By Tejas MDMichael Burry deletes his tweets, because he hates being wrong. But the investor, who became famous for predicting the 2008 financial crisis, is closely followed, and the media documented him in June 2022 warning investors about the coming stock market crash, which he had called “the mother of all crashes”. In March this year, Burry admitted he was wrong to tell investors to sell their stocks.

In the ever-changing world of stock markets, narratives can quickly shift. US indices are currently at their 52-week highs and Nifty 50 is hovering around its all-time high.

Last year at this time, it wasn’t just Burry who was worried. Analysts believed a recession was about to hit the global economy, as central banks raised interest rates to combat inflation.

But the tide turned. As inflation continues to fall, economists say a ‘soft landing’ is likely. Goldman’s Sach has increased its odds of the US avoiding a recession in the next 12 months, to 80%, and India is expected to be the world’s fastest growing economy in FY24.

One sector that has benefited from the changing conditions is the auto sector, which tracks the broader economy - when GDP grows, cars, bikes and tractors start selling. The positive outlook for Indian auto has prompted foreign investors to raise their portfolio allocation to the sector to a record high of 6.5% in June 2023 from 5.2% in June 2022. Domestic investors’ allocation also increased to a multi-month high of 8.2% in June, as they expect strong Q1FY24 earnings for auto companies.

Within India's auto industry, the two-wheeler premium segment has been a hotbed of activity, offering higher margins and a better growth outlook. Top two-wheeler manufacturers are going after this segment with guns blazing.

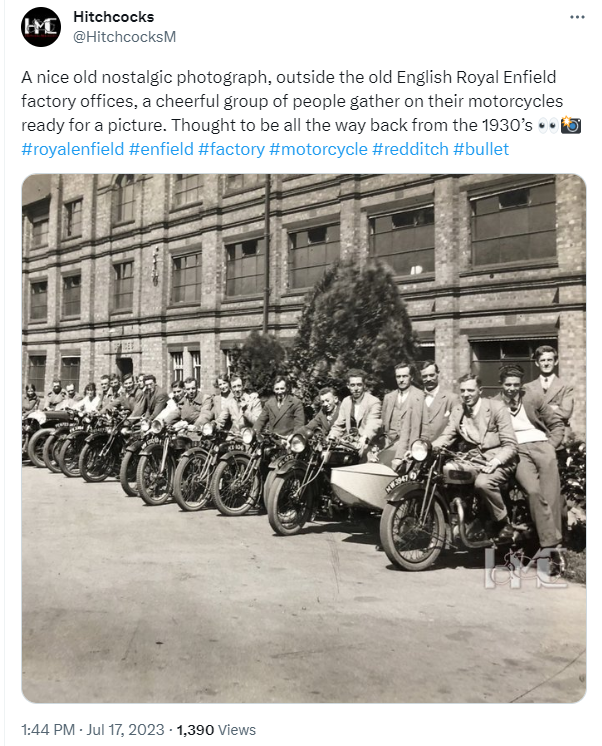

Amid the fierce competition, can the undisputed king of premium bikes, Royal Enfield, dodge the ‘bullet’ and remain at the top? Let’s find out.

In this week’s Analyticks,

- Ready to rumble: Bajaj and Hero partner with foreign players to take on Royal Enfield

- Screener: Nifty 500 outperformers ahead of results with rising Trendlyne momentum score and high durability

Bajaj and Hero go after Royal Enfield to win buyers of premium bikes

Shares of Eicher Motors, which makes Royal Enfield motorcycles, plunged 5% on July 4 after Bajaj Auto and Hero Motocorp announced new motorcycle launches. These were no ordinary launches - Bajaj and Hero have partnered with foreign players Triumph and Harley Davidson to challenge Royal Enfield, the dominant player in the premium motorcycle segment (> 250 cc) with an 86% market share.

These parnerships present the first big threat to Royal Enfield's India dominance - Triumph and Harley are iconic, global bike brands. Who can forget the Terminator riding in on a Harley Davidson FatBoy?

Under threat, Eicher Motors has underperformed both Nifty 50 and Nifty Auto in the past quarter.

While Hero unveiled the Harley-Davidson X 440, Bajaj Auto launched its Triumph Speed 400 in the first week of July. The pricing of both motorcycles came in lower than expected, at around Rs 2.3 lakh ex-showroom. These two bikes will directly compete with Royal Enfield’s top-selling models - Classic 350 (Rs 1.93 lakh), Himalayan, and Meteor 350.

The strategic pricing of these new bikes shows how badly Bajaj and Hero’s want to capture market share from Royal Enfield. During the post-launch meeting, Rajiv Bajaj, the CEO of Bajaj Auto, did not hold back. He compared his approach to the infamous American bank robber William Sutton. He said, “When asked, why do you rob banks, he (William Sutton) said, that's where the money is. So if Royal Enfield is where the money is, then we have no choice but to rob that bank."

Niranjan Gupta, Hero’s CEO, said, “We are here to win in the premium segment, whatever it takes.”

It is obvious that the CEOs of these two-wheeler manufacturers are now laser-focused on a segment that was left to Royal Enfield for the past decade. Why the change of heart?

Premium two-wheelers beat industry’s volume growth, with higher margins

Domestic two-wheeler volumes grew 17% in FY23 after falling for three consecutive years. However, the numbers are still below FY15. During the three years of declining volumes, the premium motorcycle segment fell more slowly, compared to the overall numbers.

In FY23, premium motorbikes made a strong comeback, rising 37% compared to industry volume growth of 17%. This segment is projected to keep growing faster than the industry.

Analysts see rising purchasing power and growing incomes driving these sales. India is getting richer, and people's tastes are changing. During 2018-22, India is estimated to have produced 70 new millionaires every day.

A People Research on India’s Consumer Economy (PRICE) report suggests that by 2030, the country's demographics could change from the current inverted pyramid - with a small rich class and a large low-income class - to a rudimentary diamond, where a big part of the low-income group moves up to become middle class.

These shifts explain the premiumization trend that is gaining momentum across consumer sectors like FMCG and hotels. The auto industry is no different.

Royal Enfield, which focuses only on the premium segment, is the established leader in this space with a market share of 86%, followed by Jawa (5%), Honda (5%), and Bajaj (3%). Bajaj and Hero are now hoping to put a serious dent in RE’s market share.

Can Harley and Triumph break Royal Enfield's dominance?

Barring Hero, the other companies below saw rising domestic sales volumes YoY in Q1FY24, indicating robust Indian demand. However, exports for all four two-wheeler manufacturers has been disappointing, falling YoY. Analysts expect muted export growth in FY24.

Following the new vehicle launches, Prabhudas Lilladher saidin its report that the competition will disrupt the market for Royal Enfield, and that the company will need to move fast to maintain its dominance. The brokerage reduced its target price on Eicher Motors by 14% to Rs 3,460. HDFC Securities also reduced its target price as it believes aggressive competition could hurt growth.

However, ICICI Securities is asking everyone to calm down, and believes that the steep reaction in Eicher Motors’ share price is unwarranted. It expects that the premium 2W market in India will increase in size as consumers have new choices.

The brokerage also predicts that the introductory promotional pricing for Triumph and Harley bikes will end after selling a pre-specified number of units. Notably, only 10% of RE’s domestic sales come from bike models priced at Rs 2.6 lakh on-road. As Bajaj and Hero raise the prices of their new premium bikes from the current Rs 2.3 lakh, the price gap with RE could widen, allowing the company to recapture its market.

Royal Enfield is fighting back with a plan to roll out two to three motorcycles in the next five months. Right now, RE stands out from the competition with its cult following and the history it brings to the table. Originally a British company, it was acquired by Eicher Motors in 1995, but reached new heights only in the past decade. RE’s units sold rose from 25,000 in 2005 to 8,34,895 in FY23.

Even though Honda and Jawa tried to compete with Royal Enfield in recent years, they were unable to match its scale and popularity. But Triumph and Harley have arrived in India with their own history and fanbase. The new players have the real potential to accelerate the competition in the premium 2W segment.

Screener: Nifty 500 outperformers ahead of results, with rising Trendlyne momentum score and high durability

As the Q1 results season takes off, we look at stocks that are rising ahead of their upcoming earnings announcements. The stocks in this screener have outperformed the Nifty 500 over the past week ahead of their results, with increasing Trendlyne momentum scores and high durability.

The screener shows 28 stocks from the Nifty 500 index and four from the Nifty 50 index. It features stocks from the banking & finance, automobile & auto components and software & services sectors. Major stocks that appear in the screener are Zensar Technologies, Mahindra Holidays & Resorts India, RBL Bank, MphasiS, Aarti Drugs and Craftsman Automation.

Zensar Technologies has risen 12.7% over the past week, with its Trendlyne momentum score improving by 8.7 points over the past month, in anticipation of the company’s result on Thursday. Axis Securities expects the company’s revenue to grow by 1.8%, owing to increased revenue from the hi-tech segment. The brokerage also expects a recovery in the digital business, driven by the banking, financial services and insurance (BFSI) segment.

MphasiS has gained 12.2% over the past week, ahead of its result on Thursday. It has also seen a 17-point rise in its Trendlyne momentum score to 51.6 over the past month. Investors expect the company to beat the modest revenue and net profit projections given by analysts, after bellwether TCS easily beat its estimates.

Craftsman Automation comes in with a 9.9% surge in the past week, leading up to its results on July 24. It has a high Trendlyne momentum score of 66.9. Motilal Oswal expects the company’s revenue to jump 10% YoY due to the realisation of revenue from DR Axion India’s acquisition, and growth in the storage segment. The brokerage also estimates its EBITDA margin to remain flat, despite the softening of aluminium costs due to a weak product mix.

You can find some popular screeners here.

Signing off this week,

The Trendlyne Team