritime network.

Thisshipbuilding firm is making headlines due to the government’s plans to tender six Air Independent Propulsion (AIP)-capable diesel submarines worth around Rs 43,000 crore. It's the only Indian firm capable of building destroyers and conventional submarines. According toTrendlyne Technicals, the stock has risen by 8.8% in the past month. The firm’s order book at the end of June 2023 was pegged at Rs 39,117 crore, which is executable till FY27. However, the peak revenue recognition is expected in FY25 if no new major orders are bagged.

Mazagon Dock Shipbuilders’ Q1FY24 revenue increased marginally by 1.6% YoY, but net profits surged by 39.5% YoY. The bottom-line growth was driven by the faster commissioning of the P15-B destroyer ship. The management has given a revenue guidance of 10-12% for FY24, with margins at FY23 levels. Mazagon Dock has planned a capex of Rs 500 crore towards a floating dry dock.

The firm has tied up with ThyssenKrupp Marine System (TKMS) to participate in the bidding for P75I submarines (6 numbers), with an expected order value of around Rs 43,000 crore. Mazagon Dock Shipbuilders and L&T (along with Spain-based firm Navantha) have been shortlisted for the bidding process. The firm is also expecting an extension of the P75 submarine (3 numbers) valued at around Rs 22,000 crore. Apart from this, periodic refit and life certification projects are in the pipeline.

ICICI Securities says that despite Mazagon Dock’s strong execution capability, uncertainties around ordering timelines for P75I and P75 and its depleting order book pose a risk to revenue growth. The brokerage maintains its ‘Sell’ rating.

2. Kalyan Jewellers India:

This gems and jewellery retailer has risen by 18.2% in the past week, reaching a 52-week high of Rs 228.4 on Thursday. The increase comes after the company announced a 33.3% YoY improvement in its Q1FY24 net profit to Rs 143.9 crore, beating Trendlyne Forecaster’s estimate by 16.9%. Its revenue also grew by 31.3% YoY to Rs 4,387.4 crore, beating the estimate by 3.7%. This revenue surge was driven by robust store expansion and high momentum in footfall.

For FY24, Kalyan Jewellers has plans to open 52 new stores in India under the FOCO model (franchise owned while the company operates). This approach will reduce capex costs and contribute to margin expansion. The management also aims to convert its digital platform Candere into an omnichannel model by launching 25 new stores in FY24. This rapid expansion may lead to further top-line growth. In Q1FY24, Kalyan Jewellers’ operating profit margin stood at 7.8%, while its peer Titan’s was 11.2%.

But the jewellery maker needs to absorb and train employees much before the store openings, leading to increased employee cost expenses. It already added nearly 600 employees in Q1. The company also features in a screener for stocks with growing YoY costs for long-term projects.

Along with the expansion push, Kalyan Jewellers may also benefit from the rising share of organised jewellery retailers. These organised retailers are expected to claim over 40% of the market share by FY25 from 32% in 2020.

ICICI Securities maintains a ‘Buy’ call on Kalyan Jewellers and foresees revenue and profit CAGR of 21% and 28% respectively by FY25. It retains its stance based on the company’s execution performance capabilities, which it expects to sustain in the future. According to Trendlyne Forecaster, the company has a consensus recommendation of ‘Strong Buy’ from 6 analysts.

3. Jindal Steel & Power:

This metals & mining stock has been on the decline since Monday following its announcement of a 15% decrease in net profit to Rs 1,691.8 crore in Q1FY24 on August 11 post-market hours. Its revenue also fell by 3.3% YoY to Rs 12,588.3 crore due to a fall in pellet production and delays in the commissioning of key steel manufacturing facilities. These caused the company to appear in a screener of stocks with declining quarterly revenue and net profit (YoY). While its revenue was in line with Trendlyne’s Forecaster estimates, net profit beat estimates by 111.1%.

Despite the dip in net profit, Jindal Steel & Power's EBITDA margin expanded by 560 bps YoY to 21.6%, owing to a reduction in the cost of raw materials due to lower iron ore and thermal coal prices. It has managed to conclude the mining lease of Utkal C and Gare Palma IV/6, along with the commissioning of a 6 MTPA pellet plant at Angul, despite a delay in the commissioning of steel plants. This will bring down the cost of thermal coal. The delay in the commissioning of the steel plants was due to the hold-up in environmental approvals. Bimlendra Jha, Managing Director of the company, said, “The mining lease for the two thermal coal mines will lead to consistent availability of coal for our thermal coal requirements in DRI Kilns, Coal Gasification and Power Plants at lower costs.”

Following the results, ICICI Securities has maintained its ‘Buy’ rating on the stock with an upgraded target price of Rs 810 per share. This indicates a potential upside of 26.4%. The brokerage believes that the delay in the steel mining activities in Angul will affect revenue growth in the near term. However, it expects the company’s EBITDA margin to improve on the back of the captive coal mining and pellet plants. The brokerage expects its revenue to grow at a CAGR of 3.6% over FY22-25.

4. Tejas Networks:

This telecom services company rose nearly 7% in intraday trade on Wednesday after winning a contract worth Rs 7,492 crore from TCS. The contract involves supplying radio access network (RAN) equipment for BSNL's 4G/5G network project. As per the deal, the firm will supply RAN equipment across 1 lakh sites and the project is expected to be executed during 2023 and 2024.

This deal seems to have accelerated the recovery of Tejas Networks' share price. The stock had declined by nearly 10% after the announcement of its Q1FY24 results on July 21. Its net loss widened nearly 4X YoY to Rs 26.3 crore due to sharp increases in raw material costs and employee expenses. The firm's revenue growth of 49.5% YoY was not enough to offset the effects of rising input costs. It shows up in a screener for companies with net profit declining sequentially over the past three quarters.

However, Tejas Networks has not lost its positive momentum entirely. It achieved robust top-line growth in its domestic and international segments. The company's order book for the wireless business at the end of Q1FY24 stood at Rs 1,909 crore, with 86.5% of the orders coming from the Indian market. Arnob Roy, the Chief Operating Officer of Tejas Networks, said, “Around 50-60% of the company’s total order book will be executed by the end of FY24.” In addition, the recent deal win from TCS adds to the already healthy order book. However, the focus falls on order execution to bring the firm back to profit from loss.

5. FSN E-Commerce Ventures (Nykaa):

This internet and catalogue retail company plunged over 8% on Monday after reporting a 27.4% fall in its Q1FY24 net profit, missing Forecaster estimates by 83.2%. The net profit decline can be attributed to increased costs of raw materials, finance, and employee benefits. The slowdown in discretionary spending also dragged the net profit down during the quarter. However, its revenue has improved by 23.8% YoY, driven by the beauty & personal care (BPC) and fashion segments.

During the quarter, Nykaa’s GMV (gross merchandise value) grew by 24% YoY. Specifically, the GMV of the BPC segment (constituting 63.7% of the total GMV) rose by 24%, while the fashion segment’s GMV (24.5% of the total GMV) increased by 12% YoY. Nykaa’s BPC business has remained strong despite a slowdown in discretionary spending, while the fashion segment saw muted growth. Falguni Nayar, the CEO, said, “During the quarter, growth in fashion has been below our long-term expectation. I think it was a particularly tough quarter for fashion and the industry is hoping for a revival." She has also highlighted that the company remains focused on its own brands as it is key to profitability. Own brands now constitute 14% of Nykaa’s overall Fashion GMV, up from the earlier 12%, and they achieved a 30% YoY growth in Q1.

ICICI Securities highlights that the company’s EBITDA margins have expanded at a slower pace than expected. Nykaa’s EBITDA margin improved 120 bps YoY to 5.2%, largely driven by lower marketing & advertising expenses. However, the management foresees margin expansion through the scaling up of its eB2B business and the optimisation of marketing spends. The brokerage has downgraded its rating to ‘Add’ with an unchanged target price of Rs 165. As a result, Nykaa makes it to a screener of companies with broker downgrades in price or recommendation in the past month.

Trendlyne Analysis

Nifty 50 closed at 19,310.15 (-55.1, -0.3%), BSE Sensex closed at 64,948.66 (-202.4, -0.3%) while the broader Nifty 500 closed at 16,757.70 (-44.6, -0.3%). Of the 1,935 stocks traded today, 745 were gainers and 1,132 were losers.

Indian indices closed in the red, with the Nifty 50 closing just above the 19,300 mark. The Indian volatility index, Nifty VIX, fell 0.8% but still closed above 12 points. Indian indices posted weekly losses for a fourth straight week after hitting their all-time highs on July 20. The RBI, in its August bulletin, stated that the possibility of stagflation in India is low at 3%, despite the recent surge in retail inflation.

Nifty Midcap 100 and Nifty Smallcap 100 closed in the red, following the benchmark index. However, Nifty Media and Nifty Metal closed higher than their Thursday close. According to Trendlyne's sector dashboard, Transportation was the top-performing sector of the week in a volatile market.

Major European indices traded in the red, in line with the Asian indices. China’s Shanghai SE Composite Index closed 1% lower amid contagion fears of the liquidity crisis in China’s shadow banking industry. US index futures also traded in the red amid weak global cues, indicating a negative start to the trading session.

Money flow index (MFI) indicates that stocks like Suven Pharmaceuticals, Emami, KSB and Kalyan Jewellers India are in the overbought zone.

New Delhi Television rises as the Ministry of Information & Broadcasting approves uplinking and downlinking for four news and current affairs channels: NDTV Rajasthan, NDTV Madhya Pradesh/Chhattisgarh, NDTV Gujarati and NDTV Marathi.

Jio Financial Services (JFSL), demerged from Reliance Industries, is set to go public on Indian stock exchanges on August 21, 2023.

Jio Financial Services to be listed on stock exchanges on August 21.#jiofinancialservices#Reliance#MukeshAmbanipic.twitter.com/7dkg6phlBN

— Business Standard (@bsindia) August 18, 2023Indian Hume Pipe surges over 5% on receiving a letter of award (LOA) worth Rs 639.2 crore from the Rural Water Supply & Sanitation, Odisha. The LOA is for the execution of a rural piped water supply project in the Puri district. The project is expected to be completed in two years and the company will manage the operation and maintenance for five years.

BLS International Services and Escorts Kubota touch their all-time highs of Rs 261 and Rs 2,874.3 respectively. The former has risen by 16.4% over the past month, while the latter increased by 20%.

Route Mobile's UK arm inks an exclusive partnership with Vodafone Idea for the latter's international application-to-person (A2P) SMS traffic for 24 months. Route will provide comprehensive A2P monetization solutions by deploying its artificial intelligence/machine learning-driven analytical firewall solution.

Pyramid Technoplast's Rs 153.1 crore IPO gets bids for 0.82X the available 75.6 lakh shares on offer on the first day of bidding. The retail investor quota gets bids for 1.20X of the available 46.1 lakh shares on offer.

Mahindra & Mahindra is falling as it receives a penalty order of Rs 14.3 lakh from the Joint Commissioner, CGST & Central Excise. The order is directed at its merged entity, Mahindra Vehicle Manufacturers, for availing incorrect input tax credit during the transition from the excise regime to the GST regime.

Zhongrong International Trust reportedly hires KPMG to audit its balance sheet due to worsening liquidity concerns. The shadow bank has missed payments on numerous wealth management products and plans to undergo debt restructuring and asset sales after the review to repay its investors.

Exclusive: Chinese $137 billion shadow banking giant Zhongzhi, whose cash crunch has fanned contagion fears, is planning to restructure its debt and hired KPMG for an audit https://t.co/7gHGXBklEg

— Bloomberg Economics (@economics) August 17, 2023ICICI Securities downgrades Glenmark Pharmaceuticals to a 'Sell' from 'Reduce', with a target price of Rs 660 per share due to the stock's high valuation. The brokerage believes that improving demand in India, debt reduction, and increased sales in the Ryaltris segment will aid the company's net profit to grow at a CAGR of 36.5% over FY23-25.

Shipping, paper & paper products, plastic products and footwear industries rise more than 3% in the past week.

Foreign institutional investors invest Rs 6,108.9 crore in the equity market over the past week, according to Trendlyne's FII dashboard. Meanwhile, index options witness the highest investment of Rs 34,465.2 crore from foreign investors.

Manappuram Finance is falling as reports suggest that 13 lakh shares of the company have changed hands in pre-market trade. The company features in a screener for stocks that have seen a decrease in Mutual Fund holdings in the past quarter.

In its August bulletin, the RBI states that the possibility of stagflation in India is low at 3%, despite the recent surge in retail inflation. This is due to factors like easing financial conditions, stable INR/USD exchange rates, and steady domestic fuel prices.

The Reserve Bank in its August bulletin said the risk of stagflation, a period of weak growth and high inflation, remains low in India despite a sharp uptick in priceshttps://t.co/oOi7TxNRKN

— Mint (@livemint) August 18, 2023Sula Vineyards rises as visitor attendance surged at the Nashik and Bengaluru wine tourism facilities from August 12-14. During this extended weekend, its wine tourism operations generated revenue of Rs 2.1 crore, marking a 40% increase from the previous three-day record.

Adani Green Energy, Adani Power and Adani Transmission are rising as Abu Dhabi International Energy Company (TAQA) plans to invest $2.5 billion (approximately Rs 20,773 crore) in Adani Group's power businesses, according to reports.

Yatharth Hospital & Trauma Care Services surges as its Q1FY23 net profit rises by 73.1% YoY to Rs 190.4 crore and revenue increases by 39.1% YoY. Its EBITDA margin also improves by 368 bps YoY to 26.8%. The firm's Whole-Time Director, Yatharth Tyagi, says, "Our ongoing investments reflect a strategic approach to nurturing balanced future growth, exemplified by ongoing expansion efforts, both organic and inorganic."

Jefferies maintains a 'Buy' rating on Finolex Cables while increasing the target price to Rs 1,270. The brokerage anticipates the communication industry to benefit from the 5G rollout and suggests a 5-15% import boost could offset optical fiber price erosion.

Brokerage Radar | @Jefferies on Finolex Cables: Maintain 'Buy': Communication segment is likely to benefit from 5G rollout pic.twitter.com/3rofdPK0VC

— ET NOW (@ETNOWlive) August 18, 2023IT stocks like Tata Consultancy Services, Infosys, HCL Technologies, Wipro and LTIMindtree are falling in trade. All constituents of the broader Nifty IT index are also trading in the red.

GMM Pfaudler is falling and hits a 52-week low of Rs 1,376 following reports of a 13% stake, equivalent to 58 lakh shares, changing hands in a block deal.

Concord Biotech’s shares debut on the bourses at a 21.5% premium to the issue price of Rs 741. The Rs 1,551 crore IPO has received bids for 24.9 times the total shares on offer.

Mayank Singhal, Vice-Chairman & MD of PI Industries, says that seasonal delays and irregular rains have caused a drop in domestic business. But he anticipates an improvement by Q2. He adds that the firm aims for double-digit domestic growth in FY24 and assures to maintain margins at the current levels.

#OnCNBCTV18 | Seasonal delays & erratic rains led to a decline in domestic business, but should be in a better situation in the domestic markets by Q2. Looking at acquisition opportunities in various segments: Mayank Singhal of PI Industries says pic.twitter.com/c1FMywSyjh

— CNBC-TV18 (@CNBCTV18Live) August 18, 2023Pyramid Technoplast raises Rs 27.6 crore from anchor investors ahead of its IPO by allotting 16.6 lakh shares at Rs 166 each. Investors include Carnelian Structural Shift Fund, Alchemie Ventures Fund-Scheme I, Pluris Fund and Resonance Opportunities Fund.

Carborundum Universal inks an agreement with ideaForge Technology to jointly develop drone components using nanomaterial-reinforced composite materials such as graphene-reinforced polymers.

South Indian Bank receives RBI approval to appoint P R Seshadri as the Managing Director and Chief Financial Officer. His appointment will take effect on October 1, 2023.

Riding High:

Largecap and midcap gainers today include Adani Green Energy Ltd. (994.75, 6.56%), Adani Power Ltd. (304.60, 6.30%) and Adani Transmission Ltd. (871.90, 6.04%).

Downers:

Largecap and midcap losers today include Gland Pharma Ltd. (1,568.70, -3.02%), Macrotech Developers Ltd. (696.00, -2.86%) and Bajaj Holdings & Investment Ltd. (6,943.20, -2.85%).

Movers and Shakers

25 stocks in BSE 500 are trading on high volumes today.

Top high volume gainers on BSE included Vardhman Textiles Ltd. (362.05, 6.72%), Adani Green Energy Ltd. (994.75, 6.56%) and Lemon Tree Hotels Ltd. (102.15, 6.41%).

Top high volume losers on BSE were Manappuram Finance Ltd. (148.05, -3.89%), Aptus Value Housing Finance India Ltd. (271.20, -2.13%) and United Breweries Ltd. (1,519.30, -1.77%).

CSB Bank Ltd. (315.70, 4.45%) was trading at 14.4 times of weekly average. Aster DM Healthcare Ltd. (319.40, 4.91%) and Finolex Cables Ltd. (1,064.95, 3.57%) were trading with volumes 7.7 and 7.5 times weekly average respectively on BSE at the time of posting this article.

BSE 500: highs, lows and moving averages

24 stocks took off, crossing 52-week highs, while 3 stocks tanked below their 52-week lows.

Stocks touching their year highs included - Bank of Maharashtra (38.45, -0.52%), Dr. Reddy's Laboratories Ltd. (5,874.45, -0.11%) and Emami Ltd. (528.60, 3.83%).

Stocks making new 52 weeks lows included - UPL Ltd. (578.45, -1.11%) and GMM Pfaudler Ltd. (1,509.15, -0.85%).

12 stocks climbed above their 200 day SMA including Network 18 Media & Investments Ltd. (63.50, 4.18%) and Ambuja Cements Ltd. (453.05, 1.58%). 10 stocks slipped below their 200 SMA including Page Industries Ltd. (40,106.70, -2.82%) and Aptus Value Housing Finance India Ltd. (271.20, -2.13%).

Trendlyne Analysis

Nifty 50 closed at 19,365.25 (-99.8, -0.5%), BSE Sensex closed at 65,151.02 (-388.4, -0.6%) while the broader Nifty 500 closed at 16,802.25 (-50.8, -0.3%). Market breadth is holding steady. Of the 1,931 stocks traded today, 952 were on the uptrend, and 933 went down.

Indian indices extended their losses from the afternoon session and closed in the red, with the Nifty 50 closing at 19,365. The volatility index, Nifty VIX, rose by 0.9% and closed at 12.2 points. Bata India rose 6% following reports about a tie-up with sportswear giant Adidas.

Nifty Midcap 100 and Nifty Smallcap 100 closed in the green, with the benchmark index closing lower. Nifty PSU Bank closed higher, compared to Wednesday’s closing levels. According to Trendlyne’s sector dashboard, transportation emerged as the top-performing sector of the day, with a rise of over 1.9%.

Most European indices trade in the red. US indices futures trade lower, indicating a negative start. Morgan Stanley cuts China’s 2023 GDP growth to 4.7% from an earlier estimate of 5%.

Relative strength index (RSI) indicates that stocks like Shyam Metalics and Energy, Kalyan Jewellers India, Indian Railway Finance Corp and Lupin are in the overbought zone.

Fine Organic Industries, eClerx Services, and KPR Mill report strong annual return on capital employed (RoCE) of 54.9%, 34.8%, and 27.2% respectively in FY23. The companies outperform their respective sectors by 32.6, 16.1 and 7.3 percentage points.

Healthcare equipment & supplies, media and pharmaceuticals & biotechnologysectors rise more than 9% in the past month.

Power Finance Corp rises as the Ministry of Power appoints Parminder Chopra as the Chairman and Managing Director of the company. She assumes charge today.

Morgan Stanley reduces its forecast for China’s GDP growth in 2023 to 4.7% from the earlier estimate of 5%. The brokerage cites a steep slowdown in investments as a reason for the downgrade, among others.

Morgan Stanley reduces its forecasts for China’s economic growth to 4.7% from 5% into next year, citing weaker investment https://t.co/Agmh1NAahW

— Bloomberg (@business) August 17, 2023

Varun Beverages and Apar Industries touch their all-time highs of Rs 934.6 and Rs 4,453.9 respectively. The former has risen by 10.1% in the past month, while the latter increased by 24.9%.

Prabhudas Lilladher keeps its 'Buy' rating on Aster DM Healthcare with an upgraded target price of Rs 345. This indicates a potential upside of 12.8%. The brokerage believes that the company's margins will improve in the Indian market with brownfield expansion and the establishment of new hospitals in the Gulf Cooperation Council (GCC). It expects the healthcare company's revenue to grow at a CAGR of 8.9% over FY22-25.

Dr Agarwal's Eye Hospital is rising as its parent company, Dr Agarwal's Health Care, raises $80 million (approximately Rs 6,651.2 crore) from TPG Growth and Temasek. The company plans to invest more than Rs 1,200 crore to establish hospitals in India and Africa over the next three years. Dr Adil Agarwal, the CEO, says, "The investment will be used to support the business through its next phase of growth, including the acquisition of small hospitals and chains, as well as the greenfield expansion of our network."

Rashtriya Chemicals & Fertilizers rises as it receives environmental clearance (EC) from the Ministry of Environment, Forest and Climate Change, for its proposed project, installation of a new nano-urea fertilizer plant in Chembur, Mumbai. It appears in a screener of stocks with low debt.

Ashish Gaikwad, MD of Honeywell Automation India, says that the company's growth looks robust. He adds that its margins were impacted in Q1FY24 due to factors such as high competition and one-time costs. Gaikwad expects these margins to stabilize at their current levels. He also states that the current order book has increased by 41% YoY.

Honeywell Automation India says

????????growth story is very strong

????Margins will be maintained at current levels

????Order book +41% yoy#StockMarket#Niftyhttps://t.co/Q9iK7ijgKd— Nigel D'Souza (@Nigel__DSouza) August 17, 2023

Power Grid Corp of India is falling after receiving a notification to commence operations for assets under the North Eastern Region Strengthening Scheme-VI.

CCL Products, Tata Elxsi and Tata Consultancy Services underperform the Nifty 50 index over the past month post their Q1FY24 results.

IT stocks like LTIMindtree,Tata Consultancy Services, Coforge and Persistent Systems are falling in trade. The broader sectoral index Nifty IT is also trading in the red.

JSW Investments, promoter of JSW Energy offloads a 1.3% stake (2.1 crore shares) worth Rs 718 crore in a block deal on Wednesday. Meanwhile, GQG Partners Emerging Market Fund picks up a 0.6% stake (10.3 lakh shares) in the company for Rs 351 crore.

GQG Partners further ups bet in JSW Energy, buys 0.6% stake for Rs 351 crore https://t.co/6y4jdINdvJ

— ETMarkets (@ETMarkets) August 16, 2023

HDFC Securities maintains its 'Buy' rating on Crompton Greaves Consumer Electricals with an unchanged target price of Rs 400. This indicates a potential upside of 39.4%. The brokerage anticipates a short-term margin decline due to cost increases. However, it expects revenue to grow over the medium to long term, supported by enhanced branding, distribution, and R&D efforts. It expects the company's sales to grow at a CAGR of 9.2% over FY23-26.

Garware Technical Fibres' Q1FY24 net profit rises by 52.4% YoY to Rs 42.9 crore due to a fall in inventory cost. Its revenue also increases by 8.4% YoY due to improvement in the fibre and industrial products segment. It appears in a screener of stocks with high momentum scores.

Bata India is reportedly in talks with Adidas about a strategic partnership, with a possible tie-up focused towards the Indian market.

CNBC-TV18 Exclusive | Sources tell @CNBCTV18News that @BATA_India is in talks with @adidas for a strategic partnership. The tie-up is likely to be focussed on the Indian market. @VivekIyer72 with all the exclusive details pic.twitter.com/s7jDcV2OHJ

— CNBC-TV18 (@CNBCTV18News) August 17, 2023

Glenmark Pharmaceuticals receives final approval from the US FDA for its abbreviated new drug application for tacrolimus ointment, a generic version of Leo Pharma AS' Protopic ointment. The ointment is used for the treatment of eczema and has an estimated annual sales of $15.4 million in the year ended June 2023, according to IQVIA.

Cochin Shipyard surges and hits a record high of Rs 904.45 as reports suggest that it may receive contracts worth more than Rs 1.2 lakh crore over the next 2-4 years.

Cipla is falling as the Food and Drugs Administration suspends its Patalganga manufacturing unit's licence for 10 days in December 2023. The order has been imposed due to the non-conformance of good manufacturing practices. Cipla is in the process of appealing against the suspension to the state government.

Indian Railway Finance Corp is falling as reports suggest that the Centre is considering to sell a part of its stake (11.4%) through an offer for sale. The Centre currently holds an 86.4% stake in the company.

Government planning to sell a part of its holding in Indian Railway Finance Corp through OFS.#IndianRailway#IRFChttps://t.co/AEoW3OCbl2

— Business Standard (@bsindia) August 16, 2023

Shipping companies like Mazagon Dock Shipbuilders, Great Eastern Shipping, Garden Reach Shipbuilders and Shipping Corp of India are rising in trade. The broader shipping industry is also trading in the green.

Shobha Gangwal, promoter of InterGlobe Aviation, sells a 7.1% stake in the company on Wednesday in multiple bulk deals.

Alpha Alternatives Msar LLP sells a 0.8% stake in Suven Pharmaceuticals for approx Rs 108.7 crore in a bulk deal on Wednesday.

Ramkrishna Forgings is rising as it bags an order worth 16 million Euros (approximately Rs 145 crore) from a European original equipment manufacturer. The order relates to the production and delivery of differential components for a period of four years.

Riding High:

Largecap and midcap gainers today include Indian Bank (409.00, 5.94%), REC Ltd. (235.10, 5.36%) and Bata India Ltd. (1,733.55, 5.25%).

Downers:

Largecap and midcap losers today include Indian Railway Finance Corporation Ltd. (47.65, -7.02%), Indian Overseas Bank (31.20, -4.44%) and JSW Energy Ltd. (352.55, -4.20%).

Movers and Shakers

16 stocks in BSE 500 are trading on high volumes today.

Top high volume gainers on BSE included Apar Industries Ltd. (4,715.90, 9.82%), Amber Enterprises India Ltd. (2,837.20, 8.79%) and Cochin Shipyard Ltd. (875.70, 8.40%).

Top high volume losers on BSE were Eris Lifesciences Ltd. (794.85, -1.87%) and Sapphire Foods India Ltd. (1,325.50, -1.42%).

JM Financial Ltd. (78.25, 7.93%) was trading at 17.1 times of weekly average. Home First Finance Company India Ltd. (867.55, 2.49%) and Bata India Ltd. (1,733.55, 5.25%) were trading with volumes 8.1 and 5.3 times weekly average respectively on BSE at the time of posting this article.

BSE 500: highs, lows and moving averages

26 stocks hit their 52 week highs, while 1 stock hit their 52 week lows.

Stocks touching their year highs included - Ajanta Pharma Ltd. (1,781.55, 0.50%), Akzo Nobel India Ltd. (2,849.25, -0.85%) and Emami Ltd. (509.10, -0.09%).

Stock making new 52 weeks lows included - Easy Trip Planners Ltd. (38.45, -2.90%).

12 stocks climbed above their 200 day SMA including IFB Industries Ltd. (892.80, 5.63%) and Rashtriya Chemicals & Fertilizers Ltd. (111.20, 3.06%). 11 stocks slipped below their 200 SMA including Network 18 Media & Investments Ltd. (60.95, -2.56%) and Aegis Logistics Ltd. (352.00, -1.91%).

Oil is not a dependable bet. Like other commodities, its price seesaws in unpredictable ways, and many analysts who tried to predict the future price of oil have got their fingers burned (remember the $200 price per barrel predictions in early 2022?)

Oil-producing nations have also taken a hit recently from the price volatility.

For a time, things were good. The OPEC countries saw windfall profits from April 2022 to January 2023 due to the Russia-Ukraine war. But the trend has since reversed. Excess supply is sloshing around in the market, and the unexpected slowdown of China's economy has hit oil prices hard.

in response, OPEC cut oil production, which drove oil prices higher by 18% since June 2023. But the cuts didn't have the full price impact they had hoped for. The S&P had projected that oil prices would be around $90 in 2023, but the ramp-up in Iranian oil production has cut short the rally, pushing prices down to $84 from a recent peak of $88.

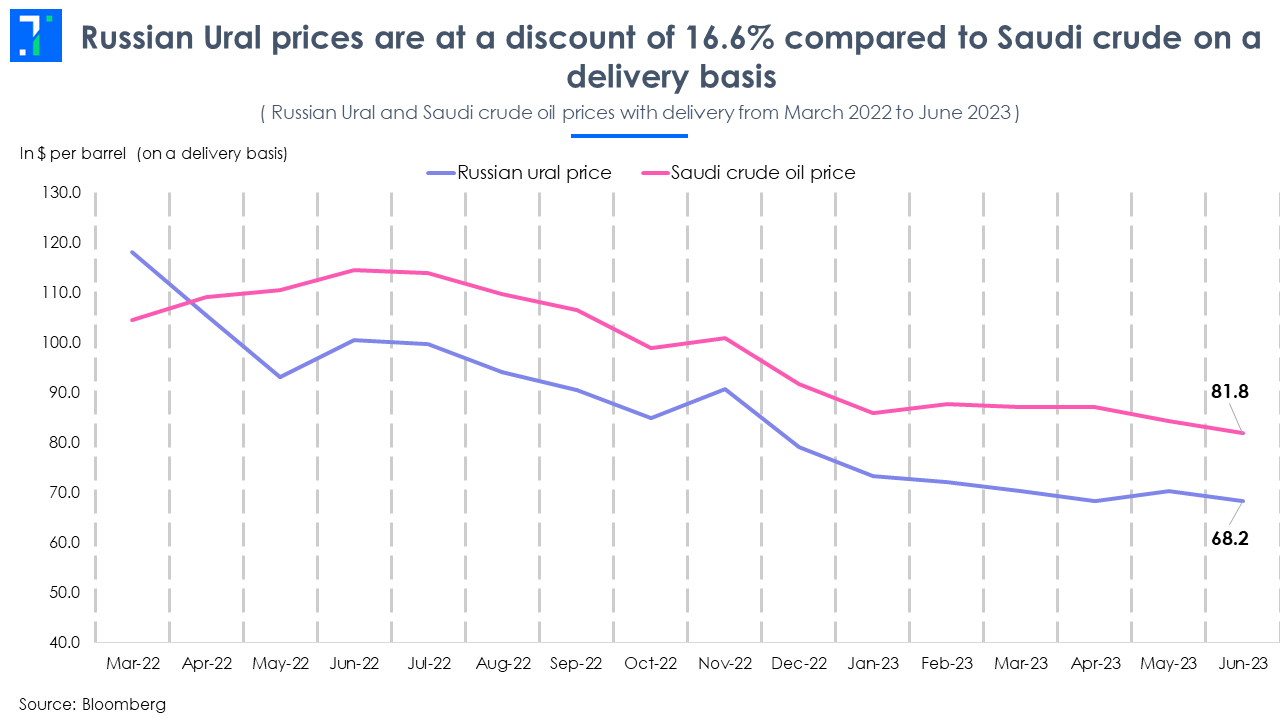

In the meantime, India and China have benefited from cheap Russian Ural. But the price gap between Russian Ural and Saudi crude on delivery has narrowed, from a $20 difference in the first quarter of 2023 to $8 in August.

In this week’s Analyticks:

- Oil price dynamics: Oil prices are defying analyst predictions

- Screener: Commodities stocks with the highest revenue and net profit growth in Q1FY24

Let’s get into it.

As oil consumption slows, OPEC makes production cuts to keep prices up

GDP growth hasslowed down for most countries this year, resulting in lower crude oil consumption. China, the largest crude oil importer, and other developed nations are consuming less oil than expected. The increasing adoption of electric vehicles across Europe, the US, and China has also limited the demand for crude.

The slowdown in consumption has resulted in higher inventory levels over the past four quarters.

Production cuts will lower inventory levels in the second half of 2023

To improve their revenue streams and get a better price for their oil, the OPEC cartel collectively reduced oil production by 1.2 million barrels per day. They are now looking to extend these cuts beyond September 2023.

Saudi Arabia faces a potential budget deficit

Saudi Arabia depends on oil and petroleum for nearly 75% of its budget revenue. The surge in oil prices in 2022 gave the Saudis a fiscal surplus of $27.7 billion. The country used the money to increase its defense spending. It also spent around $6 billion to acquire famous football players for its sports teams - including Portugal's Cristiano Ronaldo and Brazil's Neymar.

However, with oil prices below $80 in the first half of 2023 and exports falling to a 19-month low, Saudi Arabia has had to pause its spending spree. Now the country is staring at a possible fiscal deficit. It already saw a budgetary deficit of roughly $2.2 billion in the first half of 2023.

According to the IMF, Saudi Arabia needs oil prices to be above $81 in 2023 to break even in its budget spending. TheIMFhas cut the Saudi economy's GDP growth forecast for 2023 from 3.1% to 1.9%, owing to lower oil prices and production cuts.

Saudi Arabia’s breakeven price of crude to meet its expenses stands at $81 per barrel in 2023

As India and China turn to Russian Ural, Europe has replaced Asia as the top destination for Saudi crude oil. But Europe has not entirely compensated for Asia’s demand decline. To boost oil prices, Saudi Arabia inJune 2023 announced a voluntary production cut of 1 million barrels per day till September, on top of OPEC’s production cut of 1.2 million barrels per day.

Russia's cash crunch is also forcing it to cut oil production

The other big oil producer, Russia finds itself in a tough spot due to its expensive military campaign in Ukraine, and price caps on Ural exports imposed by the US and its allies. The Russian Ural, which is trading at a significant discount to crude, is being snapped up by India and China.

But higher volumes sold have not been able to make up for the revenue loss due to the price cap. This has led to a fiscal deficit of $28.3 billion fir Russia in the first half of 2023.

Russia is expected to have a budget deficit of 2.6% in 2023

Russia sold its oil for around $50-55 per barrel in the first half of 2023, but higher Ural prices in the second half of 2023 (around $60) are expected to reduce its deficit. To increase its revenue, Russia raised taxes on oil exports by 8% in August 2023.

Russia is taking steps to raise its oil price. It has pledged to reduce its crude exports by 5,00,000 barrels per day in August and an additional 3,00,000 barrels per day in September. A recent drone attack by Ukraine on a Russian oil tanker has also raised concerns about Ural supply, causing Ural prices to breach the $60 cap.

India walks the line, buying Russian oil at rates above price caps

China and India have been vocally against the price cap on Russian oil. They argue that since they aren't involved in the Russia-Ukraine conflict, their economies shouldn’t suffer. Finance Minister Nirmala Sitharman insisted that India will buy Russian Ural above the $60 price cap as long as it is cheaper than the market rate.

Right now, there are ways to get around the price cap. Unlike the free on board (FOB) basis, India’s crude import price is decided on a delivery basis (which includes the price of crude, insurance, shipping and other handling charges). This limits the transparency on the final price India is paying to Russia.

India’s on-delivery price of Russian Ural for June stood at $68.2, while for Saudi crude oil it was $81.8. However, the latest data from Argus Media suggests that August's Ural crude delivered to India’s west coast is around $82.

Russian Ural prices are at a discount of 16.6% compared to Saudi crude on a delivery basis

With the Ural price now significantly above the $60 per price cap, freight cost adjustments will be too large to go unnoticed. India and Russia need to find financiers, insurance providers, and shipping lines unaffected by Western sanctions. China, on the other hand, can substitute Russian Ural with Iranian oil. For India discounted Russian oil is the only way out to soften the blow of rising crude prices.

India is now limiting its Russian imports

India depends on imports to fulfill 85% of its crude consumption, with Russian crude accounting for about 45% of these imports. India cannot buy more Russian oil because it has limited storage space (strategic reserves), which can hold only 9.5 days' worth of crude. And due to India's minimum purchase agreements with other traditional suppliers, it can't replace all of them with Russian imports.

As the discount on Russian oil narrows, it becomes less appealing to export refined oil to Europe. This and India’s limited refining capacity for Russian Ural has restricted Ural imports to 2 million barrels per day.

Russian oil imports to India peak at 2 million barrels per day

While India has maintained a steady supply of refined oil exports to Europe so far, rising Ural prices could pose a challenge in India avoiding sanctions. As Western scrutiny intensifies, it remains to be seen whether India will persist in purchasing Russian Ural above the $60 cap.

Screener: Oil, cement, utilities stocks with the highest revenue and profit growth in Q1FY24

HPCL shows strong growth in QoQ revenue and operating profit margin

As prices of raw commodities soften, margins for companies in key sectors have improved, resulting in increased profits. This screener shows stocks from the oil & gas, cement & cement products and utilities sectors with the highest growth in revenue and net profit in Q1FY24, along with an expansion in operating profit margin.

Significant stocks that appear in the screener are GMR Airports Infrastructure, Tata Power, Hindustan Petroleum Corp, JSW Energy, Bharat Petroleum Corp and ACC.

Hindustan Petroleum Corp’s revenue grew by 10.3% QoQ to Rs 1.2 lakh crore in Q1FY24, while its net profit improved by 87.5% QoQ to Rs 6,765.5 crore compared to a loss in Q1FY23. The oil & gas company has also posted an operating profit margin of 8.1% during the quarter. This was aided by a decline in the cost of raw materials due to an 8.7% decline in Brent crude oil to $72.7 per barrel.

Another oil & gas company, Bharat Petroleum Corp, also gained from the decline in crude oil prices. Its operating profit margin increased by 17.1% QoQ in Q1FY24. This contributed to a 54.9% YoY increase in net profit to Rs 10,644.3 crore during the quarter.

Cement company ACC’s revenue improved by 8.6% QoQ to Rs 5,278 crore in Q1FY24. Its net profit improved by 97.8% QoQ to Rs 466.1 crore, aided by a reduction in power & fuel and employee benefit expenses. This led to an improvement in margins, with the operating profit margin rising 5.3 percentage points to 14.8%.

You can find more screeners here.