Oil is not a dependable bet. Like other commodities, its price seesaws in unpredictable ways, and many analysts who tried to predict the future price of oil have got their fingers burned (remember the $200 price per barrel predictions in early 2022?)

Oil-producing nations have also taken a hit recently from the price volatility.

For a time, things were good. The OPEC countries saw windfall profits from April 2022 to January 2023 due to the Russia-Ukraine war. But the trend has since reversed. Excess supply is sloshing around in the market, and the unexpected slowdown of China's economy has hit oil prices hard.

in response, OPEC cut oil production, which drove oil prices higher by 18% since June 2023. But the cuts didn't have the full price impact they had hoped for. The S&P had projected that oil prices would be around $90 in 2023, but the ramp-up in Iranian oil production has cut short the rally, pushing prices down to $84 from a recent peak of $88.

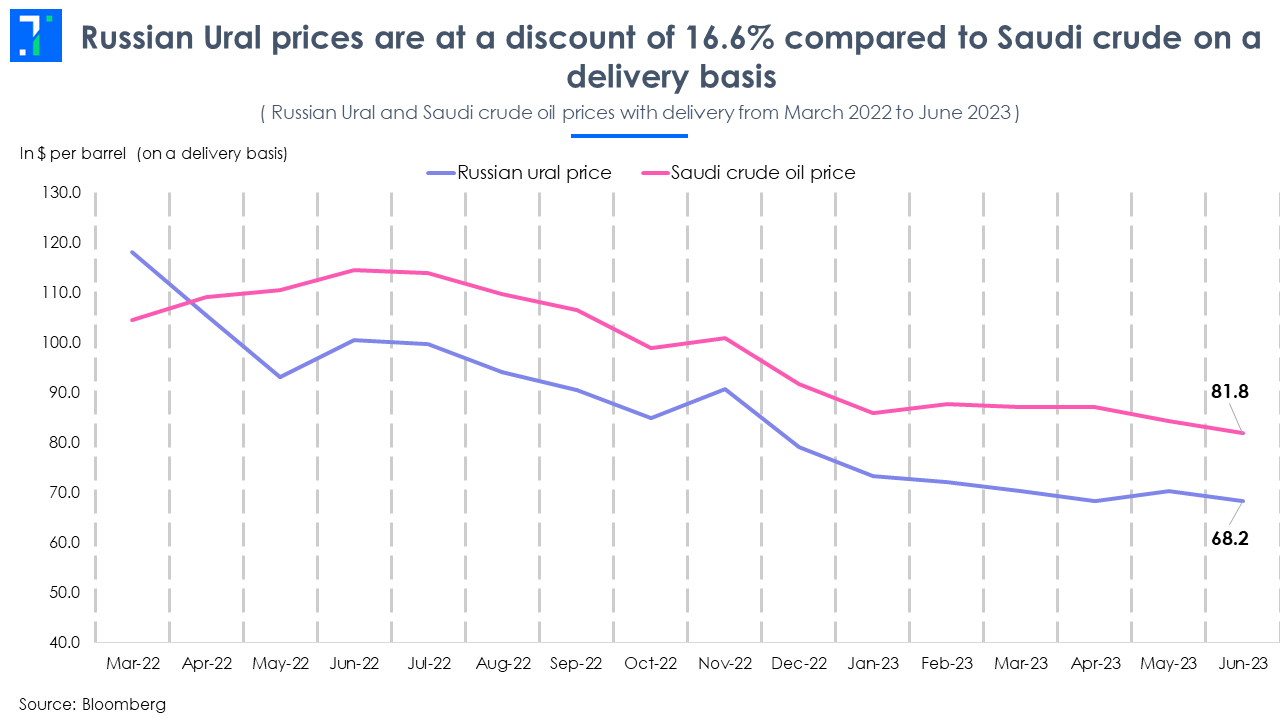

In the meantime, India and China have benefited from cheap Russian Ural. But the price gap between Russian Ural and Saudi crude on delivery has narrowed, from a $20 difference in the first quarter of 2023 to $8 in August.

In this week’s Analyticks:

- Oil price dynamics: Oil prices are defying analyst predictions

- Screener: Commodities stocks with the highest revenue and net profit growth in Q1FY24

Let’s get into it.

As oil consumption slows, OPEC makes production cuts to keep prices up

GDP growth has slowed down for most countries this year, resulting in lower crude oil consumption. China, the largest crude oil importer, and other developed nations are consuming less oil than expected. The increasing adoption of electric vehicles across Europe, the US, and China has also limited the demand for crude.

The slowdown in consumption has resulted in higher inventory levels over the past four quarters.

Production cuts will lower inventory levels in the second half of 2023

To improve their revenue streams and get a better price for their oil, the OPEC cartel collectively reduced oil production by 1.2 million barrels per day. They are now looking to extend these cuts beyond September 2023.

Saudi Arabia faces a potential budget deficit

Saudi Arabia depends on oil and petroleum for nearly 75% of its budget revenue. The surge in oil prices in 2022 gave the Saudis a fiscal surplus of $27.7 billion. The country used the money to increase its defense spending. It also spent around $6 billion to acquire famous football players for its sports teams - including Portugal's Cristiano Ronaldo and Brazil's Neymar.

However, with oil prices below $80 in the first half of 2023 and exports falling to a 19-month low, Saudi Arabia has had to pause its spending spree. Now the country is staring at a possible fiscal deficit. It already saw a budgetary deficit of roughly $2.2 billion in the first half of 2023.

According to the IMF, Saudi Arabia needs oil prices to be above $81 in 2023 to break even in its budget spending. The IMF has cut the Saudi economy's GDP growth forecast for 2023 from 3.1% to 1.9%, owing to lower oil prices and production cuts.

Saudi Arabia’s breakeven price of crude to meet its expenses stands at $81 per barrel in 2023

As India and China turn to Russian Ural, Europe has replaced Asia as the top destination for Saudi crude oil. But Europe has not entirely compensated for Asia’s demand decline. To boost oil prices, Saudi Arabia in June 2023 announced a voluntary production cut of 1 million barrels per day till September, on top of OPEC’s production cut of 1.2 million barrels per day.

Russia's cash crunch is also forcing it to cut oil production

The other big oil producer, Russia finds itself in a tough spot due to its expensive military campaign in Ukraine, and price caps on Ural exports imposed by the US and its allies. The Russian Ural, which is trading at a significant discount to crude, is being snapped up by India and China.

But higher volumes sold have not been able to make up for the revenue loss due to the price cap. This has led to a fiscal deficit of $28.3 billion fir Russia in the first half of 2023.

Russia is expected to have a budget deficit of 2.6% in 2023

Russia sold its oil for around $50-55 per barrel in the first half of 2023, but higher Ural prices in the second half of 2023 (around $60) are expected to reduce its deficit. To increase its revenue, Russia raised taxes on oil exports by 8% in August 2023.

Russia is taking steps to raise its oil price. It has pledged to reduce its crude exports by 5,00,000 barrels per day in August and an additional 3,00,000 barrels per day in September. A recent drone attack by Ukraine on a Russian oil tanker has also raised concerns about Ural supply, causing Ural prices to breach the $60 cap.

India walks the line, buying Russian oil at rates above price caps

China and India have been vocally against the price cap on Russian oil. They argue that since they aren't involved in the Russia-Ukraine conflict, their economies shouldn’t suffer. Finance Minister Nirmala Sitharman insisted that India will buy Russian Ural above the $60 price cap as long as it is cheaper than the market rate.

Right now, there are ways to get around the price cap. Unlike the free on board (FOB) basis, India’s crude import price is decided on a delivery basis (which includes the price of crude, insurance, shipping and other handling charges). This limits the transparency on the final price India is paying to Russia.

India’s on-delivery price of Russian Ural for June stood at $68.2, while for Saudi crude oil it was $81.8. However, the latest data from Argus Media suggests that August's Ural crude delivered to India’s west coast is around $82.

Russian Ural prices are at a discount of 16.6% compared to Saudi crude on a delivery basis

With the Ural price now significantly above the $60 per price cap, freight cost adjustments will be too large to go unnoticed. India and Russia need to find financiers, insurance providers, and shipping lines unaffected by Western sanctions. China, on the other hand, can substitute Russian Ural with Iranian oil. For India discounted Russian oil is the only way out to soften the blow of rising crude prices.

India is now limiting its Russian imports

India depends on imports to fulfill 85% of its crude consumption, with Russian crude accounting for about 45% of these imports. India cannot buy more Russian oil because it has limited storage space (strategic reserves), which can hold only 9.5 days' worth of crude. And due to India's minimum purchase agreements with other traditional suppliers, it can't replace all of them with Russian imports.

As the discount on Russian oil narrows, it becomes less appealing to export refined oil to Europe. This and India’s limited refining capacity for Russian Ural has restricted Ural imports to 2 million barrels per day.

Russian oil imports to India peak at 2 million barrels per day

While India has maintained a steady supply of refined oil exports to Europe so far, rising Ural prices could pose a challenge in India avoiding sanctions. As Western scrutiny intensifies, it remains to be seen whether India will persist in purchasing Russian Ural above the $60 cap.

Screener: Oil, cement, utilities stocks with the highest revenue and profit growth in Q1FY24

HPCL shows strong growth in QoQ revenue and operating profit margin

As prices of raw commodities soften, margins for companies in key sectors have improved, resulting in increased profits. This screener shows stocks from the oil & gas, cement & cement products and utilities sectors with the highest growth in revenue and net profit in Q1FY24, along with an expansion in operating profit margin.

Significant stocks that appear in the screener are GMR Airports Infrastructure, Tata Power, Hindustan Petroleum Corp, JSW Energy, Bharat Petroleum Corp and ACC.

Hindustan Petroleum Corp’s revenue grew by 10.3% QoQ to Rs 1.2 lakh crore in Q1FY24, while its net profit improved by 87.5% QoQ to Rs 6,765.5 crore compared to a loss in Q1FY23. The oil & gas company has also posted an operating profit margin of 8.1% during the quarter. This was aided by a decline in the cost of raw materials due to an 8.7% decline in Brent crude oil to $72.7 per barrel.

Another oil & gas company, Bharat Petroleum Corp, also gained from the decline in crude oil prices. Its operating profit margin increased by 17.1% QoQ in Q1FY24. This contributed to a 54.9% YoY increase in net profit to Rs 10,644.3 crore during the quarter.

Cement company ACC’s revenue improved by 8.6% QoQ to Rs 5,278 crore in Q1FY24. Its net profit improved by 97.8% QoQ to Rs 466.1 crore, aided by a reduction in power & fuel and employee benefit expenses. This led to an improvement in margins, with the operating profit margin rising 5.3 percentage points to 14.8%.

You can find more screeners here.