Nifty 50 closed at 26,052.65 (142.6, 0.6%), BSE Sensex closed at 85,186.47 (513.5, 0.6%), while the broader Nifty 500 closed at 23,906.30 (81.7, 0.3%). Market breadth is in the red. Of the 2,593 stocks traded today, 1,017 were in the positive territory and 1,530 were negative.

Indian indices closed in the green after extending gains in the morning session. The Indian volatility index, Nifty VIX, declined 0.8% and closed at 12 points. Infosys closed 3.7% higher as its board of directors approved a buyback of 10 crore shares for Rs 18,000 crore at Rs 1,800 each.

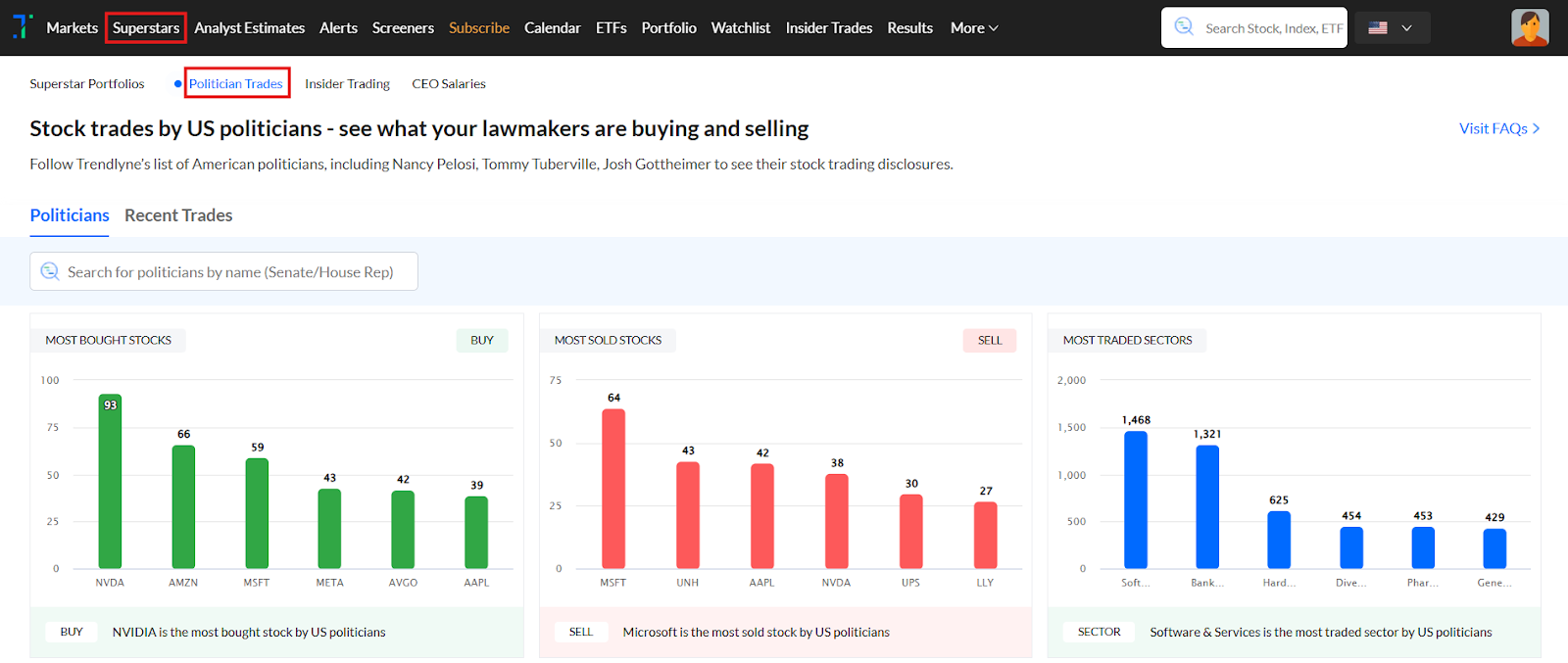

Nifty Midcap 100 closed in the green, while Nifty Smallcap 100 closed in the red. Nifty IT and BSE IT Sector were among the top index gainers today. According to Trendlyne’s Sector dashboard, Software & Services emerged as the best-performing sector of the day, with a rise of 2.6%.

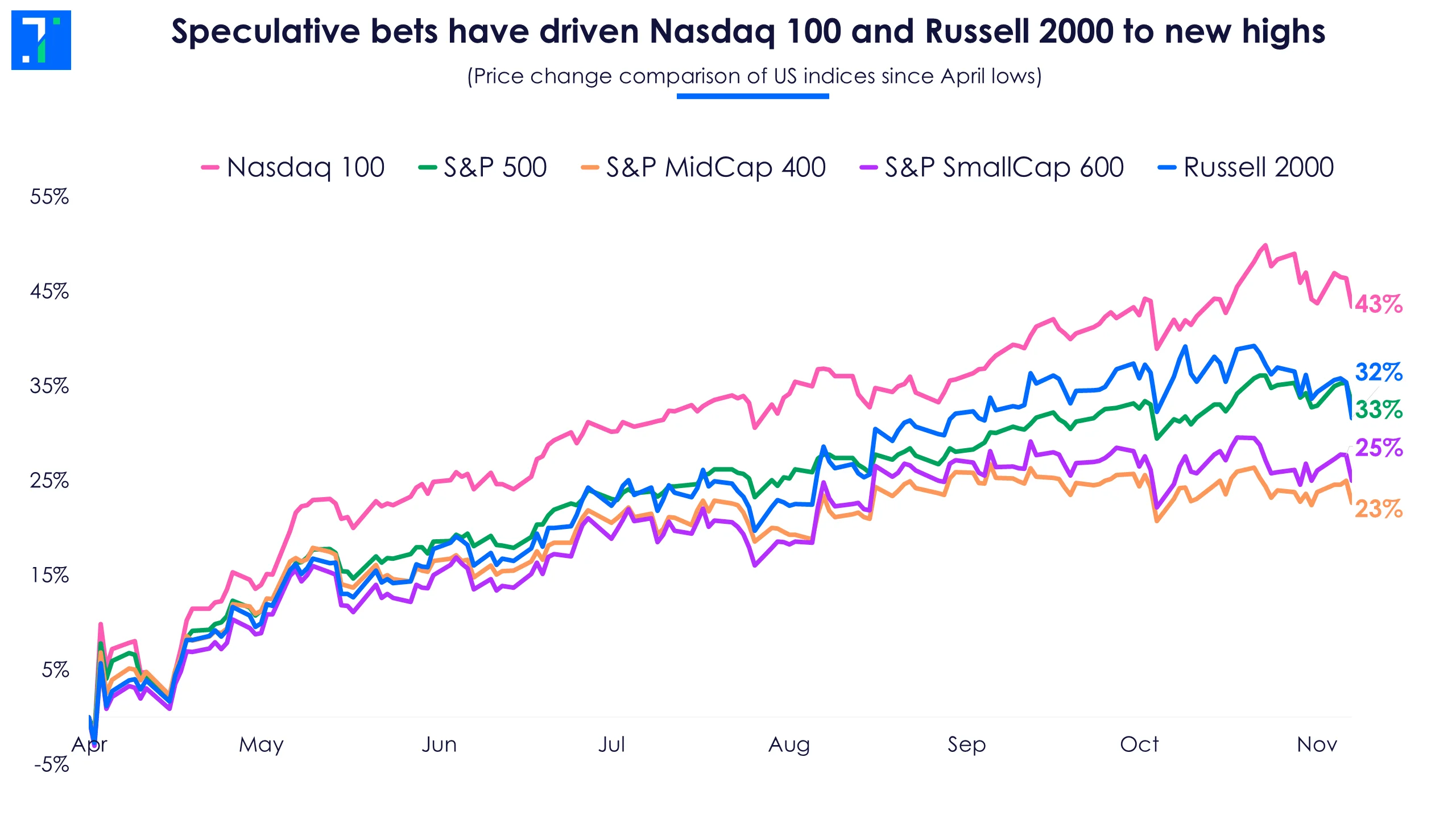

Asian indices closed mixed, while European indices are trading higher except France’s CAC 40 index. US index futures traded higher, indicating a positive start to the trading session. US tech stocks stayed under pressure on Tuesday amid worries about stretched AI-driven valuations and fading expectations of a December Fed rate cut. CME FedWatch now shows a 43.4% probability of a 25 bps cut at the December 10-11 meeting, down from 61.9% last week.

Relative strength index (RSI) indicates that stocks like GMR Airport, Canara Bank, Asian Paints, and 3M India are in the overbought zone.

Deven Choksey downgrades Ashok Leyland to an 'Accumulate' call from 'Buy', with a target price of Rs 156 per share. This indicates a potential upside of 7.4%. The brokerage cites the high valuation but remains positive on the stock, supported by improving freight activity, GST-led demand uplift, and healthy order growth across trucks, buses, and LCVs. It expects the company's revenue to grow at an 8.9% CAGR over FY26-28.

Sammaan Capital falls sharply after the Supreme Court orders the Central Bureau of Investigation (CBI) to file an FIR in a case alleging misuse of funds through dubious loans routed back to promoters. The court also noted that several agencies failed to adequately investigate the matter.

Bondada Engineering is rising as it enters a 5-year partnership with Adani Green Energy to develop renewable energy projects. The company also bags an order from Adani Green for 650 MW of solar energy works under the partnership.

Morgan Stanley expects the Reserve Bank of India to cut the repo rate by 25 basis points at its December 2025 policy meeting, citing continued downside surprises in headline CPI inflation. The brokerage then expects the RBI to become more data-dependent and shift to a “wait and watch” stance.

The Reserve Bank of India (RBI) is expected to reduce the repo rate by 25 basis points in its upcoming December 2025 policy meeting, according to a recent report released by Morgan Stanley.

Read more: https://t.co/A9sTnjQG99— businessline (@businessline) November 19, 2025

Tata Consultancy Services is rising as it secures a 5-year contract from the National Health Service (NHS) Supply Chain to upgrade its IT systems.

Knowledge Marine & Engineering Works bags a 15-year contract worth Rs 384.3 crore from Vishakhapatnam Port Authority for manning, operation, maintenance and technical management of a marine vessel.

NBCC (India) sells 609 residential units in Aspire Leisure Valley and Aspire Centurian Park, Greater Noida, for Rs 1,069.4 crore through an e-auction.

Vikas Jain of CLSA notes that India has been a rare underperformer in an otherwise strong global equity rally in 2025. However, he believes improving macro data, normalising valuations, and a slowdown in negative developments support a stance of “guarded bullishness.” He adds that downside risks appear limited, with valuations having corrected and the broader news flow stabilising.

Hindustan Unilever rises as it sets December 5 as the record date to determine eligible shareholders for its new ice-cream division, Kwality Wall’s (India). The demerger becomes effective on December 1, 2025.

Sagility falls as its promoter, Sagility BV, sells a 16.4% stake (or 76.9 crore shares) worth ~Rs 3,894.2 crore through the open market.

Marksans Pharma receives US FDA approval for its abbreviated new drug application (ANDA) for Loperamide Hydrochloride (HCL) tablets. The drug is a bioequivalent of the reference listed drug (RLD), Imodium A-D tablets of Kenvue Brands and is used to treat diarrhoea. It has an estimated market size of $300 million in the US as of 2024.

Vinati Saraf Mutreja, MD of Vinati Organics, says the company now produces the highest volume of antioxidants in India, with their revenue contribution expected to increase to 15–16% from about 12% currently. She projects revenue growth of 10–12%, margins of around 27%, and volume growth of over 15% for FY26. She notes that volumes are rising despite lower prices.

Vinati Organics says

FY26 Guidance

???? Volumes +15%

???? Revenue +10-12%

???? Margins at 27%

Co is producing the largest amount of antioxidants in India, contribution can go up to 15-16% of revenue vs 12%#StockMarkethttps://t.co/VppU9Me2Jm— Nigel D'Souza (@Nigel__DSouza) November 19, 2025

HCL Tech rises as it opens a new Calgary office and signs an MoU with Invest Alberta to strengthen its presence in Canada. The move increases delivery capacity in a market where it already serves over 50 clients.

Tenneco Clean Air India's shares debut on the bourses at a 27.2% premium to the issue price of Rs 397. The Rs 3,600 crore IPO received bids for 58.8 times the total shares on offer.

Infosys is rising sharply as its board of directors approves a buyback of 10 crore shares for Rs 18,000 crore at Rs 1,800 each.

Elara Capital upgrades SBI Cards and Payment Services to an 'Accumulate' rating and a higher target price of Rs 1,006. The brokerage highlights a clear improvement in asset quality, a stronger balance sheet, and better profitability prospects from FY27. It believes the stress cycle has largely passed and that SBI Cards is now in the final phase of balance-sheet cleanup, supporting a recovery in credit costs, cards-in-force (CIF) growth, and return ratios.

#MarketsWithBS | @elaracapital upgrades #sbicards to ‘Accumulate’ with a ?1,006 target, highlighting a decisive asset-quality turnaround, stabilising credit costs and clearer profitability visibility from FY27, as the company nears the end of its balance-sheet cleanup and gears…

— Business Standard (@bsindia) November 19, 2025

Azad Engineering rises as it signs a long-term agreement with Pratt & Whitney Canada to develop and make aircraft engine parts.

Computer Age Management Services' board of directors approves a 1:5 stock split, sets record date as December 5.

KP Energy is rising sharply as it signs a memorandum of understanding (MoU) with Inox Wind to jointly develop 2.5 GW of wind and wind-solar hybrid projects.

Morgan Stanley initiates coverage on LG Electronics India with an 'Overweight' rating and a target price of Rs 1,864. The brokerage views LG as a top-tier consumer durables franchise in India, noting its strong position in a highly competitive market. It highlights the company’s industry-leading margins and capital efficiency, and expects new capacity additions, along with rising export and B2B contributions, to drive revenue and margin growth.

#BrokerageRadar

Morgan Stanley On #LGElectronics: Initiates 'overweight' with a target price of Rs 1,864.

For more, visit our Research Reports section: https://t.co/x9gNkEkYp6pic.twitter.com/grFxIwWPXz— NDTV Profit (@NDTVProfitIndia) November 19, 2025

Goel Construction is rising as it wins a Rs 173.3 crore order from Aditya Birla Group. The work includes civil and safety projects at the Pali Cement Works unit in Rajasthan.

KEC International is falling sharply as Power Grid Corp of India excludes the company from its tenders and award of contracts for nine months for alleged breach of contractual provisions.

Waaree Energies is falling as the Income Tax Department conducts a search at its offices and facilities in India.

GR Infraprojects is rising as it secures an order worth Rs 262 crore from Western Railways in the Vadodara division for gauge conversion of a 38.9 km track and related construction works.

Nifty 50 was trading at 25,884.85 (-25.2, -0.1%), BSE Sensex was trading at 84,658.57 (-14.5, 0.0%) while the broader Nifty 500 was trading at 23,801.45 (-23.2, -0.1%).

Market breadth is in the red. Of the 2,162 stocks traded today, 846 were gainers and 1,248 were losers.

Riding High:

Largecap and midcap gainers today include L&T Technology Services Ltd. (4,440, 9.0%), Linde India Ltd. (6,076.50, 6.7%) and Max Healthcare Institute Ltd. (1,164.40, 4.3%).

Downers:

Largecap and midcap losers today include Waaree Energies Ltd. (3,174.40, -3.3%), Tata Motors Passenger Vehicles Ltd. (360.85, -2.8%) and Biocon Ltd. (410.10, -2.7%).

Crowd Puller Stocks

21 stocks in BSE 500 are trading on high volumes today.

Top high volume gainers on BSE included L&T Technology Services Ltd. (4,440, 9.0%), Linde India Ltd. (6,076.50, 6.7%) and Latent View Analytics Ltd. (494.25, 5.2%).

Top high volume losers on BSE were Sammaan Capital Ltd. (159.55, -12.7%), KEC International Ltd. (710.35, -9.1%) and Concord Biotech Ltd. (1,448.70, -3.5%).

G R Infraprojects Ltd. (1081.90, -1.5%) was trading at 18.8 times of weekly average. Gland Pharma Ltd. (1,769.80, -1.1%) and Intellect Design Arena Ltd. (1,142.80, 5.0%) were trading with volumes 17.0 and 8.4 times weekly average respectively on BSE at the time of posting this article.

BSE 500: highs, lows and moving averages

14 stocks took off, crossing 52 week highs, while 13 stocks were underachievers and hit their 52 week lows.

Stocks touching their year highs included - AIA Engineering Ltd. (3,733.40, 0.6%), Bank of Baroda (293.30, 1.7%) and Bank of Maharashtra (61.14, 1.2%).

Stocks making new 52 weeks lows included - SKF India Ltd. (1,975.60, -0.1%) and Tata Motors Passenger Vehicles Ltd. (360.85, -2.8%).

7 stocks climbed above their 200 day SMA including L&T Technology Services Ltd. (4,440, 9.0%) and Max Healthcare Institute Ltd. (1,164.40, 4.3%). 19 stocks slipped below their 200 SMA including Campus Activewear Ltd. (263.25, -3.0%) and Sundram Fasteners Ltd. (960.05, -2.5%).